The significance of the whole event for Bittensor is equivalent to the launch of the AI Agent LaunchPad by Virtuals Protocol in October last year. After that, $VIRTUAL surged over 50 times at its peak.

Written by: Thinking Weirdly

The dTAO upgrade for Bittensor, which has been highly anticipated, is finally set to go live on February 14. What exactly is the dTAO upgrade? You can check out @HelloLydia13's article “Five-Minute Quick Guide to Bittensor”.

For retail investors, the most crucial change is that all 64 existing subnet projects on Bittensor can now issue their own tokens. In other words, Bittensor has genuinely established its own ecosystem. This is undoubtedly a huge benefit for $TAO.

The significance of the whole event for Bittensor is roughly equivalent to the launch of the AI Agent LaunchPad by Virtuals Protocol in October last year. After that, $VIRTUAL surged over 50 times at its peak.

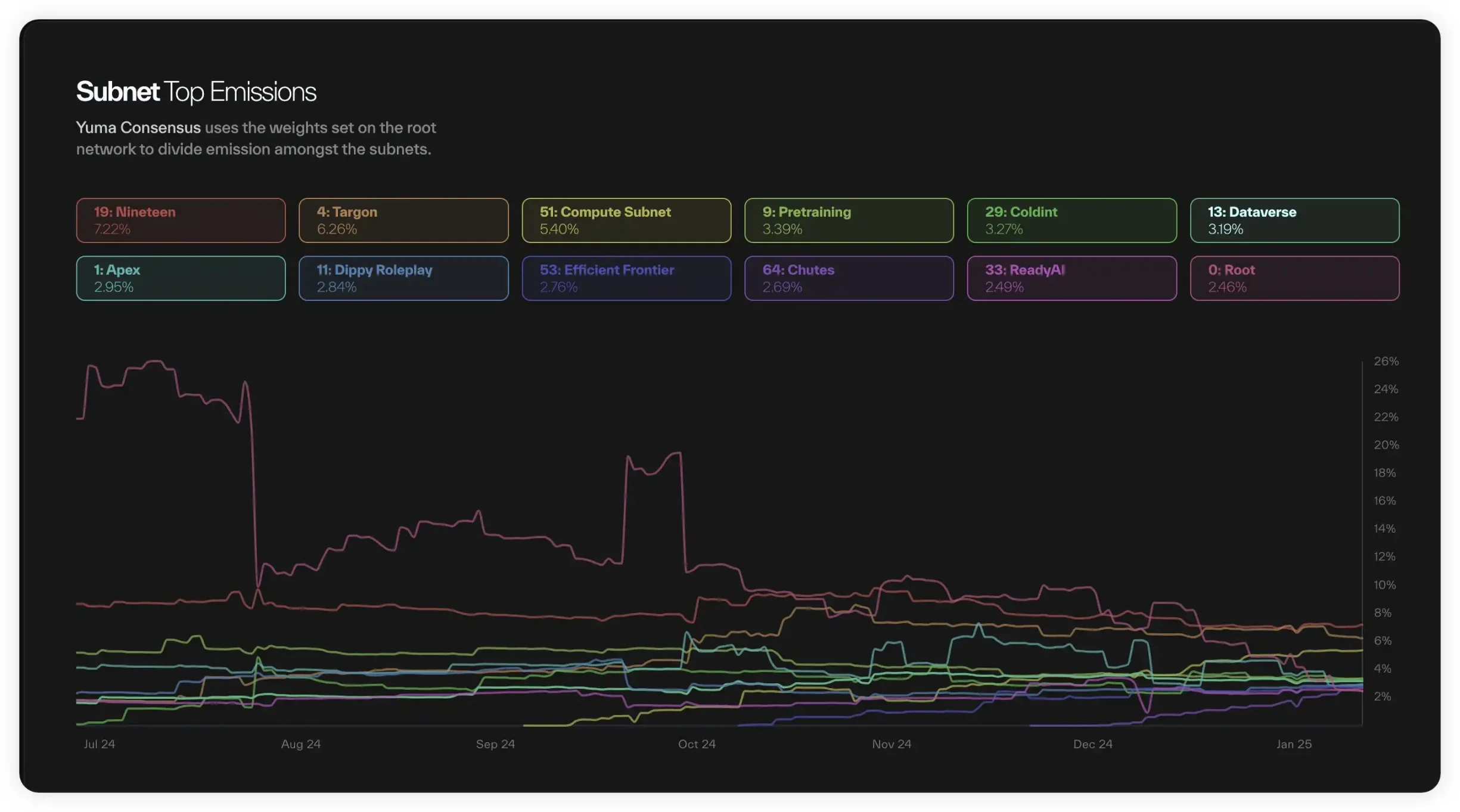

The dTAO upgrade essentially introduces a market competition mechanism to Bittensor's Yuma consensus, fundamentally decentralizing the value discovery of subnet projects.

The previous $TAO distribution model, which was determined by votes from the root network, will now be changed to a distribution based on the value ratio of $TAO and dTAO tokens in each subnet's dTAO token pool. $TAO holders can "vote with their feet" by purchasing subnet tokens to decide which subnets should receive more $TAO rewards.

The subnet represented by the dTAO token that has higher market demand will receive a larger share of $TAO emissions. Since the holders of dTAO tokens will also benefit from this, it will, in turn, promote market demand for that dTAO token, creating a positive feedback loop for the value of that dTAO token. Therefore, if you want to share in the dividends of the rising Bittensor ecosystem, a more exciting strategy than simply holding $TAO is to stake $TAO to obtain different subnet dTAO tokens (where "staking" actually means purchasing the corresponding subnet tokens with $TAO).

Since the staking has shifted to trading subnet tokens, the staking returns for $TAO are no longer guaranteed. However, if you hit on a promising subnet token, you can achieve excess returns. This will attract a lot of hot money and speculators looking to arbitrage into Bittensor.

As for how to identify promising subnet tokens, you can look at which subnets are receiving more $TAO emissions.

Derived investment opportunities also include trading DEX projects that provide dTAO trading platforms, including @taodotbot and @HotKeySwap, both of which are established projects that have already issued tokens. The market cap of $HOTKEY is only $5 million, seemingly just 1/7 of $TAOBOT. Meanwhile, the well-established TAO liquidity staking protocol @TensorplexLabs is also planning to launch its own dTAO trading platform @BackpropFinance.

However, the official Twitter account hasn't posted much content yet; you can check out this for related information.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。