Author: Chorus One

Translated by: Felix, PANews

The Berachain mainnet is officially launched. This marks the beginning of a transformation period for DeFi, where security and liquidity can be scaled simultaneously under Berachain's novel Proof of Liquidity (PoL) consensus.

Proof of Liquidity: The Foundation of Berachain

The goal of Berachain's Proof of Liquidity (PoL) consensus mechanism is to allow security and liquidity to scale simultaneously. In traditional Proof of Stake (PoS) blockchains, a large amount of capital is locked to ensure network security. While this staked capital secures the network, it remains idle and does not contribute to ecosystem liquidity. The fundamental idea behind Proof of Liquidity is to eliminate the trade-off between security and liquidity by incentivizing DeFi activities with sustainable staking income.

Three-Token Model

The economic design of Berachain revolves around three different tokens:

- BERA: The native token of the network, used for paying gas fees and staking

- BGT (Berachain Governance Token): A non-transferable governance asset obtained only through liquidity provision

- HONEY: A native stablecoin minted through over-collateralization

Validators propose blocks and allocate the issuance of BGT based on their BERA stake, which can be allocated to the reward treasury. The amount they can allocate depends on their BGT stake: the frequency of proposals depends on their BERA stake; how much BGT is allocated based on proposals depends on their BGT stake. Users providing DeFi liquidity can stake their receipt tokens in these reward treasuries to earn BGT rewards.

Key Applications Supporting Berachain

BEX: Berachain Exchange

BEX is a native decentralized exchange with House Pools and Metapools features that enhance liquidity efficiency. Liquidity providers can earn trading fees and accumulate BGT, which can be staked with validators to participate in governance and optimize emissions.

Bends: Native Lending Market

Bends allows users to borrow HONEY using collateral such as ETH, BTC, and USDC. By interacting with Bends, users can deepen liquidity while earning BGT, creating a dual incentive model for sustainable lending.

Berps: A native perpetual futures exchange that offers high-performance derivatives trading with deep liquidity and efficient capital deployment.

Introduction to BeraBoost: Optimizing Delegator Returns

With Berachain's unique issuance mechanism, delegators need to devise complex strategies to maximize returns. This is where BeraBoost comes in—an automatic allocation algorithm developed by Chorus One Research that dynamically optimizes BGT allocation to maximize returns.

How BeraBoost Works

Validators on Berachain play a crucial role in issuance allocation. Delegators staking with validators can benefit from the strategies that guide issuance to the reward treasury. BeraBoost takes this a step further by achieving the following:

Algorithmically allocating issuance to maximize rewards for delegators on their reward treasury positions

Transparently directing liquidity to where it is most needed

Automating the profit maximization process, reducing the complexity of delegator staking

