Author: Bai Ding & Shew, Xianrang GodRealmX

Since the Mentougou incident in 2014, the issues of corruption and market manipulation on centralized trading platforms have plagued all participants in the crypto space. After the FTX bankruptcy in 2022 served as a wake-up call, there has been a noticeable increase in attention towards decentralized order book platforms. Well-known on-chain order book platforms like dydx and Degate represent this trend; however, they have yet to become phenomenon-level platforms due to policy and technical reasons.

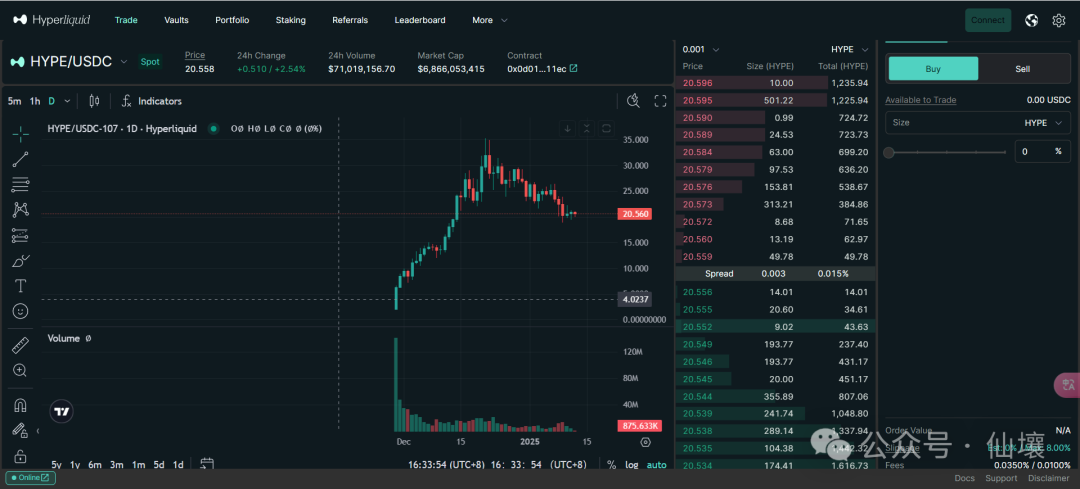

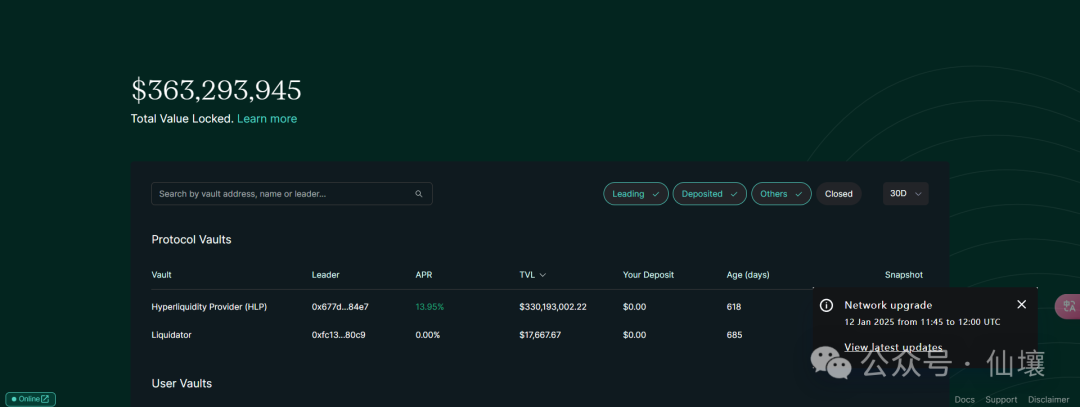

By the end of 2024, Hyperliquid, launched by the Jeff Yan team specializing in quantitative trading, has quickly gained popularity across the entire Web3 space through its product and marketing efforts, attracting widespread attention. With a total value locked (TVL) reaching several billion dollars, Hyperliquid is poised to completely revolutionize decentralized trading platforms and become a phenomenon-level application.

