The U.S. January CPI (Consumer Price Index) data will be released at 21:30 Beijing time on February 12, and the market is highly focused on this. According to market pricing, if the CPI is higher than expected (69.57%), it may put pressure on risk assets, while if the CPI is lower than expected (21.43%), it could boost market confidence. This article analyzes the short-term and long-term impacts of CPI data on the cryptocurrency market, extending to Federal Reserve policy, interest rate outlook, and potential investor strategies.

CPI Data and Market Expectations: A Barometer for the Crypto Market

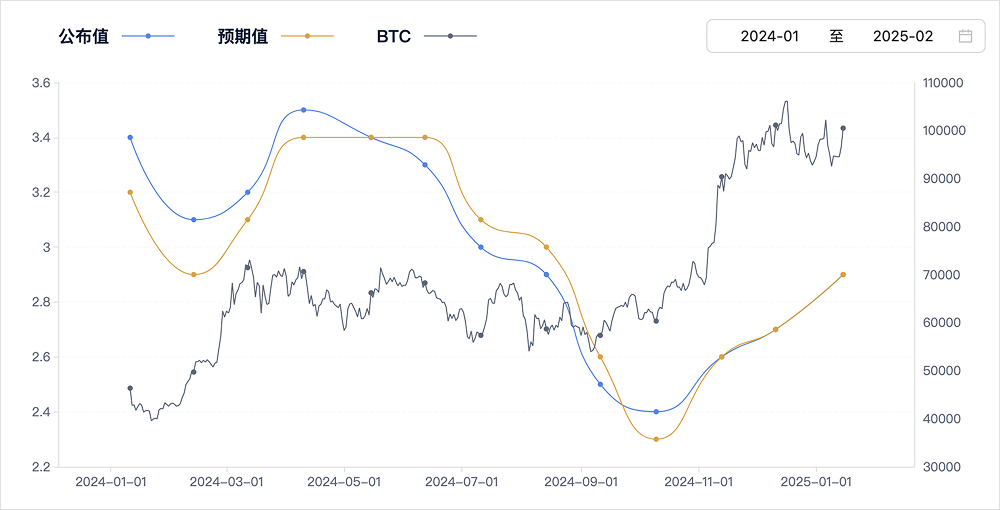

As a key indicator of inflation levels, the CPI directly influences the Federal Reserve's monetary policy decisions, and the cryptocurrency market, as a high-risk asset, is particularly sensitive to macroeconomic data. Recent data released is as follows:

It can be seen that over the past six months, when the CPI met expectations, the market generally viewed it as favorable for cryptocurrencies like Bitcoin, while a CPI above expectations often leads to short-term selling pressure.

How Does CPI Data Affect the Crypto Market?

Short-term Impact: Increased Volatility

If the CPI is higher than expected, the Federal Reserve may maintain a hawkish stance, and the market may expect interest rates to remain high for a longer period, thereby suppressing high-risk assets like Bitcoin. Conversely, a lower-than-expected CPI could boost market risk appetite, driving cryptocurrency prices higher in the short term. Due to the more fragmented liquidity in the crypto market compared to traditional financial markets, there may be significant volatility in a short period, and investors need to pay attention to market depth and liquidity conditions.

Long-term Impact: Macroeconomic Cycles and Crypto Assets

Historically, a downward trend in inflation has generally been favorable for cryptocurrencies like Bitcoin. From 2023 to 2025, Bitcoin prices reached historical highs as the Federal Reserve's interest rate hike cycle approached its end, indicating that market expectations of tightening liquidity significantly influenced the crypto market. Additionally, Bitcoin, as an inflation-hedging asset, has gained broader market recognition during high inflation periods.

Institutional Investment and Market Sentiment

With the gradual approval of Bitcoin ETFs, institutional investor participation is increasing. Changes in inflation data may affect the inflow or outflow of institutional funds, further exacerbating market volatility. For example, if the CPI data is higher than expected, institutions may reduce their allocation to Bitcoin ETFs, while if the data is lower than expected, institutions may increase their exposure to Bitcoin investments.

CPI, Interest Rate Policy, and Market Linkage

Currently, the market generally expects the Federal Reserve to begin cutting interest rates in the second half of 2025, but if the CPI is higher than expected, this timeline may be delayed. Recent market bets on the Federal Reserve's interest rate decisions are as follows:

- CPI > Expected: The Federal Reserve may continue to maintain high interest rates, the dollar strengthens, and the crypto market comes under pressure.

- CPI = Expected: The market maintains existing bets, with smaller market fluctuations.

