Author: 1912212.eth, Foresight News

Recently, the overall market has been fluctuating and continuously declining, and the MEME craze seems to be gradually fading. However, the meme coin TST on the BNB Chain has suddenly exploded in popularity.

On February 6, the market capitalization of TST was only $500,000. On February 9, Binance announced its listing, and TST immediately skyrocketed, surpassing a market cap of $500 million, increasing more than 100 times in just three days. Currently, TST has dropped from its peak of $0.52 to around $0.17, a decline of over 60%.

Originating from an Educational Video

Recently, the BNB Chain team created a video tutorial on the Four.meme platform featuring the token TST as an example. This detail was discovered and heavily promoted by savvy KOLs in the Chinese community, quickly leading to a significant price increase.

Upon learning of the speculation, the BNB Chain team quickly deleted the private key of the creator's address (which held 0.13% of the total token supply). No one in their team or at Binance held this token. Zhao Changpeng also repeatedly clarified on Twitter that he and his team had no connection to it. Perhaps due to its "decentralized" nature, this statement did not cause TST's price to drop; instead, it led to another wave of speculation due to its popularity and buzz.

However, after its official listing on Binance, TST did not escape the "listing on Binance leads to a drop" curse and soon began to decline. Another meme coin, CHEEMS, which was listed at the same time, also faced misfortune, dropping from a high of $0.001884 to $0.0007.

After TST was listed on Binance, savvy whales chose to take profits. However, as newly listed coins on Binance faced another significant drop, the crypto community once again questioned Binance's listing standards and whether the BNB Chain ecosystem could gain momentum.

Wealth Effect Dwindling, Community Refuses to Pay for BSC

As the leading exchange in the crypto industry, Binance previously garnered market acclaim through its strong wealth effect and listing effect. Now, times have changed; VC coins on the exchange are no longer favored by the market and are generally facing a survival crisis, while on-chain meme coins have become a wealth haven for users.

This phenomenon has led to a general weakness in the rise of altcoins on exchanges, with severe drops when they do fall. Aside from mainstream coins, most altcoins have experienced significant corrections over the past two months. Meme coins have also seen a period of decline following the Trump-themed coins.

Binance finds itself in a dilemma regarding its spot listing strategy; listing tokens with higher market caps often yields low returns, while those with smaller market caps carry excessive risks, and significant price fluctuations could lead to heavy losses for many investors. Additionally, since Binance's global expansion, it has also been troubled by compliance issues, affecting the advancement of many businesses.

He Yi once stated that Binance has a complex token listing review process. However, the recently listed TST was born just a few days before its listing on Binance, raising questions among some community members: Does Binance really have a thorough review process? Or did it choose a fast track to support the BNB Chain ecosystem?

The Struggling BNB Chain

Since CZ was released from prison last year, he is no longer allowed to participate in the daily operations of Binance according to legal regulations. As a figure of influence in the industry, his scope of involvement remains quite broad. For instance, in investment and its public chain ecosystem, Binance Labs has officially rebranded to YZi Labs, transforming into a large family office, with its investment scope expanding from cryptocurrencies to AI and biotechnology. In its official announcement, it stated that CZ would continue to play a key role in investment activities, directly engaging with entrepreneurs and providing guidance.

Moreover, the ecological progress on the BNB Chain has also drawn CZ's attention. Recently, Binance Labs invested in the staking project Kernel and the DEX project THENA. However, the renewed staking craze has not materialized, and the price trend of THE indicates that the community is not buying in, with the price dropping from a high of $4.18 to $0.47. Another ecosystem project, CAKE, recently fell to around $1.6, not far from its historical low of $1.05.

Behind the crisis, the BNB Chain launched an AI agent program this year and brought the meme launch platform Four.meme into GMGN, attempting to ride the wave of memes and AI agents. The awkward part is that the response has been slow, coinciding with a downturn in the market.