In a previous article titled "Technical Interpretation of Hyperliquid: Bridge Contracts, HyperEVM, and Potential Issues," we mentioned that Hyperliquid has designed a dedicated application chain for high-performance order book systems and has built a bridge for this application chain on Arbitrum, which has been classified as "pseudo Layer 3" by L2BEAT. Currently, Hyperliquid has only four validator nodes, and the risk of the bridge contract is extremely high, significantly sacrificing decentralization and security, but this also enhances trading matching efficiency, achieving a CEX-level user experience. Although this approach is highly controversial, it reflects the working style of the Hyperliquid team:

Initially focusing on user experience (UX) and rapid user acquisition, even if this approach brings security risks. Once the product reaches a certain scale, they will gradually address decentralization and security issues. This operational mindset is often seen in high-performance infrastructures like Solana and Optimism, where commercialization can yield good results.

Similarly, Hyperliquid faces the same challenge as other trading platforms: the cold start problem. Trading platforms inherently possess strong network effects, meaning "the more users, the better it works," making this sector easily dominated by oligopolies. Nowadays, cold starting a new trading platform is extremely difficult. Observing Hyperliquid's large-scale airdrops and KOL matrix, it is evident that they have put significant effort into market operations.

However, mere marketing hype cannot quickly elevate a new trading platform; there must be a strong product backing it. From Hyperliquid's product design perspective, it is also centered around the core goal of "cold start." In this article, the author will provide an overview of Hyperliquid from the perspectives of HIP, Vaults, and Token models, helping everyone gain a deeper understanding of the design philosophy behind this hot project.

