Original Source: Web3 Xiaolu

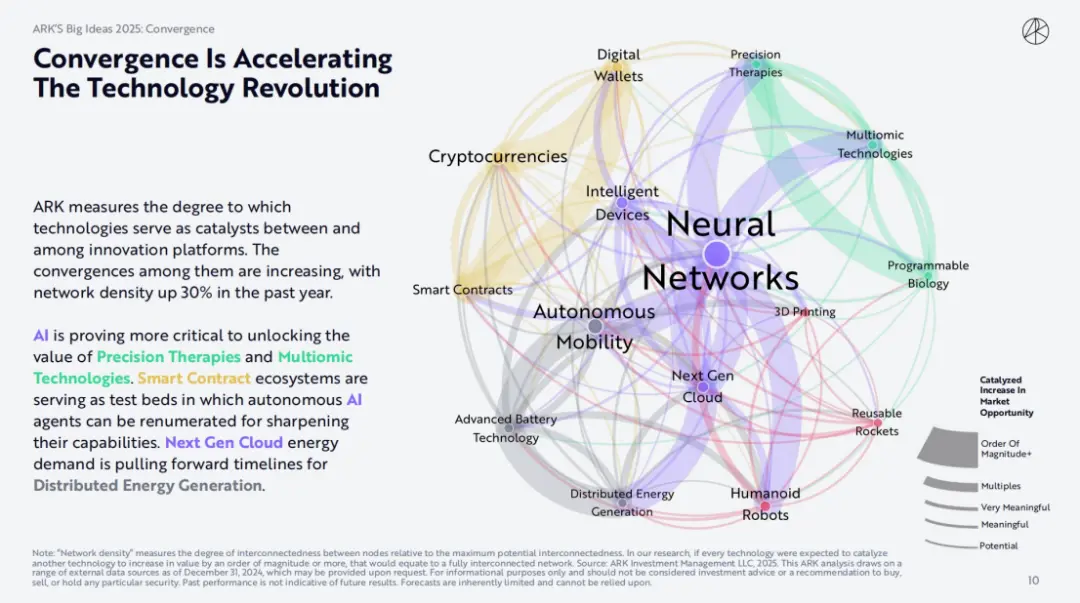

As we stand on the brink of an unprecedented era of growth, ARK Invest's "2025 Big Ideas" elucidates the complex interplay among five technology-driven innovation platforms that are evolving today: artificial intelligence, robotics, energy storage, public blockchains, and multi-omics sequencing. These platforms are driving exponential advancements across industries and catalyzing leap changes in global economic growth.

The 2025 report from ARK Invest presents 11 big ideas that illustrate the significant transformations currently underway, which are expected to dramatically enhance productivity, revolutionize industries, and create long-term investment opportunities with profound implications for investors, businesses, and society as a whole.

Consequently, we have distilled the sections of the 2025 report concerning AI Agents, stablecoins, and public blockchains, presenting a perspective on these issues from the viewpoint of Wall Street funds. This perspective allows us to break free from the current PVP state of the crypto market and approach the true utility and future trends of innovative AI Agents, stablecoins, and public blockchains from a more traditional and universal standpoint.

Take Aways:

AI Agents will change the logic of how people search and shop, facilitated by digital wallets;

Digital wallets can further integrate functions such as savings, lending, insurance, investment, and consumption from traditional banking financial services. Through the innovative paradigm of AI Agents, they can shift the value chain of global e-commerce and digital consumption from downstream to upstream;

With the utility of AI, the valuation of digital wallet companies will be enhanced. Importantly, these digital wallets can not only cover the vast existing user base of Web2 and form a value closed loop through AI Agents but also seamlessly connect to innovative applications in Web3, bringing greater economic utility to users;

The annual trading volume of stablecoins is nearing that of Visa and Mastercard, with supply and active stablecoin addresses reaching historical highs in 2024;

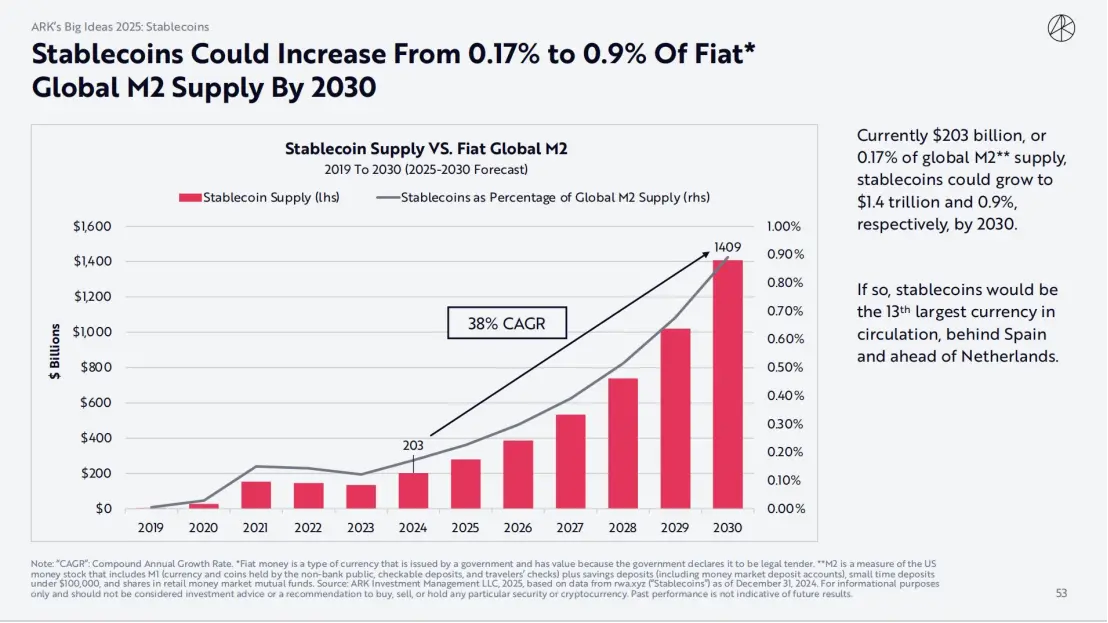

Innovations surrounding blockchain-based stablecoins will emerge continuously and become one of the important ways to export dollars, with stablecoin market capitalization expected to grow to $1.4 trillion by 2030;

In this field, as innovative financial infrastructure continues to improve and integrate with traditional financial infrastructure, coupled with the assistance of AI, we will inevitably see more investment mergers and acquisitions from the traditional financial perspective.

I. Five Major Innovation Platforms Accelerating Economic Growth

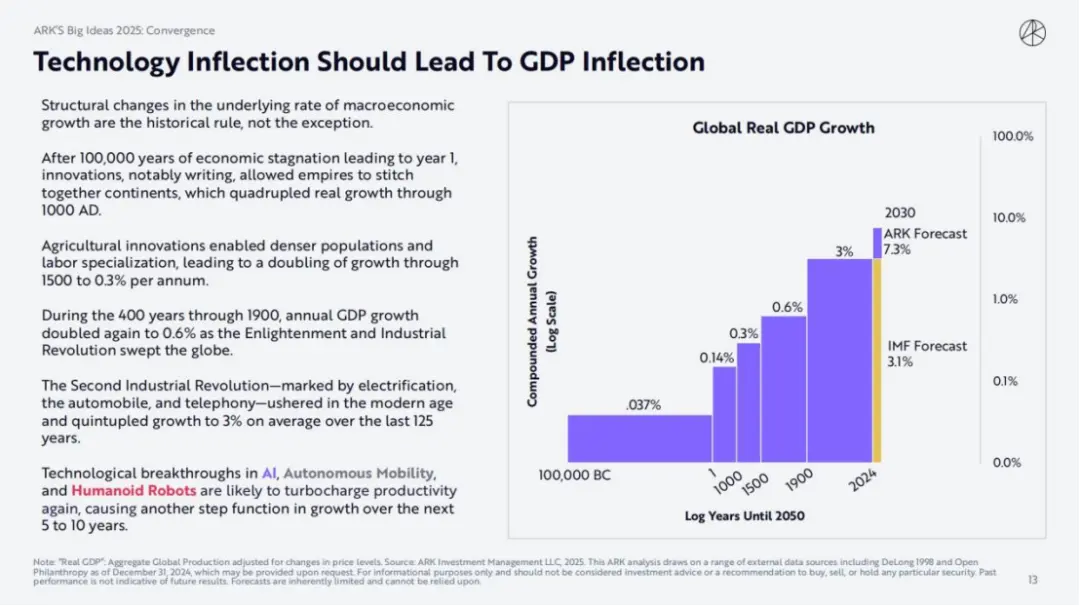

The changes in macroeconomic growth align with historical patterns. Throughout human history, the economy stagnated for 100,000 years, and innovation (especially writing) enabled empires to connect continents, quadrupling the actual growth rate by the year 1000. Subsequently, agricultural innovations increased population density and labor specialization, leading to a doubling of the growth rate by 1500, reaching 0.3% per year.

