You may have been misunderstanding the opportunities in DeFAI.

Written by: Squid

Translated by: Luffy, Foresight News

After the market experienced a significant downturn, let's examine where the real opportunities lie.

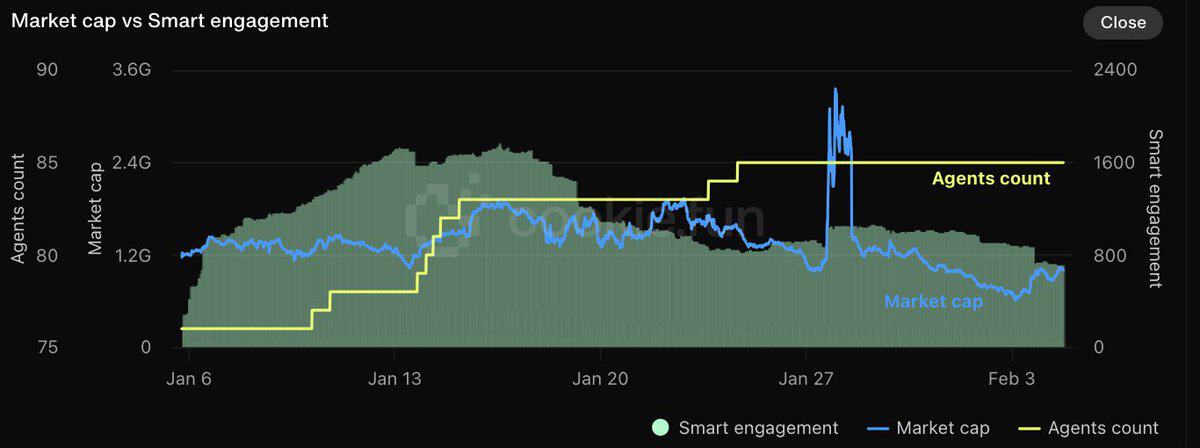

In the past two weeks, the market capitalization of DeFAI has dropped over 50% compared to mid-January, and it has fallen 70% from its peak in late January. Data sourced from @cookiedotfun.

Decentralized finance (DeFi) is now a $125 billion market, and if DeFAI captures 10% of that, it means there is still a 15-fold growth opportunity. In fact, I believe the opportunities within the DeFAI market are even greater, as the current pricing across various segments is not rational.

Recently, we witnessed an epic liquidation in the cryptocurrency space. During this period, assets were sold off indiscriminately. Artificial intelligence (AI) and DeFAI were among the hardest-hit areas.

Now is the time to seek treasures; let's delve deeper.

Why is DeFAI so popular? First, let's look at the combination of cryptocurrency and artificial intelligence from a broader perspective. The intersection of cryptocurrency and AI is a $10 billion market that urgently needs to find "practicality," and DeFAI seems to be the area most likely to discover it.

