Original author: Pzai, Foresight News

The fate of FTX has come to an end.

On February 8, this collapsed cryptocurrency exchange abandoned its restructuring plan and announced that it would begin compensating the first batch of creditors.

FTX stated on its official social media platform: "It will start making initial distributions to the allowed creditors in its Chapter 11 restructuring convenience class plan on February 18, 2025. Eligible creditors should expect to receive their distributions within 1 to 3 business days starting from February 18, 2025."

FTX was a cryptocurrency exchange founded in 2017 by former Wall Street trader Sam Bankman-Fried (SBF), which had a significant influence in the U.S. market and was once the second-largest cryptocurrency trading platform in the world, second only to Binance. However, after the chaotic financial situation between FTX and another crypto company founded by Sam Bankman-Fried, Alameda, was exposed, it went bankrupt within a week due to a bank run.

Since FTX's bankruptcy in 2022, the crypto mogul Sam Bankman-Fried and FTX have hurriedly entered the annals of history. The bankruptcy restructuring plan concerning the assets of tens of thousands of users has experienced twists and turns since 2023 and finally welcomed a key development in 2025.

According to the previous restructuring plan, FTX creditors are expected to receive full or even excess cash compensation, and the initial distribution starting on February 18 undoubtedly brings hope to the long-waiting creditors.

Details of the Compensation Plan

According to Bloomberg, for the specific compensation plan, small creditors (with claims not exceeding $50,000) account for 98% of the total number of creditors, and they will receive 118% compensation, which includes the principal plus 9% annual interest. For large creditors, the compensation ratio varies based on the type of claim, with a maximum of 142%.

In addition, non-government creditors will also receive compensation for principal plus interest. This compensation plan aims to maximize the interests of creditors and minimize their losses. Creditors need to complete KYC verification within the stipulated time before January 20, 2025, and accept payments through agents such as Bitgo and Kraken to ensure the authenticity and legality of their identities.

One of the responsible institutions for this compensation is the well-known auditing firm PwC, which stated that qualified customers/creditors in supported jurisdictions will be invited to create a BitGO account to receive their distributions. Compensation for non-corporate customers/creditors is expected to begin in the second quarter of 2025.

However, in the previous process, some creditors raised objections to the method of compensation, mainly focusing on the choice between cash compensation and cryptocurrency compensation. On December 26, 2023, the administrator of the FTX bankruptcy case submitted a revised restructuring application to the court, proposing to estimate the value of customers' crypto asset claims in USD, with the relevant assets valued based on the benchmark price on the bankruptcy date (November 11, 2022).

Court documents indicate that after full payment of claims, the plan also stipulates that additional interest will be paid to creditors as long as there are remaining funds.

FTX's "Crypto Legacy"

As one of the leading figures in the crypto space at the time, FTX left behind a considerable legacy after its collapse.

According to multiple media reports, on May 7, 2024, the company submitted a revised restructuring plan to the U.S. bankruptcy court, indicating that once all asset sales are completed, the company will have between $14.5 billion and $16.3 billion available. Currently, FTX owes approximately $11 billion to customers and other non-government creditors. This also means that FTX's creditors are expected to receive the fiat value corresponding to their crypto assets at the time of bankruptcy.

So, will such a large amount of funds have a certain impact on the market in the future?

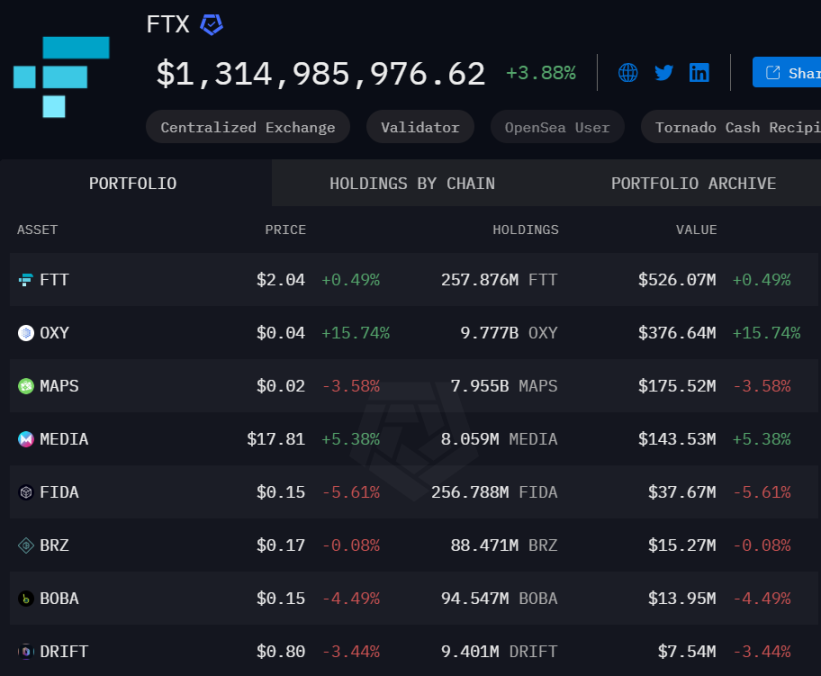

According to Arkham data, FTX still holds $1.3 billion in crypto assets, of which over 50% is FTT, valued at $526 million. Currently, the total market capitalization of FTT tokens is about $700 million, and once FTX undergoes liquidation, this token will suffer a devastating blow.

The most critical assets, Bitcoin and Ethereum, are currently not held by FTX, according to Arkham data. The trading volume of other tokens is also relatively poor, with the top holdings like OXY, MAPS, MEDIA, etc., showing almost no liquidity, so the potential liquidation of this portion of assets will have a minimal impact on the overall cryptocurrency market.

However, it is worth noting that on February 12, according to Ember monitoring, FTX/Alameda conducted its monthly SOL redemption transfer 6 hours ago: redeeming 184,162 SOL from staking and distributing it to 23 addresses. Since November 2023, FTX/Alameda's staking address has cumulatively redeemed and transferred out 4.629 million SOL in this manner, with an average transfer price of $116.2. Currently, FTX/Alameda's staking address still has 6.338 million SOL staked, valued at $1.27 billion. It is currently unclear how this asset will be handled.

Another interesting piece of news shows that compensating creditor assets has not only become FTX's final mission but also its "get out of jail free card." In August 2024, a judge in New York ultimately approved the now-defunct cryptocurrency exchange FTX and its sister trading company Alameda Research to repay $12.7 billion to FTX creditors as part of a settlement with the U.S. Commodity Futures Trading Commission (CFTC). The CFTC's $4 billion claim ranks behind creditors and interest, and payments to the CFTC will go into a supplemental relief fund to compensate severely harmed cryptocurrency holders (only to be paid if funds are sufficient).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。