In the 400 years leading up to 1900, the annual GDP growth rate doubled again to 0.6% as the Enlightenment and the Industrial Revolution swept the globe. Thereafter, the second industrial revolution, marked by electrification, automobiles, and telephones, initiated modernization and quintupled the growth rate over the past 125 years, reaching an average of 3%.

Today, breakthroughs in artificial intelligence and smart robotics may once again enhance productivity and propel economic growth to a new level in the next 5 to 10 years. By 2030, ARK Invest expects the growth rate to reach 7.3%, compared to the IMF's 3.1%.

In this context, the integration of multiple technology platforms, including artificial intelligence and public blockchains, is increasing, with network density growing by 30% over the past year.

Public Blockchains

After large-scale adoption, all currencies and contracts may migrate to public blockchains, enabling the verification of digital asset scarcity and proof of ownership. The traditional financial system may reconfigure assets to accommodate the rise of cryptocurrencies and smart contracts. These technologies enhance transparency, reduce the impact of capital and regulatory controls, and lower the costs of contract execution.

In such a world, as more assets become easier to monetize, businesses and consumers will gradually adapt to the new financial infrastructure, making digital wallets, which concern everyone's assets, increasingly important.

AI

With the development of data, artificial intelligence computing systems and software can solve complex problems, automate knowledge work, and accelerate the integration of AI technology into every economic sector. The adoption of neural networks should be more significant than electrification and could create trillions of dollars in value. In terms of scale, these systems will require unprecedented computing resources, and AI-specific computing hardware will dominate the next generation of cloud data centers for training and operating AI models.

The potential for end users is evident: AI-driven smart devices will permeate people's lives, changing how they consume, work, and entertain themselves. The adoption of AI should transform every industry, impact every business, and catalyze every innovation platform.

II. AI Agents Redefining Consumer Interaction and Business Workflows

AI Agents understand intent through natural language, plan using reasoning and appropriate context, take action using tools to achieve intent, and improve through iteration and continuous learning. As smarter AI models emerge, AI Agents will utilize more and more complex tools to accomplish higher-value tasks.

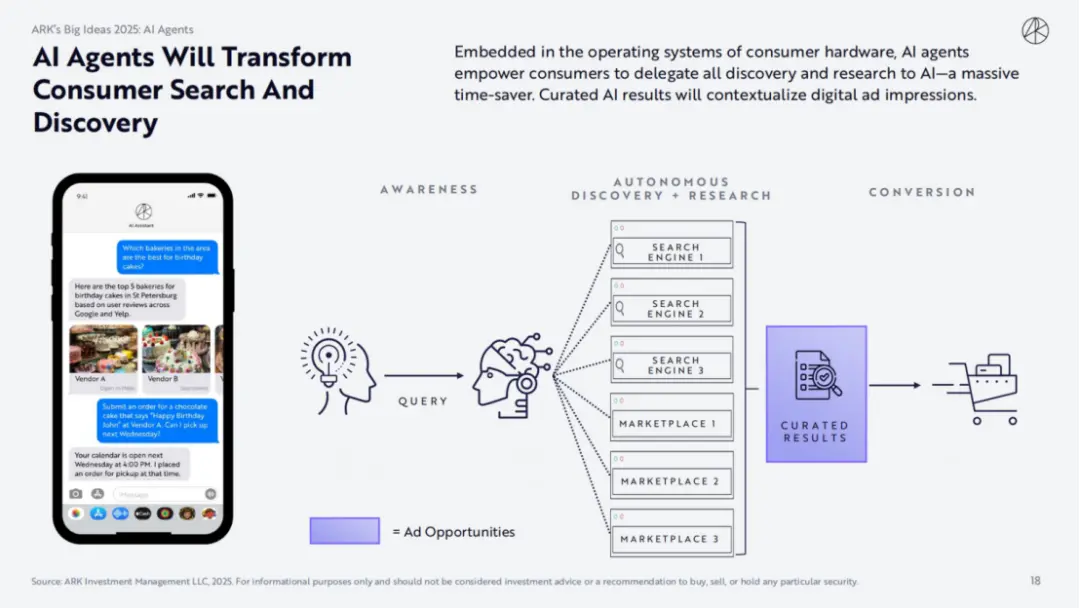

AI Agents will accelerate the adoption of more digital applications and bring about a revolutionary change in human-computer interaction. Whether in hardware sales or software subscriptions, the combination with AI Agents will drive the large-scale application of AI. For example, embedding AI Agents in the operating systems of consumer-grade hardware will allow consumers to delegate all discovery and research to AI, saving a significant amount of time.

2.1 AI Agents Will Change the Logic of Search and Shopping

AI Agents may become the gateway to personal search; if search shifts to personal AI Agents, their advertising revenue could surge. By 2030, ARK Invest believes that AI advertising revenue could account for over 54% of the $1.1 trillion digital advertising market, directly capturing market share from traditional search giants like Google.

Digital Advertising. Curated AI feedback results will provide opportunities for digital advertising. If search business shifts to personal AI Agents, the advertising revenue of AI Agents could skyrocket. ARK Invest estimates that by 2030, AI advertising revenue will account for over 54% of the $1.1 trillion digital advertising market.

Online Consumption. By 2030, the shopping volume of AI Agents could approach 25% of the globally reachable addresses for online shopping. Consumers using AI Agents in shopping will simplify product discovery, provide personalized solutions, and facilitate convenient purchases. ARK Invest's research indicates that by 2030, AI Agents could facilitate nearly $9 trillion in total online consumption globally.

2.2 Digital Wallets Will Help AI Agents Achieve a Value Closed Loop

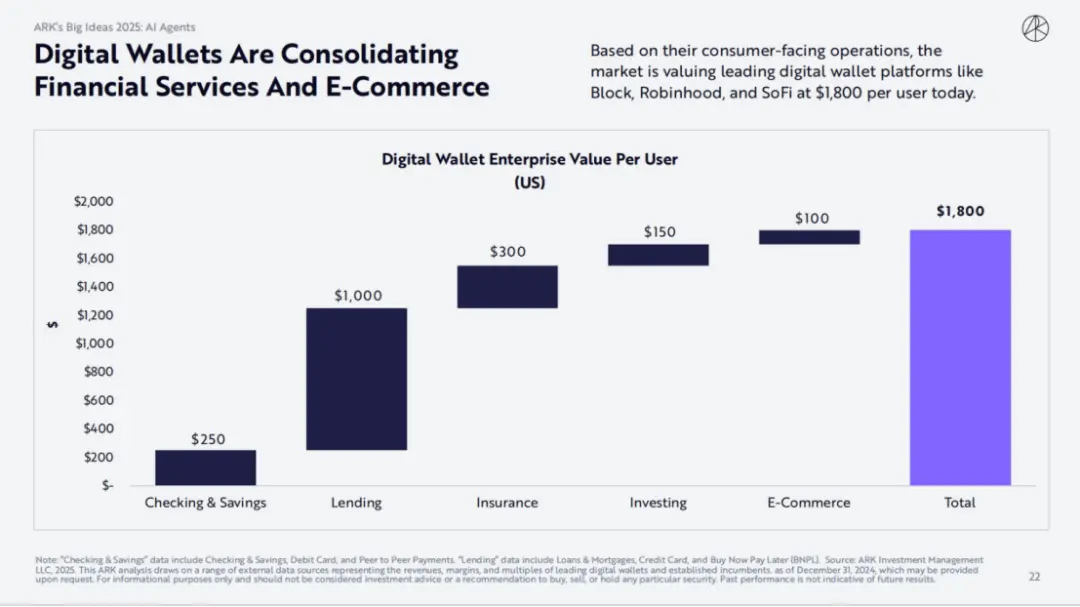

ARK Invest's research shows that digital wallets authorized by AI Agents will capture market share from traditional payment methods like credit and debit cards, potentially accounting for 72% of all e-commerce transactions by 2030. Digital wallets are integrating financial services and e-commerce. Based on their consumer-facing business, the market values leading digital wallet platforms like Block, Robinhood, and SoFi at $1,800 per user.

