In the past three months, 116 tokens were listed, with 68 of them "nearly zero," and one-third "peaked upon listing."

Written by: ChandlerZ, Foresight News

Since its launch, Moonshot has quickly emerged in the market with its focus on the Meme coin ecosystem, even being referred to by some industry insiders as the "Binance of the Meme world." In the current context of relatively low overall trading sentiment, the price changes, market capitalization trends, and development status of various projects reflected in the listing data on the Moonshot platform provide important insights for us to understand the Meme ecosystem more deeply.

In short, Moonshot is a Meme trading platform built on the Solana blockchain, which lowers the entry barrier for ordinary users into the crypto market through a simplified registration and trading process. The platform supports various fiat deposit methods, including Apple Pay, credit cards, and PayPal, and has achieved quick and convenient asset withdrawals. During the Meme coin craze in the second half of 2024, Moonshot successfully attracted some users by quickly selecting and listing popular tokens.

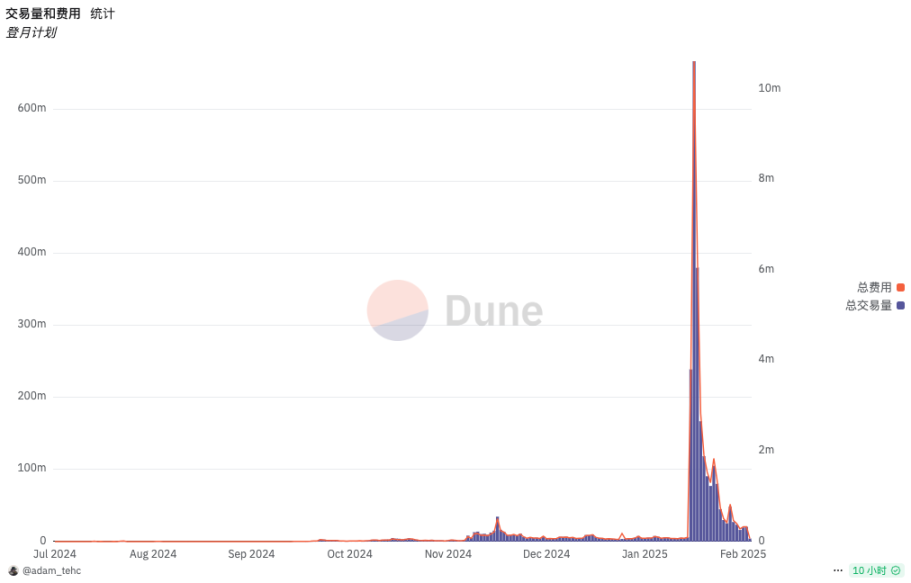

Dune data shows that in 2024, the trading volume and transaction fees on Moonshot exhibited a stable development trend, with daily trading volume around ten million dollars and an average of 3,500 to 4,900 daily unique traders. This change in status stemmed from U.S. President Trump launching his personal Meme coin TRUMP on January 18, 2025, after which Moonshot listed TRUMP, and Trump's official Twitter account promoted the TRUMP token, igniting a surge in interest.

According to official data, within 12 hours, Moonshot was recommended as a purchasing method on the TRUMP token's official website, processing nearly $400 million in transaction volume, breaking the record for fiat currency entry, and attracting over 200,000 new users.

As TRUMP and the overall market cooled down, Meme coins also experienced widespread corrections and price fluctuations. What is the wealth creation effect of Moonshot? We attempt to explore the real performance of the tokens listed on Moonshot over the past three months through in-depth analysis, discussing its situation as an emerging trading platform and the market conditions behind this effect.

