In 2025, AI applications will usher in a year of explosion.

Author: Liu Xuenan, Investment China

The explosive DeepSeek is enough to be recorded in history. Many years later, when people look back at this moment, the conclusion may be that since the release of ChatGPT by OpenAI at the end of 2022, the mainstream narrative of AI development in China has always been "catching up," while DeepSeek emerged, transforming "catching up" into "innovation" and "popularization," even "restructuring" and "surpassing."

However, VCs are clearly disappointed, as none of the large model startup projects they supported, including the "Six Little Dragons of Large Models," have achieved global popularity like DeepSeek. The newly released Kimi reinforcement learning model k1.5, which was launched almost simultaneously with DeepSeek, is the first multimodal model after OpenAI's o1, and while it is close to or even surpasses o1 in many aspects, it has not made much of a splash and is similarly drowned in the fervor surrounding DeepSeek.

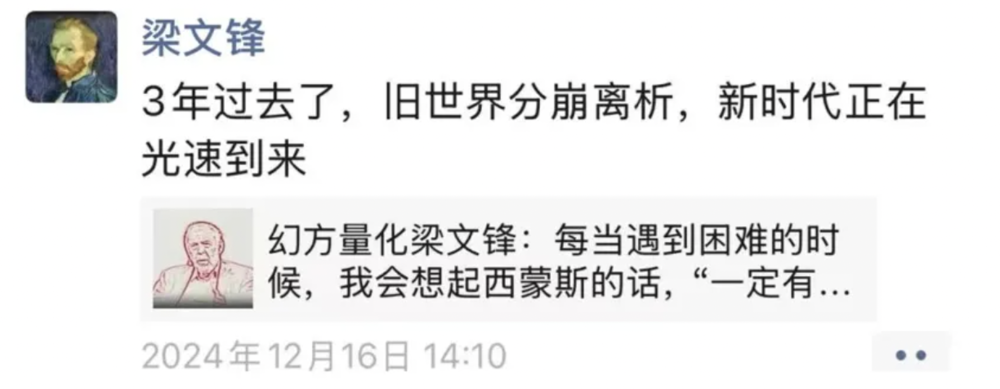

Everything may have started when DeepSeek's founder, Liang Wenfeng, appeared on the evening news, becoming a guest of the Prime Minister. What he said at this meeting may not be the most important; the public is more concerned about why an 80s-born man with long bangs suddenly gained high-level attention. Looking at social media, oh? He runs a quantitative fund. Curiosity piqued.

As a long-term observer of the AI industry in the primary market, the speed of public opinion fermentation was lower than my expectations, but the extent far exceeded my imagination. On January 20, Liang Wenfeng appeared on the evening news, and the news fermented for a full week. The "DeepSeek R1 $5.5 million training cost," which is set to overturn the world, only caused Nvidia's stock price to drop by 3.12% on Friday, but the following Monday, it led to a significant drop of -2.73% in the A-share ChiNext index. At that time, my assessment was that DeepSeek slapped Nvidia in the face but then kicked A-shares even harder.

The slap came quickly. On January 27, Nvidia opened lower and fell nearly 17%, and the global computing power was in mourning, crying "the wolf is coming," with DeepSeek being that wolf. Of course, my personal honor or disgrace is of little consequence; getting slapped is a common occurrence. But Chinese VCs have almost become the biggest "victims" outside of AI computing power, with public opinion generously praising Liang Wenfeng and his idealism while also subjecting Chinese VCs to extreme humiliation and condemnation. For example, a post on Xiaohongshu had the title "DeepSeek once again proves that Chinese VCs are a joke." Even more unfortunately, it received over a thousand likes.

But I still want to say clearly that moral condemnation is very low-level. At this stage, discussing "why VCs did not invest in DeepSeek" is not very meaningful beyond emotional venting; not investing is simply not investing, and any objective or subjective reasons sound like excuses. Further reflection is certainly necessary, but not immediately. Looking at the domestic primary market, from LPs to GPs, and through all stages of fundraising, investment, management, and exit, many "chronic diseases" are difficult to eradicate in a short time, and many are not even within the control of VCs/PEs.