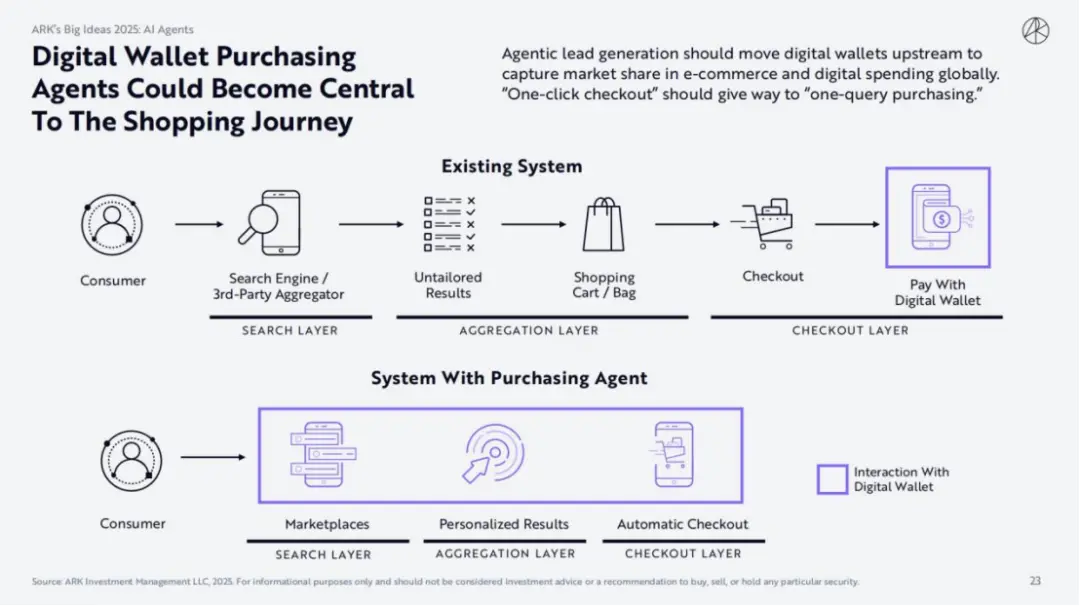

In addition to integrating functions such as savings, lending, insurance, investment, and consumption from traditional banking financial services, with the help of the innovative paradigm of AI Agents, digital wallets can undertake the value chain of global e-commerce and digital consumption from downstream, thereby shifting the value chain upstream.

As a result, the previous "one-click checkout" model of e-commerce platforms like Amazon may give way to the "one query and purchase" model of AI Agent wallets.

2.3 The Valuation of Digital Wallet Companies Will Be Enhanced

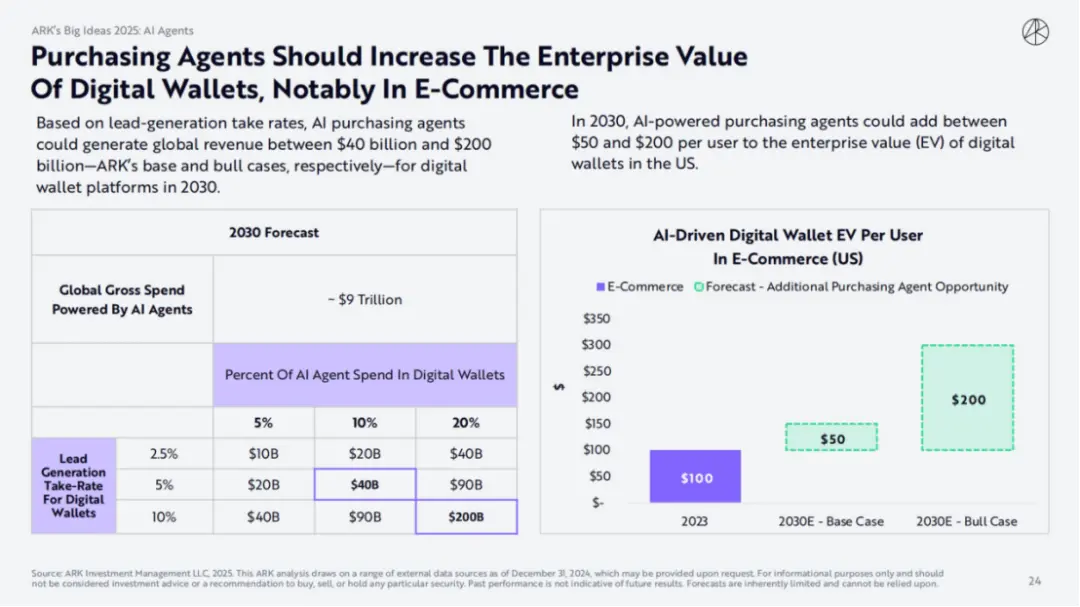

Based on potential customer generation rates and the impact of the innovative paradigm of AI Agents, by 2030, AI Agents could create global revenues of $40 billion to $200 billion for digital wallet platforms (for ARK's base and optimistic scenarios, respectively). By 2030, AI Agents could add $50 to $200 in enterprise value (EV) for each user of digital wallets in the United States.

For internal cost reduction and efficiency improvement, companies deploying AI Agents should be able to increase unit numbers and/or optimize labor to engage in higher-value activities while keeping the workforce unchanged. As artificial intelligence develops, AI Agents may handle a higher proportion of workloads and independently complete higher-value tasks.

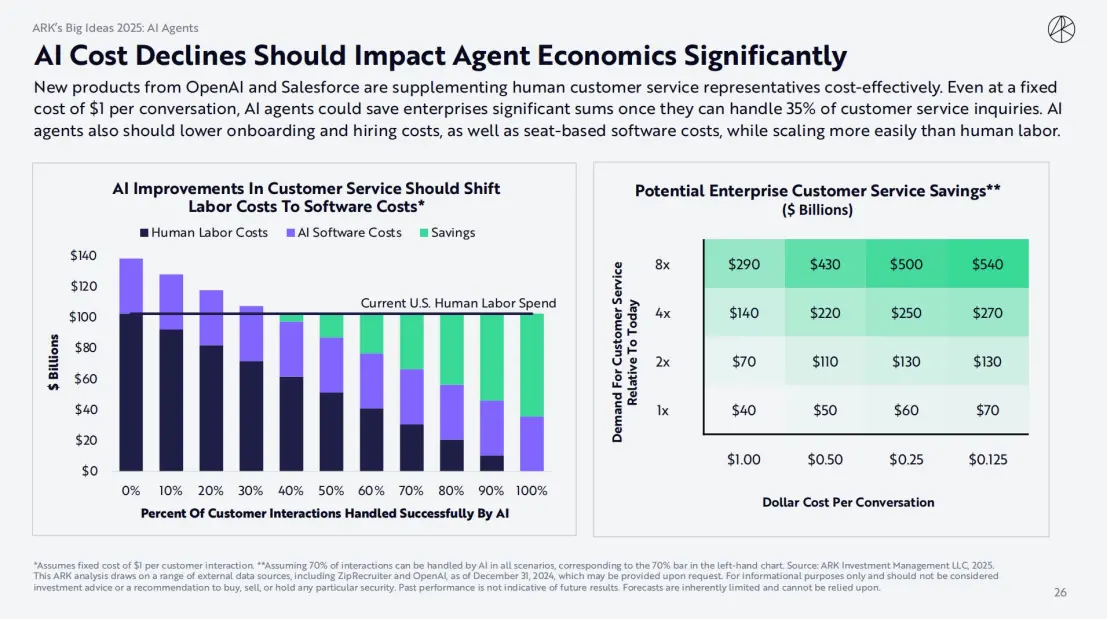

At the same time, with the decline in AI costs, an increasing number of low-cost, efficient AI Agent products will emerge. New products from OpenAI and Salesforce are economically supplementing human customer service representatives. Even if the fixed cost per conversation is $1, as long as AI Agents can handle 35% of customer service inquiries, they can save businesses a significant amount of money. AI Agents should also reduce onboarding and recruitment costs as well as software costs based on seats, while being easier to scale than human labor.

