1. Tune in to Strategy's Twitter from 21:00 to 21:10 tonight

Michael Saylor, co-founder of Strategy (formerly MicroStrategy), posted a chart on Twitter showing the amount of Bitcoin held by the company. According to past patterns, he usually announces the changes in Strategy's positions after 9 PM on Monday evenings, which can lead to significant short-term volatility in BTC. This is worth paying attention to.

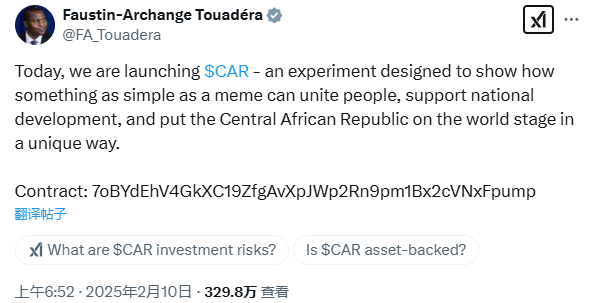

2. Central African President Launches Meme Coin - CRA

In addition to Trump, another country's president is promoting a meme coin.

This morning, Central African President Faustin-Archange Touadéra tweeted about the launch of CAR, bringing strong narrative and traffic endorsement, sweeping through the entire crypto community. Some individuals made significant profits in a short time; for example, a trader turned $5,000 into $12 million in less than 3 hours, achieving a return of 2450 times. However, the risks associated with this project are still quite high.

- No news has confirmed whether the Central African President's account has been hacked;

- According to third-party platform monitoring, the official domain car.meme was registered not long ago (registered on February 6);

- The circulation of CAR tokens is highly concentrated in a few addresses, and if large holders sell off, the impact could be significant;

- Lessons from TRUMP should be learned.

3. Views on the Trade War

The trade war initiated by Trump continues to escalate, impacting global supply chains, which may affect the mining industry (supply side, easily causing a chain reaction).

1. Mining Equipment Costs Surge, Miners May Be Forced to Sell BTC

The tariff pressures from the trade war will directly affect the chip supply chain for mining equipment, leading to increased costs. If production costs rise while BTC prices remain unstable in the short term, miners' profit margins will be squeezed, potentially triggering a wave of miner sell-offs, increasing market selling pressure.

2. Global Energy Market Volatility, Rising Mining Costs

Trump's tariff policies may also have a chain reaction on energy prices, especially for the mining industry that relies on cheap electricity; increased costs will force some computing power to exit the market, which could even affect Bitcoin's network security.

Currently, the trade war's short-term impact on the stock market, cryptocurrency, and other markets is leading to increased risk aversion, with both markets under pressure and retreating. Analyzing from the perspectives of global market risk appetite, dollar liquidity, and capital demand for safe-haven assets, BTC may unfold as follows:

- Short-term (1-3 months): Market sentiment is unstable, BTC may maintain a volatile trend, and key breakthroughs in resistance zones need to be monitored.

- Medium-term (3-6 months): If the trade war leads to the Fed cutting interest rates early, BTC may see a capital inflow, opening up upward space.

- Long-term (6-12 months): Global economic cyclical adjustments may lead institutional funds to increase BTC allocations, and the market is expected to welcome trend opportunities.

4. Analysis of BTC's Current Status (Based on 45-Minute Custom Cycle)

Recently, BTC's overall trend has shown a downward oscillation, with highs and lows continuously declining, and market bearish forces dominating. The current market analysis is as follows:

1. Indicator Signals: Bears Strong but Market is Brewing a Rebound

- Coinbase BTC premium has turned positive, indicating signs of recovery in US market demand.

- MACD line divergence indicates a short-term need for correction.

2. Capital Flow: Major Orders Buying Low, Market May Welcome a Trend Change

- Recently, there have been multiple instances of large market buy orders, especially around 95,000 USDT, indicating major players are entering to buy the dip.

- High-volume sell orders are dense at higher levels, and major selling has not yet stopped (selling pressure), but the volume has weakened compared to earlier.

3. Key Support and Resistance Levels

- Short-term support level: $95,620 (a dense area of major buy orders, which may become a rebound starting point).

- Strong support level: $94,705 (if broken, the trend may continue to weaken).

- Key resistance above: $97,640 (breaking through may open up new upward space).

- Strong resistance level: $100,125 (near psychological pressure points, recently encountered resistance and retreated multiple times).

