Despite the recent poor performance of ETH, as a loyal holder still holding ETH, stabilizing and increasing the coin-based value of ETH is a topic worth careful study.

To conclude, considering security and liquidity, the best opportunity for ultra-low-risk coin-based value increase for ETH at present should be Ether.fi. Currently, Ether.fi's actual yield is 5.8%, significantly higher than other similar protocols.

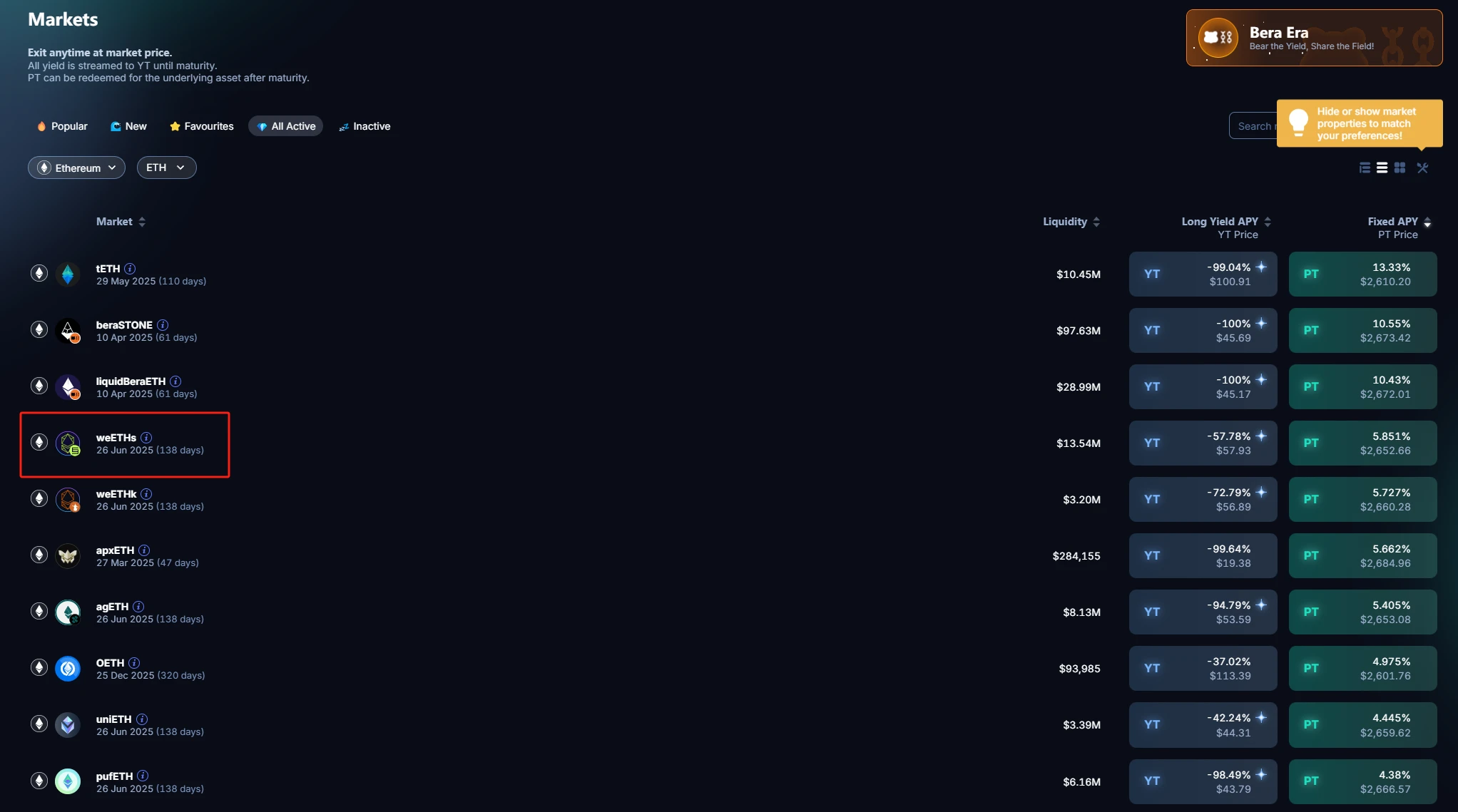

According to Pendle's calculations, tETH belongs to a new protocol that has not been market-tested, and the bear chain requires a certain lock-up period. Therefore, Ether.fi's Symbiotic pool is the protocol with the highest yield apart from the aforementioned two protocols.

Let’s dive in:

About Ether.fi

Ether.fi is a decentralized staking protocol based on the Ethereum blockchain. Ether.fi offers native re-staking, where staking rewards are automatically compounded to generate higher returns. This feature helps users maximize their earnings without manual intervention. Ether.fi aims to make staking within the Ethereum ecosystem more accessible, efficient, and decentralized.