III. Stablecoins Reshaping the Digital Asset Space

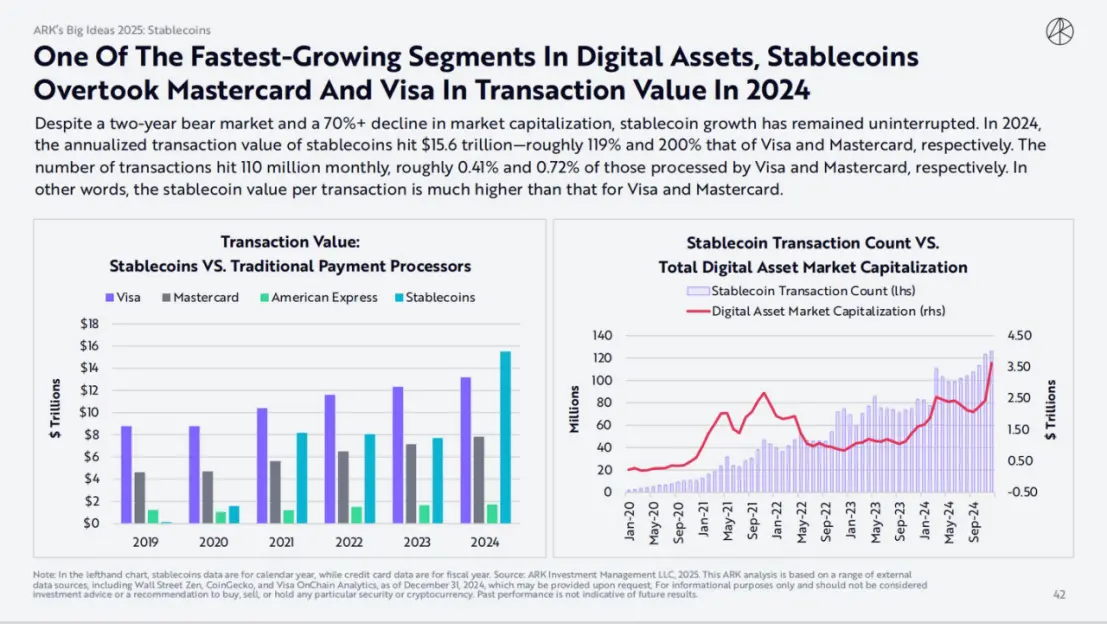

As one of the fastest-growing areas in digital assets, stablecoin trading volume surpassed Mastercard and Visa in 2024. Despite experiencing a two-year bear market with a market cap decline of over 70%, the growth of stablecoins remains uninterrupted.

3.1 Stablecoin Trading Volume Approaching Visa and Mastercard

According to ARK Invest's report, in 2024, the annualized trading volume of stablecoins reached $15.6 trillion, approximately 119% and 200% of Visa and Mastercard, respectively. Monthly trading volume reached 110 million transactions, accounting for about 0.41% and 0.72% of the transaction volume processed by Visa and Mastercard. In other words, the value of each stablecoin transaction is significantly higher than that of Visa and Mastercard.

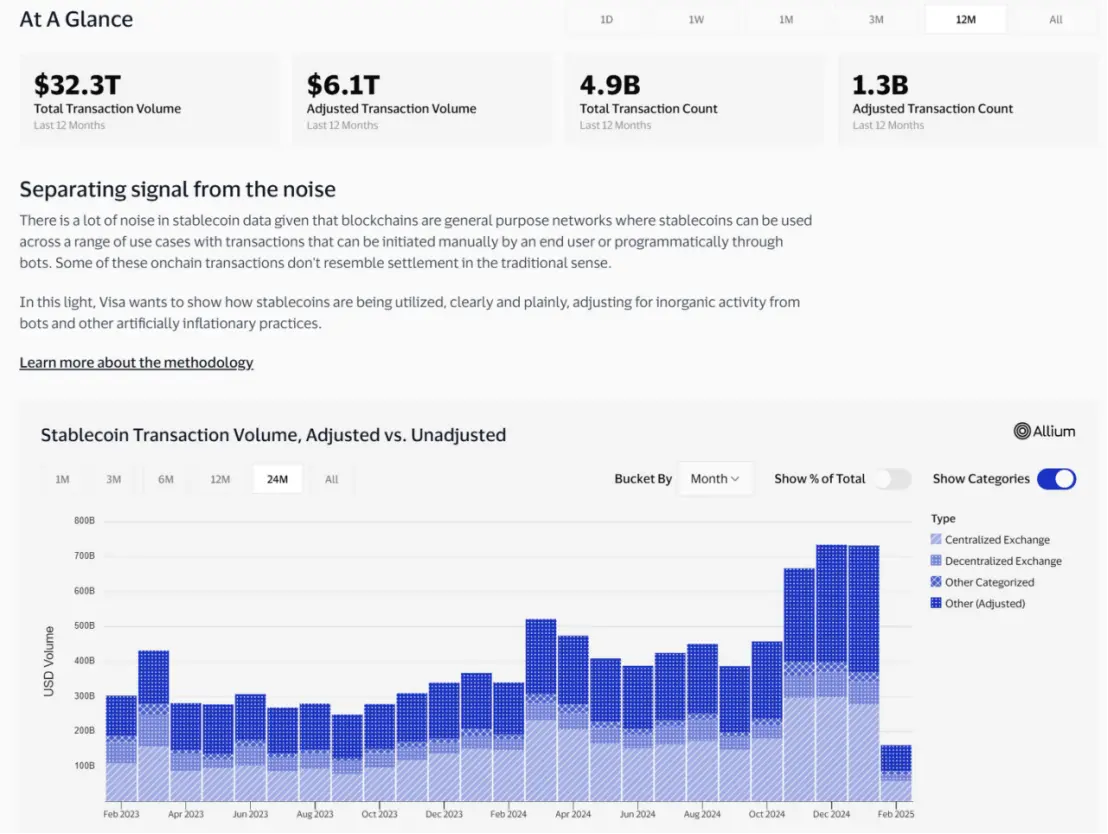

(visaonchainanalytics.com/transactions)

Due to the various use cases for stablecoins, transactions can be manually initiated by end users or programmatically initiated by bots, resulting in a significant amount of noise in stablecoin data. Therefore, Visa adjusts the stablecoin data to eliminate inorganic activities adapted for bots and other forms of artificial inflation.

According to the Visa Onchain Analytics Dashboard: Overview, the adjusted annualized trading volume of stablecoins in 2024 reached $5.62 trillion. We analyzed the data for the 12 months ending February 2025:

Original Data:

The annualized trading volume of stablecoins was $32.3 trillion, with a total of 4.9 billion transactions, averaging $6,592 per transaction. Corresponding to a total supply of $200 billion in stablecoins, the turnover rate was 161.5.

