2024-2025 Crypto Market: A New Landscape Driven by Institutional Funds, Ecological Dilution, and Changes in Retail Speculation Models. Adapting to these changes will be key for investors and Web3 builders to succeed.

Author: SubQuery Network

Translation: Baihua Blockchain

The Cyclicality of the Cryptocurrency Market: Why 2024-2025 is Different from the Past?

The crypto market has always exhibited cyclical fluctuations, experiencing extreme bull markets and deep corrections. Since the birth of Bitcoin in 2009, we have witnessed multiple market cycles, each influenced by unique factors.

While certain core elements remain constant, such as the four-year Bitcoin halving, each cycle introduces new market dynamics that reshape market structure and investment logic.

- What Makes the 2024-2025 Cycle Different?

As we enter the new market cycle of 2024-2025, there is an increasing consensus that “this time is different.” From the accelerated positioning of institutional investments to the changes in retail participation, several key factors are giving this cycle distinct characteristics.

Here are the key reasons this market cycle is different from the past, and what it means for investors and Web3 builders.

Review: The Traditional Cycle Pattern of the Crypto Market

The cyclical fluctuations of the crypto market typically follow this pattern:

1) Adjustment/Bear Market Phase — Reality sets in, investors take profits, and liquidity in speculative assets dries up.

2) Frenzy/Peak Phase — The market overheats, speculative sentiment dominates, and Altcoins experience explosive growth.

3) Expansion/Bull Market Phase — Optimism returns, prices rise, media attention surges, attracting new retail investors.

4) Accumulation Phase — After a bear market, “smart money” and long-term holders quietly accumulate at low levels.

This pattern has repeated itself across multiple market cycles:

The Bitcoin bubble and crash of 2013

The ICO frenzy of 2017

The bull market of 2021, driven by DeFi, NFTs, and institutional funds. However, the cycle of 2024 presents a different form, with the market structure being reshaped by new forces.

- Institutional Capital Driving Bitcoin's Dominance

One of the most significant changes in this cycle is the deep involvement of institutional funds. Unlike previous bull markets primarily driven by retail speculation, this rise is led by institutional investment:

Expansion of the derivatives market — The growth of Bitcoin futures and options markets has made the market more liquid and structured, less affected by extreme volatility compared to the past.

Interest from corporations and sovereign nations — Large corporations and even sovereign nations are incorporating Bitcoin into their balance sheets or using it as a hedging tool.

Impact of Bitcoin ETFs — The U.S. approval of spot Bitcoin ETFs allows trillions of dollars in institutional capital to allocate BTC in a compliant manner, significantly enhancing market maturity. The result of this change is that Bitcoin has performed particularly strongly in this cycle, absorbing the majority of market liquidity. Bitcoin's dominance (BTC Dominance) continues to rise, making the phenomenon of Altcoins experiencing explosive surges seen in past cycles difficult to replicate.

- Market Dilution: More Altcoins, Reduced Overall Gains

In past cycles, the number of newly issued Altcoins was relatively small, making them more prone to explosive growth. However, in this cycle, the supply of crypto assets has surged, leading to significant market dilution.

Data Comparison (Source: Dune Analytics):

2017-2018 — There were only about 3,000 tokens in the market.

By the end of January 2025 — There are 36.4 million tokens circulating in the market. The reasons for this phenomenon include:

Token unlocks — Many projects are still continuously releasing tokens within their vesting periods, creating long-term selling pressure that puts downward pressure on prices.

Over-saturation of the meme coin market — In previous cycles, the meme coin market was mainly dominated by a few tokens (like Dogecoin, Shiba Inu), but the explosive growth of meme coins in 2024 has led to new meme coins being born almost daily, resulting in severe internal competition that makes it difficult for any single meme coin to maintain sustained popularity.

Surge of L1 & L2 ecosystems, leading to dispersed liquidity — The emergence of numerous Layer 1 and Layer 2 solutions has caused market funds to be diverted across different public chain ecosystems, unlike in the past when they were concentrated on a few popular chains. Impact: The era of Altcoins experiencing widespread surges may have ended. While some Altcoins may still outperform the market, the “full bull market” scenario where almost all coins would surge has become increasingly unrealistic.

