Original Title: Jupiter Crypto Conglomerate

Original Author: Marco Manoppo, Investor at Primitive Ventures

Original Translation: Ashley, BlockBeats

Editor's Note: Jupiter announced several significant initiatives at the Catstanbul conference, including acquisitions, AI funding, token buybacks and burns, and the launch of the cross-chain network Jupnet, showcasing its ambition for vertical integration. This article analyzes its business strategy and explores how brand, community, and user experience determine value capture in a permissionless crypto environment, revealing the inevitable trend of applications moving towards integration.

The following is the original content (reorganized for readability):

Last month, Jupiter released a series of major announcements at its flagship conference, Catstanbul. To summarize—there was a lot of information. There was a Burning Cat, acquisition announcements, and most importantly: Jupiter openly acknowledged that its ambitions extend beyond its current ecosystem. In today’s article, we will break down Jupiter's latest business strategy and discuss why, over a long enough time frame, every crypto application that controls users will ultimately choose vertical integration to maximize value capture. Let’s dive in.

TL;DR

Acquisitions

Jupiter acquired a majority stake in Moonshot, a popular mobile trading app that generated $35 million in fee revenue following the Trump meme coin craze. Additionally, Jupiter completed a full acquisition of Sonar Watch, a Solana DeFi asset management tool.

Funding Support

Jupiter is collaborating with Shaw from ElizaOS to allocate $10 million to support AI developers launching through the Jupiter Launchpad.

Token Buyback

50% of the transaction fees from the Jupiter protocol will be used to buy back JUP tokens.

Token Burn

3 billion JUP tokens (approximately $3.6 billion) have been burned to reduce supply and lower the fully diluted valuation (FDV) of the protocol.

Jupnet

Jupiter plans to launch Jupnet, a cross-chain network aimed at integrating the entire crypto ecosystem into a single decentralized ledger, maximizing convenience for users and developers.

Honestly, this is one of the strongest product roadmaps and new plan announcements I have seen in recent quarters. The Jupiter team's execution is top-notch, from their extremely detailed communication (Meow basically posts long articles on Twitter every day) to the high level of transparency they maintain with the community, showcasing exceptional execution capabilities.

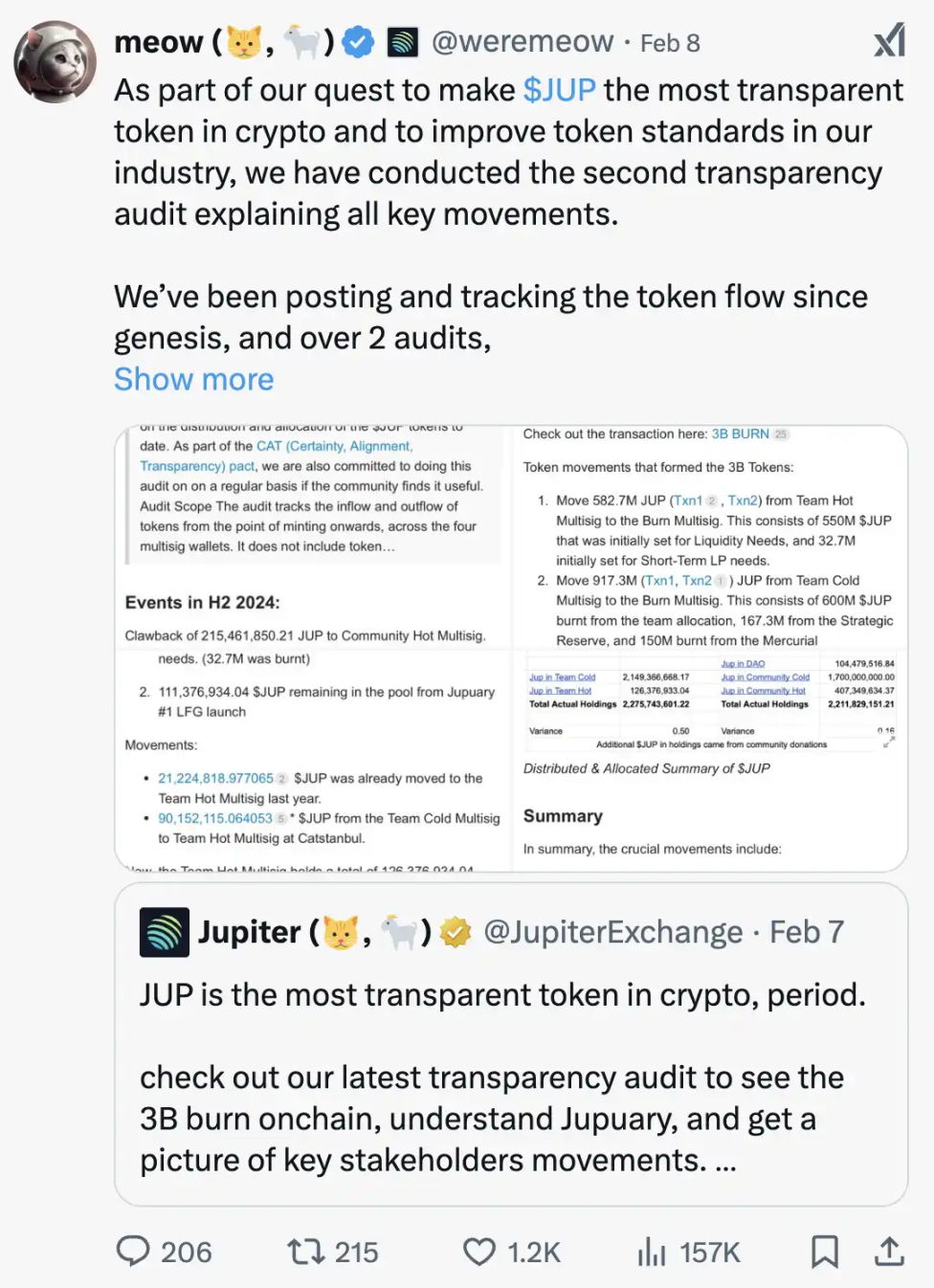

A typical example:

Jupiter recently released a transparency audit report detailing the key cash flows of the team. "We have been publicly tracking token flows since inception, and through two audits, we accounted for all token movements (except for 1 JUP), integrating the tokens into verified wallets."

Read that last sentence again. For any crypto protocol that has completed a TGE, it is crucial to make every effort to track the ownership of each token. Similarly, publicly traded companies clearly document their stock ownership structure. In the crypto space, due to the permissionless nature of blockchains, tracking ownership is relatively more difficult, but there are still tools available to help teams achieve high-precision tracking.

Meanwhile, Uniswap…

Given enough time, every application will vertically integrate

The core point of today’s article is that business strategies in the crypto world fundamentally differ from business models in traditional permissioned environments.

Outside the crypto industry, companies typically build "moats" through regulatory barriers, long-term B2B contracts, proprietary innovations, and so on.

However, in the crypto industry, such "moats" largely do not exist, as the permissionless nature of blockchain allows anyone to build on existing products, and users can almost always choose alternatives.

Therefore, what truly matters is brand, user experience, and community, because as the industry matures, we will see more and more experienced entrepreneurs entering the crypto space, building on existing infrastructure, and launching predatory attacks on the current industry giants.

Ironically, this mirrors what Deepseek is currently doing to OpenAI.

Ultimately, in the crypto space, "moats" will evolve into the following three points:

Brand → Users trust you

Real community → Users want to be part of your organization and enjoy true ownership (through profit sharing)

User experience → Users like your product

Aggregation strategies in a permissionless environment are wise moves

Before Jupiter's success, many were skeptical of the aggregation model, especially in the EVM ecosystem, where its market performance was lackluster. For example, 1inch failed to surpass Uniswap's market cap, as most users still preferred to use Uniswap directly (too lazy to switch) or chose other MEV-friendly DEXs like CoW Swap.

However, in the Solana ecosystem, Jupiter managed to convince users that it provided the best trading experience, successfully aggregating traffic and achieving value capture.

Honestly, I’m not sure when this shift occurred. I remember during the DeFi Summer of 2020-2021, I used Orca and Raydium while also trying out early versions of Jupiter. If my memory serves me right, by the end of DeFi Summer, the user experience of Orca and Raydium had become quite poor due to reasons including:

Lack of a unified token standard (e.g., multiple versions of bridged USDC)

UI lagging

This poor user experience was still evident a year later.

Jupiter used to display the best trading paths to prove its exchange rates were optimal. In hindsight, this was a very clever move, as there was no clear DEX market winner in the Solana ecosystem at that time. Even though Raydium held the highest market share, its market dominance was far from that of Uniswap on Ethereum.

Excellent business strategy and operations

In simple terms, Jupiter executes better in its core business—providing Solana users with the best token exchange experience. Many protocols in the EVM ecosystem have attempted similar strategies, but few have succeeded. Additionally, the Jupiter team was initially formed by the Racoon Dev group led by Meow, which means they could maintain operations during the bear market with a few engineers in low-cost emerging markets, minimizing capital consumption.

Not all successful startups need a "sexy startup angle"; many successful crypto entrepreneurs initially operated development studios. This "traditional service-oriented business" can teach extremely efficient cost management skills and show founders how to target market opportunities effectively.

By 2024, this savvy business operation capability is fully reflected in the Jupiter team.

In just 12 months, Jupiter has acquired 5 teams:

Moonshot: Acquired this mobile meme trading platform

SonarWatch: Acquired an on-chain asset management tool

Ultimate Wallet: Acquired a self-custody wallet

Coinhall: Acquired a decentralized trading terminal

SolanaFM: Acquired a blockchain explorer

Forgive my bluntness, but this is truly a genius move. Some of the acquired projects faced fierce competition and market challenges, making them excellent acquisition targets. Moreover, I have no insider information, but I wouldn’t be surprised if these acquisitions were primarily completed using JUP tokens. Given JUP's current FDV, the Jupiter team undoubtedly expanded its territory at a low cost while bringing in a group of excellent developers.

Conclusion

This idea is not new. Dan Elitzer from Nascent wrote in 2022 about "The Inevitability of UNIchain," with the core point being: "As applications reach a certain scale, control over block space becomes increasingly important… The solution is to build a dedicated chain or Rollup, managed by validators who care about the application's success."

My view is similar but more straightforward—this reflects human nature in capitalist commercial society: optimizing value capture and vertical integration.

The crypto industry is still operated by humans, and we cannot escape our instinctual desire for control over the value chain. Let’s be realistic.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。