116 Tokens Listed in March, 68 "Nearly Zero," One-Third "Peaked Upon Listing"

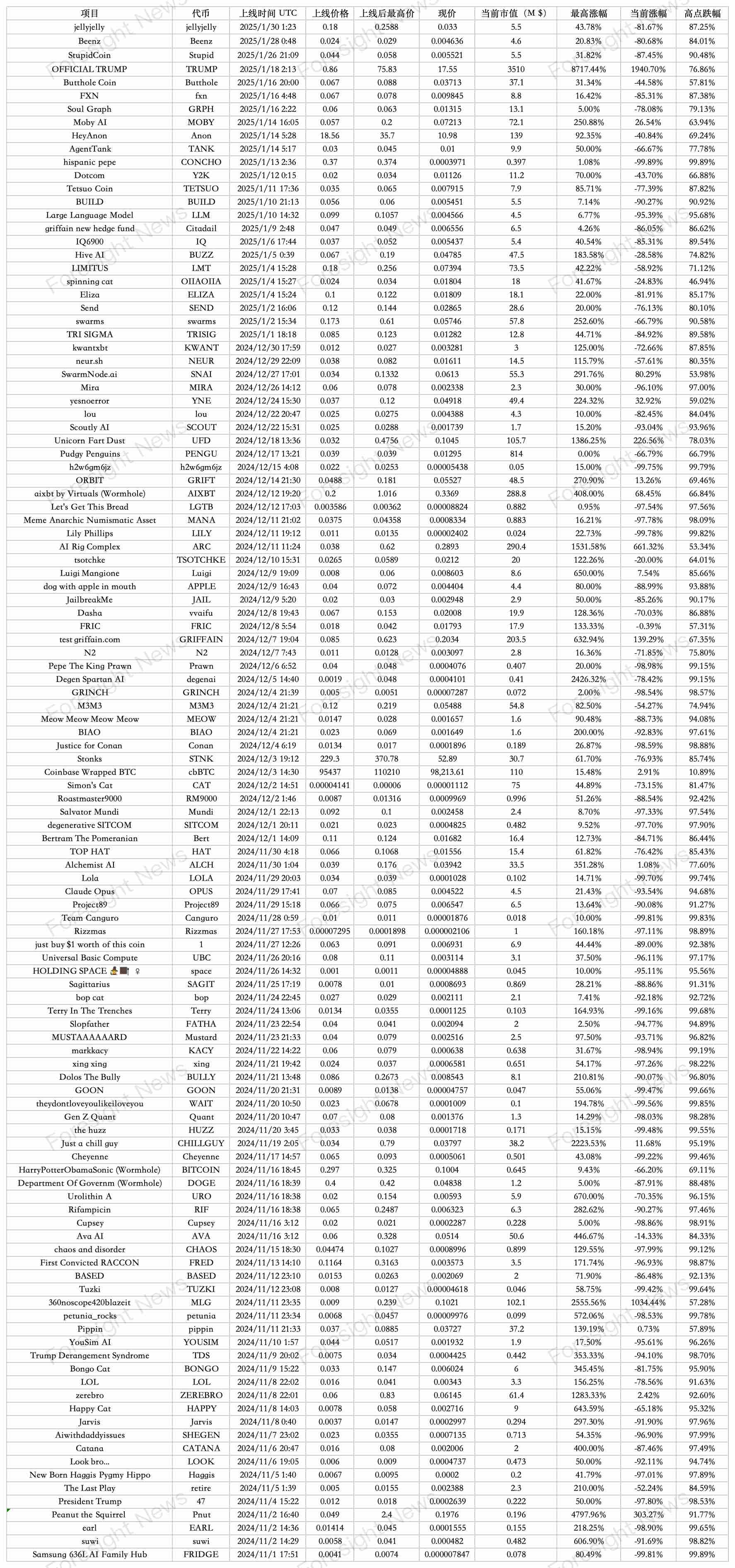

In this article, we selected tokens listed on the Moonshot platform from November 2024 to January 2025 as our research sample, with data sourced from the listing time records provided by the "Moonshot Listings" account.