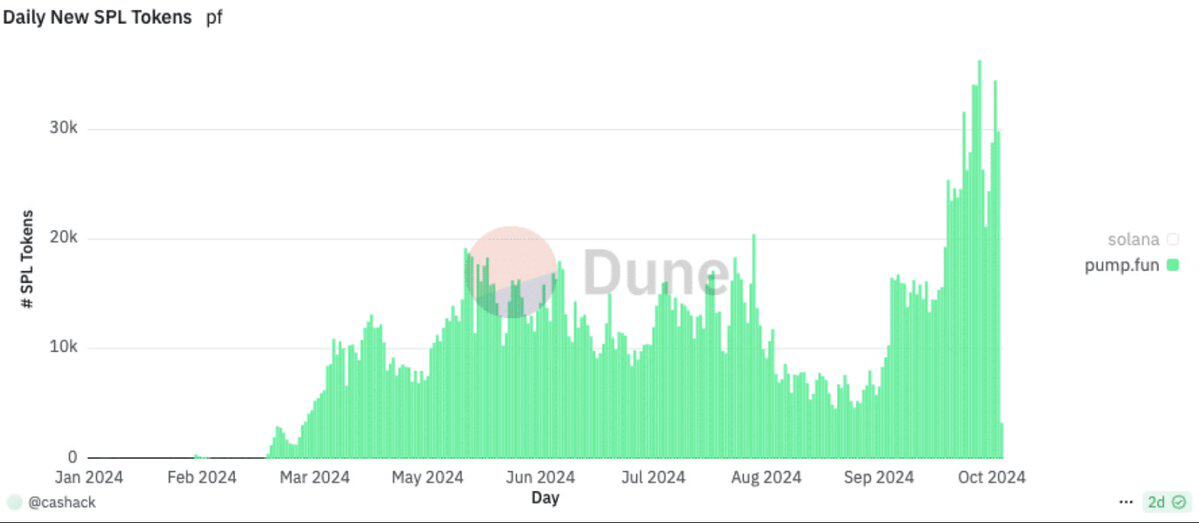

For most of these crypto agents, the product is their token. Because of this, we see that the areas with the highest product-market fit (PMF) are those that allow teams to easily launch tokenized social agents through frameworks and Launchpads. As the supply of tokens grows exponentially, this market is becoming saturated, and the demand for social agent tokens and Launchpads will decrease, forcing the community to strive for new development directions.

Moving in the direction of the puck (going with the flow)

From a macro perspective, DeFAI is meaningful; this field represents one of the strongest application scenarios of cryptocurrency—DeFi—and one of the most unmet needs—finance.

That said, just because this field makes sense on a macro level does not mean every project will succeed. Let's explore further to see where the opportunities might lie.

Looking at the recent DeFAI market landscape, most launched projects have limited utility in DeFi. I believe this is due to the novelty of the field and the time required to build projects.

People want to acquire tokens, and currently, most launched projects are targeting the easiest but least practical goals.

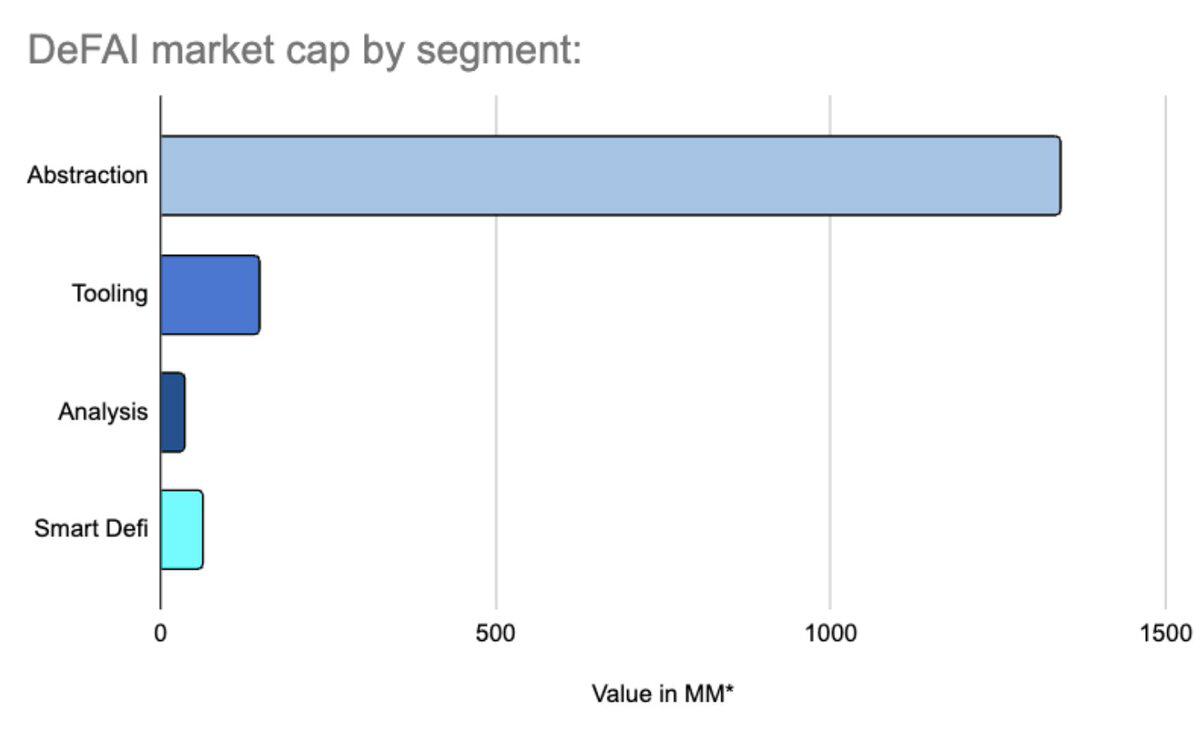

Valuation landscape, a snapshot of projects obtained from @cookiedotfun earlier this month, showing significantly lower valuations now.