I believe the urgent discussion should focus on the present and the future, at least including three questions: Can DeepSeek be invested in now, and what is its valuation? What impact does DeepSeek have on various AI projects previously invested in? What positive guidance does the AI industry transformation triggered by DeepSeek provide for VCs' next capital deployment in AI?

1. DeepSeek Financing? Liang Wenfeng "Playing Tai Chi"

Regarding DeepSeek's valuation and whether it can be invested in, many messages have already leaked in the past few days. Just last night, there were reports that Alibaba would invest $1 billion for a 10% stake at a $10 billion valuation. In response, Alibaba's Vice President Yan Qiao quickly refuted the rumor through social media, stating, "The information circulating about Alibaba investing in DeepSeek is false." However, an investor close to this transaction told Investment China, "It's quite sensitive now, and they are not convenient to say anything; we need to wait a bit longer," so this denied transaction may still have some variables.

Before this, a certain AI investor told Investment China that DeepSeek is in contact with investors, and the valuation he revealed is $8 billion, which differs from the aforementioned "Alibaba's $10 billion valuation" "false news." Regardless of whether it is $8 billion or $10 billion, DeepSeek's valuation has far exceeded the highest among the "Six Little Dragons of Large Models," which is MiniMax at $4 billion.

According to Investment China, many investors have directly or indirectly approached Liang Wenfeng to confirm whether financing has officially started, with valuations roughly around the aforementioned range, but Liang Wenfeng has not given a direct acknowledgment or denial, instead opting for a "playing Tai Chi" approach. Many investors have also reached out to relevant personnel responsible for IR at DeepSeek to inquire whether financing is underway, and as of yesterday, they received denials.

Additionally, there is information that some people within DeepSeek have "advised Liang Wenfeng many times about whether DeepSeek should seek financing." This at least indicates two points: first, there may not be a unified opinion within DeepSeek regarding whether to seek financing, but the decision-making power certainly lies with Liang Wenfeng, as he holds the key to unlocking the treasure; second, Liang Wenfeng may have recently had contact with some investors or industrial capital, but it has remained within a very small circle.

For instance, Zhu, who has repeatedly scoffed at investing in large models, is definitely not in this circle. Even though DeepSeek has changed his attitude towards large models, stating, "I will definitely invest," when Investment China asked him if he had heard about DeepSeek's financing news, he replied, "No." But Zhu is still Zhu, and he is very precise about whether VCs should participate in DeepSeek's financing, saying, "The price is no longer very important; the key is to participate in this."

To digress, in short, VCs have high expectations for DeepSeek's financing. Multiple investors have described to Investment China the necessity of DeepSeek's financing from the perspectives of C-end traffic acquisition, surging bandwidth and computing power costs, future scaling up, and most importantly, retaining talent to maintain continuous innovation capabilities.

Of course, it is still that saying, the key is only in Liang Wenfeng's hands, as well as in the hands of those who can decide whether DeepSeek can move towards a larger narrative. What follows is just a matter of time. But from my personal perspective, I would prefer to see whether DeepSeek can hold on for a while longer; on one hand, the longer the time, the more exciting the game will be; on the other hand, as one investor said on social media, "If DeepSeek can maintain the purity of being a private company to build public good, this beauty is rare."

2. "No matter what, we must kneel to get some shares"

DeepSeek's emergence before and after the Spring Festival has left large model investors feeling complex emotions. The surprise lies in the fact that Chinese large model companies can catch up with the world level so quickly, while the panic stems from the potential for a huge change in the entire AI investment logic.

"At least domestically, DeepSeek has already won this war. The valuation of the ongoing round of financing has reached $8 billion, making it the highest-valued company in the industry, which is causing a scramble for investment or can only be directed." An AI investor told me.

DeepSeek had not previously opened financing, with initial funding supported by Huanshuo Quantitative. According to Liang Wenfeng's statements in interviews, he had tried to find funding sources but found that his focus on research did not align with VCs' greater emphasis on commercialization, so he abandoned the idea. In stark contrast, after its explosive success, DeepSeek began to be surrounded by investors.