HIP-1 and HIP-2

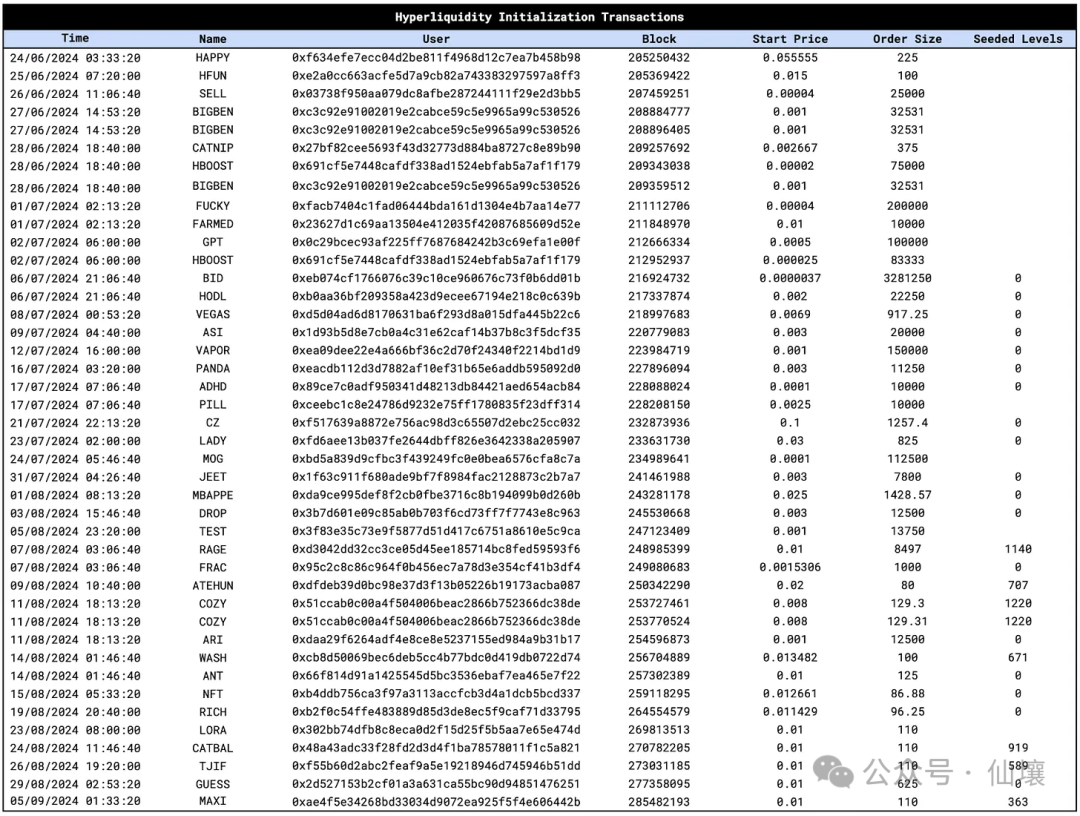

Similar to Ethereum's EIP proposals, Hyperliquid has named its proposals HIP and has introduced two core HIPs that are crucial for it: HIP-1 and HIP-2, aimed at solving the issues of token listing and circulation. Among them, HIP-1 primarily addresses the token issuance and management scheme on the Hyperliquid chain, akin to Ethereum's ERC-20.

Here, we can compare it with the token listing methods of Ethereum DEXs. Most DEXs adopt an AMM product model, and listing a new token involves two steps:

First, the token developer must call the Mint function in the token contract that complies with the ERC-20 standard, defining basic data such as token name, symbol, and total supply.

Then, the newly minted token is paired with another asset (like ETH or USDT) and added to the DEX's liquidity pool, providing initial liquidity. Subsequently, market participants will naturally price the token through arbitrage, SWAP, and other activities.

In Hyperliquid's system, the process of listing tokens is much simpler. First, the Hyperliquid application chain is specifically designed for order book systems. If you issue a new token on Hyperliquid using the HIP-1 standard, the system will automatically create a trading pair for the new token with USDC. When deploying the token contract, you can set a hyperliquidityInit parameter to determine how many tokens will be injected as initial liquidity into the order book market. This eliminates the need to manually inject initial liquidity as in Ethereum AMMs.

In this regard, the main function of HIP-2 is to utilize the aforementioned initial liquidity for automated market making, addressing the initial circulation problem of the token.

So, what are the details of the HIP-2 automated market making scheme? In simple terms, the scheme proposed by HIP-2 is to conduct "linear market making" within a preset price range. The token deployer must first preset a price range, and then the Hyperliquid system will automatically publish buy and sell orders based on this range, ensuring that there is always liquidity in the market.

This part of the details mainly includes three aspects:

Setting the price range and order frequency: The token issuer must specify the upper and lower limits of the market making price, as well as the dividing point for buy and sell orders. Each price point increases by 0.3% relative to the previous price point. This process will be updated approximately every 3 seconds (or longer) to ensure that the system's orders always closely follow market fluctuations, avoiding delays.

Order generation: When the price range is updated, HIP-2 will calculate how many orders should be placed at different price levels based on the spot quantity provided by the token issuer.

Automated reverse market making: Whenever a "full sell order" is executed, the system will automatically place a reverse limit buy order using the funds from the transaction (e.g., USDC). This way, there will always be new orders appearing in the market, ensuring that liquidity remains active.

Currently, the general market makers have two main charging methods: The first is to charge a fixed monthly fee, while the second does not charge a direct monthly fee but borrows a certain percentage of tokens from the project party for market making, usually ranging from 0.5% to 1.5%. To prevent the token price from skyrocketing and increasing repayment costs, market makers can change their charging methods at any time or repay tokens at a pre-agreed price, which involves a game between the project party and the market makers, and will not be elaborated on due to space constraints.

Hyperliquid officially reduces market making costs with the HIP-2 scheme and accepts user deposits for market making in a decentralized manner, which involves its module called Vaults, which we will introduce later.

HIP-1 and HIP-2 aim to significantly reduce the costs of token listing and circulation for project parties. HIP-1 ensures the decentralization and transparency of token listing, while HIP-2 specifically provides "automated market making" services for order book systems, allowing project parties lacking market maker resources to confidently engage in market making on the spot order book platform. This has earned Hyperliquid a good reputation; however, due to the currently high listing fees, general project parties are still kept at bay.

