U Card, with its strong privacy, convenient payment, and low fees, provides an excellent off-chain payment solution for cryptocurrency investors.

Written by: FinTax

Introduction

In recent years, with the rapid development of the cryptocurrency market and digital payment technologies, various exchanges and wallet service providers have launched their own U Card products. U Card has become a tool for an increasing number of Web3 users for cross-border payments and daily consumption. Meanwhile, discussions about U Card on various social media platforms have surged, making it a hot topic. Some view it as the key to solving the cryptocurrency OTC problem, while others take a wait-and-see approach, and some are filled with skepticism. In this article, FinTax will introduce the basics of U Card and particularly remind you not to overlook the tax and other risks associated with U Card.

1. The Concept of U Card

1.1 U Card

U Card is a tool that provides financial services for cryptocurrency investors. The usage of U Card is similar to that of a bank card, allowing cardholders to spend directly or withdraw cash without needing to convert virtual currency into fiat currency in advance.

U Card is divided into two main categories: physical U Cards and virtual U Cards. Physical U Cards, such as Mastercard U Card and UnionPay U Card, have a wider acceptance range and higher acceptance rates. Virtual U Cards, like Dupay, are often used for e-commerce or international payments, offering more convenience and flexibility, but cannot be used for cash withdrawals at ATMs.

Common U Card issuance models include the following:

Direct issuance by banks. Banks utilize their own payment networks and compliance frameworks to provide users with stable cryptocurrency payment solutions.

Issuance in collaboration between banks and cryptocurrency companies. In this case, banks provide traditional financial infrastructure, while third-party companies manage and convert cryptocurrencies.

Independent issuance by professional cryptocurrency payment companies. Some companies focused on cryptocurrency payments independently issue U Cards through partnerships with payment networks like Visa or MasterCard.

Collaborative issuance through a SaaS model. This refers to third-party payment companies providing U Card issuance platforms for distributors or other financial service providers through a Software as a Service (SaaS) model.

1.2 U Card Usage Mechanism

U Card is relatively easy to use, which is one of the key reasons for its widespread acceptance. We can understand the usage mechanism of U Card in two steps.

Recharge: Users recharge USDT into their wallets and then transfer USDT from their wallet address to the U Card address. At this point, the U Card operator will convert the USDT into the corresponding foreign currency.

Withdrawal or consumption: Users can use the U Card to withdraw cash at ATMs worldwide or directly swipe the U Card to pay for expenses. At this time, the payment is made in the converted fiat currency, not in USDT.

2. Reasons for U Card's Popularity

2.1 Protecting Personal Privacy

Web3 users often place a high value on personal privacy, including transaction privacy, and wish to remain anonymous during payments or transfers. U Card provides users with excellent privacy protection mechanisms. On one hand, virtual U Cards typically do not require real-name registration, allowing users to purchase or recharge anonymously; on the other hand, although physical U Cards may require some level of KYC verification, they still significantly reduce the risk of personal information exposure compared to the extensive personal information required for transactions through traditional banks.

2.2 Simplifying Payment Processes

U Cards typically offer real-time payments and settlements, avoiding the time delays that may occur with traditional bank transfers and eliminating the need to convert USDT into fiat currency beforehand, providing strong convenience. Additionally, besides traditional POS payments, U Cards can also be used for payments through digital wallets, QR code payments, and other methods, compatible with various mainstream payment channels, offering strong flexibility.

2.3 Reducing Cross-Border Payment Costs

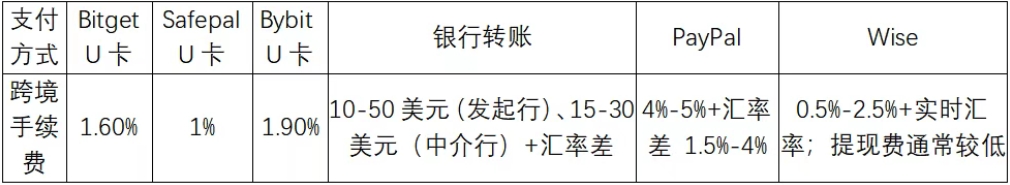

The fees associated with U Cards are often significantly lower than those of traditional payment channels, particularly evident in cross-border payments. The following compares the cross-border fees of various payment methods:

3. Potential Risks of U Card

3.1 Tax Risks

Due to the support for anonymity or minimal real-name requirements, some users hope to evade taxes using U Cards, such as concealing income sources to reduce tax liabilities. However, this behavior of tax evasion through U Cards is actually unfeasible. First, although U Cards have a certain level of anonymity, most U Cards still rely on international payment networks (Visa, MasterCard, etc.). These payment networks record detailed transaction data, including transaction amounts, merchant information, transaction times, etc. Therefore, tax authorities can still trace the flow of related funds through these transaction records. Secondly, for cross-border transactions, tax authorities can track cross-border fund flows through foreign exchange monitoring systems and bank information exchanges. Many countries have signed agreements for automatic exchange of tax information (CRS, Common Reporting Standard), making cross-border fund flows relatively transparent. Through this method, tax authorities can also obtain transaction information related to U Cards. Finally, in actual use, payment platforms may impose strict real-name verification on large transactions. If users are involved in frequent large fund flows, the platform may require additional information such as proof of the legality of the fund sources. Therefore, tax evasion through U Cards is not feasible and may lead to tax audits and penalties.

3.2 Legal Risks

Using U Cards also requires attention to several legal risks. For example, in some countries with strict foreign exchange management, although U Cards do not set personal withdrawal limits, exceeding foreign exchange quotas for outbound funds may violate foreign exchange management regulations. If discovered by foreign exchange management authorities, users may face administrative fines or even criminal charges. Additionally, the legal status of cryptocurrencies is still unclear in some countries, and some countries completely prohibit the use of cryptocurrencies. In such cases, using cryptocurrency U Cards for transactions may also be deemed illegal. Therefore, before using U Cards, users should understand the basic compliance requirements of their country and region. Furthermore, users should not use U Cards as tools for illegal activities. For instance, if users engage in high-frequency, large-amount transactions with U Cards or assist others in cashing out, they may also be deemed to be engaging in illegal operations or money laundering, facing criminal penalties.

4. Conclusion

In summary, U Card, with its strong privacy, convenient payment, and low fees, provides an excellent off-chain payment solution for cryptocurrency investors, gaining widespread favor. However, U Card is not without its flaws, and users still face potential issues such as tax risks and legal risks, which must be approached with caution; otherwise, the consequences may outweigh the benefits.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。