With its brilliance revealed, even if it wanted to hide its sharpness, it would be difficult. In the eyes of the aforementioned investor, financing has now become a necessity due to the situation. "Now DAU has skyrocketed to 20 million, and the traffic is coming in so rapidly that it is clearly unsustainable. If DeepSeek were only developing models without applications, that would be fine, but now that applications have been developed, they are spending hundreds of thousands or even millions every day, and must consider issues like servers and network resources. Additionally, they have already run through single points, and now they need to scale up, which also requires money."

However, this news has not been confirmed by the parties involved. In response to recent inquiries from investors, the person in charge of financing at DeepSeek still stated, "There are no financing plans." Last night, the news that "Alibaba plans to invest $1 billion for a 10% stake at a $10 billion valuation" was also clearly denied by Alibaba's Vice President, but this did not prevent Alibaba's stock from rising over 6% in pre-market trading.

A state-owned enterprise and large company that could invest tens of billions is considered the most likely candidate to enter DeepSeek's financing round. Some interesting details include that the Huanshuo headquarters in Hangzhou, located in the Huijin International Building, shares the same office building with the Zhejiang Provincial Financial Holdings, which is currently filled with reporters and investors, while DeepSeek's Beijing office is located in the Rongke Building, which is also shared with Baidu's investment.

An investor from a provincial state-owned enterprise told Investment China that their organization has been in contact with DeepSeek "from top to bottom" recently, hoping to "kneel for a portion of shares" to get in, but DeepSeek has been very tight-lipped, insisting that there is currently no open financing window.

In fact, for those in the AI circle, DeepSeek is not mysterious; the legend of hoarding 10,000 A100s during the pandemic is widely circulated. Information I gathered from investors indicates that at the beginning of 2023, DeepSeek had discussions with a range of large model companies and investment institutions, including Xiaohongshu's founder, Mao Wenchao. However, in January of this year, DeepSeek reached a cooperation agreement with Xiaohongshu, and currently, the only official social media accounts DeepSeek has are Xiaohongshu, X, and WeChat public accounts. Clearly, Liang Wenfeng has a certain preference for Xiaohongshu.

Like Liang Wenfeng's statement, after the discussions, he and the VCs found that their goals were not aligned. "VCs are all managing money for LPs, and they all need to make money, so we can't find common ground." In July 2023, Liang Wenfeng established Hangzhou DeepSeek Artificial Intelligence Basic Technology Research Co., Ltd., focusing on general artificial intelligence and large model research and development. Coincidentally, ByteDance also began investing in AI research and development around that time.

Another detail is that around 2022, quantitative funds were continuously suppressed by policies, and Huanshuo's management scale also continued to shrink. Before founding DeepSeek, Liang Wenfeng, in addition to engaging with VCs, had a large number of GPU computing power clusters at his disposal, and with his own money, he had considered using the abundant computing power he held through investment shares or finding cloud vendors to cooperate, even hiring two people specifically for strategic investment to look at a large number of technology projects, including low-altitude ones, but Huanshuo's conclusion was, "What can be done outside can also be done by ourselves," and most projects "were not very meaningful," ultimately leading to "not investing in any." Later, based on Liang Wenfeng's idealistic feelings about technology, DeepSeek was born.

The changes in the large model market are rapid, and DeepSeek is quickly becoming a disruptive force in the market. "When I look at various AI projects, I basically always ask what foundational models they are using and which models they think are better. By 2024, the general feedback from everyone has been Tongyi, Doubao, and DeepSeek," said Eric (a pseudonym), a partner at an investment firm.

The popularity of DeepSeek among the general public stems from two models. On January 13, DeepSeek launched its app version, using the V3 large model, which is a fully open-source MoE (Mixture of Experts) model. DeepSeek reported that the training cost of its V3 model is only $6 million, just 1% of Llama 3's cost. On January 20, DeepSeek released the open-source large model R1, achieving performance close to OpenAI's latest O1 model at an extremely low training cost. A day later, DeepSeek topped the free download charts in the Apple App Store in the US and China.

"Nobody could have predicted that DeepSeek would become this popular. When V3 was released, the industry noticed, but since the app wasn't online at the time, it didn't ignite the C-end. After the application was released, ordinary people felt that the product was effective, and DeepSeek began to appear in street conversations. The difference between organic traffic and purchased traffic became apparent at this point," said Jared (a pseudonym), a partner at another firm.