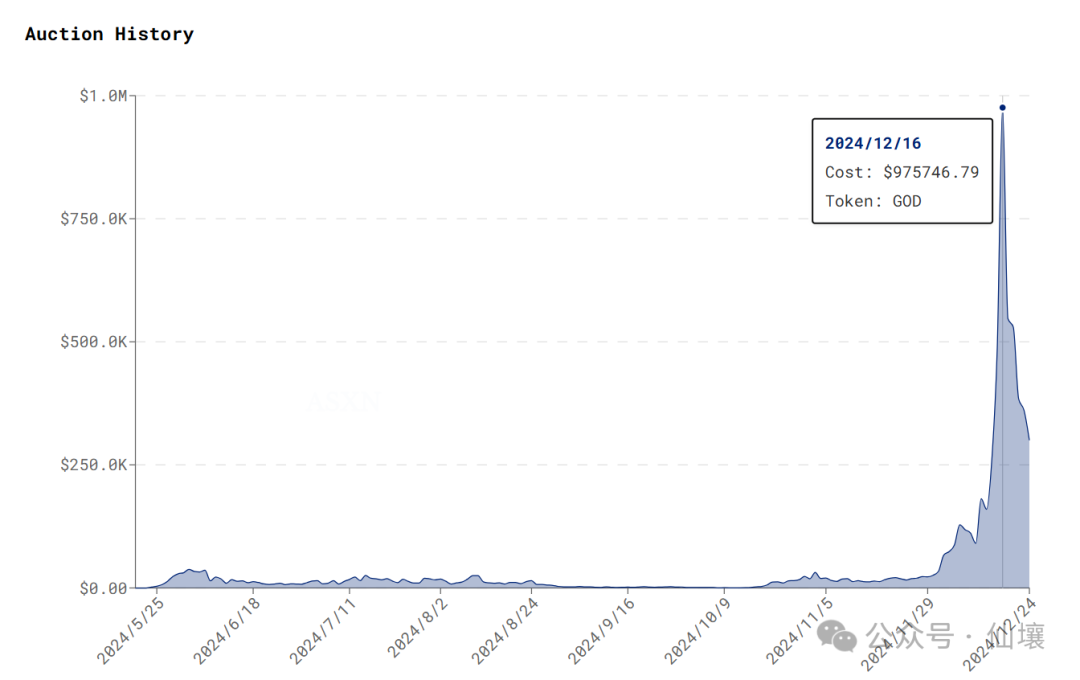

When discussing the topic of listing fees, it is essential to explain the Dutch auction mechanism adopted by Hyperliquid. In the past six months, CEXs have charged exorbitant listing fees, listed controversial tokens, and experienced token price crashes, all pointing to the centralization issues in their listing processes. Against this backdrop, the HIP-1 proposal stipulates that the listing on the Hyperliquid platform adopts a publicly transparent Dutch auction mechanism, rather than being decided by the platform itself, which has garnered widespread goodwill.

In Hyperliquid's scheme, every 31 hours constitutes an "auction cycle," during which one listing quota is publicly auctioned. The annual listing quota is limited to 280. At the beginning of each auction cycle, the new auction starts at double the transaction price of the previous cycle. If the previous cycle's auction is unsuccessful, the current cycle will start from $10,000. Due to the Dutch auction format, the auction price will gradually decrease from the initial price until a bidder accepts the selling price, thus gaining the right to list the token.

Compared to traditional CEXs, Hyperliquid's listing mechanism is quite innovative. It first ensures the public transparency of the listing process, avoiding human intervention and price manipulation. Secondly, this method completely hands the decision-making power to the market, preventing CEX insiders from collecting insider fees. In December of last year, Hyperliquid's listing auction price approached $1 million, which also prevented lower-quality project parties from having the financial means to list, directly avoiding the phenomenon of memecoin proliferation.