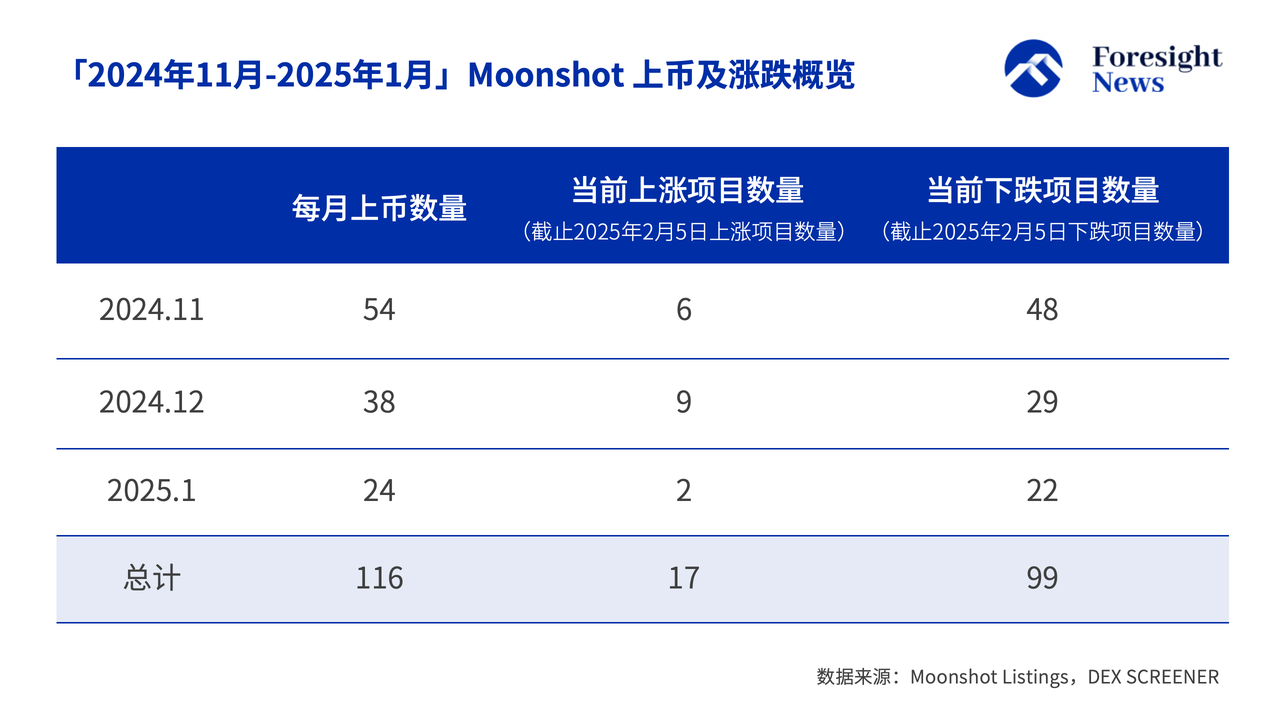

The overall data is shown in the figure below:

The "Moonshot Listings" records show that during these three months, Moonshot listed a total of 116 tokens, with 54 listed in November 2024, 38 in December, and 24 in January 2025.

Further analysis shows that in the current market environment, only 17 of the 116 listed tokens have a current price higher than their listing price, accounting for less than 15%, with the vast majority of projects currently in a downward trend, and over 85% of projects experiencing declines.

