Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

Last week, Uniswap released the long-awaited V4 version. Perhaps due to the coinciding Chinese New Year holiday, the response to Uniswap V4 in the Chinese-speaking community has not been significant. However, objectively speaking, this upgrade, which Uniswap claims to be "the biggest upgrade in the project's history," is quite remarkable.

The core of Uniswap V4 lies in Hooks. Hooks can be understood as a type of smart plugin that allows any logic to be executed when the state of the liquidity pool changes (before and after trading or adding/removing liquidity), thereby allowing developers a high degree of freedom to customize trading functions. With the release of V4, Uniswap can no longer be viewed merely as a trading platform but can serve as a backend protocol to unlock more use cases, enabling different developers to utilize Hooks to build various types and features of applications based on different scenario needs.

In the following sections, we will review 10 projects that have begun using Hooks for development, giving us a glimpse into the magic of Hooks.

ƒlaunch

ƒlaunch is deployed on the Base network and is a Meme token issuance and trading platform based on Uniswap V4.

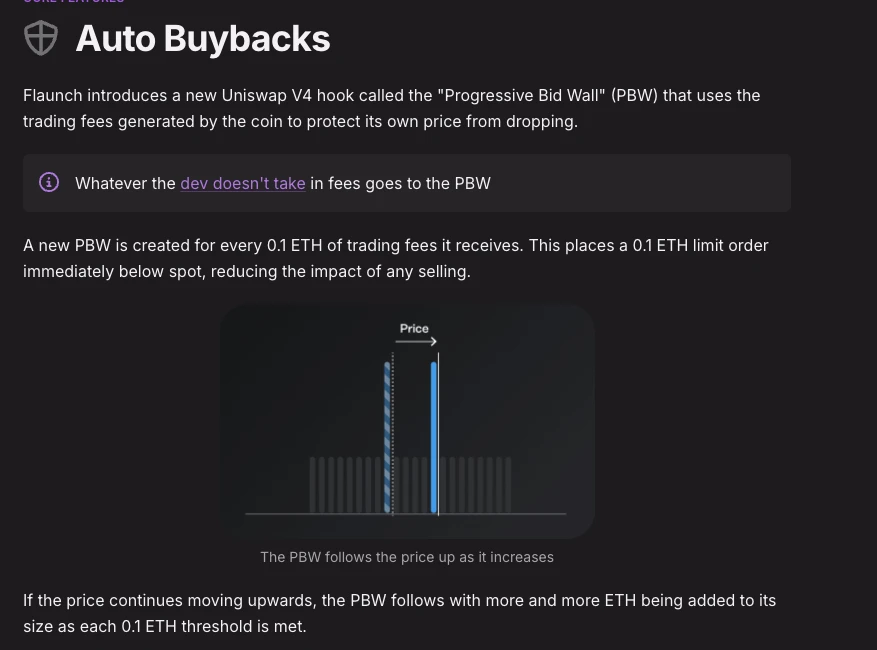

The feature of ƒlaunch lies in utilizing Hooks to provide customizable functions for token launches, such as custom fee settings, automatic buybacks, and fee sharing, among others.

The so-called "automatic buyback" means that all transaction fees generated from token trading activities on ƒlaunch will automatically be used for the buyback of the corresponding token. Specifically, every time the transaction fee accumulates to 0.1 ETH, the buyback function will be automatically triggered, adding these funds as limit buy orders through Hooks, thereby strengthening the price support of the token.

Bunni

Bunni is one of the first DEXs built on Uniswap V4, with Bunni V2 now live on the Ethereum mainnet, Base, and Arbitrum.

Bunni's feature is to provide programmable liquidity functions, helping LPs to build yield-maximizing, dynamic, and automated liquidity pools, maximizing LP profits under different market conditions.

