Recently, the price trend of Bitcoin has entered a state of stalemate. The chart clearly shows that over the past ten trading days, Bitcoin's price has exhibited a distinct sideways oscillation pattern, failing to effectively break through key resistance levels, let alone return to the ambitious target of $100,000. To explore the deeper reasons behind Bitcoin's lackluster rebound this time, we will analyze information from multiple dimensions and angles, including the macro environment, market sentiment, technical aspects, and potential risks.

Overall Market Sentiment: Cautious Observation Becomes the Main Tone, Upward Momentum Significantly Lacking

Profit-taking and the rebalancing of long and short forces: Looking back at the previous rapid rise in Bitcoin's price, it undoubtedly accumulated a large amount of profit-taking positions. When prices reach high levels or face uncertainty, some early investors or short-term traders tend to lock in profits, triggering selling pressure in the market. Meanwhile, although long-term investors still have confidence in Bitcoin's future, the bullish forces appear relatively cautious in the current volatile market, lacking the previous momentum. While bearish forces are poised to act, they have not formed an overwhelming advantage, leading to a delicate balance between bulls and bears, with sideways oscillation becoming the most direct market manifestation.

Global macroeconomic fog shrouds: Uncertainty suppresses risk appetite. Looking globally, the macroeconomic environment remains full of variables, becoming a sword of Damocles hanging over high-risk assets, including Bitcoin. Persistently high inflation pressures, the shadow of geopolitical conflicts, and expectations of monetary policy adjustments in major economies together create a complex and uncertain macro picture. Against this backdrop, investors' risk-averse sentiment has intensified, leading to more cautious allocations to risk assets. As a high-risk alternative asset, Bitcoin is naturally constrained by macro uncertainties, making it difficult to attract large-scale incremental funds, significantly suppressing upward momentum.

Market sentiment shifts from frenzy to rationality: Cooling effects emerge. After experiencing a previous surge, the market's perception of cryptocurrencies has gradually returned to rationality. Investors are no longer blindly chasing short-term profits but are more focused on risk management and value judgment. The irrational upward momentum driven by FOMO (Fear of Missing Out) has gradually faded, and overall market sentiment has cooled. In the absence of clear positive signals, investors are more inclined to wait and see, awaiting clearer directional guidance from the market. The market needs new narratives, technical breakthroughs, or favorable policies to reignite investor enthusiasm and break the current dull pattern.

Technical Analysis: Key Resistance Constitutes Suppression, Breakthrough Requires Time

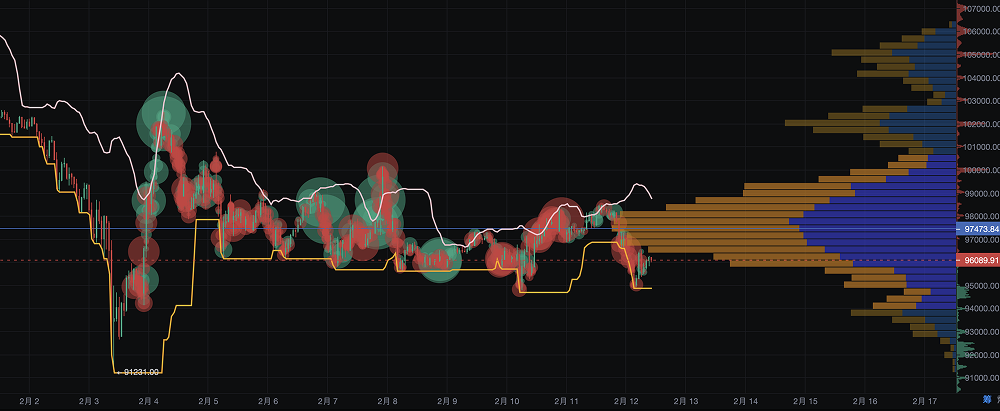

Important resistance levels: An insurmountable technical gap. From a technical analysis perspective, Bitcoin's price has encountered strong resistance at specific points, particularly around the clearly marked $102,500, which is likely to form an important technical barrier. This resistance level may have accumulated multiple pressures from previous highs, dense trading areas, and key technical indicators. The repeated attempts to test this area have all failed, indicating that the bearish forces' defense in this region is solid. For the bulls to achieve an effective breakthrough, they need to accumulate stronger energy and invest more time and patience.