The popularity of any product relies on timing, location, and people. Timing is crucial. In Eric's view, the current upward curve of AI has already slowed, the pre-training data is nearly exhausted, and the capabilities of large language models are no longer easily improved. The focus must shift to reasoning models represented by OpenAI's O1 and DeepSeek's R1. "At this point, it's a choice between continuing to spend big money to chase a ceiling or not pursuing that 5% improvement and instead reducing costs to one-tenth of the original. The cost-reduction path represented by DeepSeek has emerged at just the right moment."

3. "The Six Little Dragons" Will Find It Difficult to Raise Funds Without Differentiation

"The comprehensive costs of large model training in China (data, labor, electricity, and computing power) are lower than in the US, and DeepSeek, due to its excellent engineering capabilities, has controlled costs to the extreme. In the next two quarters, DeepSeek will become the industry benchmark, and cost reduction is the trend," Jared believes.

In the past, large models burned money fiercely, and the reduction in R&D costs primarily shakes the valuation logic of these companies.

Eric believes that the high panic triggered by DeepSeek overseas is precisely because the valuations of those large companies need to be reassessed. "In the past, everyone believed that large models were essentially a competition for capital, just as we said that if you didn't secure $100 million before May 2023, you shouldn't pursue large models in China. But when everyone realizes that so much money isn't necessary, the valuations of large model companies may struggle to hold up. In the long run, valuation is based on the value you create, while in the short term, it depends on how high people perceive your barriers."

Wang Rongjin believes that whether DeepSeek's emergence will impact the valuations of existing large model companies is still uncertain, but its extremely low costs have brought shockwaves to the industry. If large model companies can innovate in other ways to reduce training or reasoning costs, the impact on valuations may be limited. "It is not ruled out that domestic companies will innovate in other ways to achieve similar effects, which is also worth looking forward to."

Jared's attitude is more pessimistic. He believes that if the "Six Little Dragons" do not pursue differentiation, they will find it difficult to raise funds again. Large companies have capital backing and can continue to fight, but for startups, if they cannot secure the top position in a single project, it is basically of little significance. "Of course, as long as there is differentiation and they don't burn money, surviving is also a way out."

In fact, the "Six Little Dragons" have already diverged into different paths. Some companies are still burning money to train large models; for example, I learned that a certain company had revenues of around 300 million last year but costs exceeding 2 billion. Some companies have already given up; for instance, Lingyi Wanju has established a "Joint Laboratory for Industrial Large Models" with Alibaba Cloud, no longer pursuing the training of super large models but continuing to train models with moderate parameters that are faster and cheaper, building profitable applications based on the latter.

"When the results of pre-training are no longer as good as open-source models, every company should not be fixated on pre-training." In an interview with "Wandian," Li Kaifu said. Some companies are investing more energy in multimodal models, such as MiniMax. Others are turning to focus on vertical industries, such as Baichuan, which has now focused on developing medical large models. Jared believes that whether these large model companies' valuations are reconstructed ultimately depends on the results of commercialization; if DeepSeek seeks financing, it will face the same commercialization issues.

4. Consensus and Divergence Regarding DeepSeek

DeepSeek has been seen by some as a symbol of "national fortune," but whether it can dominate remains a point of divergence among investors.

Jared believes that large companies will find it difficult to innovate like DeepSeek. The reason is that large companies have excess resources, which leads to a lack of focus on how to optimize costs to the extreme. At the same time, internal competition is severe, with more emphasis on competing for personnel rather than for projects. KPIs are often simplified to "how many DAUs are achieved," a goal that can be met through purchasing traffic, making it difficult for everyone to focus on solid technological innovation. Those from hedge fund backgrounds place great importance on resources and costs, always thinking about how to engineer innovations to reduce costs, which differs from the genes and skill sets of large companies.

However, Eric believes that among those star startups, DeepSeek will remain in the top position for a long time, but it is still difficult to say that DeepSeek's large model is superior to those of Alibaba and ByteDance. From the perspective of the technical paradigms employed, theoretically, the paradigm ceiling of OpenAI's O1 is higher than that of DeepSeek's R1. "Whether to save money or pursue a high ceiling is a choice issue. In China, everyone's capabilities are strong; it's just that the focus is different. Doubao and Tongyi have developed multimodal models, while DeepSeek is more focused, only developing language models, and its greatest strength lies in cost savings."