LIKWID

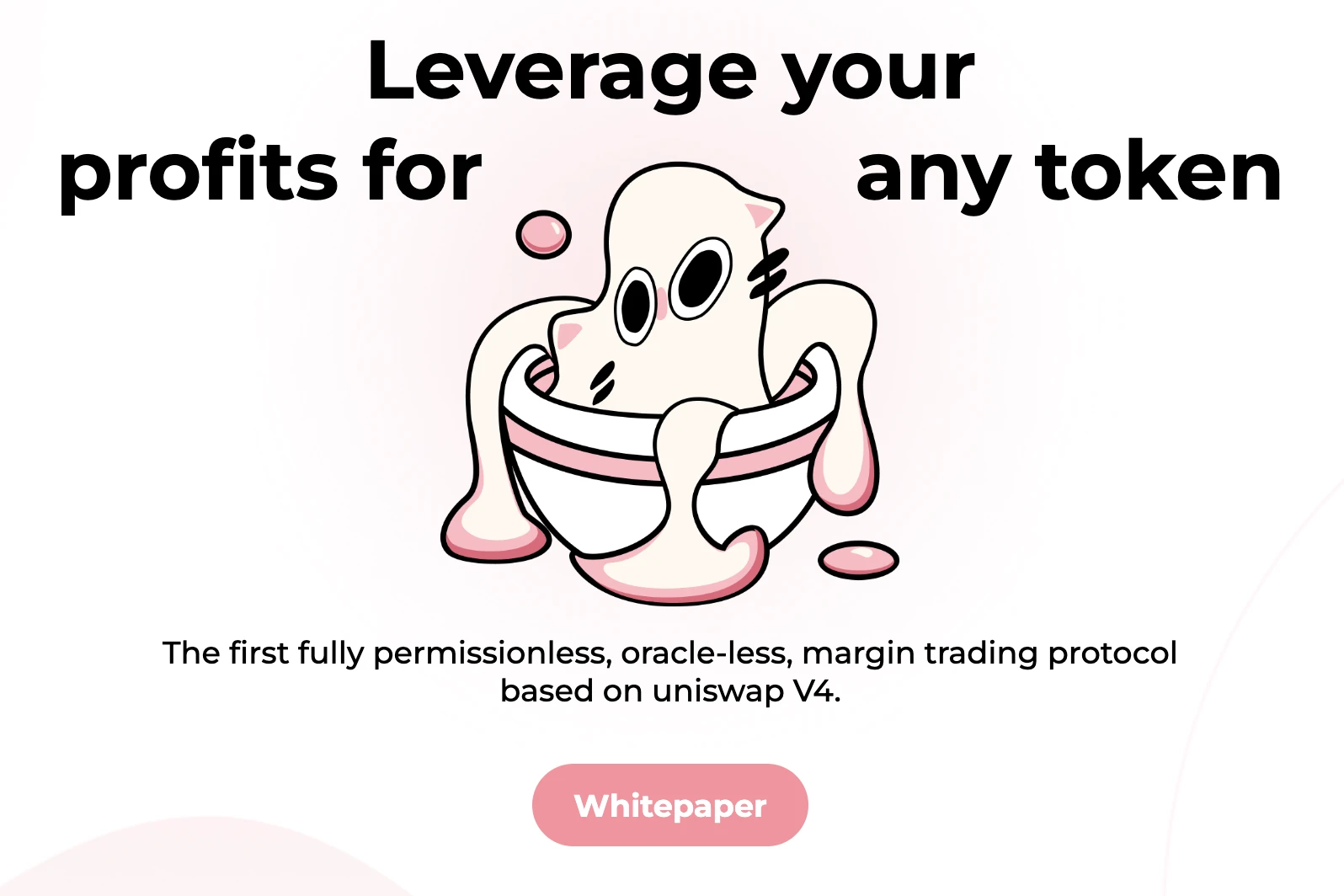

LIKWID is a leveraged trading platform powered by Uniswap V4.

LIKWID aims to completely change the classic AMM model from xy=k to (x+x')(y+y')=k, enabling permissionless and oracle-free leveraged trading of any token, supporting both long and short positions.