Key Features and Characteristics

One of the main features of Ether.fi is its liquid staking capability. Users do not need to lock up ETH for long periods; instead, they receive liquidity tokens, such as eETH (ETH staked on ether.fi), in exchange for staking ETH. These tokens represent the staked ETH, allowing users to trade or use them in various DeFi applications, providing greater flexibility and liquidity.

How It Works

Seamless staking to earn rewards: Users can stake their ETH through the Ether.fi protocol. When users stake their ETH in the Ether.fi protocol, they receive an equivalent amount of liquidity tokens (eETH). eETH is a native re-staking liquid staking token that entitles holders to staking rewards generated by the underlying staked ETH while maintaining liquidity and participating in various DeFi.

These rewards are automatically compounded within the Ether.fi protocol, maximizing the earning potential for eETH holders.

Ether.fi employs a liquid staking mechanism that allows users to stake their ETH without long lock-up periods. This feature provides users with greater flexibility and liquidity compared to traditional staking methods.

Governance token: ETHFI is the governance token that drives the ether.fi network. By holding ETHFI tokens, users can vote on proposals, upgrades, or parameter changes, ensuring a decentralized and community-driven governance model that makes the protocol management approach more inclusive and democratic.

Why Choose Ether.fi?

Ether.fi offers several key advantages for users looking to participate in decentralized staking on the Ethereum blockchain, including:

(1) Strong Liquidity

It allows users to stake less than 32 ETH on Ether.fi, automatically receiving an equivalent amount of eETH or weETH minted by the protocol, which can be freely traded and quickly exchanged back to ETH or other crypto assets when liquidity is needed.

(2) Multi-Scenario Applications

eETH and weETH possess the properties of ERC-20 tokens, allowing users to earn liquidity pool rewards and use them in various DeFi platforms, such as lending, liquidity provision, or as a medium of exchange, expanding users' operational scope and potential earnings within the Ethereum ecosystem.