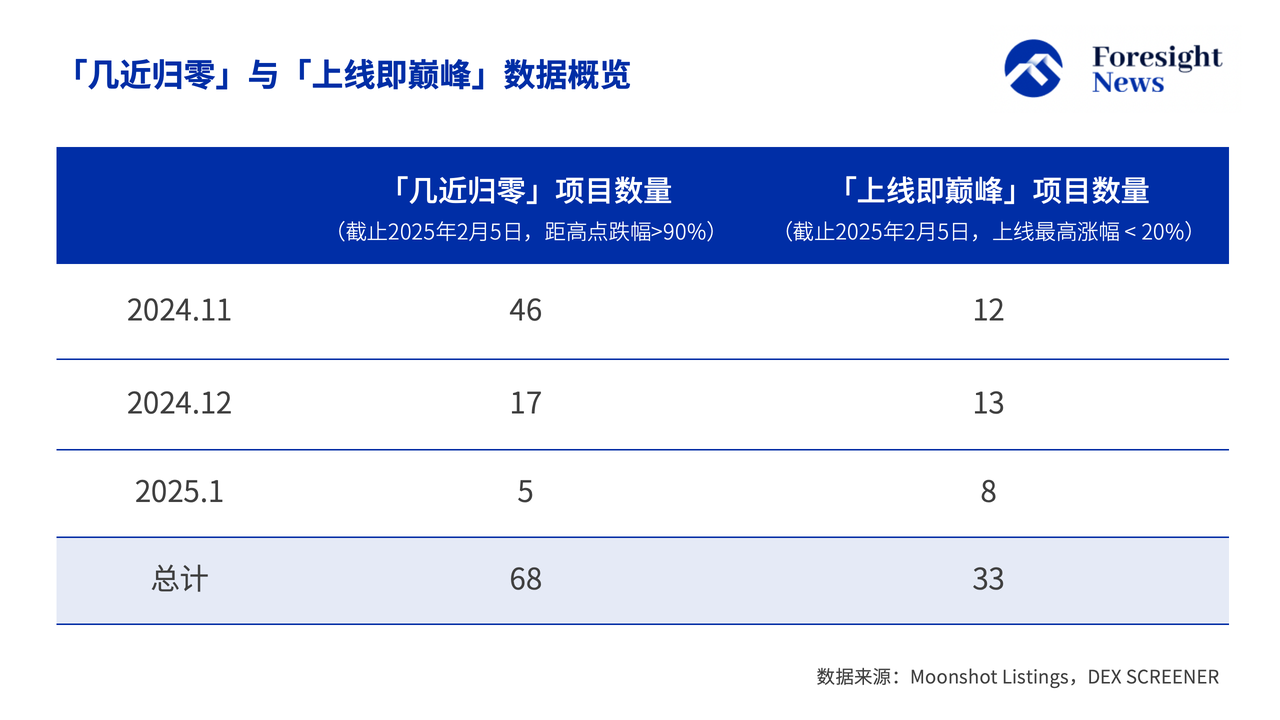

Due to the characteristic of most Meme coins going to zero, we also attempted to objectively calculate this data. If we define projects that have dropped more than 90% from their peak price after listing as "nearly zero" projects, the statistical data shows that among the 116 tokens we analyzed, 46 projects in November met this standard, 17 in December, and 5 in January 2025, totaling 68 projects, accounting for over 58.6%. This number intuitively reflects that most tokens quickly lost market support after the initial frenzy.

At the same time, we also found that according to the standard of a maximum increase of less than 20% after listing, the projects classified as "peaked upon listing" were 12, 13, and 8 in the three statistical periods, totaling 33 projects, meaning nearly one-third of the projects were already close to their historical highs when they first appeared on Moonshot, and then quickly lost their potential for growth due to a lack of sustained fundamental support or weakened market confidence.

