Tonight at 21:30, the U.S. Labor Department will release the non-farm payroll data for January, which is the first non-farm data since Trump took office and is highly anticipated. Due to factors such as the recent Los Angeles wildfires and adjustments in immigration policy, this non-farm data may show a cooling trend. AiCoin (aicoin.com) data indicates that the market currently expects an increase of 170,000 in non-farm employment for January, down from the previous value of 256,000; the unemployment rate is expected to remain steady at 4.1%.

Previously, Powell has publicly stated that the labor market and wages are no longer the main causes of inflation. In other words, if the labor market remains stable, meaning that the increase in non-farm employment stays within 170,000 to 200,000, and the unemployment rate remains steady or lower than the previous value, it is unlikely to trigger market risk aversion.

However, recently, due to the global trade war initiated by Trump, both traditional and cryptocurrency markets are under pressure, leading to a gloomy market sentiment, with Bitcoin continuing to decline and panic spreading. Tonight's non-farm data is expected to impact the market in the short term, potentially determining the weekend's trend.

Short-term Pain: Can Non-farm Data Revive the Market?

Although the market is facing short-term challenges, some analysts believe that Bitcoin may see a significant rise.

André Dragosch, Head of European Research at Bitwise, believes that the current market sentiment and positions have significantly decreased, making it a good opportunity to increase Bitcoin holdings. He pointed out, "Historical data shows that Bitcoin usually performs well in February, and we may be on the eve of an upward trend."

Analyst Mikybull noted that Bitcoin's seasonal trend indicates that February often brings an increase. From historical data, Bitcoin's average return in February is 14.08%, with only two declines in the past ten years. Additionally, the average return in the first quarter is 52.43%, providing some upward momentum for the market.

Jeff Park, Head of Alpha Strategy at Bitwise Invest, even predicts that the "outbreak of financial war" will lead to a "significant increase" in Bitcoin prices. He stated, "Trump's policies may ultimately weaken the dollar, thereby stimulating demand for risk assets like Bitcoin."

However, some analysts warn that due to the impact of leveraged trading, Bitcoin may still retest the $80,000 level. The Alphractal data analysis platform points out that there are a large number of long leveraged positions in the market, and if Bitcoin falls below key support levels, it could trigger further liquidations, leading to a temporary price correction.

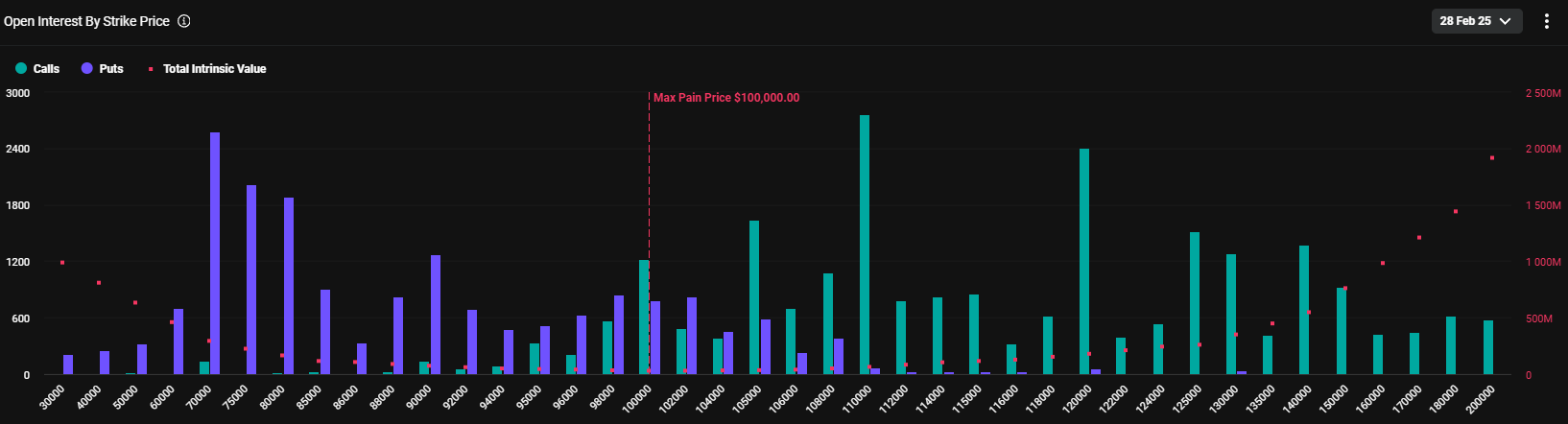

Additionally, options data shows a surge in large trades of Bitcoin put options, indicating an unfavorable outlook for the market this month. Among them, there are put options worth $124 million at the $90,000 level; similarly, a large number of put options are piled up in the $70,000 to $80,000 range, totaling $634 million.