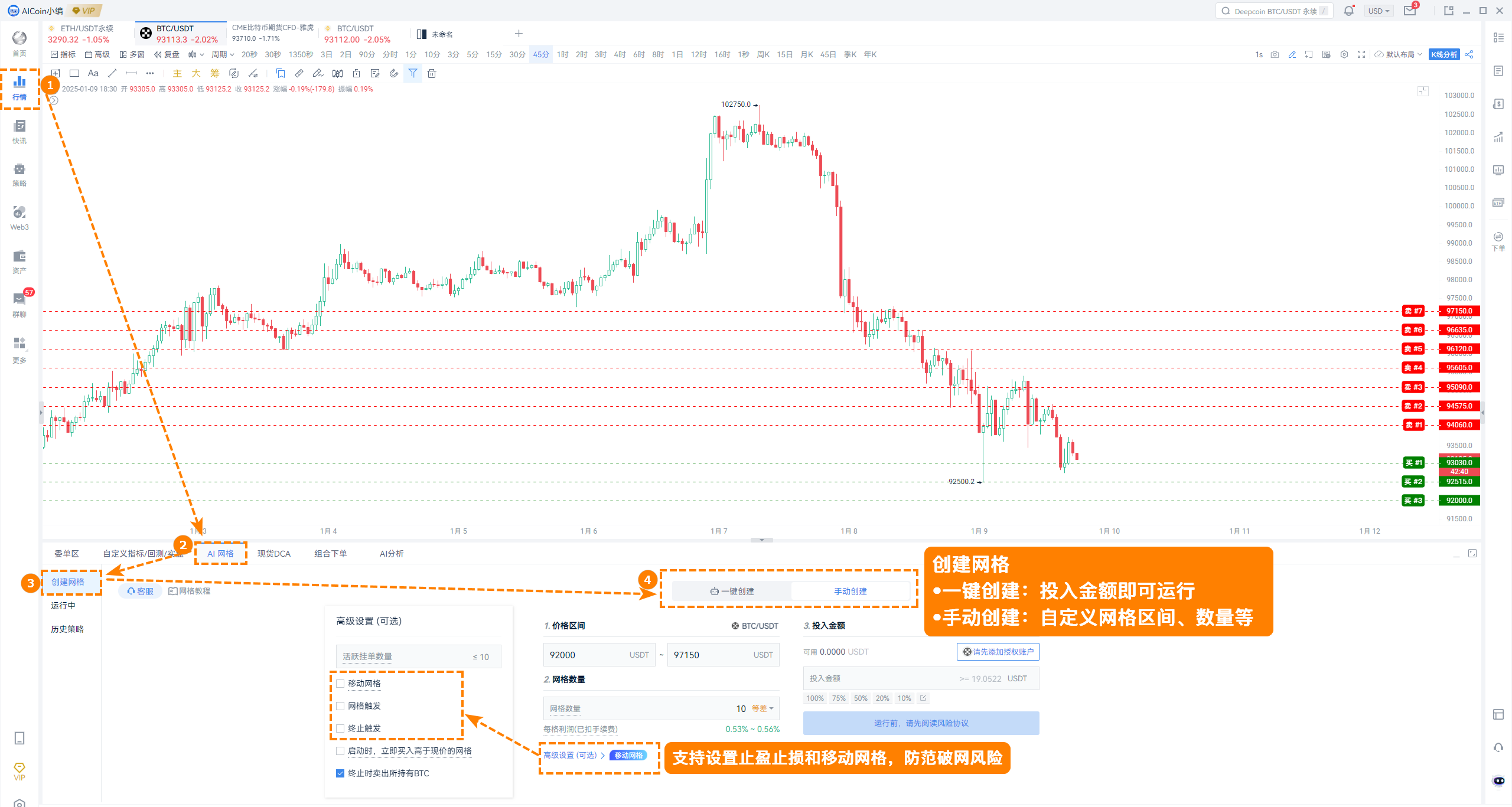

5. Strategy Recommendations - Grid Trading (Buy Low, Sell High)

In a volatile market, the most effective strategy is grid trading. Whether the market is rising, falling, or oscillating, profits can be steadily gained through buying low and selling high.

- Shorting grid after a surge: Capture pullback profits by utilizing the rise and fall.

- Longing grid after a drop: Position at lows to accumulate profits for future rebounds.

- Neutral grid for oscillating markets: Achieve continuous profits through “selling high and buying low.”

Functional Highlights:

- Mobile Grid: The grid's upper and lower limits automatically follow price changes, avoiding missing market opportunities and adapting to various trends.

- Efficiently Capture Short-term Opportunities: Capture every phase of pullbacks or rebounds, turning every fluctuation into profit.

- Flexible Profit and Loss Settings: Reduce risks brought by extreme market movements, helping you trade steadily.

Special Reminder: Running grid strategies can mitigate risks by setting profit and loss limits and using mobile grids to prevent network breakdown risks.

Recommended Reading:

“Beginner's Guide: Quickly Understand AI Grid Tools”

“Trump's New Tariff Policy: Challenges and Opportunities for the Cryptocurrency Market”

The above content is for sharing purposes only. If you have any questions, you can join the 【PRO CLUB】 group to contact the editor~

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying, Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。