Author: Revc, Golden Finance

I. The Twilight of Idealism: How VC Barnacles Hollow Out the Foundations of Decentralization

1.1 L2 Colonization: The Alienated Scaling Revolution

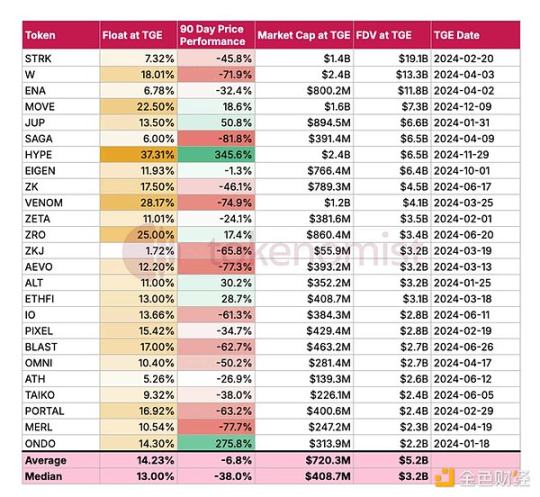

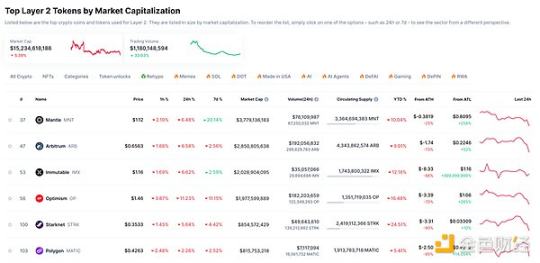

Data Erosion: The current circulating market value of L2 tokens is $15.2 billion, with an unlocked token scale reaching $30 billion. From a liquidity perspective, this equates to an invisible inflation pressure of 4% on the Ethereum ecosystem. Moreover, related tokens have averaged a nearly 50% decline from their peak, and the actual impact may be even greater, as these L2s generally have close to 60% of their tokens yet to be unlocked, meaning at least another $30 billion in funds will need to be absorbed by Ethereum ecosystem investors.

Power Transfer Trap: VC institutions account for 67% of the Optimism governance committee, and the early proposal rejection rate of ArbitrumDAO exceeds 80%, revealing the nominal existence of decentralized governance.

Liquidity Siphoning Effect: EigenLayer's re-staking protocol has locked up over $18 billion, but 90% of the generated revenue flows to institutional stakers.

1.2 The Prisoner's Dilemma of Re-staking

Distorted Economic Model: Protocols like Lido and EigenLayer have fixed ETH annual yields at 3-5%, forcing project teams to design inflationary token models to maintain incentives.

Death Spiral Empirical Evidence: A leading L2 token has seen a 300% increase in circulation over the past six months, while its price has dropped 72%, creating a vicious cycle of "issuance - devaluation - re-issuance."

Staking Oligopoly: The top 10 whale addresses control 43% of EigenLayer's voting power, while the top 10 Bitcoin addresses account for only 5% of its circulation.

II. Dissecting Capital Parasitism: From Technological Utopia to Financial Alchemy

2.1 The VC Colonial Trilogy

Cognitive Colonization: By directing developer funding programs to cultivate projects that align with capital narratives, a top VC has directed 83% of its investments over the past three years towards the infrastructure layer.

Governance Colonization: In DAO governance, "money politics" shows a correlation of 0.91 between the proposal approval rate and the amount held by the proposer in the Aave community.

Economic Colonization: Establishing a "protocol tax" system, a certain DEX protocol has an actual annual yield of 15%, of which 11% flows to liquidity providers associated with VCs.

2.2 Alienation of the Developer Class

Technological Feudalism: Among Ethereum core developers, 62% are full-time serving VC-funded projects.

Diminished Innovation: The number of new independent protocols in the Ethereum ecosystem in 2023 has decreased by 37% year-on-year, while the Solana ecosystem has grown by 209%.

Value Disconnection: Gitcoin donation data reveals that only 23% of Ethereum developers agree with the "application-first" development philosophy.

