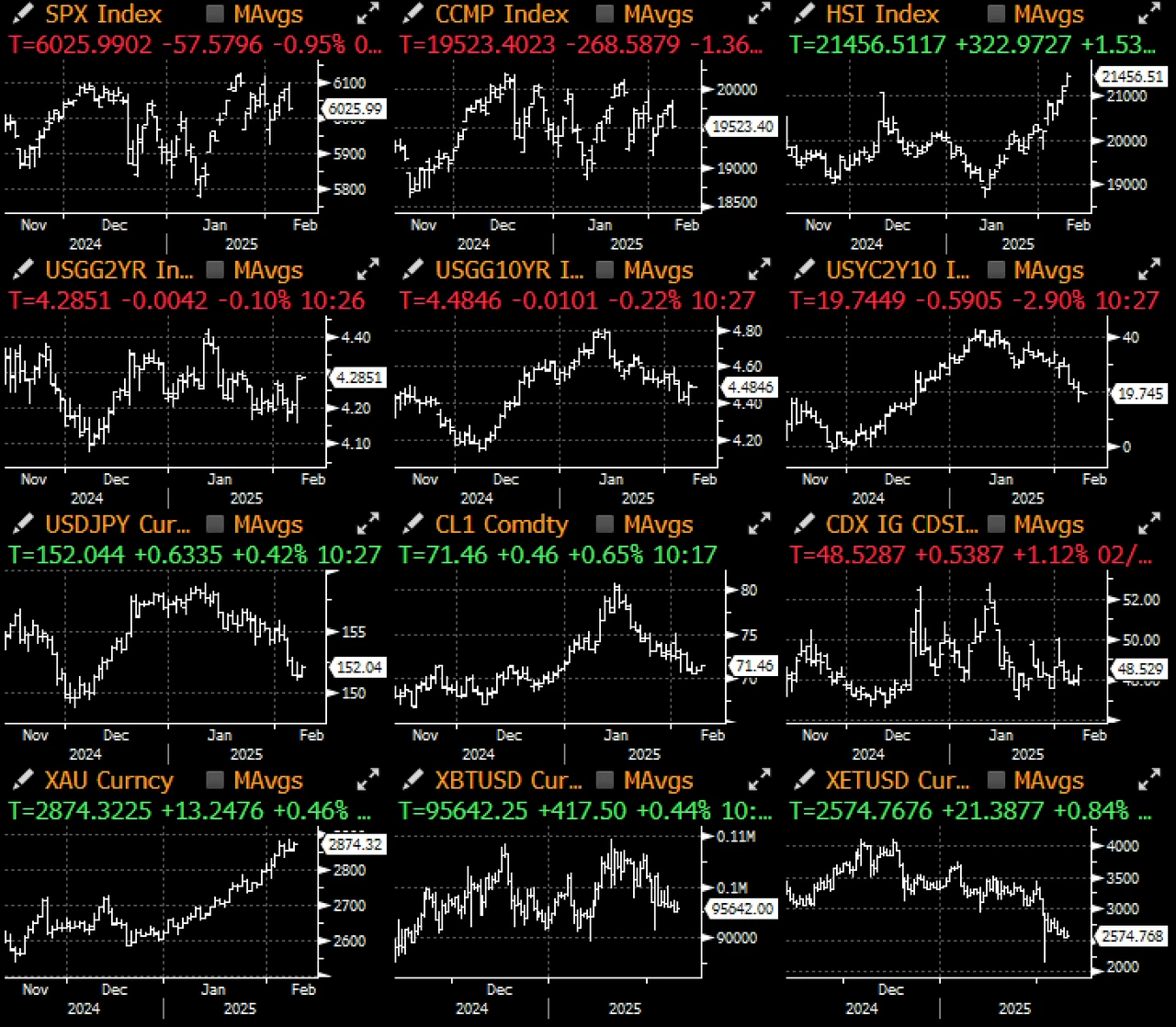

The market has opened 2025 amidst a series of unfavorable starts and unresolved price movements. With the shocking DeepSeek narrative and President Trump's occasional tariff threats, risk assets are struggling to find direction.