Adjusted Data (excluding bot operations and high-frequency trading behaviors):

The annualized trading volume of stablecoins was $6.1 trillion, with a total of 1.3 billion transactions, averaging $4,692 per transaction. Corresponding to a total supply of $200 billion in stablecoins, the turnover rate was 30.5.

Thus, according to Visa's data, the adjusted trading volume of stablecoins is now approaching Mastercard's annual trading volume level, with each transaction amount being of higher value.

(If there are any inaccuracies in the data or other statistical criteria, please feel free to communicate and correct.)

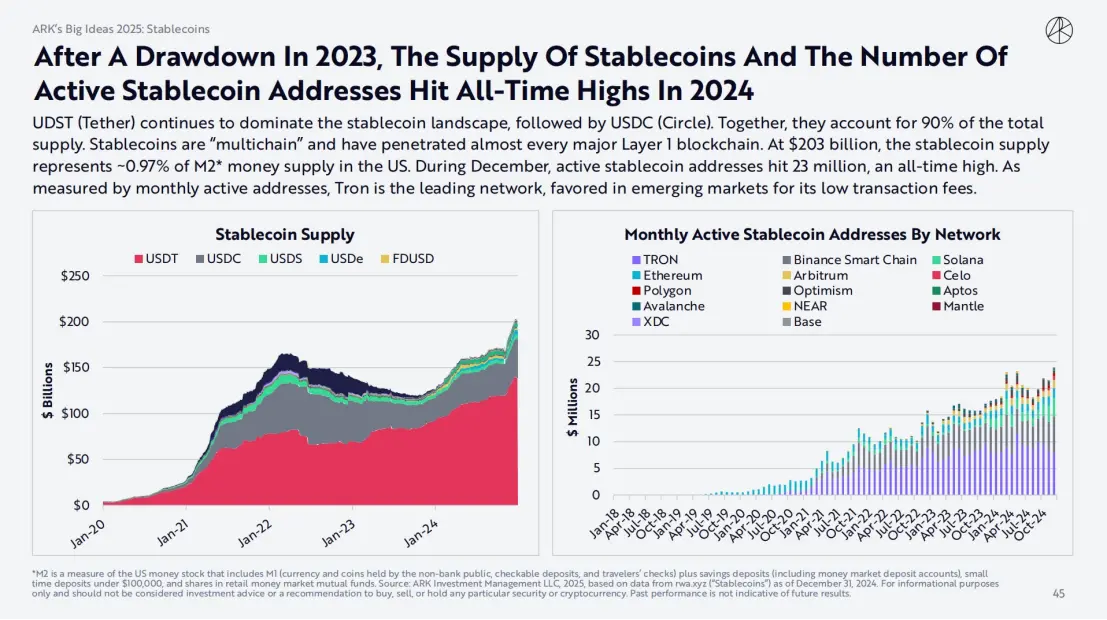

3.2 Stablecoin Supply and Active Stablecoin Addresses Reach Historical Highs in 2024

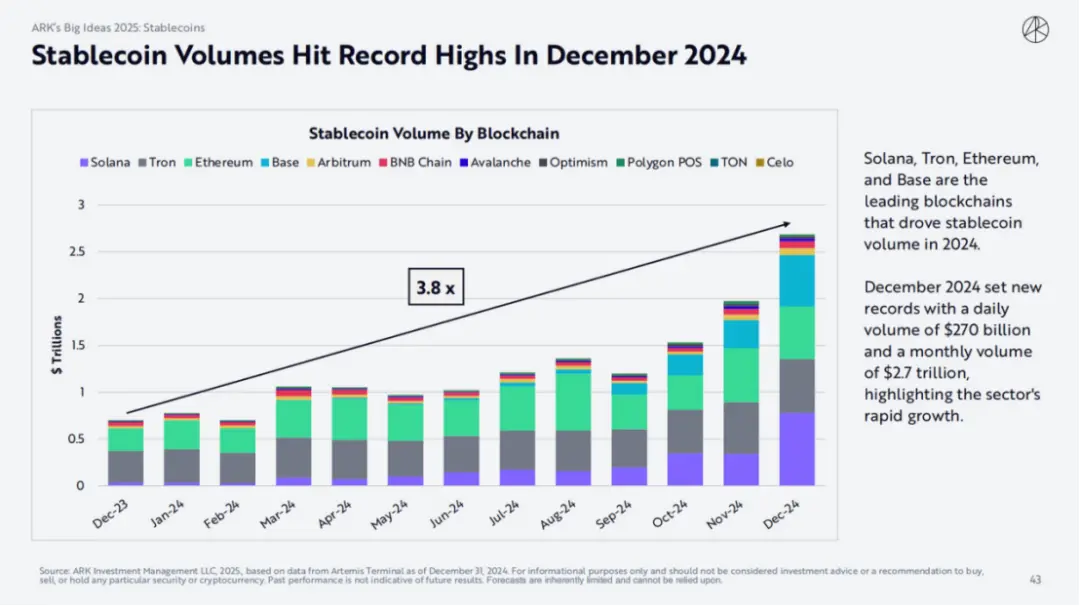

Despite differences in data statistics, the overall market cap of stablecoins has surpassed $200 billion and continues to trend upward. Solana, Tron, Ethereum, and Base are the leading blockchains driving the growth of stablecoin trading volume in 2024. December 2024 set a new record with daily trading volume reaching $270 billion and monthly trading volume reaching $2.7 trillion, highlighting the rapid growth of the industry.

Despite differences in data statistics, the overall market cap of stablecoins has surpassed $200 billion and continues to trend upward. Solana, Tron, Ethereum, and Base are the leading blockchains driving the growth of stablecoin trading volume in 2024. December 2024 set a new record with daily trading volume reaching $270 billion and monthly trading volume reaching $2.7 trillion, highlighting the rapid growth of the industry.

After a decline in 2023, USDT (Tether) continues to dominate the stablecoin space, followed by USDC (Circle). Together, they account for 90% of the total supply. Multi-chain stablecoins have nearly penetrated all major L1 blockchains. The current stablecoin supply is $203 billion, approximately 0.97% of the U.S. M2* money supply. In December 2024, active stablecoin addresses reached 23 million, setting a historical high. Measured by monthly active addresses, Tron is the leading network, favored in emerging markets due to its low transaction fees.

L2 blockchains, which are lower in cost and higher in efficiency, are attracting the interest of retail investors. Retail investors are flocking to Layer 2 for cheaper and more convenient stablecoin transactions, increasing the market share of blockchains like Arbitrum, Base, and Optimism. Meanwhile, whales and institutions continue to operate on the base layer of Ethereum. Transactions under $100 dominate on Base and Optimism, while transactions over $100 dominate on the base layer of Ethereum.