III. Ecological Darwinism: The Revelation of Solana's Counterattack

3.1 The Evolutionary Advantage of Business Genes

Demand-Driven Mutation: The average lifecycle of MEME coins in the Solana ecosystem is 3.2 times that of similar projects on Ethereum.

Innovative Organizational Model: Jupiter adopts a "developers as users" model, allocating 50% of tokens to community testing participants.

Regulatory Adaptability: By collaborating with traditional institutions like Visa to establish compliance channels, the proportion of illegal transactions is only 0.3%.

3.2 Cultural Gene Comparison

Developer Profile: Among Ethereum developers, those with backgrounds in economics or cryptography account for 68%, while product managers or game designers make up 55% of Solana developers.

User Behavior Differences: Solana users conduct an average of 17 transactions per day, while Ethereum users only 2.3 times.

Capital Efficiency Ratio: At the same market capitalization, the fee income generated by the Solana ecosystem is 4.7 times that of the Ethereum L2 system.

IV. The Rebirth Equation: From Technological Whales to Ecological Oceans

4.1 Surgical Plan

L2 Debridement Plan: Native Rollups or L1 are essentially processes of Ethereum reclaiming power. Since the industry still recognizes Ethereum as the largest decentralized platform, it cannot allow VCs to exploit its political correctness to continue building infrastructure legos indefinitely. It should attempt to establish a boundary supported by the developer community for Ethereum, and with a boundary, evolution can occur, as decentralization also requires an entity to implement will and ensure that commercial interests feed back into the ecosystem.

Support for Base and Hyperliquid: Base has effectively become the largest "feudal lord" in the Ethereum ecosystem, often compared to Solana in terms of AI innovation and capital inflow during bull markets. Although it has not yet "militarized" (i.e., issued tokens), this shift could happen at any time. However, in the process of Mass Adoption, Base is expected to attract more users and developers to Ethereum. Base indeed performs better than other L2s.

Staking System Reform: Introduce dynamic staking weights based on contribution, reducing the voting power coefficient of VC addresses to 1/10 of ordinary users.

Economic Firewall: Require L2s to use at least 30% of their revenue for ETH buybacks and burns, establishing a symbiotic economic model.

4.2 Genetic Modification Project

Developer Renaissance Plan: Establish an application layer innovation fund, with at least 50% of funds directed towards independent developers without VC backgrounds.

Governance Gene Modification: Use AI-driven governance oracles to automatically identify and filter governance proposals with VC characteristics.

Ecological Rewilding: Establish a "Dark Forest" arena on the testnet, allowing only fully decentralized protocols to participate in liquidity competition.

V. From Ideals to Reality: Rethinking the Meaning of Ethereum's Decentralization

Disruptors of Class Leap: Social class solidification and capital barriers hinder fair competition. Decentralization lowers entry barriers, allowing ordinary people to participate fairly in the market through DeFi and DAOs, breaking traditional wealth flow rules.

Counterweights to Capital Monopoly: Financial capital monopolizes market rules, while decentralization replaces intermediaries with smart contracts, increasing transparency, safeguarding individual asset control, and maintaining economic vitality.

Enders of Internet Oligopoly: Tech giants monopolize data, while decentralized technology empowers users with data sovereignty, and Web3 ensures the free flow of information, weakening corporate exploitation of data.

Accelerators of Innovation and Transparency: Centralized systems suppress innovation, while decentralization enhances transparency and open protocols incentivize innovation.

Conclusion: The Awakening Moment of Leviathan

As Ethereum's block time continues to flow forward, this crypto blue whale faces a critical choice in species evolution: to continue slowly sinking as the ideal host for VC barnacles or to undergo painful genetic mutations to be reborn?

Historical experience shows that truly revolutionary protocols must complete the leap from technical standards to ecological civilization. Perhaps, just as humpback whales in the ocean actively strike the hulls of ships to shake off barnacles, what Ethereum needs is not gradual reform but a complete leap in its economic model. This includes increasing constraints on L2s and strengthening boundaries to evolve in a manner more aligned with commercial laws.

When L2 parasitic tokens are abandoned by the market, we may witness Ethereum, which adheres to the principles of decentralization, rise again.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。