- CPI < Expected: The market may increase bets on interest rate cuts, driving the crypto market up.

Additionally, attention should be paid to statements from Federal Reserve officials; if they suggest maintaining high interest rates to curb inflation, it will further impact market expectations.

Recent Context and the Impact of CPI Data

The market is currently facing several macro variables, including:

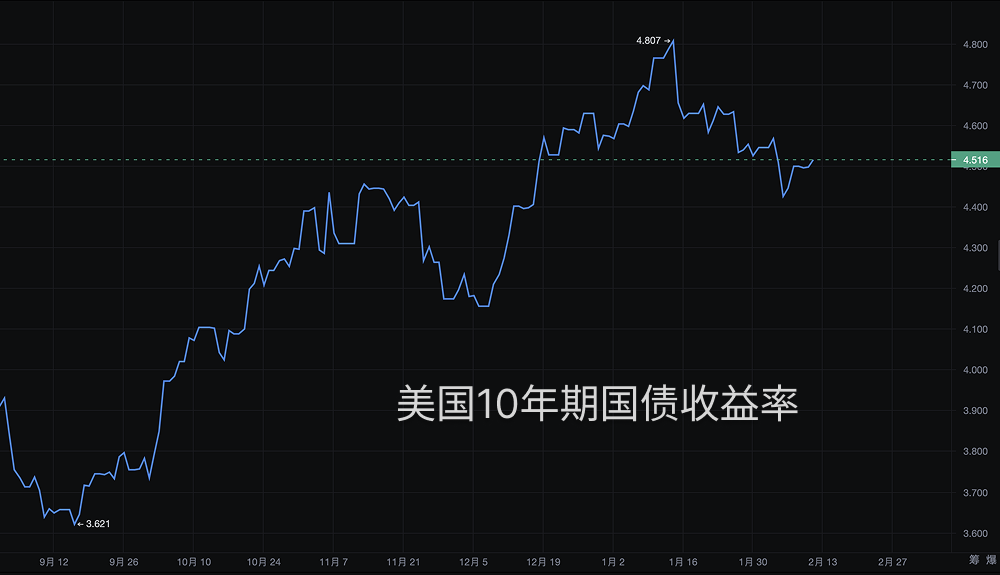

- U.S. Treasury yield fluctuations: Recently, the 10-year U.S. Treasury yield has hovered around 4.2%. If the CPI is high, yields may rise further, putting pressure on risk assets.

- U.S. Dollar Index (DXY) trends: If the CPI is higher than expected, it may support a stronger dollar, which is unfavorable for cryptocurrencies like Bitcoin.

- Market risk sentiment: Global markets are still assessing the Federal Reserve's monetary policy path. If CPI data triggers significant market volatility, it may exacerbate short-term adjustments in risk assets.

- Geopolitical risks: Recent international tensions may increase market demand for safe-haven assets, indirectly affecting the crypto market.

Investor Strategies and Recommendations

In response to potential market reactions triggered by CPI data, investors may consider the following strategies:

(1) Pay attention to market expectations and position in advance

If the CPI data is likely to be lower than expected, consider moderately increasing positions in mainstream assets like Bitcoin or Ethereum in the short term, taking advantage of the rebound driven by market sentiment.

(2) Avoid short-term volatility risks

If the CPI data is higher than expected, it may trigger market turbulence. Short-term investors may choose to reduce leverage and decrease exposure to high-volatility assets.

(3) Focus on long-term positioning opportunities

In the long run, CPI data will influence the Federal Reserve's policy rhythm. Investors can pay attention to the inflow of institutional investments like Bitcoin ETFs to gauge long-term trends. Additionally, considering the impact of CPI on dollar liquidity, holding Bitcoin and other crypto assets long-term remains a strategy to hedge against traditional market risks.

Conclusion: A Key Moment for Market Barometers

CPI data not only affects the Federal Reserve's interest rate decisions but also directly influences the short-term volatility and long-term trends of the crypto market. Investors should closely monitor the data release and comprehensively assess it in conjunction with market expectations, the dollar index, U.S. Treasury yields, and other factors to formulate reasonable trading strategies.

As the institutionalization of Bitcoin ETFs progresses, the macro correlation of the crypto market is strengthening. Therefore, inflation data and Federal Reserve policy will continue to be important variables affecting the market for some time. Investors need to stay alert and flexibly adjust their investment strategies to respond to potential market changes.

Disclaimer: The above content does not constitute investment advice.

If you have any questions, you can contact us through the following official channels:

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying, Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。