Trump's tariff policy has triggered market turmoil, causing a short-term impact on Bitcoin, but may enhance its safe-haven attributes in the long run, solidifying its status as "digital gold."

Author: htxofficial

Translation: Baihua Blockchain

1. Trump's Tariff Policy: Where is the Bitcoin Market Headed?

Recently, former U.S. President Donald Trump reiterated his policy plans, stating that he would impose high tariffs on Canada, Mexico, and China, which has led to significant fluctuations in global financial markets. As a result, the stock market, foreign exchange market, and cryptocurrency market all experienced substantial volatility, with Bitcoin (BTC) briefly falling below the $92,000 mark. Although the market faced shocks in the short term, in the long run, the trade war and high tariffs may actually benefit decentralized assets like Bitcoin.

This report will analyze the impact of Trump's tariff policy on Bitcoin and the broader cryptocurrency market from multiple perspectives, including macroeconomics, monetary policy, market structure, and investor sentiment, and explore the future development trends of Bitcoin.

2. Overview of Trump's Tariff Policy

In an increasingly globalized world, trade relations between countries have become tighter. However, in recent years, U.S. trade policy has gradually shifted towards protectionism, especially during Trump's presidency (2017-2021). The Trump administration believes that the U.S. is at a disadvantage in international trade, based on the following reasons:

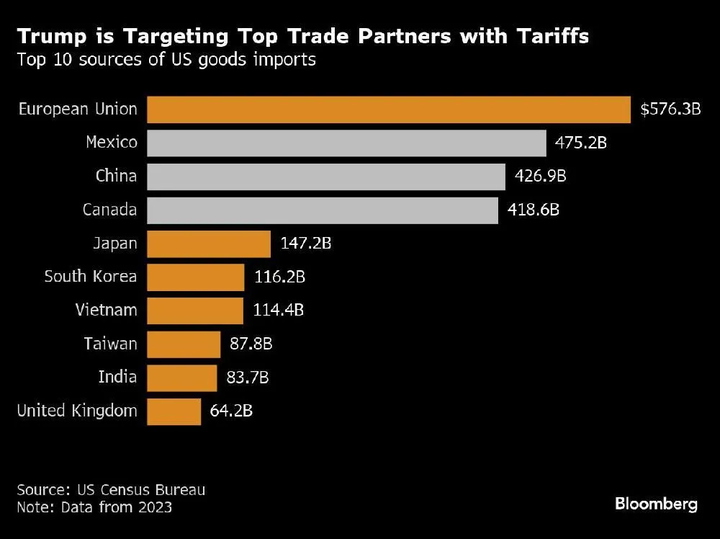

Expansion of Trade Deficits: The U.S. has maintained high trade deficits with China, Mexico, Japan, and the EU for a long time, and Trump claims this has led to job losses in U.S. manufacturing.

Deindustrialization: Over the past few decades, a significant amount of U.S. manufacturing has been outsourced to Asia and other regions, leading to a decline in domestic industry. To address this, Trump has attempted to encourage companies to return to the U.S. by raising tariffs. Additionally, national security concerns are also a core consideration, as Trump and his advisors believe that China's technological rise poses a threat, thus restricting the export of high-tech products and imposing tariff pressure on Chinese industrial development.

1) Context of the 2024 U.S. Presidential Election

In the 2024 U.S. presidential election, Trump has once again become the Republican candidate and is vigorously promoting his "America First" policy. His core trade proposals include:

Escalation of Trade Sanctions Against China: Committing to impose tariffs of at least 60% on all Chinese imports.

Reassessment of the USMCA: If elected, he may reevaluate trade agreements with Mexico and Canada.

Trade Pressure on Europe and Japan: Demanding that they reduce their trade surpluses with the U.S., or face higher tariffs. These policies further exacerbate global uncertainty regarding the future trade environment, affecting capital flows and global market sentiment.

2) Major Tariff Measures

The core of Trump's trade policy is to impose high tariffs on major global economies (especially China, the EU, Japan, and Mexico). Proposed specific measures include:

Imposing Tariffs Over 60% on Chinese Imports

Scope of Affected Goods: Electronics, automobiles, solar panels, industrial equipment, semiconductor manufacturing equipment, etc.

Impact: Increased import costs for the U.S. and heightened instability in global supply chains.

Adjusting Tariffs on Europe, Japan, and Mexico

Europe: Potentially increasing tariffs on German cars, French wine, and Italian luxury goods to reduce the U.S.-EU trade deficit.

Japan: May require Japan to further open its market, or face higher tariffs on cars and parts.