(3) Staking Rewards + Re-Staking Earnings

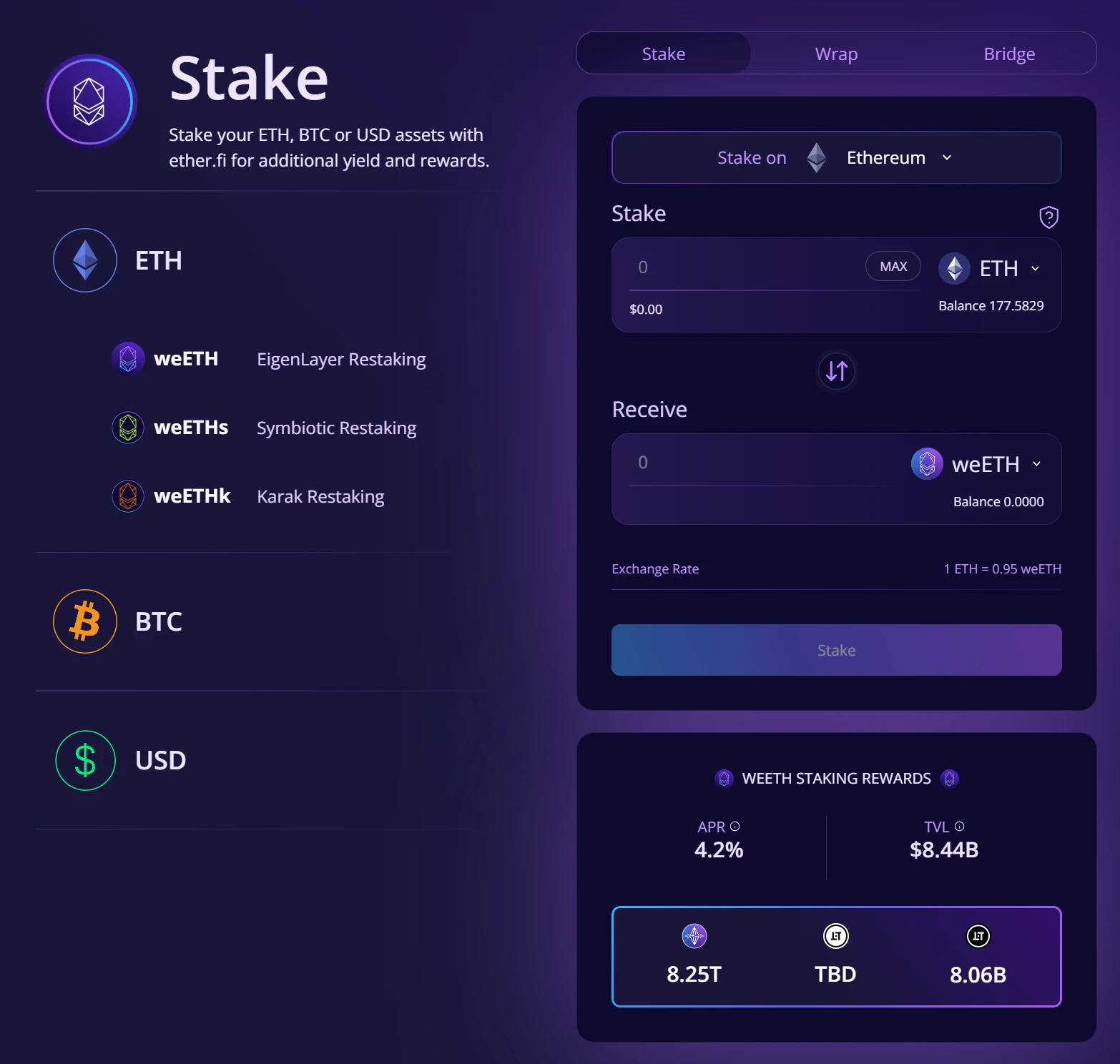

Users can re-stake their ETH through Ether.fi to protocols like EigenLayer, Symbiotic, and Karak, earning corresponding staking rewards that automatically accumulate and compound over time, bringing users more earnings.

With these advantages, Ether.fi aims to make staking within the Ethereum ecosystem more convenient, efficient, and decentralized while maximizing staking rewards.