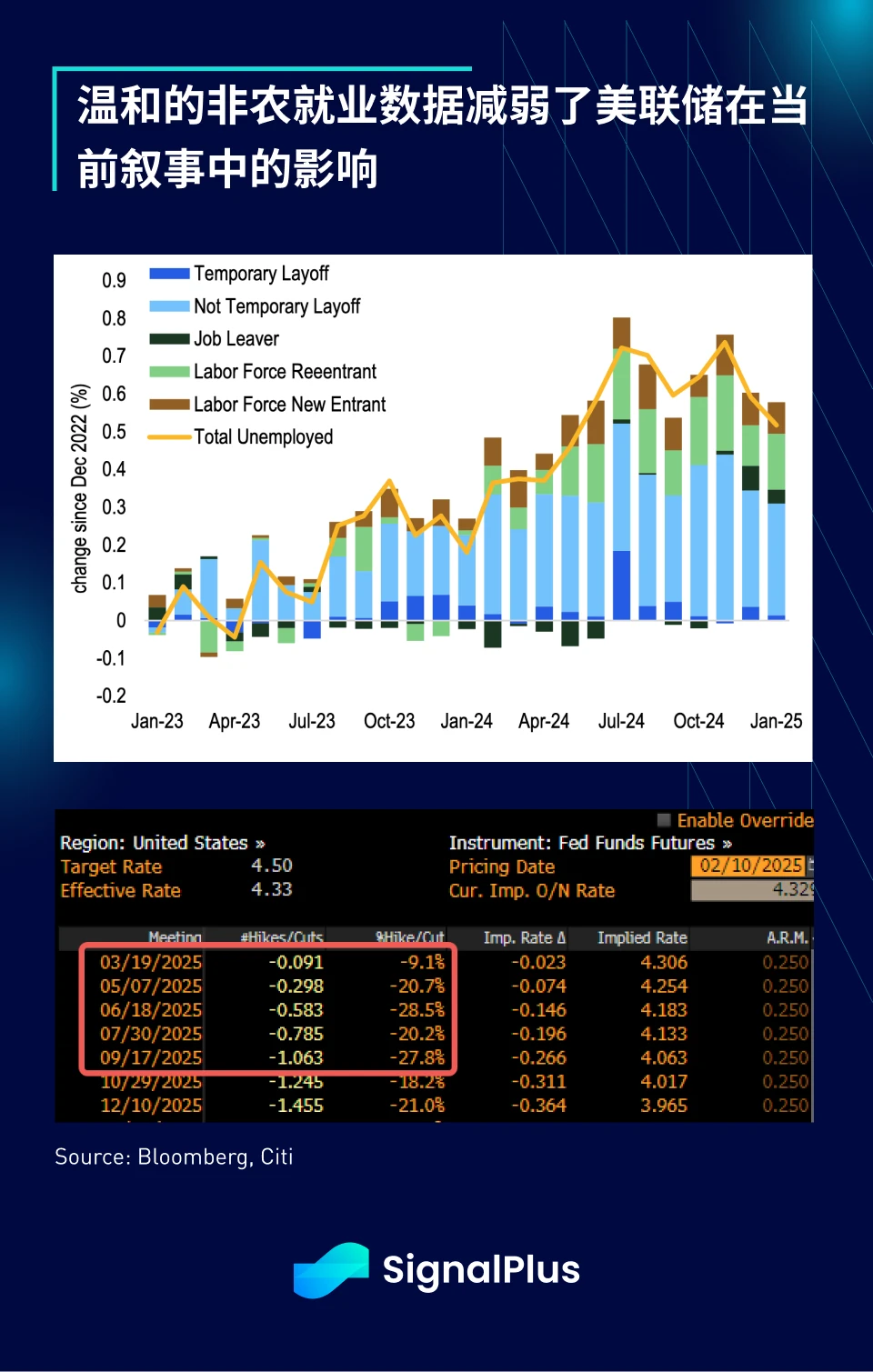

Economic data is currently of secondary importance; January's non-farm payroll data came in slightly below expectations, but the unemployment rate also dropped to 4%, leading to a muted market reaction. Federal funds futures currently reflect only a 9% expectation for a rate cut at the March FOMC meeting, with a complete rate cut priced in only after five meetings in September, diminishing the Fed's influence in the current narrative.

On the other hand, the unpredictability of tariff policies continues, with Trump stating he will announce a 25% tariff on all steel and aluminum imports today (Monday) and immediately implement reciprocal tariffs. As the market prepares for a challenging opening in U.S. stocks, there was selling pressure on U.S. stocks on Friday night.