40% of Tokens Doubled After Listing, TRUMP Dominates

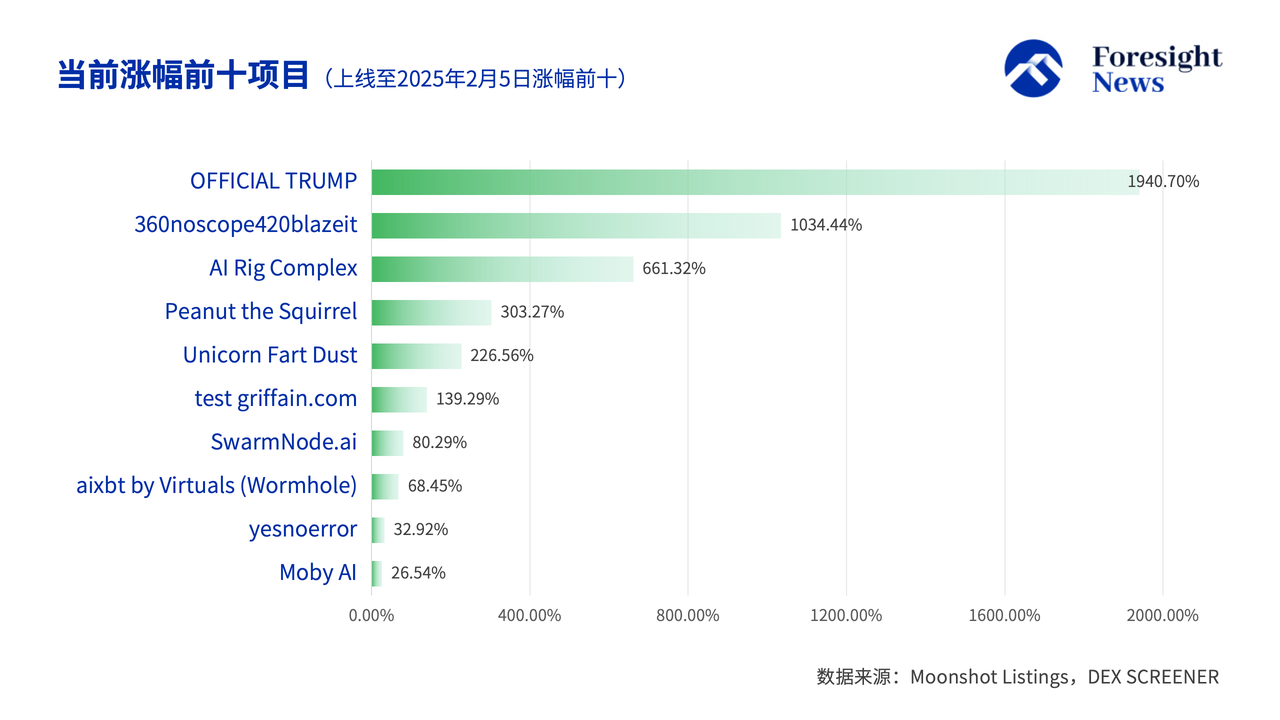

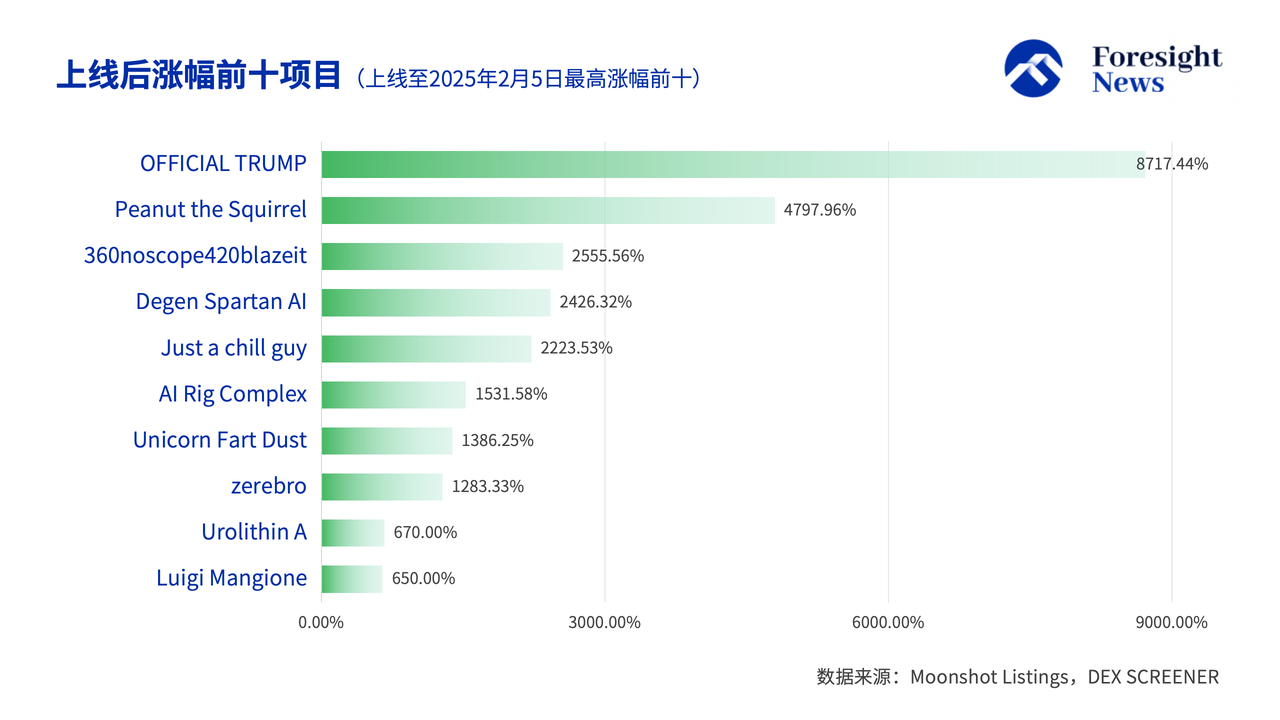

About 40% of the tokens achieved at least a doubling of their price after listing, indicating that the market initially showed high enthusiasm and support for some projects. From the data, the current increase and the increase after listing of the top ten projects show a certain degree of overlap, with some tokens leading in both historical peaks and current performance. Due to special political factors, TRUMP undoubtedly holds an absolute dominant position.

PNUT and 360noscope420blazeit (MLG) achieved increases of 4797.96% and 2555.56%, respectively, while degenai, CHILLGUY, and several other projects also surpassed the 20-fold increase threshold. These data indicate that under extreme market sentiment and short-term speculation, some tokens once gained extraordinary market attention and speculative funding support, forming strong peaks in their increases.

However, compared to their historical peaks after listing, the current price increase of the top ten projects appears relatively moderate. Currently, TRUMP's increase is 1940.70%, far below its previous high; similarly, MLG and AI Rig Complex (ARC) are at 1034.44% and 661.32%, both significantly down, while the current tenth-ranked increase, Moby AI, is only 26.54%. This disparity reflects that although some projects once experienced explosive growth, as market sentiment became more rational and profit-taking became common, the increases of the vast majority of projects have significantly narrowed.

These two sets of data complement each other, together painting a picture: in the short term, some projects once welcomed explosive increases due to market speculation, but as market heat cooled and profit-taking effects emerged, very few projects could sustain growth. This also reveals the characteristics of strong speculative sentiment and severe price volatility in the current Meme coin market, while also exposing the severe situation faced by the vast majority of projects after experiencing initial frenzy, which is the return to value and risk reassessment.