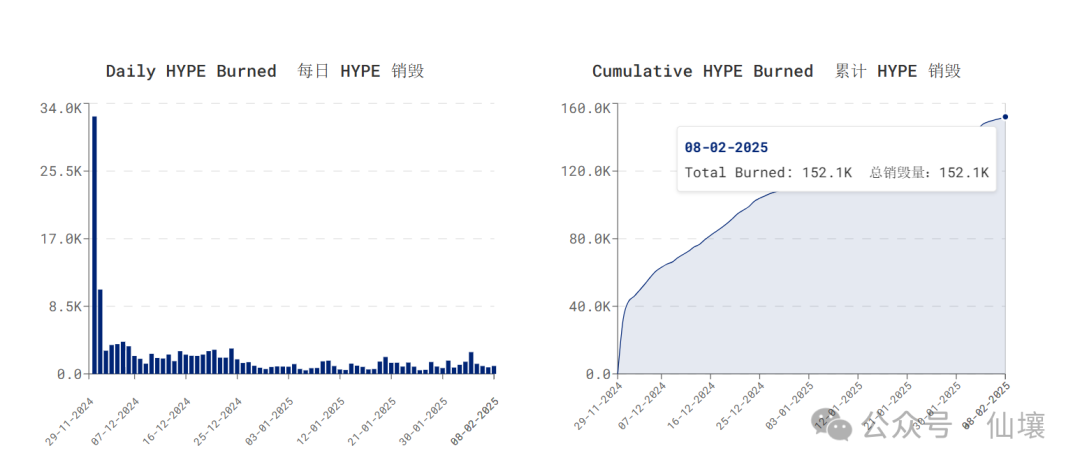

Image source: ASXN Data

In summary, we can see that the significance of HIP-2 lies more in helping weaker project parties achieve a rapid cold start by providing initial liquidity support, which also aids Hyperliquid in its own cold start as a trading platform. The Dutch auction method allows the market to determine the pricing of listing rights, ensuring full transparency throughout the process, making it a fair and just approach. It can be said that Hyperliquid has indeed opened a new model for order book trading platforms, and once it addresses the underlying security issues of the application chain, it is expected to become a phenomenon-level platform capable of competing with Binance for influence.

Vaults

Similar to traditional CEX platforms, Hyperliquid also has basic scenarios such as leverage and contract trading. When it comes to contracts and leverage, there must be corresponding liquidation components, and Hyperliquid provides a more decentralized and open form that everyone can participate in.

The Hyperliquid platform has a core primitive called Vaults, which is written at the L1 chain level. The market making and liquidation activities occurring on the Hyperliquid platform are all operated by Vaults, and users can provide funds to Vaults and share the profits/losses from market making or liquidation based on their share ratio.

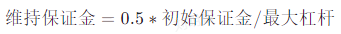

Here, it is briefly explained that the maximum leverage multiple supported by each asset in Hyperliquid varies, ranging from 3 to 50 times, with the specific calculation formula as follows:

For example, if the maximum leverage multiple supported by a certain asset is 50 times, then according to the formula, the liquidation line is 1% of the initial margin, and for a maximum leverage of 3 times, the liquidation line is 16.7%. When the account's net value falls below the liquidation line, liquidation is triggered. There are two types of liquidation methods: order book liquidation and backup liquidation.

Order book liquidation means that if a trader's account net value first falls below the liquidation line, the trader's position will automatically attempt to issue a market order to the order book platform to close all or part of the position, while the remaining collateral can still belong to the trader. Backup liquidation occurs if the account's net value falls below two-thirds of the liquidation line, and the position has not been processed in a timely manner through order book liquidation. In this case, Vaults will intervene for backup liquidation, at which point the trader's position and margin will be transferred to the liquidator and will not be returned to the user. It can be said that the Vaults primarily handle backup liquidation in such scenarios, providing a safety net for the Hyperliquid platform to prevent bad debts.

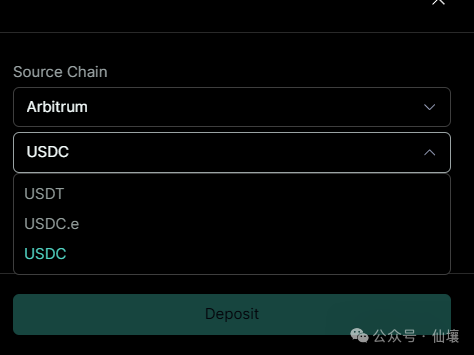

Currently, Vaults only supports deposits of three stablecoin assets: USDC, USDT, and USDC.e (cross-chain USDC).

Image source: Hyperliquid.xyz/vaults

From the perspective of revenue sources, there are three potential sources of income for Vaults participants. The first is market making income, which includes short-term price fluctuations and funding rates obtained from holding unilateral positions. The second is order placement income; in Hyperliquid, takers pay a trading fee of 0.025, while makers receive a reward of 0.002% for providing liquidity. The third is liquidation income; when a position falls below two-thirds of the liquidation line, the HLP liquidation vault can take over that position and profit from it.