Against the backdrop of tariff risks and ongoing global central bank purchases, gold prices are expected to rise to new highs this week. Since Trump took office, the People's Bank of China has increased its gold reserves for the third consecutive month. Notably, even as terminal rates rise and cryptocurrency momentum weakens, gold's upward trend continues, indicating that the structural change in demand is no longer solely influenced by central bank liquidity.

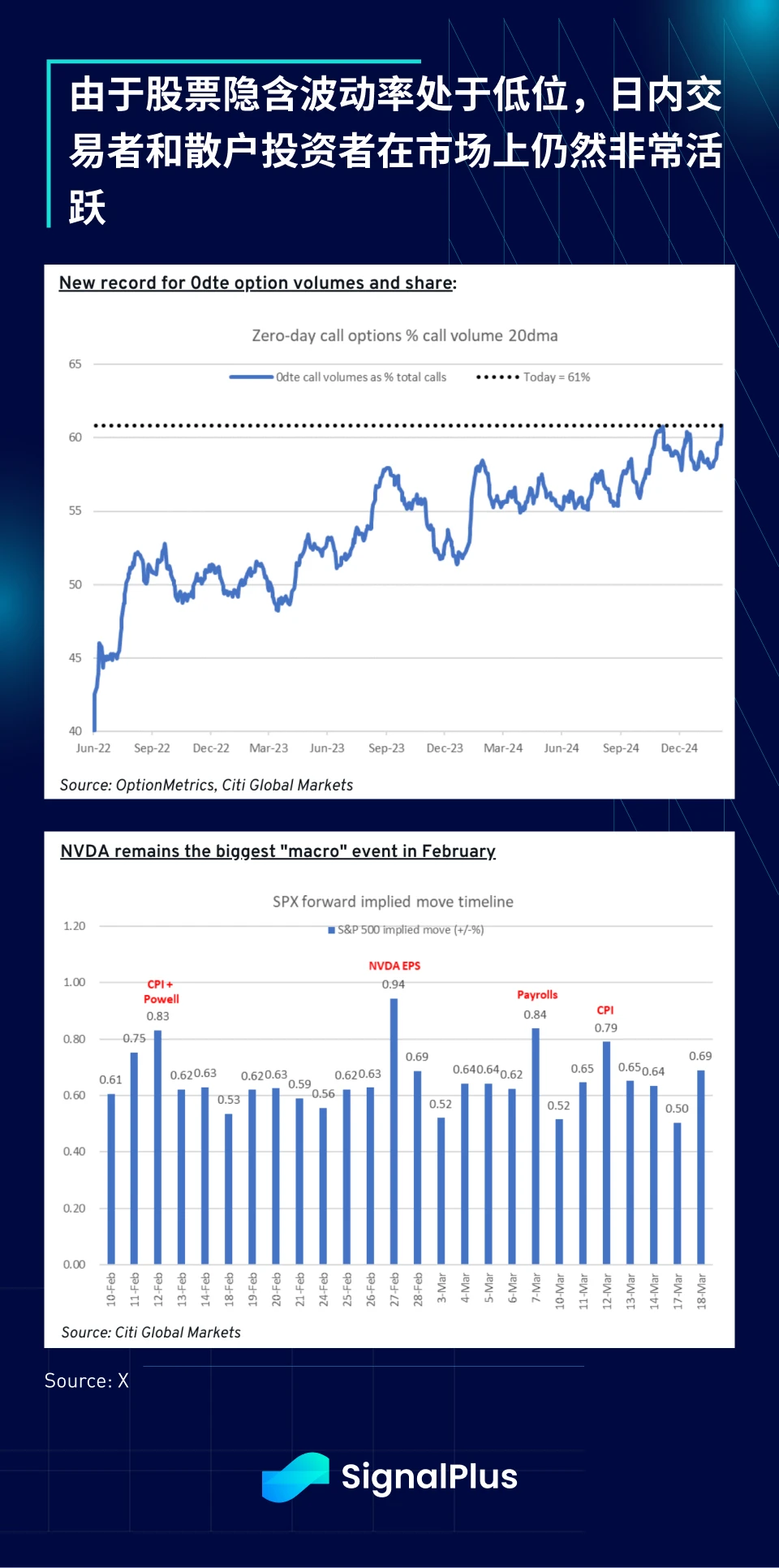

Despite the volatility at the start of the year, U.S. retail investors and day traders remain actively engaged in the stock market, with daily expiring options trading volume rebounding to historical highs. Apart from events like CPI/Powell and Nvidia's earnings report, implied volatility in stocks remains low.

