Is the Altcoin Market Facing a Turning Point?

The Federal Reserve has delivered the "worst news," yet the market remains unusually calm! On February 11, Federal Reserve Chairman Jerome Powell's remarks drew significant market attention. He clearly stated, "There is no need to rush to cut interest rates." This is undoubtedly considered the "worst news" for the cryptocurrency market since 2025. However, surprisingly, the market did not experience the anticipated massive sell-off—some altcoins even saw price increases! What could be the reason for this? Has the market already hit bottom?

Why is the Altcoin Market So Calm?

Renowned cryptocurrency analyst Matthew Hyland expressed his views on X (formerly Twitter), suggesting that the market may have already anticipated the Federal Reserve's continued interest rate policy. Hyland wrote, "Today's news may be the worst news for the cryptocurrency market in 2025, but there has been almost no sell-off in altcoins, and some are even rising."

He further pointed out, "The market is forward-looking and may have already 'sensed' this signal, which also explains why there was a sell-off last week." This indicates that the news of the Federal Reserve maintaining its current interest rate policy may have already been digested by the market.

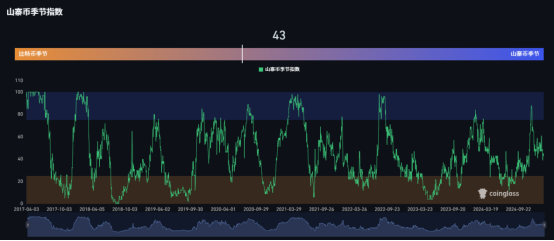

It is worth mentioning that the Altcoin Season Index currently shows 43/100, still leaning towards "Bitcoin Season," which indirectly indicates that the performance of altcoins is relatively stable.

Powell's Remarks: A Litmus Test for the Market

When Federal Reserve Chairman Powell addressed the Senate Banking Committee, he mentioned that the U.S. economy remains "strong," and therefore there is no rush to adjust interest rates. This statement directly reflects the Federal Reserve's confidence in the current economic state and also implies that the possibility of rate cuts has been further compressed in the short term.

As a high-risk asset, the price of cryptocurrencies is often closely related to the Federal Reserve's interest rate policy. Rate cuts typically enhance market liquidity, making cryptocurrencies more attractive; while rate hikes make low-risk assets like bonds and fixed deposits more appealing, thereby weakening the market demand for cryptocurrencies.

However, Powell's remarks this time did not trigger a chain reaction in the crypto market, but rather hinted at a potential market bottoming signal.

Nine Brother's Perspective: Market Turning Point or Dilemma?

Currently, the Federal Reserve's conservative stance on future rate cut prospects may serve as a "stress test" for the cryptocurrency market. The absence of a massive sell-off could suggest that the crypto market has already hit bottom and is gathering strength for the next wave of momentum.

All of this has one prerequisite: Bitcoin must not break below 91.5K; only by oscillating within this range can altcoins have a chance; otherwise, they may still face another wave of declines!

Special Attention: Tonight at 21:30, the U.S. January CPI data will be released, with an expected value of 2.9%. If it is below or within the expected value, it is bullish for Bitcoin!

For more information, you can follow our media account [Seven Crypto Academy] or contact our assistant to join the VIP group. You can also gain access to our bottom-fishing and top-selling column content by sharing, commenting, and liking.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。