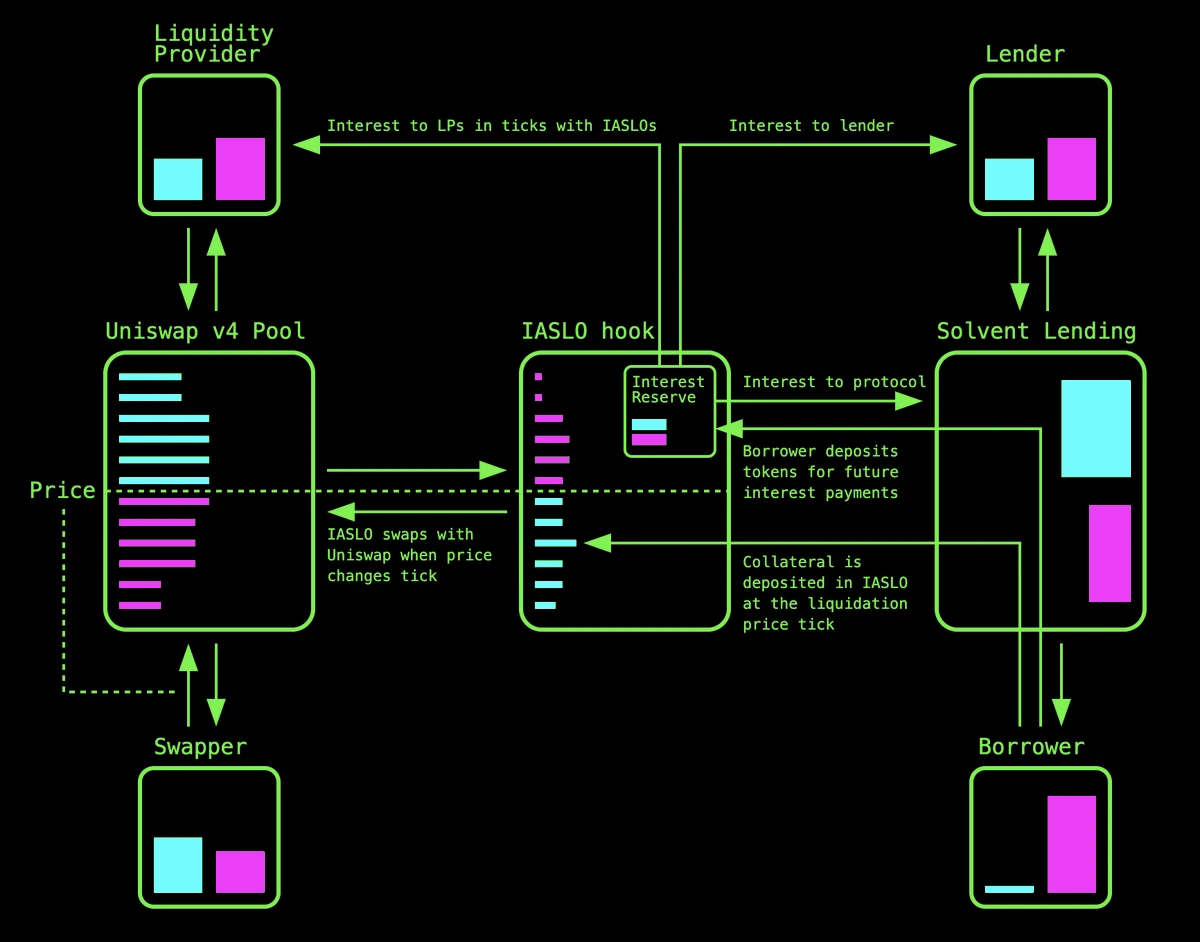

Solvent Network

Solvent Network is positioned as a lending protocol, with its main feature being the use of Uniswap V4's Hooks to ensure timely liquidation execution at any level of price fluctuation, thereby enhancing the robustness of the protocol.

Tenor Finance

Tenor Finance is positioned as a non-custodial fixed-rate lending protocol. With the help of Uniswap V4's Hooks, Tenor Finance allows users to borrow and lend ERC20 tokens at fixed rates using a fully on-chain interest rate AMM.

Cork Protocol

Cork Protocol is building an on-chain credit default swap (CDS) market using Uniswap V4's Hooks. The protocol aims to set custom fees and liquidity concentration based on the maturity of the swapped tokens.

According to official announcements, Cork Protocol is expected to launch on the mainnet soon.

Doppler

Doppler is a liquidity guidance protocol developed by Whetstone Research, designed to address issues related to Uniswap V4 integration by executing the entire liquidity guidance auction within Hooks contracts.

Semantic Layer

Semantic Layer focuses on building the next generation of MEV solutions for Uniswap V4. The project aims to utilize Hooks to create a new generation of DeFi applications that can reduce MEV risks.

A51 Finance

A51 Finance aims to build an intent-based liquidity automation engine on Uniswap V4, allowing users to perform various intent-based operations such as position transfers, automatic rebalancing, dynamic fee adjustments, and automatic withdrawals.

HookRank

HookRank is a platform that tracks and evaluates the security and maturity of various Hooks in Uniswap V4. It aims to provide reliable resources for developers and users to find safe and effective Hooks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。