- Retail Funds Being Absorbed, Market Structure Changes

Retail traders have always been the core driving force of bull markets in the crypto space, but a significant change in this cycle is that retail liquidity is being absorbed by new trading models rather than traditional spot markets. The most representative of these is the rise of Pump.fun…

1) How Pump.fun Changes Retail Trading Behavior in Crypto?

Pump.fun officially launched on January 19, 2024, and quickly changed the trading methods of global retail crypto traders.

One of the most notable market changes in this cycle is the rise of platforms like Pump.fun, which has spawned a new speculative trading model. The core gameplay of Pump.fun: Anyone can create a Solana Token for free in one minute, which not only drives the hottest meme coin trend of 2024 but also makes high-risk, high-reward “gambling-style trading” the mainstream approach for retail traders.2) Key Impacts of This Phenomenon

🔹 Creates more exit liquidity for insiders

Token founders and early holders can quickly cash out using retail funds,

while the high-frequency rotation in the market leads many retail traders to incur losses before arbitraging. 🔹 Accelerates fund rotation, weakening mainstream Altcoin trends

Funds move extremely quickly, with most meme coins having a lifecycle of only a few hours or days,

making it more difficult for traditional Altcoins to form stable upward trends, as funds are continuously drawn away to higher-risk micro-cap projects.

3) Conclusion:

The emergence of Pump.fun is reshaping the market landscape, attracting retail funds from traditional Altcoins to high-risk micro-cap assets, making the flow of funds and trading logic in this bull market significantly different from previous cycles.

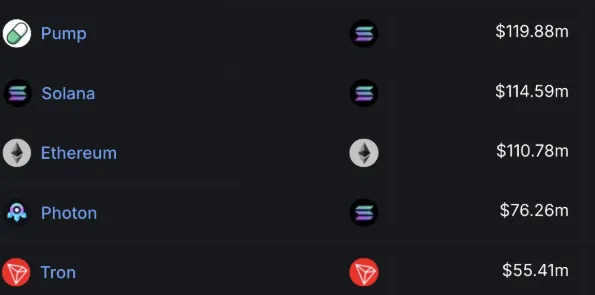

**Pump.fun's revenue in January 2025 surpassed Solana and Ethereum. In January 2025, Pump.fun generated revenue of *$116.72M*, surpassing *Solana ($116.46M) and Ethereum ($107.64M)*.4) Community Reminder: Beware of SQT Fake Tokens

Recently, multiple counterfeit SQT Tokens have appeared on the Pump.fun platform, intending to mislead traders. These tokens are not related to the official SubQuery Network, and purchasing them carries significant risks.

Before trading, please be sure to verify the token contract address through official channels (Discord and Telegram channels). Beware of scams and do not trust random tokens on the platform to avoid being maliciously exploited.

5) What Does This Mean for Crypto Investors?

- Retail speculation is shifting to new avenues. From Pump.fun to various new on-chain trading mechanisms, the flow of funds is changing, and understanding these trends can help traders better grasp market liquidity.

- The rise of Altcoins will be more “selective”. Unlike previous cycles where all coins could surge, in this cycle, only projects with real application scenarios, strong economic models, and actual demand will be the ultimate winners.

- Bitcoin remains the dominant force in the market. With continued inflow of institutional funds, BTC still holds a dominant position, meaning that a large number of investors are more inclined to hold Bitcoin rather than speculate on Altcoins.

- Conclusion: The Cycle of the Crypto Market is Still Evolving, but the Landscape of 2024-2025 Has Changed Completely

Although the crypto market still follows the traditional cycle pattern, this cycle is significantly different from the past:

- Institutional funds are entering on a large scale, boosting Bitcoin's dominance

- The market is overly diluted, and Altcoins no longer experience widespread surges

- Retail funds are shifting towards shorter-term, higher-risk on-chain speculative trading

- Changes in the macro environment and market structure are affecting long-term market trends. For investors and Web3 builders, adapting to these market changes is key to winning in this cycle. The rules of the game have changed, but opportunities still exist for those who can anticipate the flow of funds.

This article link: https://www.hellobtc.com/kp/du/02/5662.html

Source: https://subquery.medium.com/understanding-crypto-market-cycles-why-this-cycle-feels-different-6beb49fcf6b1

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。