Key Support and Pressure: BTC's Short-term Trend is Gradually Clarifying

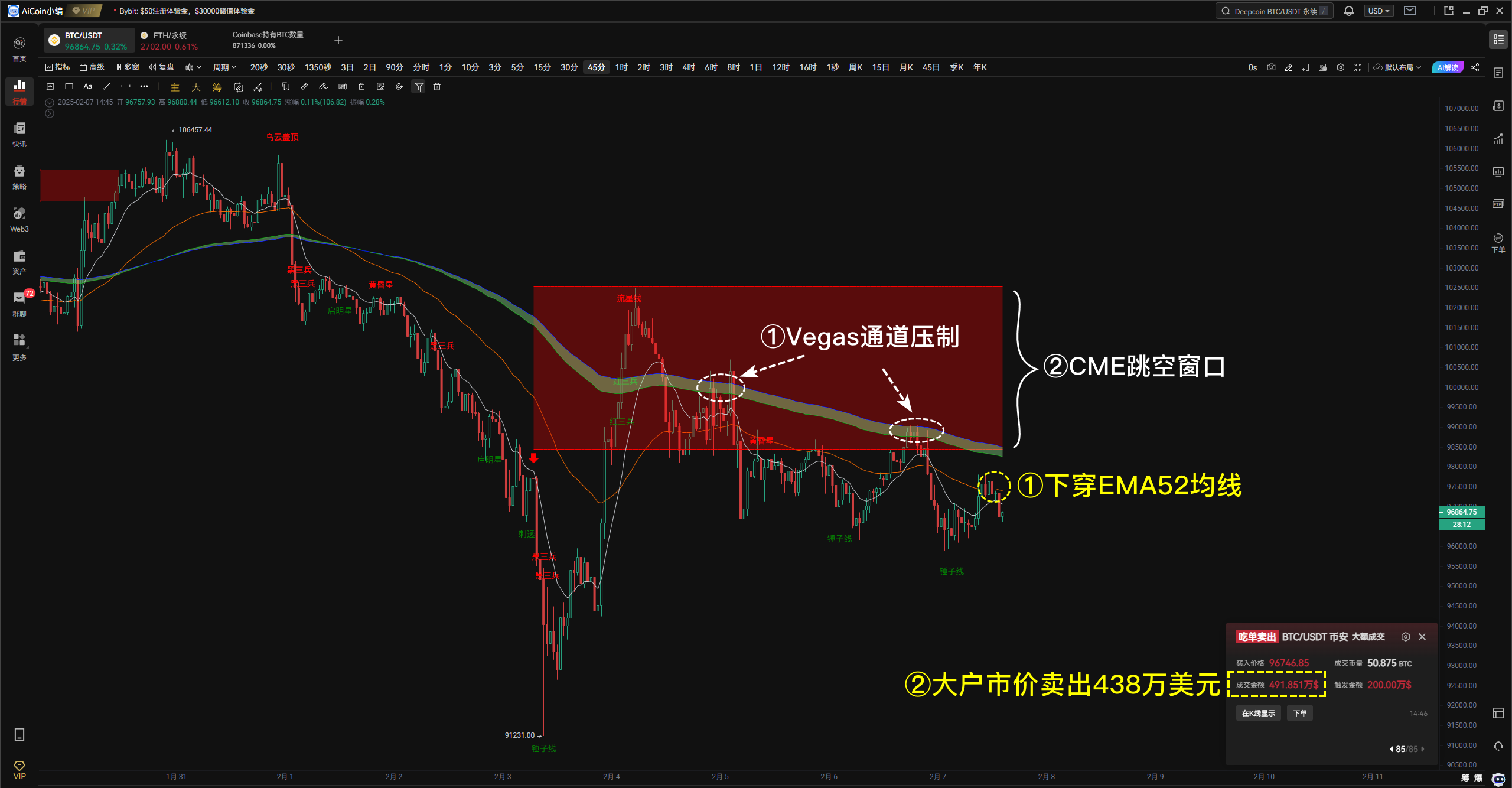

From a technical perspective, Bitcoin is currently in a phase of consolidation, and the market may trend conservatively in the short term. Recently, the BTC price has been suppressed by the Vegas channel at a 45-minute custom cycle and has shown multiple rejections within the CME gap, indicating heavy selling pressure above. Additionally, this morning at 10 AM, a large market sell order of $4.38 million on Binance exacerbated the risk of a short-term pullback. As of the time of writing, BTC has fallen below the EMA52 moving average, and the likelihood of continued consolidation seeking a bottom during the day is high.

Furthermore, after BTC retraced and tested $91,130, the market showed some signs of support, while the short-term key resistance level remains at $99,000 to $100,000. Bitcoin needs to effectively break through this resistance zone to potentially welcome further increases.

Institutions Continue to Increase Holdings: ETF Funds Drive Bitcoin Growth

Despite the uncertainty in the short-term market, one noteworthy trend is that institutional funds continue to flow into Bitcoin.

Since the launch of the U.S. spot Bitcoin ETF, the asset management scale of this investment product has reached $117.5 billion, attracting over $40 billion in capital. In the past two weeks, a total of $2.35 billion has flowed into the U.S. spot Bitcoin market, indicating that institutional investors remain optimistic about Bitcoin's long-term prospects.