Mexico: Trump has previously threatened to impose tariffs on Mexican exports to compel stronger border controls. If he is re-elected, similar measures may be reinstated.

Policies Supporting U.S. Domestic Manufacturing

Tax Incentives: Providing tax reductions for companies investing in manufacturing in the U.S.

Government Procurement Priority: The "Buy American" policy is further strengthened, requiring government agencies to prioritize purchasing domestically manufactured products. These measures may further escalate global trade tensions, disrupt market stability, and drive up demand for decentralized assets like Bitcoin.

3) Impact of Tariff Policy on Global Markets and Economy

Trump's tariff policy may bring about the following negative impacts:

Global Economic Slowdown: High tariffs will increase business costs, potentially leading to a decline in consumer spending, thereby dragging down global economic growth. The International Monetary Fund (IMF) warns that the trade war could reduce global GDP growth by 0.5%-1%.

Supply Chain Disruptions: Companies may need to reorganize their supply chains, increasing uncertainty. For example, Apple and Tesla may have to seek new suppliers, raising operational costs.

Rising Inflation Pressures: Tariffs increase the cost of imported goods, potentially exacerbating inflation. The Federal Reserve may adjust monetary policy as a result, affecting market liquidity.

4) Impact on the U.S. Economy

Although the Trump administration believes that tariff policies help boost the U.S. economy, potential risks include:

Rising Consumer Costs: Many everyday consumer goods rely on imports, and increased tariffs may lead to higher costs for U.S. consumers. The tariff policies from 2018-2019 resulted in an additional $80 billion in costs for U.S. businesses and consumers.

Declining Corporate Profits: Increased tariffs may squeeze corporate profits, leading to layoffs or reduced investment, particularly impacting industries such as manufacturing, retail, and agriculture.

Federal Reserve Policy Adjustments: If inflation remains high, the Federal Reserve may delay interest rate cuts or even be forced to raise rates, affecting market liquidity. A high-interest-rate environment will put pressure on the stock and bond markets, increasing market volatility.

5) Impact on Bitcoin and the Cryptocurrency Market

Although tariff policies may cause market volatility in the short term, in the long run, the trade war may benefit Bitcoin for several reasons:

Increased Demand for Safe-Haven Assets: As economic uncertainty rises, investors may shift funds from traditional markets to decentralized assets like Bitcoin in search of safety.

Expectations of Dollar Depreciation: If the trade war leads the Federal Reserve to adopt loose monetary policies, the dollar may weaken, thereby enhancing Bitcoin's appeal.

Capital Flowing into the Cryptocurrency Market: Historical experience shows that whenever global markets are in turmoil, the demand for Bitcoin tends to rise.

6) Reactions from Traditional Financial Markets

Trump's tariff policy has heightened market uncertainty, triggering risk-averse sentiment across global markets, affecting various asset classes including stocks and commodities.

Stock Market Decline

Following Trump's announcement of increased tariffs, the three major U.S. stock indices—S&P 500, DJIA, and Nasdaq—all fell by 2%-4%, primarily due to:

- Rising business operating costs, compressing profit margins

- Declining consumer spending, leading to weak market demand

Market risk-averse sentiment is rising, with funds flowing out of the stock market.

#### **U.S. Dollar Index (DXY) Strengthens in the Short Term**Despite concerns about the economic outlook, the dollar has strengthened in the short term due to: * **Market expectations that the Federal Reserve may delay interest rate cuts** * **Investors viewing the dollar as a safe-haven asset** However, **a stronger dollar typically puts pressure on Bitcoin prices in the short term**. But in the long run, concerns about the U.S. financial system may further increase Bitcoin's value.  #### **Gold Prices Surge** As market risk-averse sentiment heats up, **gold prices have surpassed $2,800 per ounce**, with investors flocking to it as a safe-haven asset. Amid increased volatility in the stock market, **institutional investors and hedge funds may be reallocating funds to increase their gold holdings**. ### 3. **Conclusion** Trump's aggressive tariff policy has triggered **significant market turmoil**, affecting **stocks, foreign exchange, and crypto assets**. While short-term uncertainty may exert pressure on Bitcoin prices, in the long run, the weakening of market confidence in the **traditional financial system** may drive **demand for decentralized assets**. As global investors seek alternatives beyond fiat currencies and traditional investments, Bitcoin's role as **digital gold** will become more pronounced, and it is expected to benefit from this economic shift. Article link: https://www.hellobtc.com/kp/du/02/5666.html Source: https://htxofficial.medium.com/macro-report-on-the-crypto-market-trumps-tariffs-trigger-market-turmoil-but-ultimately-benefit-1343da97b664

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。