During the Spring Festival, Wang Rongjin, founding partner of Xuan Yuan Capital, was researching the underlying logic of DeepSeek. In his view, DeepSeek has made many innovations in applications, engineering, architecture, and other areas. As for the aspects of market discussion regarding references, he feels there is nothing wrong with that; OpenAI's Transformer originated from Google, Apple's iOS partially referenced Xerox, and Microsoft's GUI partially referenced Xerox's Alto. Everyone is standing on the shoulders of giants to make further progress.

Descriptions from foreign media are even more interesting. Some media have likened the different paths between OpenAI and DeepSeek to the conflict between the "wrong but romantic" Royalists and the "right but repugnant" Roundheads during the 17th-century English Civil War. The AI Royalists pursue AGI at all costs, while the AI Roundheads focus on more practical goals, solving specific problems as efficiently as possible. The latest news regarding large model financing overseas is that Safe Superintelligence, founded by Ilya Sutskever, is negotiating financing at a valuation of $20 billion—still an expensive price.

A fog still hangs over the industry. "For several years, there have been shocking new developments in large models at the beginning of the year, and often the events at the beginning of the year are disconnected from what happens later, so now no one can predict what will happen by the end of the year," Jared said.

Eric believes that the post-training model mode represented by R1 has just begun, and DeepSeek has only proposed a fork in the middle; it is still unknown how it will develop, but there is no doubt that the demand for entrepreneurship will increase dramatically. In his view, the more important significance of DeepSeek lies in bringing a new value perspective. "Their goal is not to make money but to create valuable innovations; this value perspective is worth considering for Chinese companies, especially large ones."

As Liang Wenfeng said in an interview, "In the future, there will be more and more hardcore innovations. When this society allows hardcore innovators to achieve success, collective thinking will change. We just need a bunch of facts and a process." Over the past forty years, the wealth creation movements in real estate and the internet have not been driven by bottom-up innovation, but only when people see a certain relationship between returns and contributions will speculation cease to be the greatest value in Chinese business society.

"In 2025, AI applications will usher in a year of explosion."

This is the most common viewpoint I heard from investors and financial advisors at the end of last year, with some investors explicitly stating: in 2025, only AI applications will be considered.

After the Spring Festival, with the fire of DeepSeek, investors and companies have become even more eager for AI applications. However, amid the excitement, they cannot hide their confusion: they know opportunities are coming, but they cannot see where the opportunities are.

It must be acknowledged that in the face of the changes brought by DeepSeek, most companies have not had time to adjust at the strategic level, but in terms of action, they are urgently holding meetings around DeepSeek. Some investors have also stated that after work resumed, they held meetings about DeepSeek for two consecutive days and have already made emergency deployments.

When mentioning DeepSeek, many people's first impression is its high cost-performance ratio. However, the impact brought by this point has not reached a consensus in the industry.

Traini CEO Sun Linjia believes, "Excessive technological egalitarianism is not necessarily a good thing; it may lose the driving force for innovation. It seems that 2025 will be a year of transitioning from closed-source shells to open-source shells, resulting in a plethora of homogenized products that still struggle to find profitable methods. Currently, there are not as many companies capable of fine-tuning large models as one might imagine, and even fewer can sustain innovation; they lack data and talent."

Of course, he also acknowledges that smaller models and improved economics will positively impact applications, but on the application side, technology is not the biggest constraint; rather, it is the understanding of the industry.

In fact, prompts can now meet the needs of many applications, and it seems that not much good product has been produced. If we have Android systems because iOS is closed-source, we have not seen many smartphone brands emerge. The software applications that grew on Android did not kill iOS and its applications. Llama's capabilities are also powerful enough to meet the needs of most applications, but we are still far from what we expect.

More people are still willing to see the positive side that DeepSeek brings to the application side. For example, some investors point out that after DeepSeek's emergence, application vendors only need to focus on the front-end and back-end interaction experience of the application itself, while refining based on scenarios, which saves a lot of foundational investment.

Ma Chunquan, founder and CEO of Hecis, pointed out that the development of AI is akin to the development of electricity, which will give rise to many application vendors; this is a fundamental capability. The emergence of DeepSeek has reduced the cost of this fundamental capability to a very low price.