Most of the market value in DeFAI is concentrated in the "abstraction" category. Abstraction is mostly based on text-based alternative user experiences (UX). This category represents "low-hanging fruit" because it leverages existing DeFi projects and large language models (LLM) APIs, which are logically limited and primarily based on intent. Given the current number of projects and valuations in this field, it is likely that winners have already emerged, and I believe opportunities here are limited compared to other categories.

I also encourage investors to try out these products. For my part, I find that most projects in the abstraction space do not provide a good user experience.

Interestingly, this market structure creates some opportunities for traders…

Recently, DeFAI valuations have plummeted, and the naysayers seem to have been proven right… Product development takes time, and considering the stage of the projects, I believe this valuation decline is mostly reasonable. That said, as prices fall, people will feel bored, and I believe there may be opportunities for those who pay attention to the market in the future.

So, where exactly are the opportunities?

First, I believe most opportunities lie in tokens that have not yet been launched. That said, these subfields already exist, and some projects are already online; to seize the opportunities, you must keep an eye on the market and be prepared. To help identify directions to focus on, let's review a framework for thinking about the DeFAI market.

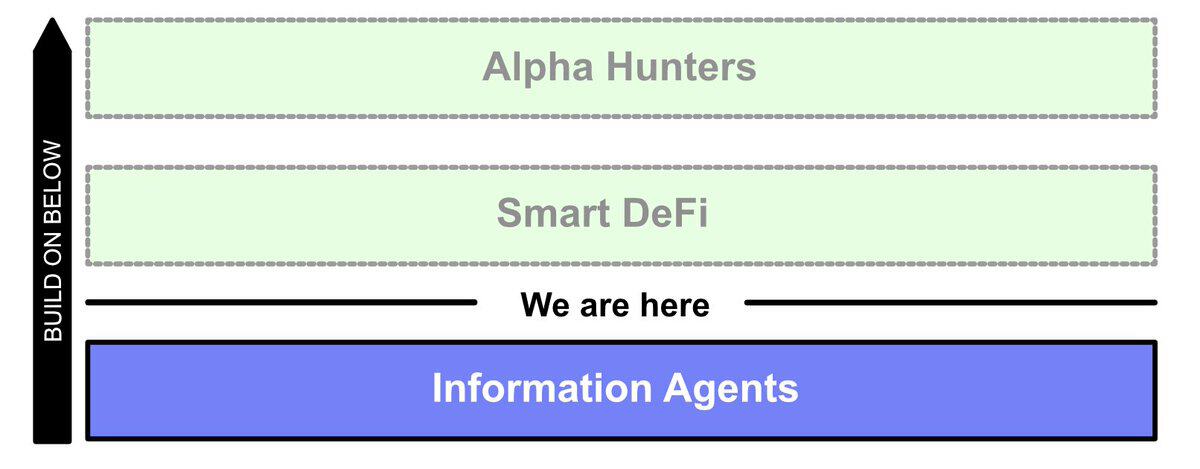

Information Agents

This is the era of AI agents mining information and fulfilling simple intents.

Large language models excel at processing text and communicating in text. Since the vast majority of AI agents at this stage utilize existing models' APIs, their strongest application scenarios are in natural language processing (NLP). I won't delve into this here, as there are many other resources covering this topic, but here are two high-level areas:

Alternative User Interfaces / Abstraction: These are chat-based user interfaces that aggregate and abstract DeFi protocols and even blockchains. They can provide macro information, find projects, and execute simple actions. For example, "I want to buy SOL -> Buy SOL through Jup." Ultimately, these tools will use existing DeFi primitives / aggregators and cross-chain bridges to execute actions. I suspect that "winners" may have already emerged, and we are likely to see the market consolidate into a few platforms. Growth will be reflected in improved AI and integration capabilities, as well as an expanded user base, which remains an unproven market. For my part, I am uncertain whether text-based interfaces can truly enhance the DeFi user experience.