"High Point Halved" Actually Indicates Resilience

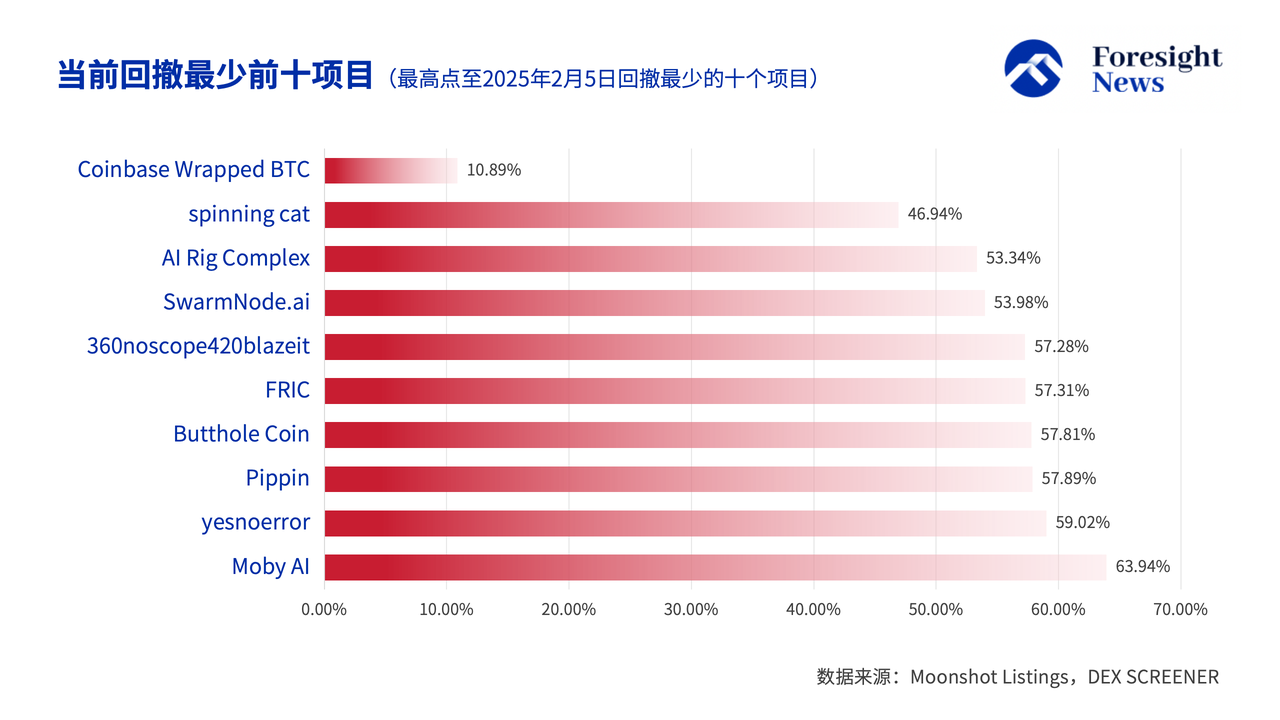

From the data on high point retracements, excluding the special project Coinbase Wrapped BTC, those projects that retraced around 50% are actually considered to have dropped relatively little.

Taking spinning cat (OIIAOIIA) as an example, its retracement is about 46.94%, which can be seen as relatively mild in high point corrections, while subsequent projects like ARC, SNAI, MLG, FRIC, Butthole, and Pippin have retracement levels close to or exceeding 50%. This indicates that in the entire sample, only a few projects with retracements around 50% can still be considered to have dropped relatively "little," while the majority of projects have experienced much more severe price corrections.