Technical indicators enter an adjustment cycle: Digesting pressure, building momentum. Some technical indicators show that the Bitcoin market has entered an overbought area after the previous rise, or is exhibiting warning signals such as a top divergence. These technical signals indicate a depletion of short-term upward momentum, and the market needs to undergo a technical adjustment to repair overheated indicators and digest accumulated pressure. The current sideways oscillation can be seen as a necessary process for the market to self-repair and accumulate energy. Only after sufficient adjustment and energy accumulation can the market potentially welcome a new round of upward trends.

Breakthrough signals are lacking: The market awaits clear directional guidance. To break the current stalemate, the market typically requires clear technical breakthrough signals. If the price can effectively stabilize above key resistance levels, accompanied by a significant increase in trading volume, and indicators like MACD and RSI emit clear bullish signals, it would be a positive sign. However, in the recent market trend, these key breakthrough signals have not yet clearly emerged, and the market remains in a tug-of-war between bulls and bears, with an unclear direction. Investors generally adopt a wait-and-see strategy, awaiting clearer breakthrough directions from the market.

Lack of Major Positive Catalysts: The Market Craves New Narratives and Momentum

Regulatory policy fog: The unresolved sword of Damocles. Globally, the direction of cryptocurrency regulatory policies remains full of uncertainty, becoming a sword hanging over the market. The attitudes of regulatory agencies towards cryptocurrencies, the formulation of policy frameworks, and the strengthening of regulatory efforts all directly impact market sentiment and capital flows. Until regulatory policies become clearer, market participants generally maintain a cautious attitude. Any negative regulatory signals could trigger market turbulence, while the lack of clear positive regulatory policies makes it difficult to form strong expectations for a unilateral price increase.

Institutional capital entry rhythm: Slowing down or building momentum? In recent years, the entry of institutional capital has been seen as an important engine driving the continuous rise in Bitcoin prices. However, has the pace of institutional capital inflow slowed recently? Are institutional investors also waiting for clearer market signals? These questions are directly related to Bitcoin's future upward momentum. If the pace of institutional capital entry slows down, or if institutional investors turn to a wait-and-see approach, the Bitcoin market may lose important capital support, making the rebound path more tortuous.

The market urgently needs new narrative hotspots: Stimulating market vitality. The cryptocurrency market has always been easily driven by innovative narratives and market hotspots. For example, the rise of concepts like DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and the Metaverse has previously attracted widespread attention and capital, driving the prices of related crypto assets to soar. However, the current market seems to lack innovative narratives or hotspot concepts that could lead a new round of trends. The market needs new stories and new growth points to reignite investor enthusiasm, break the current dull situation, and inject new vitality into Bitcoin's rebound.

Other Potential Factors: Unseen Market Undercurrents Cannot Be Ignored

Miner selling pressure: Potential supply-side risks. Although there is currently no conclusive evidence indicating a significant increase in miner selling pressure, miners, as important participants in the Bitcoin market, have their mining costs, revenue expectations, and judgments about future market trends, all of which may affect their holding strategies and selling behaviors. If the miner community generally feels pressure and chooses to increase selling, it could impact the supply side of the market, thereby exerting downward pressure on Bitcoin prices. Investors need to closely monitor the dynamics of the miner community and be wary of potential selling risks.

Exchange liquidity: Affecting the market's microstructure. Cryptocurrency exchanges, as the core hub of market trading, have their liquidity status, trading depth, and system stability directly affecting the market's microstructure and price volatility. If exchanges experience liquidity tightening, insufficient trading depth, or systemic risks, it could exacerbate market turbulence and even trigger sharp price fluctuations, thereby suppressing Bitcoin's price stabilization and rebound. Investors need to pay attention to the operational status of major exchanges and be wary of potential liquidity risks.