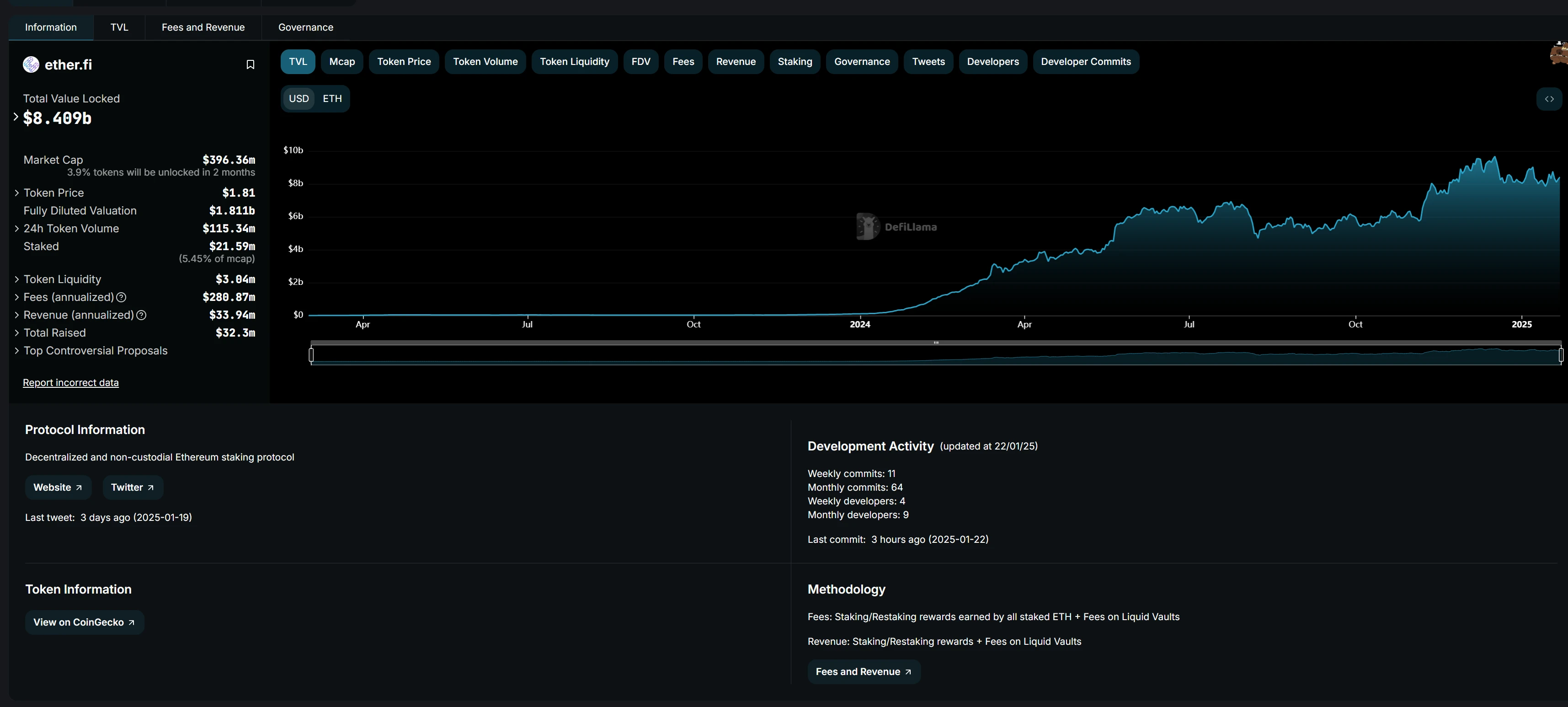

Robust Growth Trajectory

Explosive growth in TVL: As of January 14, 2025, EtherFi's TVL (Total Value Locked) has reached approximately $8.5 billion, ranking as the 4th largest project across the entire ETH network, including L2, with excellent security. It has the highest adoption rate and fastest growth among all liquid staking projects.

Reliable Team Background

Ether.fi completed a $5.3 million funding round on February 2, 2023, led by North Island Ventures, Chapter One, and Node Capital, with participation from BitMex founder Arthur Hayes. On February 27, 2024, Ether.fi completed a $27 million Series A funding round led by Bullish and CoinFund, highlighting the protocol's rapid expansion trend and investor confidence.

Currently, Ether.fi has disclosed information about five team members in official documents, including founder Mike Silagadze, who is currently the CEO of DeFi fund company Gadze Finance and the founder of Canadian higher education platform Top Hat (which raised $130 million in Series E funding in 2021). Based on the successful entrepreneurial experience of Ether.fi's founder, he possesses knowledge and experience in both business operations and the crypto field, enabling him to efficiently execute and scale EtherFi, ensuring that EtherFi's operations and innovations align with the needs of the crypto ecosystem.

Additionally, the Ether.fi team adheres to three guiding principles:

First, decentralization is the primary goal, and there will never be a compromise on the non-custodial and decentralized nature of the protocol.

Second, the Ether.fi protocol has a sustainable revenue model and long-term participation, with the team thinking and planning with a long-term perspective.

Third, they uphold professional ethics and will always do the right thing for the Ethereum community.

Composition of Staking Rewards

The staking rewards from Ether.fi mainly consist of the following components:

(1) Ethereum Network Staking Rewards: Currently, the annualized yield for Ethereum staking is around 2.7%.

(2) Re-Staking Rewards: Ether.fi re-stakes users' staked ETH to other protocols or validator nodes like EigenLayer and Symbiotic to earn additional rewards. These rewards may be distributed in the form of the project's own tokens, such as Eigen, ETHFI, or governance tokens or yield certificates from other protocols.

(3) MEV Rewards: In the Ethereum network, nodes can earn fees during the transaction packaging and ordering process, including priority fees given by users and MEV rewards. As a node operator, Ether.fi will return a portion of the transaction ordering revenue to staked users, but this revenue has a certain degree of uncertainty, depending on the activity level of the Ethereum network and transaction congestion.

(4) Liquidity Mining Rewards: In Ether.fi's liquidity pool, users will receive corresponding liquidity tokens, such as eETH or weETH, after staking ETH. These tokens can participate in liquidity mining and provide liquidity in other DeFi protocols to earn additional mining rewards. The rewards are typically in the form of governance tokens from related DeFi protocols or a share of transaction fees.

(5) Airdrops and Other Incentives: Ether.fi will periodically launch airdrop events or other incentive measures to attract users to participate in staking. For example, during specific periods, staking a certain amount of ETH will increase the total token quantity in the airdrop reward pool by a certain proportion, giving users the opportunity to receive additional ETHFI tokens or airdrop rewards from other partner projects.

Conclusion: According to the current mainstream and secure ETH LRT solutions on the market, the yield provided by Ether.fi is one of the highest.

Estimation of Regular Staking Rewards

Among the mainstream ETH staking protocols, Ether.fi's Symbiotic pool has the highest yield in the network, estimated to reach an APR of 6–10%.

Symbiotic is the largest competitor of EigenLayer, and Ether.fi x Symbiotic can achieve four mining streams:

- ETH carries a 2.7% yield;

- Ether.fi points;

- Symbiotic points;

- Veda points.

Note: The above APR accounts for the potential value of the above points and allows for flexible access, meaning funds can be withdrawn at any time.

You can directly deposit on the Ether.fi front end, portal: https://app.ether.fi/weeths.

Summary

The DeFi application scenario design of Ether.fi's eETH provides more directions for DeFi applications and a layering mechanism for yield accumulation, allowing for better expansion and enabling more users to participate in Ether.fi. Overall, as a derivative product in the LSD track, Ether.fi's design in key management is innovative, and its yield advantage and ease of use have helped it achieve considerable TVL, making it the best yield location for current ETH.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。