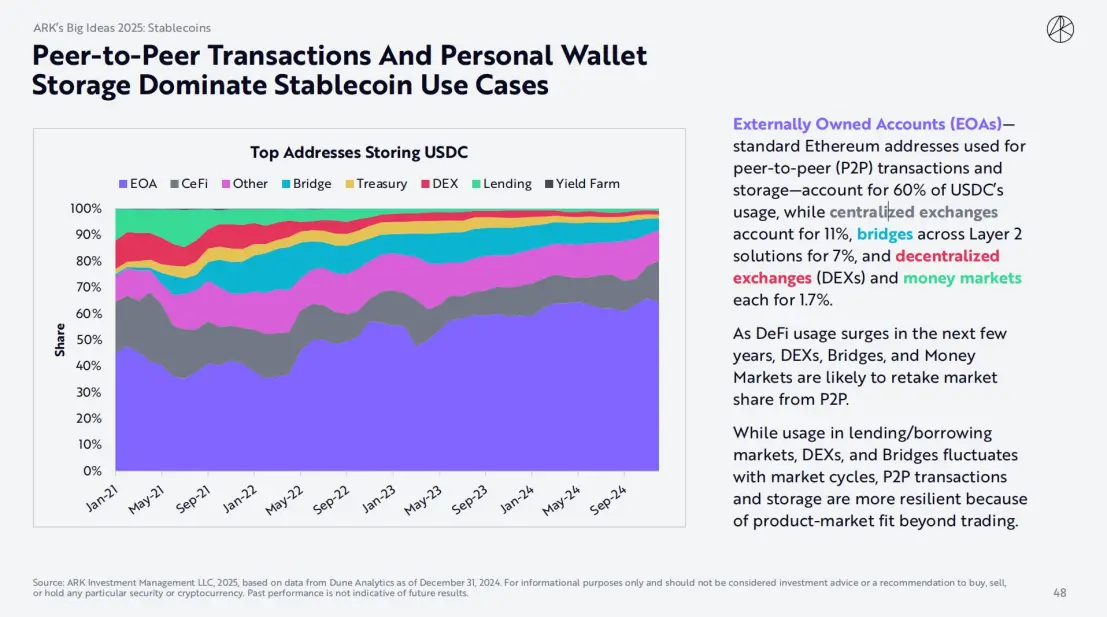

3.3 Peer-to-Peer Transactions and Personal Wallet Storage Dominate Stablecoin Use Cases

EOA wallets—Ethereum addresses used for peer-to-peer (P2P) transactions and asset storage—account for 60% of USDC usage, while centralized exchanges account for 11%, cross-chain bridge L2 solutions account for 7%, and decentralized exchanges (DEX) and money markets each account for 1.7%.

With the expected surge in DeFi usage in the coming years, DEXs, cross-chain bridges, and money markets may reclaim market share from P2P. While the usage of lending markets, DEXs, and cross-chain bridges fluctuates with market cycles, P2P transactions and storage are more resilient, as they have a higher product-market fit beyond just trading.

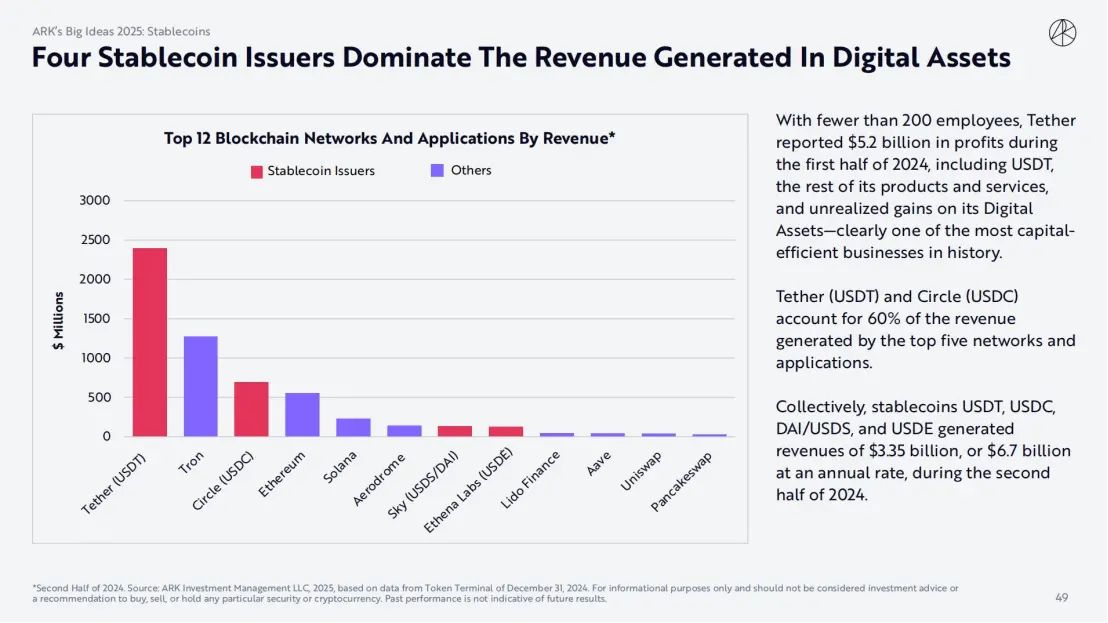

3.4 Four Stablecoin Issuers Dominate Stablecoin Revenue

Tether, with fewer than 200 employees, reported a profit of $5.2 billion in the first half of 2024, which includes USDT, other products and services, and unrealized gains from its digital assets—clearly one of the most capital-efficient businesses in history. Tether (USDT) and Circle (USDC) account for 60% of the revenue generated by the top five networks and applications. Overall, stablecoins USDT, USDC, DAI/USDS, and USDE generated $3.35 billion in revenue in the second half of 2024, annualizing to $6.7 billion.

Circle and Tether have been generating billions in revenue through Treasury bills and other securities as collateral for their stablecoins. However, in 2024, to respond to competition and demand, yield-bearing stablecoins operating outside the U.S. began to pass a significant portion of their interest income to users. Unless absolutely necessary, Circle and Tether are unlikely to follow this trend. Although still small in scale, yield-bearing stablecoins are the fastest-growing category in the stablecoin market.

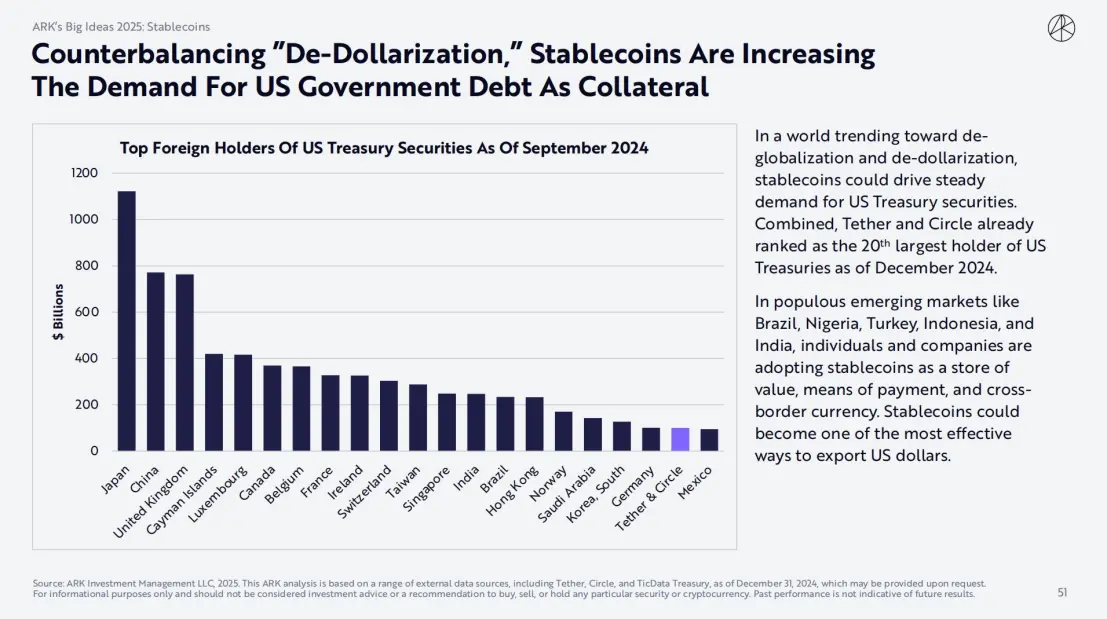

3.5 Stablecoins Will Accelerate Growth and Absorb U.S. Debt

To balance "de-dollarization," stablecoins are increasing demand for U.S. government debt as collateral. In a world moving towards de-globalization and de-dollarization, stablecoins may drive stable demand for U.S. Treasury bonds. As of December 2024, Tether and Circle combined have become the 20th largest holders of U.S. Treasury bonds. In populous emerging markets such as Brazil, Nigeria, Turkey, Indonesia, and India, individuals and companies are adopting stablecoins as a means of value storage, payment, and cross-border currency. Stablecoins may become one of the most effective ways to export dollars.

Currently, the market cap of stablecoins is $203 billion, accounting for 0.17% of the global M2** supply. By 2030, the market cap of stablecoins could potentially grow to $1.4 trillion and 0.9%. If this happens, stablecoins will become the 13th largest currency in circulation, just behind Spain and ahead of the Netherlands.