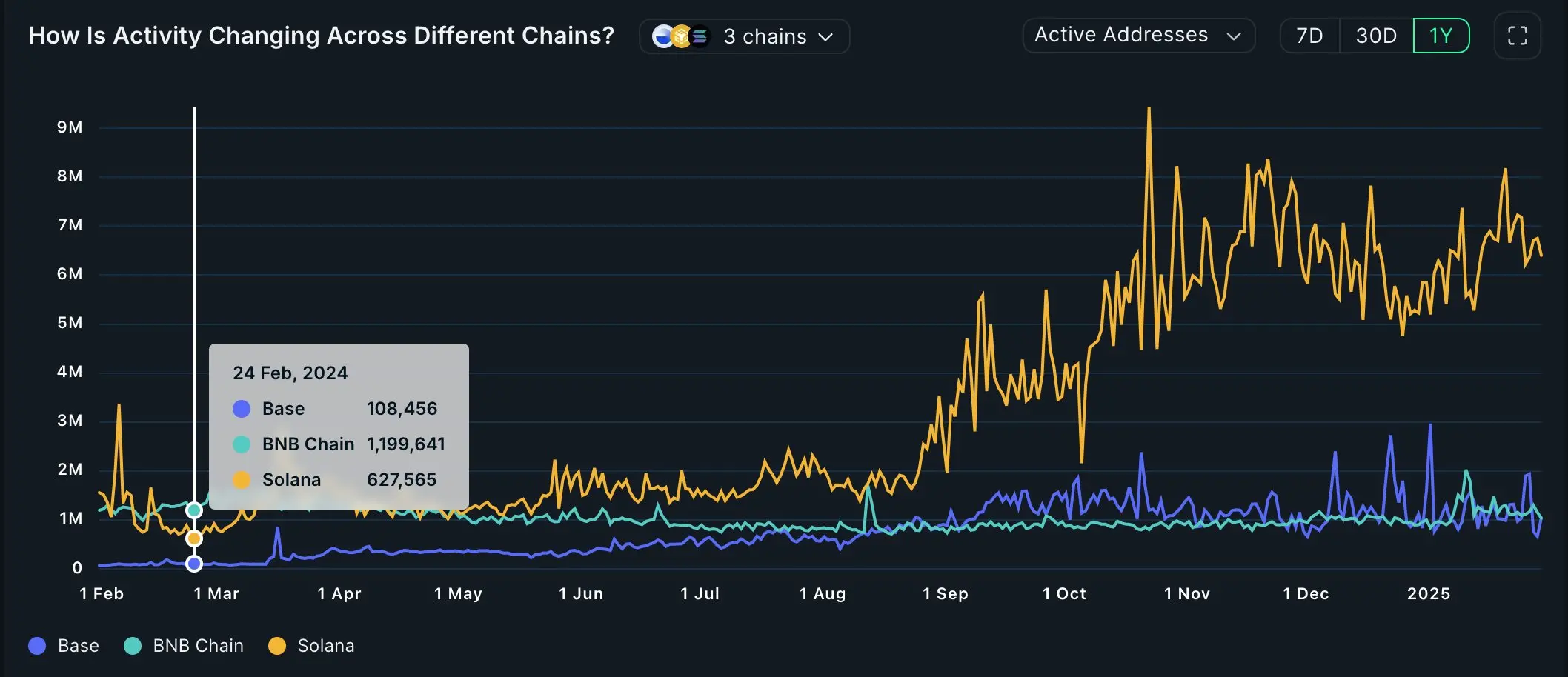

The BNB Chain performed well in the last cycle, but this cycle has been mediocre, even lagging far behind. The performance of ecosystem projects has been lackluster, and the meme ecosystem has not shown improvement. Compared to Solana and Base chains, the trend has clearly declined. As of January 30 this year, the number of daily active addresses on the Solana network was six times that of the BNB Chain, and even the new L2 player Base surpassed the BNB Chain in daily active addresses, whereas about a year ago, the BNB Chain had twice the daily active addresses of Solana.

With the ecosystem stagnating and the wealth effect lacking, even CZ, the face of the platform, cannot sit idly by.

On February 7, CZ initiated a vote on "Should BNB Chain try to eliminate or actively reduce the MEV problem?" and stated, "I hate any form of front-running, and MEV feels like that to me. In a decentralized world, no one can completely stop it. But there are ways to reduce it."

Subsequently, CZ responded multiple times on Twitter regarding TST-related issues and expressed his views, leading to a brief surge in TST's popularity, with some early buyers making substantial profits.

Following the meme discussion, CZ also specifically addressed the community's concerns about the listing process, stating, "As an observer, I think there are some issues with Binance's listing process. The platform announces first, then lists four hours later. While a notice period is necessary, during these four hours, the token price can be pushed up on DEX, and then someone sells it on CEX."

In response, community members suggested that CEX could optimize the listing process by synchronously providing initial liquidity, incentivizing liquidity programs, and connecting with DEX liquidity pools. CZ responded to the suggestions, saying, "I think CEX should automatically list (almost) all tokens like DEX, but I am no longer responsible for operating CEX."

Conclusion

If CEX were to automatically list almost all tokens like DEX, it would raise significant questions about CEX product positioning, listing effects, and more. CZ's recent frequent tweets regarding BNB Chain and listing issues are certainly aimed at addressing community concerns, but based on the current performance of some representatives, the results have been minimal.

Perhaps the root of the problem goes beyond Binance itself and involves deeper issues within the entire crypto industry: crypto nihilism, a series of meme bloodsucking, a lack of industry innovation, and selling tokens becoming the main business of project parties…

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。