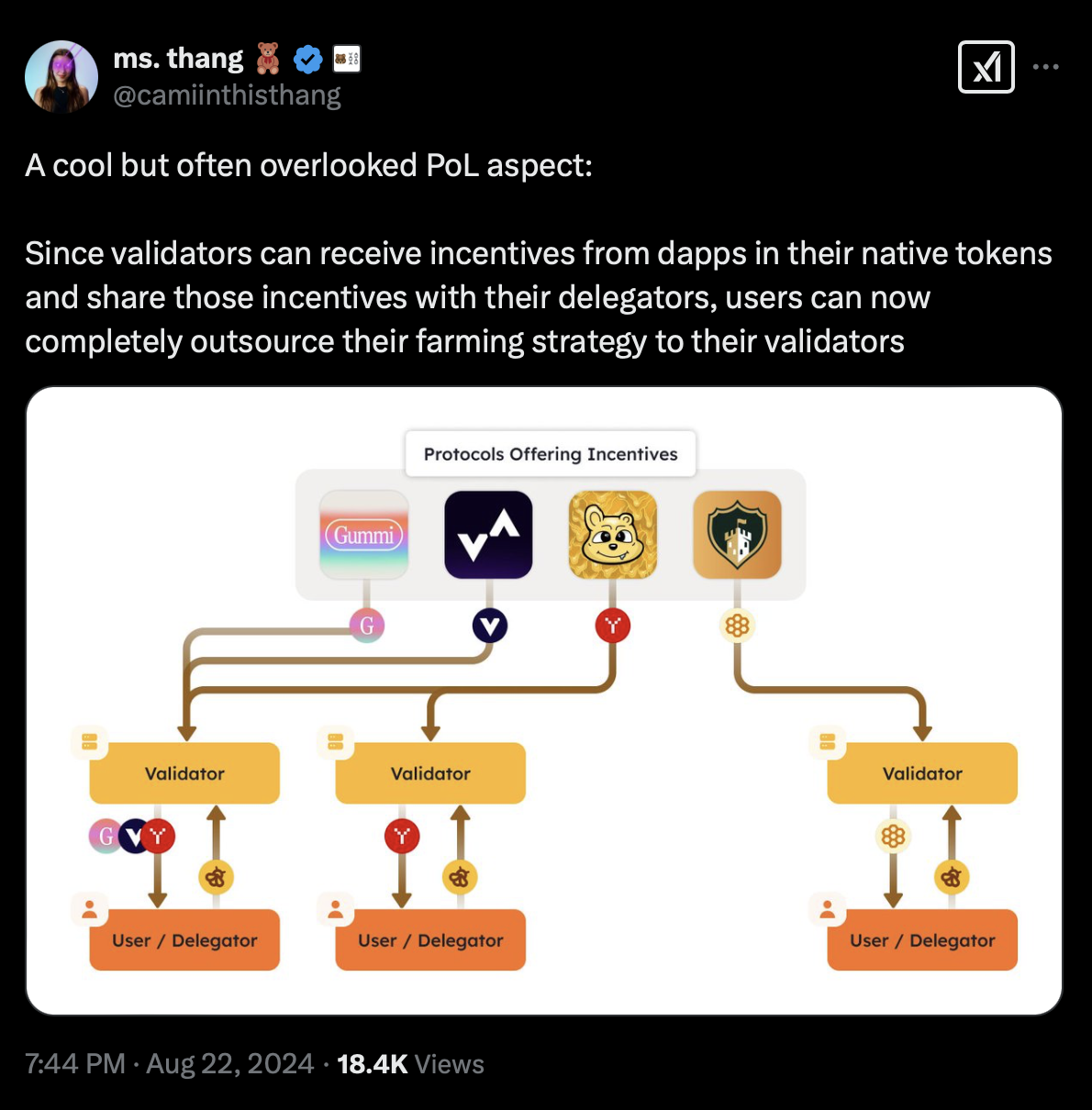

This reflects how traditional DeFi yield farming strategies work but integrates it directly at the consensus level. As Camila Ramos emphasized, Berachain's PoL effectively allows users to outsource their farming strategies to validators, providing a way for both skilled and novice users to optimize returns without active management.

Learn more about BeraBoost here.

Why Berachain Breaks the Boundaries of DeFi Infrastructure

Berachain's PoL brings a fundamental shift to blockchain economics. By combining security with capital efficiency, Berachain not only enhances validator incentives but also promotes deeper liquidity for the entire ecosystem. The introduction of BeraBoost further refines this model, allowing delegators to passively maximize returns while strengthening the network's decentralized security. With the mainnet launch, Berachain is poised to redefine on-chain liquidity dynamics, governance participation, and validator incentives—while maintaining seamless Ethereum compatibility. Builders, liquidity providers, and institutional participants now have a powerful new platform to engage with.

About Chorus One

Chorus One is one of the largest institutional staking providers globally, operating infrastructure for over 60 Proof of Stake (PoS) networks, including Ethereum, Cosmos, Solana, Avalanche, Near, and more. Since 2018, Chorus One has been at the forefront of the PoS industry, providing user-friendly enterprise-grade staking solutions, conducting industry-leading research, and investing in innovative protocols through Chorus One Ventures. As an ISO 27001 certified provider, Chorus One also offers slashing and double-signing insurance to its institutional clients.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。