Depositing assets into Vaults is not a guaranteed profit. On one hand, market price fluctuations may lead to losses in market making strategies; on the other hand, if Vaults takes over a position awaiting liquidation, any delays in liquidation due to various reasons, or a sharp drop in the asset awaiting liquidation, can lead to losses.

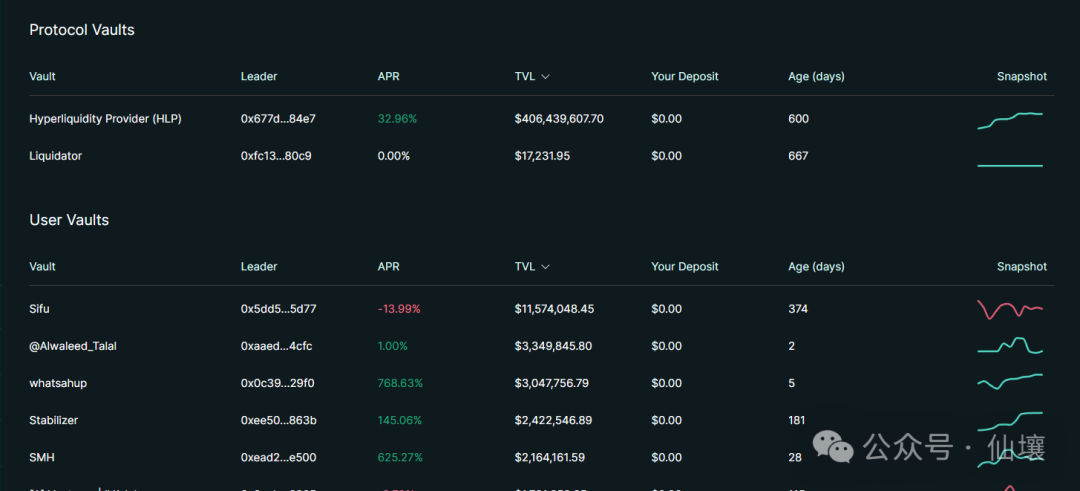

Currently, the original Vaults created by the Hyperliquid official team include two: the HLP vault responsible for market making and the Liquidator vault responsible for liquidation. Additionally, anyone can create their own customized "User vault" on the Hyperliquid chain, set their own quantitative strategies, and become a "creator" responsible for their own profits and losses.

Of course, users can also join official or other user-created Vaults as "followers," similar to a copy trading model. Since Vault creators need to manage funds, they will receive a 10% profit share from followers, provided that the proportion of assets injected by the creator into their own vault must always be greater than or equal to 5%; otherwise, withdrawals will be restricted.

Vaults with varying yields

It should be emphasized that as an emerging exchange, a series of designs by Hyperliquid are aimed at solving the cold start problem. The existence of Vaults means that potential profits from market making and liquidation are shared with the community. According to Hyperliquid's official documentation, the purpose of this approach is "de-platforming," opening up the power monopolized by CEXs and achieving democratization. However, this is essentially a means to address the cold start problem of the trading platform, akin to using a blank check to attract users and liquidity, which not only solves the cold start issue but also garners positive feedback, achieving a win-win situation.

Although market enthusiasm has declined, the TVL of Hyperliquid Vaults remains in the hundreds of millions, having completed its cold start, with some Vaults even achieving an APR of nearly 9000%, demonstrating a significant wealth creation effect. However, one issue to note is that regarding how to ensure the safety of funds deposited in the vaults, the official team seems to have not disclosed relevant information, which poses certain risks.

Token Empowerment

Previously, Hyperliquid airdropped 70% of $HYPE to the community, but $HYPE did not experience significant selling pressure; instead, it rose from $2 at TGE to about $30, which is closely related to the strong empowerment of the $HYPE token. Currently, common token empowerment strategies mainly include two approaches: one is to provide holders with income incentives, and the other is to create deflation to reduce circulation.

