Macroeconomic Interpretation:

Today, two major events in the fields of technology and current affairs caught my attention: first, Trump's positive evaluation of DeepSeek and the strong push from the Ministry of Industry and Information Technology (MIIT), and second, Musk's appearance on the cover of Time magazine and the enhancement of his political influence. These two events not only caused a stir in their respective fields but also had a profound impact on the cryptocurrency market. We will analyze the specific effects of these events on the cryptocurrency market, particularly on related sectors and Bitcoin (BTC).

The rapid development and widespread application of DeepSeek have become the focus of the technology sector recently. Since the beginning of the year, DeepSeek's user growth rate has reached new highs, and the stock prices of related concept stocks have also surged significantly. Data shows that related concept stocks such as Daily Interactive, Parallel Technology, and Ankai Micro have all seen notable increases. This trend indicates that the market is full of confidence in DeepSeek's future development. Trump's positive evaluation of DeepSeek further bolstered market confidence, as he clearly stated that DeepSeek would not pose a threat to U.S. national security and could instead bring technological benefits to the U.S. This statement not only alleviated market concerns about potential regulatory pressures on DeepSeek but also paved the way for its global promotion.

The MIIT's strong push and the comprehensive access from the three major telecom operators have injected powerful momentum into DeepSeek's development. The MIIT not only called for the promotion of inclusive applications of AI technology but also provided DeepSeek with exclusive computing power solutions and supporting environments. This initiative not only enhanced DeepSeek's technical strength but also provided strong support for its application in multiple scenarios and products. Several companies, such as Kunlun Wanwei, SenseTime, and Zeekr, have announced their integration with DeepSeek, further expanding its application scope and market influence.

The rapid development of DeepSeek has had a positive impact on the cryptocurrency market, especially on sectors and coins related to the integration of AI and blockchain technology. For instance, some projects focused on the fusion of AI and blockchain may gain more attention and funding inflows due to the promotion of DeepSeek. These projects achieve secure data sharing and decentralized training of AI models through blockchain technology, presenting broad application prospects. As DeepSeek is widely applied, the market demand and value of these projects may further increase.

Moreover, the development of DeepSeek may also drive upgrades in the infrastructure of the cryptocurrency market. As the demand for computing power from AI technology increases, the performance and scalability of blockchain networks will become key factors. Some projects dedicated to enhancing blockchain performance may benefit from this. These projects optimize the underlying architecture of blockchain to provide higher transaction speeds and lower fees, laying a solid foundation for the integration of AI and blockchain.

Musk's appearance on the cover of Time magazine and the enhancement of his political influence is another major focus in the political arena. Musk is portrayed as a figure deeply intertwined with presidential power and U.S. politics, which not only enhances his personal influence but also brings more attention to his companies and projects. Musk has always held a positive attitude towards cryptocurrencies, especially BTC and DOGE. His increased political influence may bring more policy support and market confidence to the cryptocurrency market.

The impact of Musk's enhanced political influence on the cryptocurrency market is mainly reflected in two aspects. First is policy support. Musk has consistently advocated for technological innovation and free markets, and his increased political influence may promote government support for cryptocurrencies and blockchain technology. For example, he may push the government to reduce regulatory pressures on cryptocurrencies, creating a more favorable policy environment for the development of the cryptocurrency market. Second is market confidence. Musk's personal influence and his supportive attitude towards cryptocurrencies may enhance market confidence in cryptocurrencies, attracting more investors into the market. Particularly, BTC, as the leader of the cryptocurrency market, may benefit from this, with prices expected to rise further.

In summary, the rapid development of DeepSeek and Musk's enhanced political influence have had a positive impact on the cryptocurrency market. The widespread application of DeepSeek promotes the integration of AI and blockchain, benefiting related sectors and coins. Musk's increased political influence brings more policy support and market confidence to the cryptocurrency market, particularly positively affecting the price trend of BTC.

BTC Data Analysis:

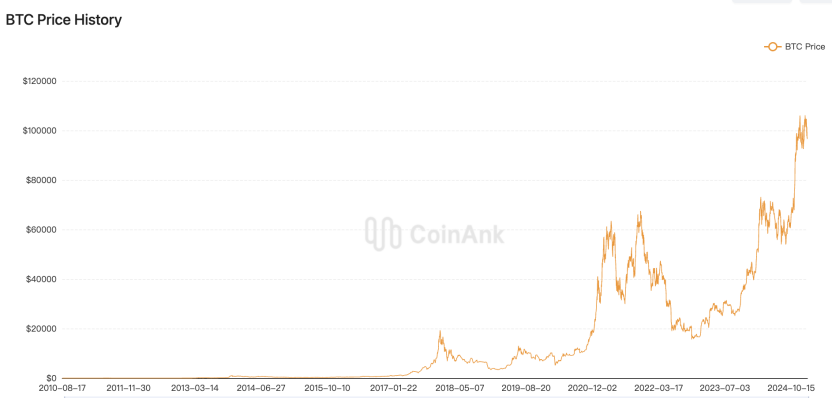

Bitcoin has achieved an investment return rate of approximately 9.2 million times over its 14 years since inception, while #gold and #S&P 500 have return rates of 110% and 354%, respectively. According to coinank data, in the short term, #BTC's return rate over the past year is 109%, while gold and the S&P 500 are 41% and 20%, respectively.

Bitcoin's extraordinarily high return rate highlights its disruptive characteristics as an emerging asset. Despite a return rate of about 9.2 million times over 14 years (far exceeding gold's 110% and the S&P 500's 354%), its high returns come with high-risk attributes. Data shows that Bitcoin's short-term correlation with the S&P 500 is 0.21, and only 0.09 with gold, indicating its independence from traditional assets, but its volatility is significantly higher than that of gold. For example, while the 109% return rate over the past year is impressive, the maximum drawdown during the same period may exceed 14%, highlighting short-term risks.

Gold's stability is reflected in its safe-haven function, especially during market turmoil, with a low correlation (close to 0) with the stock market and its anti-inflation capability, making it a "ballast" for investment portfolios. The S&P 500, as a traditional equity asset, offers stable returns but is constrained by high valuations and macro policy risks. Institutions like Goldman Sachs have already suggested reducing exposure to U.S. stocks by 2025.

We believe that Bitcoin's high returns stem from its supply-demand scarcity (such as the halving mechanism) and the growth dividends during its early technology adoption phase, but one must be cautious of its correlated volatility with tech stocks; gold, on the other hand, supports long-term value through historical credibility and central bank accumulation. The complementarity of the two is significant, and moderate allocation can balance risk and return. For example, BlackRock suggests a 2% allocation to Bitcoin and 5%-10% to gold to balance returns and stability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。