The extremely optimistic market sentiment seems to be nearing a "sell" signal that triggers various sell-side trading models. In fact, the earnings outlook for the SPX index shows a downward trend in both the fourth quarter of 2024 and the forecasts for 2025, leading us to adopt a cautious stance on the recent stock market outlook.

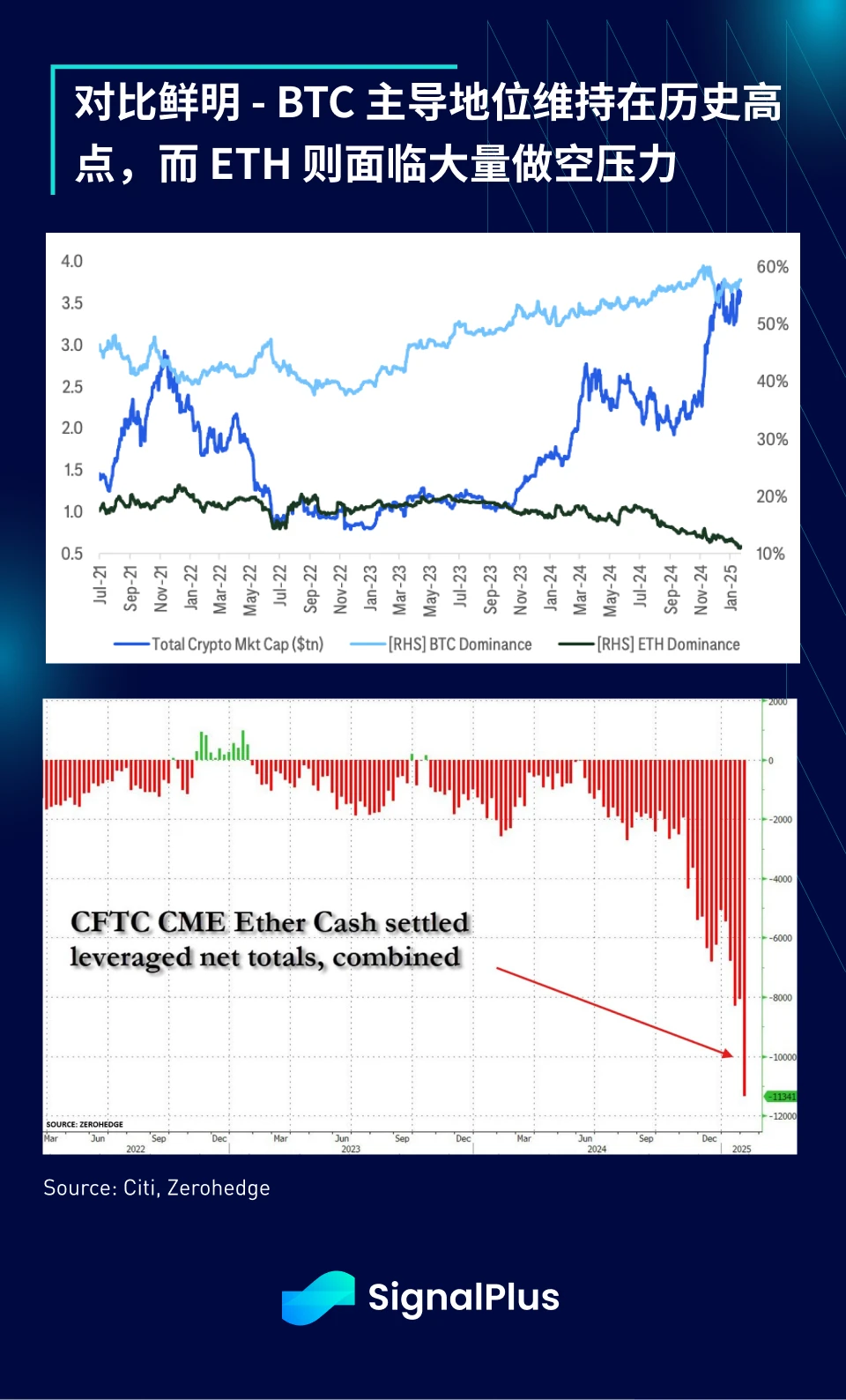

In the cryptocurrency space, price movements have been disappointing. While the market remains excited about the potential for BTC to be included as a reserve asset and the participation of mainstream institutions, major altcoins have dropped 15-20% since the beginning of the year. We previously expressed concerns about the issuance of the $TRUMP Memecoin and its potential negative impact on the cryptocurrency industry. So far, this concern has been validated, as trading volumes in cryptocurrencies have significantly declined since the new year, and recent large-scale liquidations have severely impacted trading account profits and losses.