Summary and Outlook: Where is the Path to Breakthrough?

In summary, the recent sideways oscillation of Bitcoin's price and the lack of rebound are a comprehensive reflection of various complex factors. The overall cautious observation of market sentiment, the key resistance faced on the technical level, the lack of major positive policies or innovative narrative stimuli, and other potential risk factors together constitute the predicament currently faced by Bitcoin.

Looking ahead, whether Bitcoin can break the current sideways pattern, return to an upward channel, and ultimately achieve the goal of breaking through $100,000 will depend on the evolution of the following key factors:

- Can market sentiment welcome a turnaround? Whether the global macroeconomic situation can stabilize, whether geopolitical risks can be effectively controlled, whether market risk appetite can rebound, and whether new market hotspots can emerge will directly affect the direction of market sentiment. Only when market sentiment returns to optimism can the Bitcoin market welcome a true rebound opportunity.

- Can the technical aspect achieve an effective breakthrough? Whether Bitcoin's price can successfully break through the strong resistance level around $105,457.44, accompanied by effective increases in trading volume, and whether technical indicators can emit clear bullish signals will be key to judging short-term market trends. Once an effective technical breakthrough occurs, it is expected to open up upward space for Bitcoin's price.

- Can regulatory policies release positive signals? The movements of major global economies regarding cryptocurrency regulatory policies will have a profound impact on the long-term development of the market. If a more friendly and clearer regulatory framework can emerge in the future, it will help eliminate market uncertainties, attract more compliant capital, and lay a solid foundation for Bitcoin's long-term development.

- Can institutional capital continue to increase? The attitudes and capital flows of institutional investors remain one of the important driving forces in the Bitcoin market. If institutional investors can continue to increase their Bitcoin allocations or if new large institutions announce their entry, it will inject strong confidence and capital support into the market, driving further increases in Bitcoin prices.

Investment Advice: Proceed with Caution, Focus on Key Variables

In the current market environment, for Bitcoin investors, a cautious and steady approach should become the main tone of investment strategy. Investors should maintain a rationally optimistic attitude, closely monitor market dynamics, analyze various information in depth, avoid blindly chasing price increases or selling off in panic.

Key variables to focus on include:

- Global macroeconomic trends: Closely monitor macroeconomic indicators and events such as inflation data, economic growth expectations, and geopolitical events to assess their potential impact on the Bitcoin market.

- Monetary policies of major economies: Pay attention to the monetary policy trends of central banks in major economies, such as the Federal Reserve and the European Central Bank, especially changes in interest rates and quantitative easing policies, and analyze their impact on risk assets.

- Cryptocurrency regulatory policies: Continuously track the latest developments in cryptocurrency regulatory policies in major countries and regions around the world, and assess the potential impact of regulatory policies on market sentiment and capital flows.

- Dynamics of institutional capital entry: Focus on the allocation of Bitcoin by institutional investors and whether new institutional investors announce their entry, analyzing the influence of institutional capital on the market.

- Changes in technical indicators: Combine technical analysis tools to closely monitor Bitcoin's price performance at key resistance and support levels, as well as changes in trading volume, MACD, RSI, and other technical indicators to assist in judging market trends.

Risk warning: The investment risk in the cryptocurrency market is extremely high, with significant price volatility. Investors should fully recognize the potential risks, make prudent decisions, and avoid blindly trusting any insider information or investment promises. The analysis and advice provided in this report are for reference only and do not constitute any investment advice. Investors should make independent investment decisions based on their own risk tolerance and investment goals, and bear the investment risks themselves.

Conclusion: The future development path of Bitcoin is destined to be fraught with challenges; the short-term sideways oscillation is merely an interlude in the long river of market development. Investors must remain calm and rational, continuously learn and conduct in-depth research to navigate the ever-changing market and seize investment opportunities.

Disclaimer: The above content does not constitute investment advice.

If you have any questions, you can contact us through the following official channels:

AiCoin official website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。