IV. Public Blockchains and Smart Contracts: Reducing Costs and Creating New Use Cases at the Application Layer

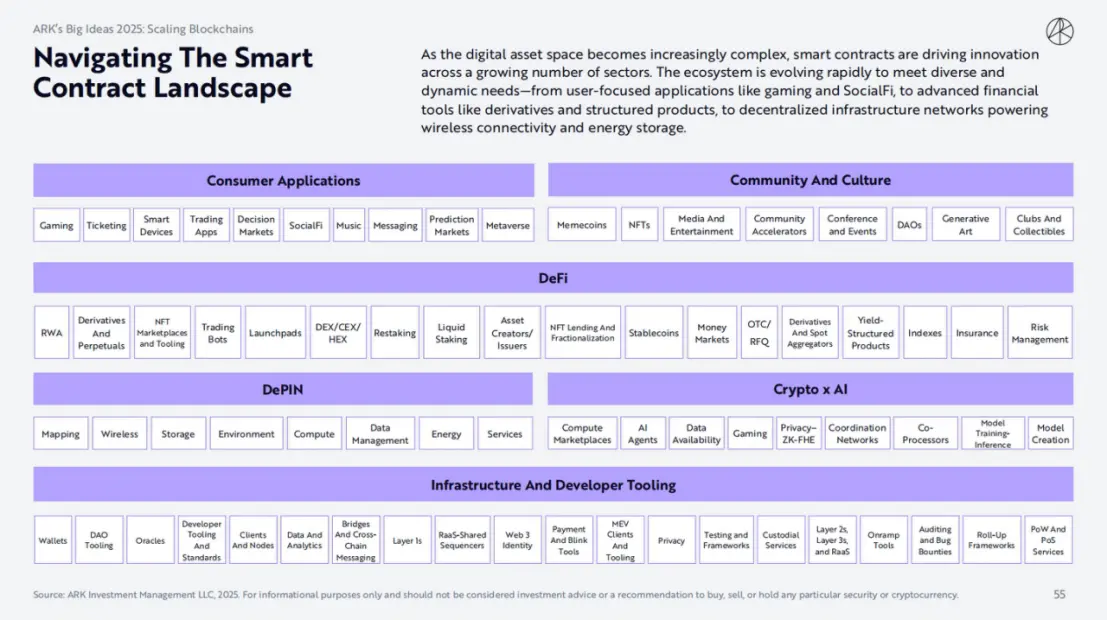

As the digital asset space becomes increasingly complex, smart contracts are driving innovation across more industries. The ecosystem is rapidly evolving to meet diverse and dynamic demands—from user-centric applications like gaming and SocialFi to advanced financial instruments such as derivatives and structured products, and decentralized infrastructure networks supporting wireless connectivity and energy storage.

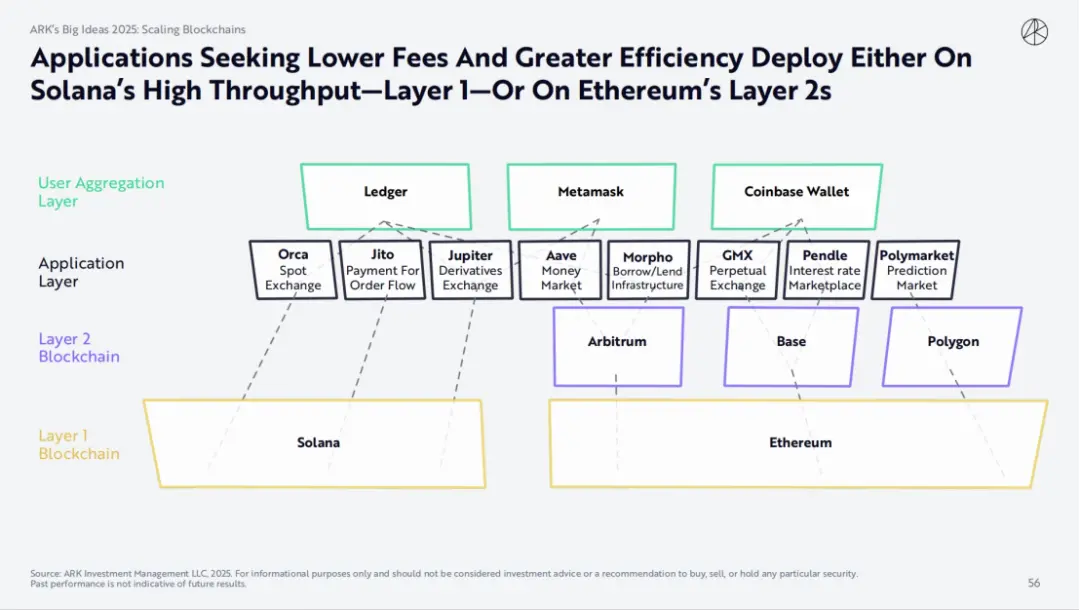

These technology stacks require a blockchain that seeks lower fees and higher efficiency for deployment. This has resulted in two patterns in the current market: either deployed on Solana's high-throughput L1 or on Ethereum's L2.

4.1 The Ethereum Ecosystem is Shifting to L2

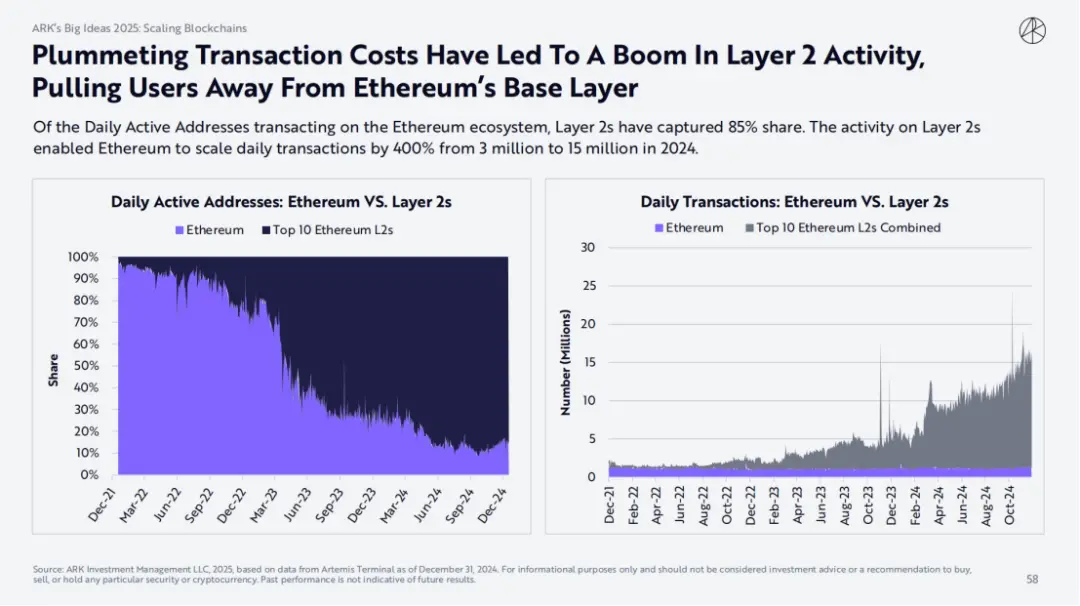

The significant reduction in transaction costs has led to a surge in L2 activity, pulling users away from Ethereum's base layer. Among the daily active addresses trading in the Ethereum ecosystem, L2 accounts for 85% of the share. L2 activity has increased Ethereum's daily transaction volume from 3 million to 15 million in 2024, a growth of 400%.