Analytical Tools: These are auxiliary tools that help traders mine and process information. This is a diverse category, with some examples including code reviews, token analysis, and social sentiment analysis. Analytical tools will continue to evolve to become more complex and play an important role in the ever-evolving cryptocurrency / AI ecosystem. AI-driven analytical tools compete in the same market as traditional analytical tools. Overall, there is still significant room for growth in cryptocurrency analysis. I believe that segmented analytical tools will be able to capture more value than general analytical tools.

Notable projects to watch:

Abstraction: griffain, neur, The Hive, Venice, etc.

Analysis: Cookie DAO, Kaito AI, Hiero Terminal, etc.

Smart DeFi

Shifting from information to action, capable of mining information and taking action based on that information.

Currently, this is a $200 million market, and I believe it will ultimately occupy a large portion of the DeFAI market. Assuming the market size is $12 billion, if "Smart DeFi" captures 50%, then this subfield still has a 30-fold opportunity. Similarly, I believe winners have not yet emerged…

Where is the practicality (value)? Initially, practicality will come from continuous monitoring and automation, allowing users to take advantage of small inefficiencies in the market that they might otherwise overlook or deem too small to warrant their time. This market already exists. As the field develops, large language models will enable DeFAI protocols not only to automate but also to adapt and expand market scope to further enhance returns. Over time, the degree of return enhancement will align with the development of intelligence, reasoning capabilities, and infrastructure.

Teams that succeed in this field will have to build or utilize custom models, DeFi infrastructure, and data pipelines. This deeper integration requirement is why this field is underdeveloped compared to the abstraction area. Building these things takes time.

Smart DeFi is not a new market, but AI can enhance and expand it. Examples of existing products include yield optimization projects Lulo, Carrott, and aggregators Ranger and Jupiter.

Existing fields are those where deterministic models perform well. For example, "The cheapest rate between X protocols is Y, so use Z." Ultimately, operations based on large language models may help enhance these protocols by providing alternative user experiences or enriched information, but existing projects are unlikely to be disrupted.

How will Smart DeFi expand in this market?

Large language models are probabilistic. In fixed markets, this can lead to poor performance; for example, if you are comparing trading prices, the cheapest is always the best.

The probabilistic nature and the ability to handle various types of information indeed provide an advantage, allowing DeFi to expand into new, more dynamic markets.

Every day, over 50,000 new tokens are born. I know this data is a bit outdated, but this trend continues…

In the long tail of the market, trading volume and value constantly shift among new assets. Due to volatility, existing DeFi primitives struggle to serve this category. As we continue to "tokenize the world," this market will keep expanding.

Moreover, tokens are not equity; tokens can be constructed/represent value in various ways. The high diversity of assets in the market is another favorable factor for intelligent systems.

Smart DeFi can help DeFi expand into this market for the following reasons:

Ability to mine/evaluate new assets

Dynamic monitoring, understanding, and acting on new market narratives

They can integrate social, on-chain, and off-chain data and apply reasoning to take multiple actions.

From a macro perspective, there are synergies, but where are the opportunities?

Let's look at a promising subfield, Smart Liquidity Provisioning (Smart LPing).

Liquidity provision is challenging because each liquidity pool has different risk profiles, and yields fluctuate significantly across different assets. Currently, there are some tools based on user investment philosophies that can help allocate assets, but the degree of composability/automation is limited.

The vision for liquidity provision agents is to dynamically optimize liquidity provision yields by adjusting risk parameters and selecting assets/pools based on a combination of on-chain and social data. This could ultimately create a new asset that can dynamically harvest yields from the long tail market, thereby improving overall market efficiency.