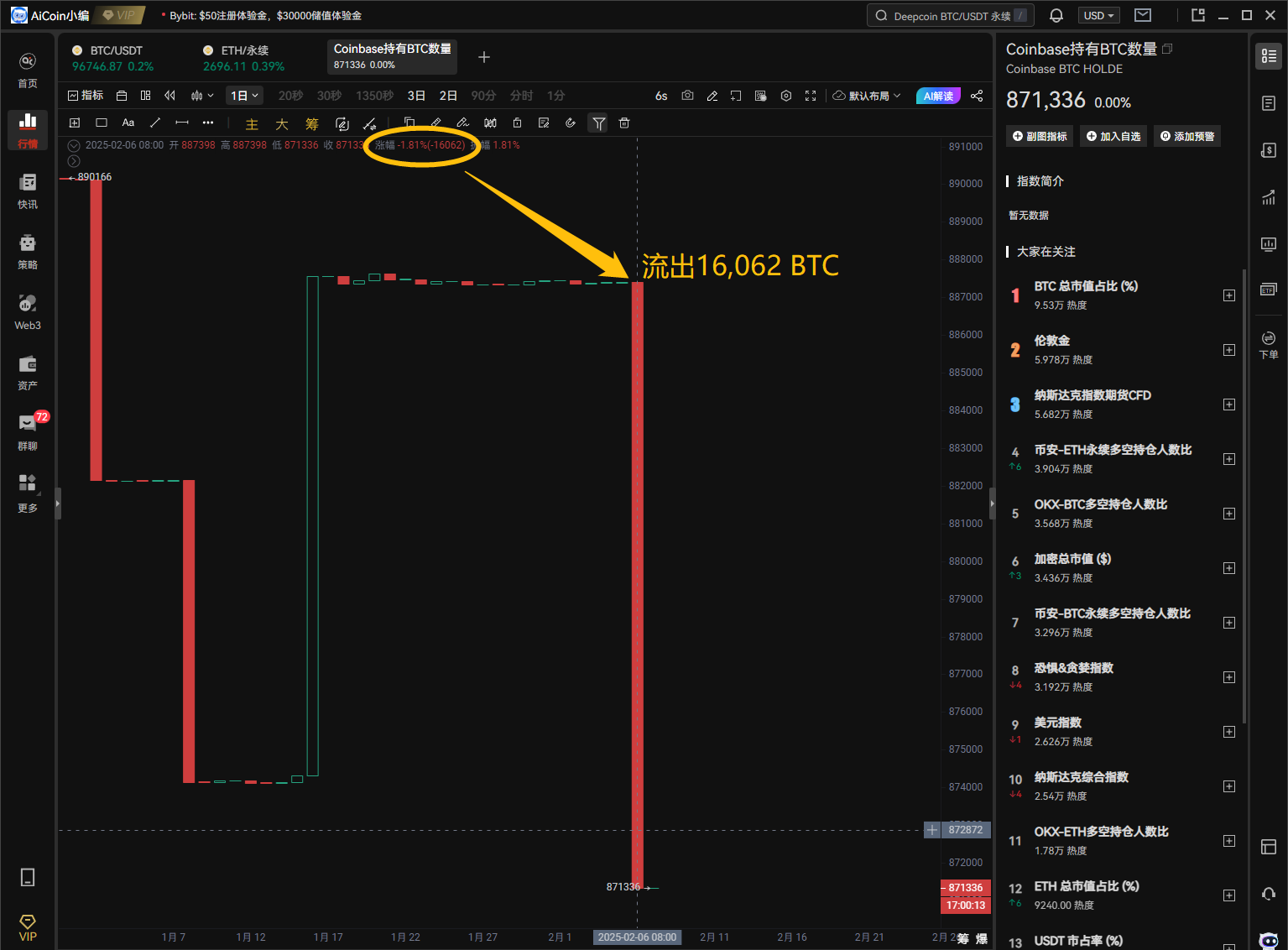

At the same time, the supply of Bitcoin on exchanges is also decreasing, dropping from 3.1 million BTC to 2.67 million BTC over the past six months. On February 6, more than 16,000 BTC were transferred out of Coinbase. This indicates that investors are moving Bitcoin to self-custody wallets, reducing the liquid supply in the market.

However, the market remains susceptible to external risks, especially as Trump's trade war may continue to escalate, and global economic uncertainty remains high. Recent trading advice is to remain cautious.

Recommended Reading:

• Track Non-farm Data: https://www.aicoin.com/zh-Hans/data/npe

• Real-time Spot Bitcoin ETF Data: https://www.aicoin.com/zh-Hans/web3-etf/

• Use AiCoin Tools to Position for Non-farm Trends: https://www.aicoin.com/zh-Hans/article/439661

The above content is for sharing purposes only. If you have any questions, you can contact us through the following official channels:

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying, Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。