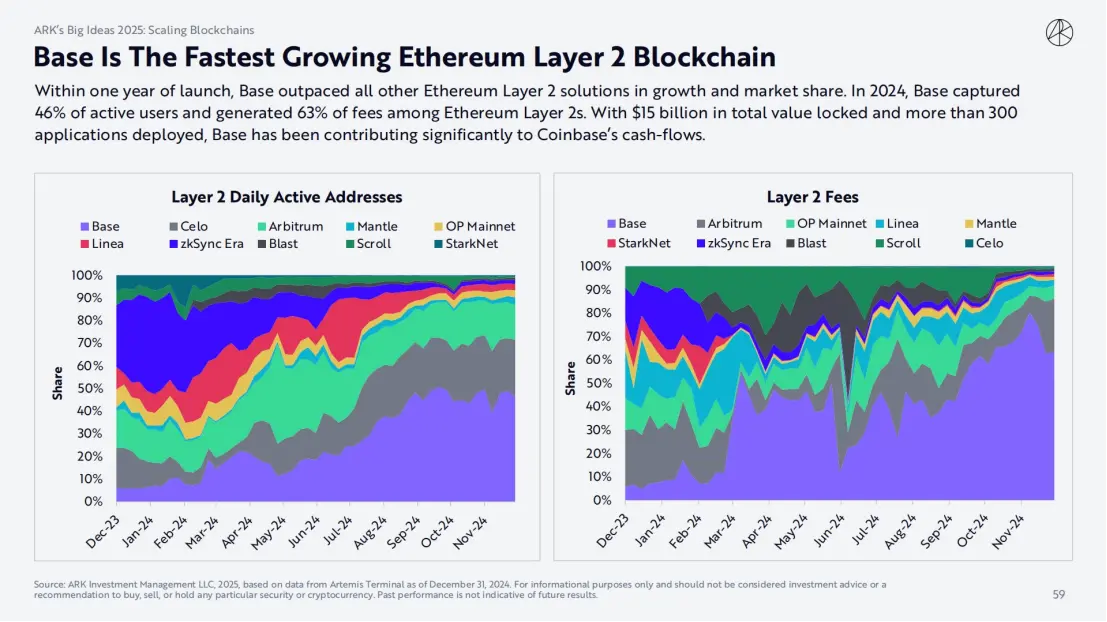

Among them, Base is the fastest-growing Ethereum L2 blockchain. Within a year of its launch, Base has surpassed all other Ethereum L2 solutions in growth and market share. In 2024, Base accounted for 46% of active users and generated 63% of fees in Ethereum L2. Base has a TVL of $15 billion and has deployed over 300 applications, making a significant contribution to Coinbase's cash flow.

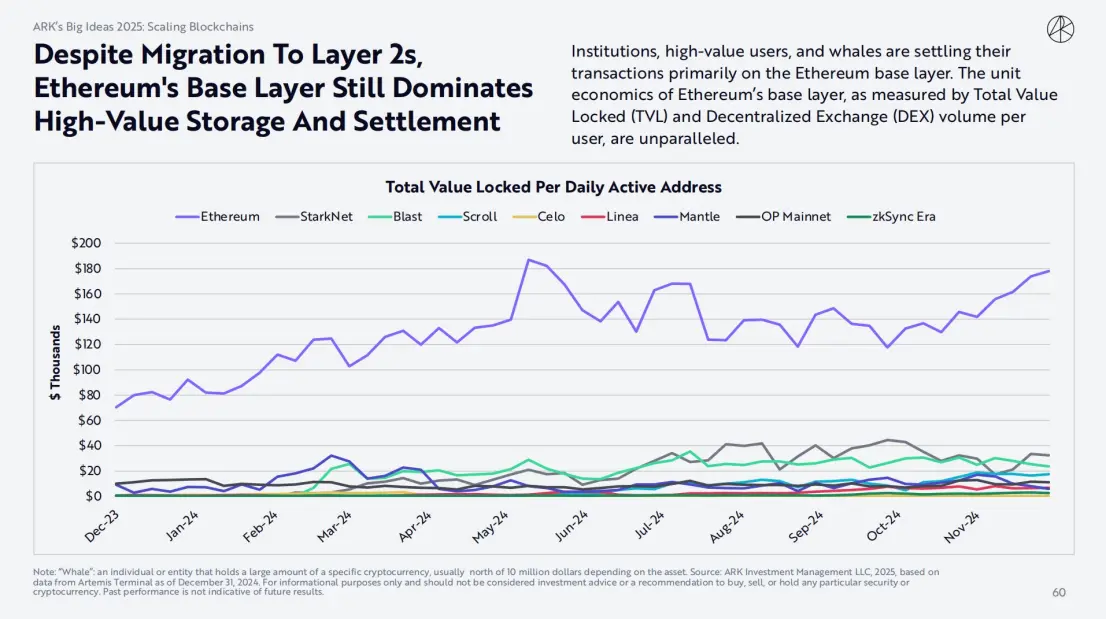

Despite this, Ethereum's base layer still dominates high-value storage and settlement. Institutions, high-value users, and whales primarily settle their transactions on Ethereum's base layer. Measured by total locked value (TVL) and decentralized exchange (DEX) volume per user, the unit economics of Ethereum's base layer are unparalleled.

4.2 Solana's Share Has Increased Across Multiple Metrics Due to Retail Adoption

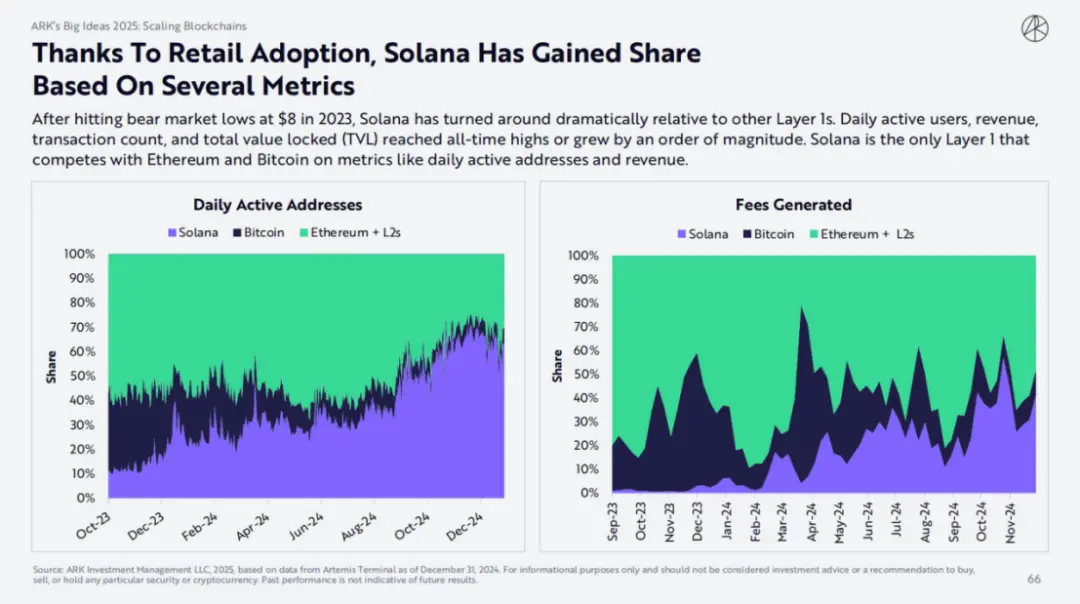

After hitting a bear market low of $8 in 2023, Solana has seen a significant improvement relative to other L1s. Daily active users, revenue, transaction numbers, and total locked value (TVL) have all reached historical highs or increased by an order of magnitude. Solana is the only L1 that competes with Ethereum and Bitcoin in metrics like daily active addresses and revenue.

After hitting a bear market low of $8 in 2023, Solana has seen a significant improvement relative to other L1s. Daily active users, revenue, transaction numbers, and total locked value (TVL) have all reached historical highs or increased by an order of magnitude. Solana is the only L1 that competes with Ethereum and Bitcoin in metrics like daily active addresses and revenue.

Solana and Base are leading in developer adoption and thought leadership. Among the 39,139 new crypto developers in 2024, Solana leads with 7,625 developers, surpassing the Ethereum mainnet. Base has 4,287 developers, ranking sixth overall, surpassing Arbitrum and Starknet, and becoming the leading Layer 2 solution on Ethereum.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。