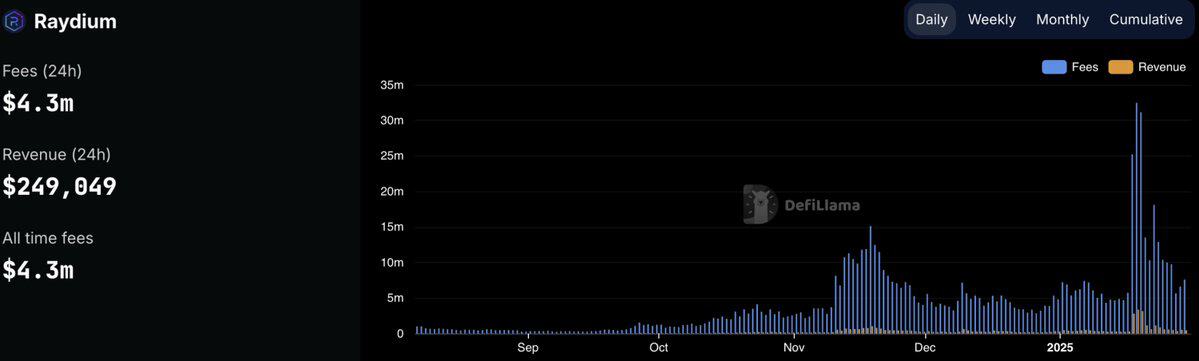

Raydium's fees, which can serve as an indicator of on-chain trading volume.

Why choose a native AI team?

Yes, realizing this vision takes time. That said, I believe native AI teams are more competitive in areas with lower market efficiency/absolute returns, as more of the returns can be attributed to intelligence. Native AI teams tend to be smaller, allowing them to act faster and focus more on the "intelligent" factor.

Some teams I want to mention include: Cleopetra, Alris agent, and Voltr.

Other areas I won't delve into include smart dollar-cost averaging, trade execution, and products based on social signals. As intelligence improves, the proportion of returns attributed to humans will begin to be eroded by AI tools.

Project Plutus has already shown interesting early results in smart limit orders, and I look forward to testing it personally.

Next, Alpha Hunters

Let's see if an agent can generate Alpha returns.

Here are some common responses from more industry professionals. While I agree that we are far from this goal, I think it is ignorant to completely dismiss Alpha agents. Believe in something…

Generating Alpha returns is difficult.

In traditional markets, hedge funds spend billions of dollars each year collaborating with the smartest people in the world to create an edge. However, systemic frictions mean that the cryptocurrency market is far less efficient than traditional markets, which makes it more feasible for agents to generate Alpha returns. New asset classes/narratives emerge weekly, meaning that cryptocurrency cannot directly apply the same strategies as traditional finance.

Why give up on Alpha?

I firmly believe that "Alpha hunters" will not be innovations from 0 to 1, but will emerge gradually. In the foreseeable future, Alpha returns will still be driven by humans, assisted by AI. Over time, returns will gradually be attributed to agents. Once a certain critical point is reached, we may see the emergence of true "Alpha hunting agents" that will employ humans or collaborate with them.

Tokens will help launch, coordinate, and integrate the emerging ecosystem.

Currently, two protocols adopting interesting approaches are:

Almanak: Almanak integrates boutique data pipelines, advanced risk engines, and AI-driven agents to generate and execute various financial strategies under human supervision. It is an agent/strategy platform that continuously identifies Alpha returns and serves users in a secure non-custodial environment.

Allora: Allora's reasoning system intelligently aggregates and weights AI predictions based on real-time accuracy. Human participants act as workers, providing predictions and assessing the quality of reasoning to refine the system's market forecasts. The goal is to apply these predictions to the market.

Crypto-native teams dedicated to model development will also play a key role. Ultimately, intelligence is key.

Other protocols I like include: Pond (focused on developing crypto-native models using on-chain data) and Nous Research (they have done a lot of work to help develop the first decentralized training optimal model, and they also mentioned exploring the "demand" for agents).

This field is still in its early stages, so keep an eye on those teams with the potential to grow.

As the marginal cost of intelligence continues to decline and the number of new markets created daily increases, agents are ready to embrace an emerging market segment that is fleeting for humans but too dynamic for robots. Believe in something.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。