Master's Discussion on Hot Topics:

Last night, as soon as the CPI data was released, the market was slapped hard. Bitcoin instantly dropped below 95k, and even I thought it would plummet. However, unexpectedly, after the U.S. stock market opened, the market opened low and then rose, stabilizing Bitcoin as well.

The support below is quite strong, clearly indicating that large funds are propping it up. Then, when the budget proposal was mentioned, the market surged again. Following that, Trump and Putin had a phone call, and the market went into a frenzy, with Bitcoin even touching 97k at its peak. I must say, Trump understands the capital market better than many analysts; he is undoubtedly a master trader.

Now, let's talk about Bitcoin's miraculous V-shaped recovery. Given such poor CPI data, why could the market still rebound? Many friends are confused. In fact, since around 12:30 AM, Bitcoin has been slowly rising alongside the U.S. stock market, but the trading volume has not increased, indicating that everyone is still on the sidelines.

Suddenly, around 12:55 AM, there was a surge in volume, and market sentiment switched instantly—good news arrived! Who was the source of this good news? Powell. During the hearing, someone asked him about the relationship between banks and cryptocurrencies, and he directly stated that the Federal Reserve has already tacitly allowed banks to cooperate deeply with cryptocurrencies.

The SEC's previous SAB121 has also been revoked, which means banks can now redeem stablecoins, custody Bitcoin, and even engage in cryptocurrency collateralized lending. This news is far more important than the CPI, directly igniting the market's FOMO sentiment.

This is already the second time Powell has given Bitcoin the green light. Last time he said Bitcoin is not a competitor to the dollar but to gold, which directly sent Bitcoin to 100k. Now with this new development, who still dares to say he is an enemy of the crypto market?

Reflecting on this market movement, the biggest insight for me is that the market's reaction is not related to the data itself but to the market's rhythm. The CPI data was terrible, but the entire altcoin market has already been down for two to three months, and the sentiment had long been worn down. At this point, another blow does not cause panic in the market.

When the data was first released, there was indeed a brief panic sell-off. However, the overall market and altcoins did not collapse, indicating that someone had already positioned themselves in advance, waiting to buy.

Now, let's talk about Ethereum. Recently, Ethereum's ETF holdings have reached a new high, and there is an upgrade scheduled for April 6, so the market will likely speculate a bit. But the problem is that Ethereum's rise cannot rely solely on these external stimuli; it needs to generate its own momentum, and the ecosystem needs new stories and narratives.

If the foundation could sell fewer coins, Ethereum might have more momentum. Otherwise, the ETF is just a short-term emotional booster; in the long run, the market still needs to see if Ethereum can come up with new tricks.

In simple terms, the market trend after this CPI data has taught everyone a lesson: bad news is not necessarily a bad thing. The core of market fluctuations is not the data but the current emotional cycle of the market. Trading is like a relationship; rhythm is more important than tactics. Promise me, please don’t be a simp, okay?

Master's Trend Analysis:

Resistance Levels:

First Resistance Level: 99500

Second Resistance Level: 98300

Support Levels:

First Support Level: 96700

Second Support Level: 95650

Today's Suggestions:

After the sharp drop, Bitcoin has currently recovered yesterday's losses. Although there has been a rebound, the possibility of further decline cannot be ruled out. From a technical analysis perspective, since it has broken through yesterday's downward trend line, the rebound view can continue.

Since it is still fluctuating in the 95-98k range, it is better to operate with a higher probability of success by waiting for a gradual breakthrough of the marked resistance area rather than expecting an immediate test of 100k.

As the downward trend line has been broken, the short-term important support line can be set at the 60-day and 20-day moving averages as well as the first support level, while paying attention to entry opportunities in the pullback range.

During the day, I do not recommend looking for a one-sided upward trend. When the price fluctuates within the range, the first support can be seen as a good risk-reward area. If the price returns to the downward trend line, it can be determined as a strengthened bearish area.

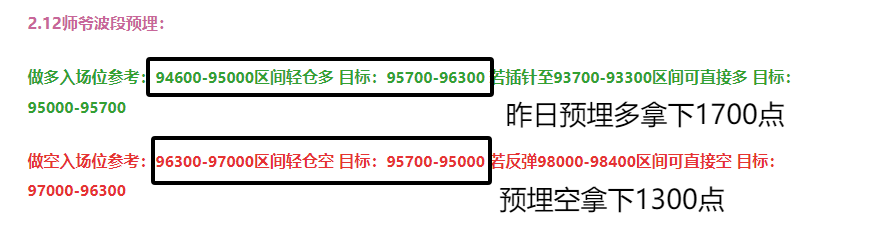

2.13 Master's Band Pre-Positioning:

Long Entry Reference: Light long near 94000, Target: 95650-96700

Short Entry Reference: Light short in the 98000-98500 range, Target: 96700-95650. If it rises near 99500, go short directly, Target: 98300.

This article is exclusively planned and published by Master Chen (WeChat public account: Coin God Master Chen). For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Friendly Reminder: This article is only written by Master Chen on the official account (as shown above). Other advertisements at the end of the article and in the comments section are unrelated to the author! Please be cautious in distinguishing between true and false, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。