BTC's strong performance relative to other assets is most evident compared to ETH, which is currently facing record short pressure and intense FUD sentiment. This second-largest token has dropped 23% since the beginning of the year, significantly lagging behind BTC's +2.5%. The lack of L1 catalysts and narrative dominance may continue to pressure Ethereum.

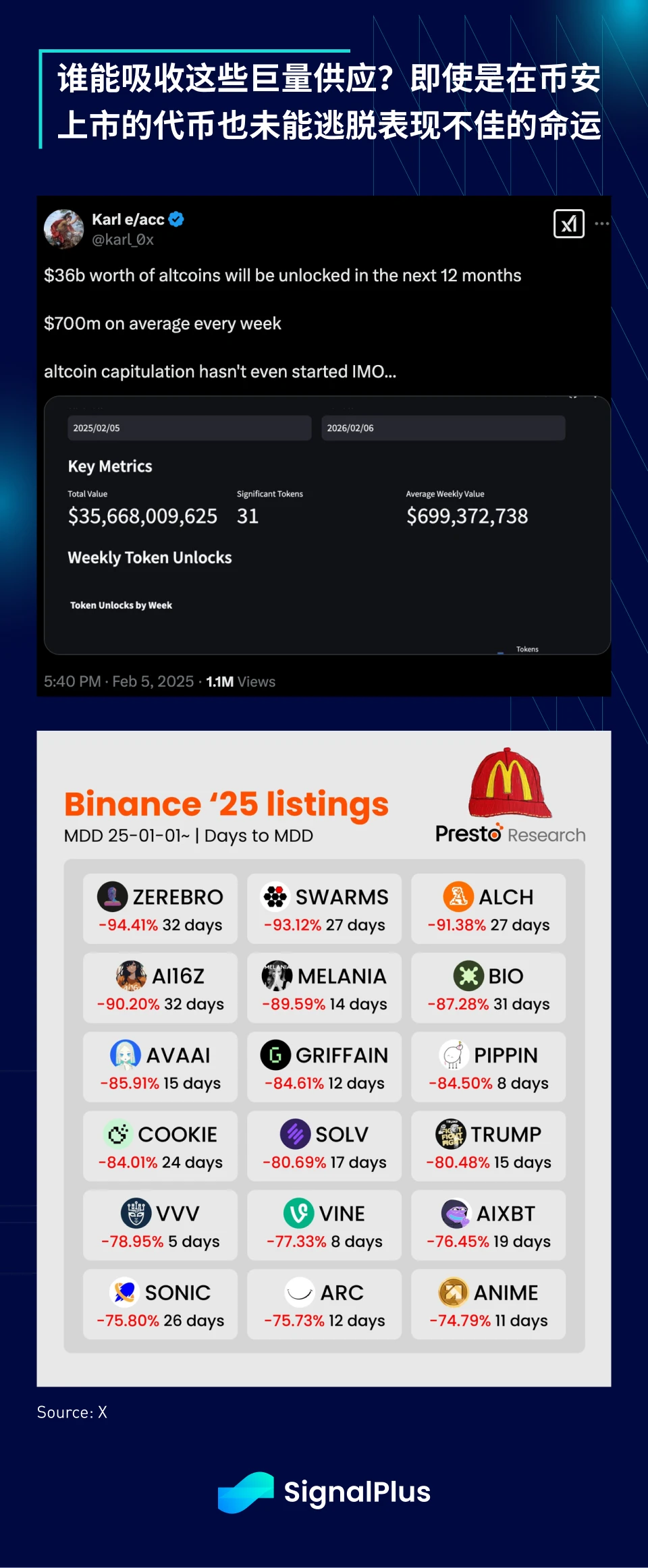

Worse still, analysts point out that over $30 billion in altcoin supply will be released in the next 12 months. These unlocked tokens will flow into a market with limited demand and significant wallet losses. However, the TradFi funds entering the market may only focus on BTC or the top three tokens, unlikely to spill over into the altcoin market. This weak market state is also reflected in the performance of new tokens after their listing, even on Binance. It seems that this time is truly different for the current cycle moving towards maturity.