He further explained: many areas that previously hesitated to use AI can now explore and innovate because the current cost of AI in terms of computing power consumption, compared to customer value or output results, is negligible. For example, in the field of receipt recognition, we previously only dared to apply it in small batches, but now it has almost become zero cost, allowing us to apply it "recklessly."

It should be noted that when it comes to whether C-end applications or B-end applications are more favored by VCs, I received a unified answer from investors—that is, B-to-B applications have better investment cost-performance ratios.

Even internal personnel from non-investment industry companies believe that DeepSeek-related projects will be quite popular in the investment market this year, as they see the fully open-source DeepSeek accelerating the emergence of many niche scenario models.

First, B-end users are the most capable of paying, and all B-end applications still follow the original enterprise software thinking, meaning that each field will have its own large model. This is due to the differences in databases and knowledge bases across different fields.

However, the current problem is that application vendors do not create models themselves, which prevents them from seeing the demand and effects. More importantly, entrepreneurship in applications differs from large models; investors will not give companies much time and funding to experiment.

Similarly, it is currently impossible to predict which scenarios will explode; it can only be said that the emergence of these niche applications is accelerating.

Second, costs have decreased. What could previously only be done in laboratories can now be applied to every corner. In other words, many scenarios that have not been covered by AI will see more vendors using very low-cost AI for transformation.

In the view of Lu Jiaqing, a senior partner at Guoke Jiahe, if distinctive applications can emerge, they can quickly scale up. Especially for listed companies with application scenarios, creating an industry application that previously required hundreds of servers now only needs ten, resulting in a drastic cost reduction.

Furthermore, AI applications will definitely increase, and they will capture more market attention, as true large-scale commercialization of applications has not yet been realized.

The reason for not choosing C-end products is that investors share a consensus—C-end applications will eventually belong to large companies, which has been evident in the past.

In addition to the application layer, significant changes are also occurring at the hardware level. For example, to accommodate the influx of traffic brought by DeepSeek, previously idle computing centers built in various locations have been revitalized. Relevant practitioners indicate that these computing centers have begun to generate revenue. DeepSeek itself has also benefited from the data centers built in Zhejiang Province. Investors close to DeepSeek have stated that since its explosive popularity before the holiday, Zhejiang has provided many vacant data centers to DeepSeek at low prices.

According to a certain cloud service provider's observations, after the launch of the DeepSeek R1 version, there has been a very noticeable increase in user registrations, with a growth of an order of magnitude within one or two days, approximately 10 to 20 times. These registered users mainly fall into two categories: one is individual developers who want to validate their innovative ideas, and the other is corporate developers who are more interested in creating innovative applications that combine AI with business.

In this field, there are also some non-consensus views.

"The emergence of DeepSeek can disrupt the logic of computing power in the short term, but in the long run, the vigorous development of AI and applications will inevitably lead to an overall increase in demand, and computing power will still hold value. Of course, this is somewhat bearish for domestic GPUs, as low-process chips can be used, meaning the market does not need so many players; in the future, only one or two will be able to go public. This is also somewhat bearish for other domestic large model companies," Lu Jiaqing assessed.

Another chip investor stated, "This is an absolute boon for the chip industry, as it allows for good training results using chips with relatively low computing power, which means many chip manufacturers can secure relevant orders. Additionally, the lower the training costs, the more it facilitates the penetration of artificial intelligence in application fields."

As an investment institution focused on the smart automotive industry, Wang Rongjin is also concerned about whether DeepSeek will impact the landscape of intelligent driving, whether it will prompt other companies to iterate quickly, and whether it will lead to a re-evaluation of related targets' valuations.

Regarding the changes and opportunities brought by DeepSeek, I believe there is much more to discuss than what has been mentioned above. More importantly, the rise of DeepSeek is not just a technological iteration; it has also fostered the currently most scarce resource in China—confidence. I can't help but recall the views in "Sapiens" about "telling stories" and "believing in stories." Human society has developed over thousands of years through the collapse of old narratives and the construction of new ones in a spiral upward. Optimistically, perhaps DeepSeek is the turning point for the re-consolidation of confidence across various strata of the Chinese economy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。