Hyperliquid shares a large portion of its business revenue with $HYPE holders to create incentives. The platform's revenue is mainly divided into two parts: trading fees and listing fees. A portion of the trading fees is used to repurchase $HYPE; according to statistics, about 50% of the daily trading fee revenue on the Hyperliquid platform is used to repurchase $HYPE, and these $HYPE are usually burned to reduce circulation. Additionally, a portion of the listing fees (about 50%, with the official not disclosing specific documents) is also used for repurchasing and burning $HYPE.

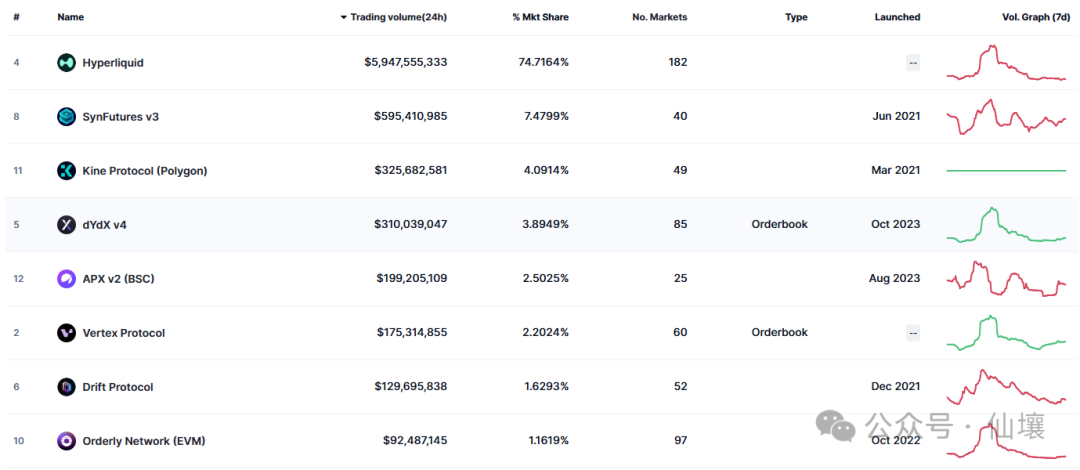

As of early February, Hyperliquid's market share among all on-chain derivatives trading platforms approached 75%, establishing a monopolistic position, thus the effect of its business revenue empowering the platform's official token is quite significant. Hyperliquid continues to maintain a strong growth trend.

As of February 8, 2025, the amount of $HYPE burned has reached 152,000 tokens, valued at approximately $3.426 million.

In addition to business revenue, Hyperliquid's infrastructure has also empowered $HYPE. First, Hyperliquid L1 uses $HYPE as gas fees; although it claims to provide gasless trading, this means that users do not need to perceive the existence of gas when trading, as the system has included gas fees in the trading fees. However, this does not mean that the design of gas has been eliminated at the chain level. Furthermore, with the implementation of HyperEVM and the establishment of DeFi infrastructure in the ecosystem, $HYPE may have specific scenarios such as lending and staking.

Controversies Surrounding Hyperliquid

The controversies surrounding Hyperliquid mainly focus on two aspects. The first is the issue of fund security; Hyperliquid operates on an independent public chain that is not open-sourced, and trading on Hyperliquid is equivalent to depositing into the Hyperliquid L1 bridge. Although the bridge contract of Hyperliquid has been audited by the well-known company Zellic, the node code associated with the bridge contract has not been open-sourced, which may pose potential issues. Additionally, Hyperliquid uses a multi-signature bridge, and the multi-signature nodes are likely controlled by the project team.

Some projects that have received auditing services from Zellic

Moreover, Hyperliquid has been criticized for issues related to wash trading. The data on its open contracts is also quite exaggerated for a DEX.