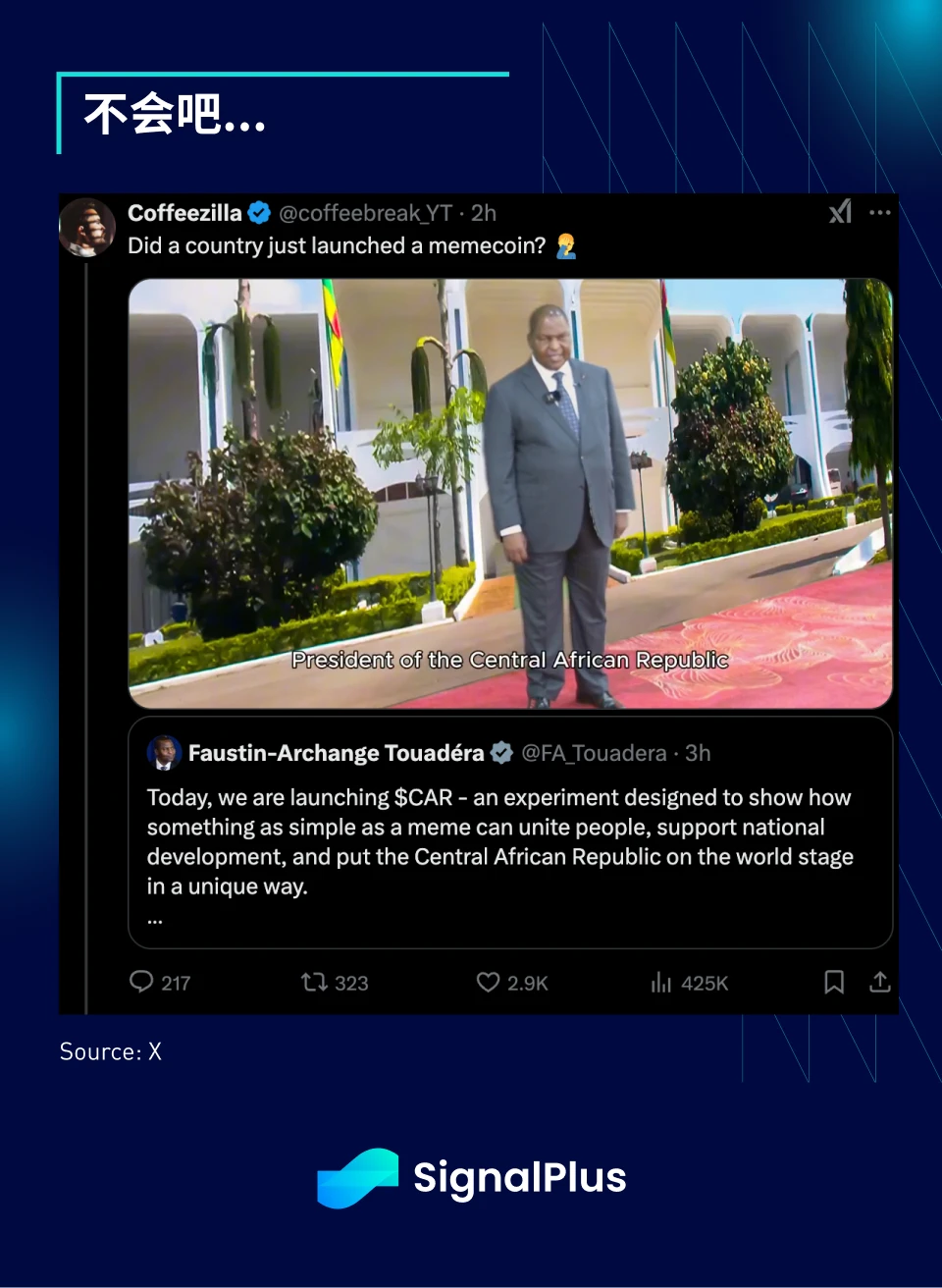

Finally, let's discuss a lighter topic: after the issuance of $TRUMP, will more countries issue their own memecoins to raise budget funds? I sincerely hope this is just a joke and not a phenomenon that will be normalized in the coming year!

You can use the SignalPlus trading indicator feature at t.signalplus.com for more real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and communicate with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。