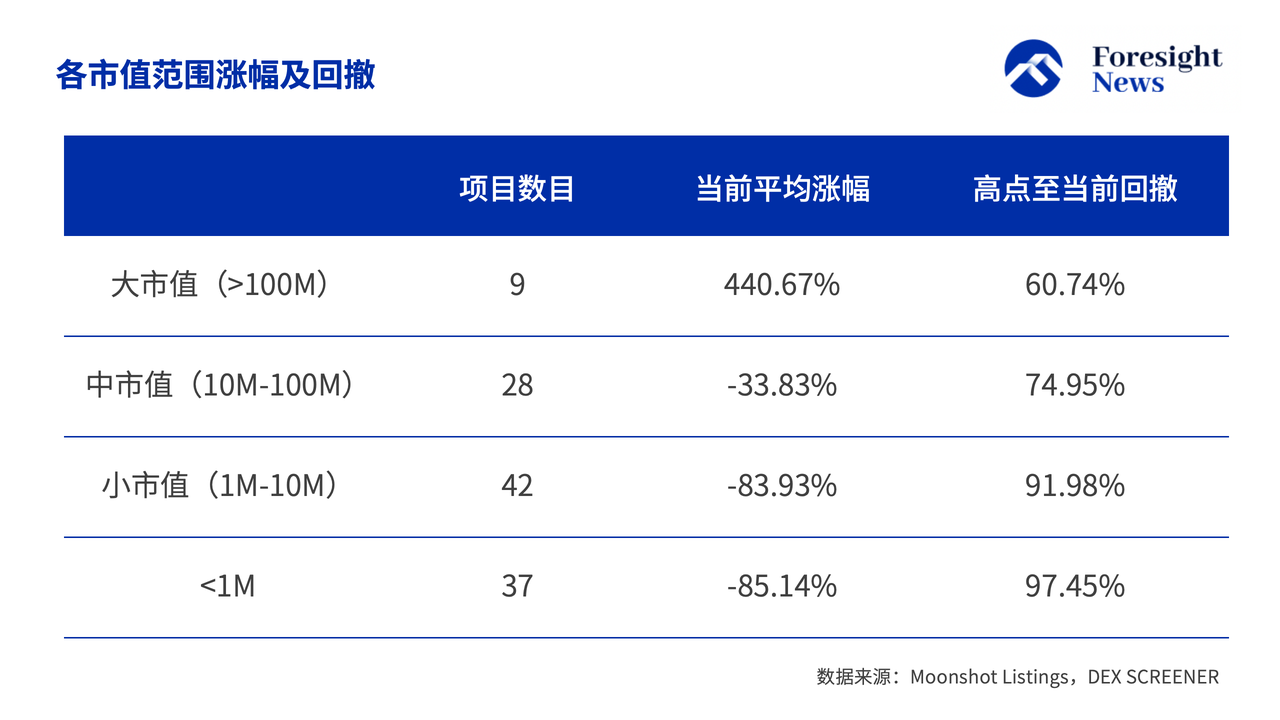

If we conduct a tiered statistical analysis based on market capitalization, there are currently only 9 projects in the large market cap group of Meme coins, with an average current increase of 440.67% and an average peak retracement of 60.74%. In contrast, the mid-cap (28 projects), small-cap (42 projects), and projects with a market cap below 1M (37 projects) present a starkly different situation. Low market cap projects are significantly affected by speculative sentiment and market volatility, with most already in a "zero" state.

In summary, we can see that the wealth creation effect exhibited by this platform in the Meme field is both dramatic and exposes its inherent high-risk characteristics. As an emerging trading platform primarily focused on Meme coins, Moonshot's listing effect has indeed generated astonishing returns for certain projects (such as TRUMP) in the short term under extreme market conditions, attracting a surge of speculative funds. However, from the overall data perspective, among the 116 listed projects, over 85% have experienced significant declines, and low market cap and sub-1M market cap tokens are generally facing an almost zero fate, indicating that the listing effect has not been able to form widespread and lasting value support in the current market environment.

Meme coins, as assets driven mainly by entertainment and topicality, exhibit extreme and rapid price fluctuations; trends emerge quickly but dissipate just as fast, with the speed of going to zero being astonishing. This extreme volatility and fragility are core characteristics of the Meme asset market, where market sentiment can be pushed to a peak by temporary speculation, but once the hype fades, funds quickly flow back, and the speed of price corrections or even going to zero far exceeds expectations.

It can only be said that while the listing effect of the Moonshot platform has brought substantial returns to "some" investors, it has also sounded an alarm for market participants. In this market characterized by short-term gains, speculative enthusiasm is often fleeting, and risk management and rational investment are the only pathways to navigate this high-risk domain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。