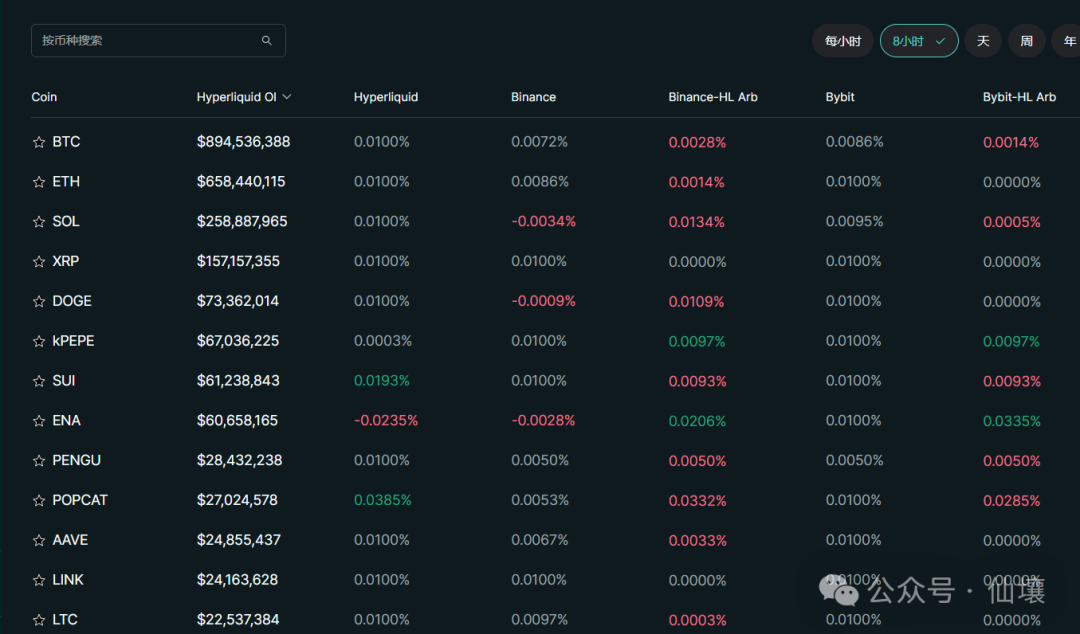

Hyperliquid's funding rate panel

The image shows the funding rate panel provided by Hyperliquid, which is intended to give users an intuitive comparison of funding rates for easy cross-market arbitrage. However, it exposes some intriguing issues with Hyperliquid. We can see that the funding rates for most tokens are similar, remaining at the default 0.01%. Many people suspect that there is not actually that much trading volume on Hyperliquid.

In a truly active market, supply and demand cannot be perfectly balanced, leading to fluctuations in funding rates. When buy orders exceed sell orders, the funding rate for borrowers will be lower, while when sell orders are more frequent, the funding rate will rise. The presence of so many identical 0.01% rates suggests that Hyperliquid may be engaging in wash trading, increasing trading volume through frequent clearing transactions and repeated orders to create a false impression of market activity.

Some traders in the market have also reported that they attempted to engage in quantitative trading on Hyperliquid but were unsuccessful due to insufficient actual trading depth. However, aside from user experience and inference, the issue of wash trading cannot be confirmed, as Hyperliquid is not open-sourced, and we cannot obtain complete raw trading data through node setup. In fact, this issue does not need to be confirmed; we might as well consider another question: if wash trading truly exists, why would Hyperliquid engage in it? The answer still relates to the cold start problem.

Wash trading is an effective means to address the cold start of trading platforms. Referring to various Web2 products with significant network effects, various forms of wash trading are far more common than in Web3. To this day, e-commerce platforms like Taobao and Tmall have approximately 30-40% of their trading volume completed through wash trading each year; on video platforms like YouTube, there are often automated likes, comments, and follows simulating user behavior; in popular games like Peacekeeper Elite, it is likely that among 50 players in a match, only you are a real person, while the rest are all AI.

As for the larger order book CEXs in Web3, no one dares to claim they have never engaged in wash trading, so this issue is widespread and not as severe as many imagine. As mentioned earlier, Hyperliquid's style is that all actions are firmly aimed at solving core issues, even if there are some negative impacts on reputation, so wash trading aligns with its consistent approach. Its core issues boil down to two: cold start and user experience. To address these two problems, it might even resort to a centralized, non-open-source public chain, let alone wash trading.

Overall, the product design of Hyperliquid is fundamentally centered around one principle: all product links and operational actions work in concert to navigate the cold start period, providing users with a CEX-like experience, even if it faces controversy and sacrifices certain aspects. From the results, its strategy has been very successful and is worth reviewing and studying.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。