Author: CoinGecko

How many publicly traded blockchain companies are there?

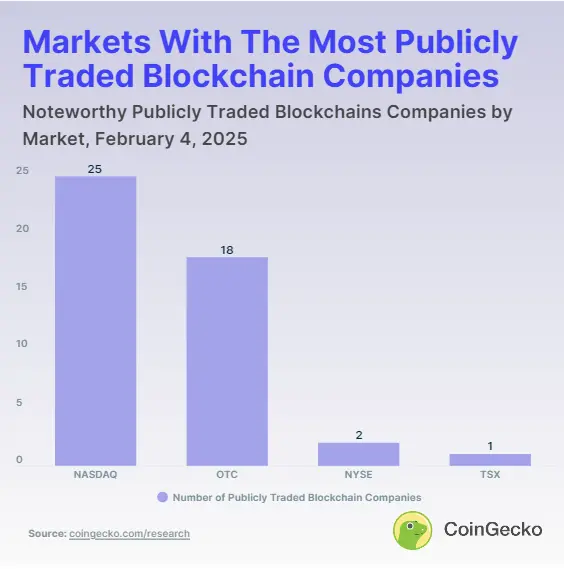

There are a total of 46 publicly traded blockchain companies worth noting. Unsurprisingly, most blockchain companies are listed on the Nasdaq, with 24 in total. The largest to date is the cryptocurrency exchange Coinbase (COIN), with a market capitalization of $74 billion. Bitcoin mining company Mara Holdings (MARA) follows closely behind, but with a market cap nearly 10 times lower at $7 billion.

The Nasdaq Stock Exchange is the most concentrated exchange for tech companies. Among the 100 highest market capitalization companies in the Nasdaq 100 (NDX) index, excluding financial companies, 59.6% come from the IT sector.

The smallest publicly listed blockchain company is the metaverse-focused blockchain industrial company (BCII), but it is only available for over-the-counter (OTC) trading. In the decentralized OTC market, there are 18 blockchain companies available for trading.

On the New York Stock Exchange (NYSE), only two listed companies are involved in the cryptocurrency space: Bit Mining (BTCM) and Hyperscale Data (GPUS). The latter is an example of a trend, having rebranded from Ault Alliance (AULT), which focused on cryptocurrency mining, to GPUS, becoming a provider of AI data center infrastructure.

The 46 publicly traded blockchain companies, including Galaxy Digital (GLXY) led by Michael Novogratz, are only listed on the Toronto Stock Exchange (TSX).

Notably, there are 47 blockchain companies listed on major Canadian exchanges, from TSX and TSX Venture to CSE and Cboe. However, the largest companies are also listed on Nasdaq, while most others have market capitalizations below $10 million or are ETFs. Therefore, Galaxy Digital, listed on TSX, is the only notable exception among non-low-priced stocks.

Which industry do most blockchain companies belong to?

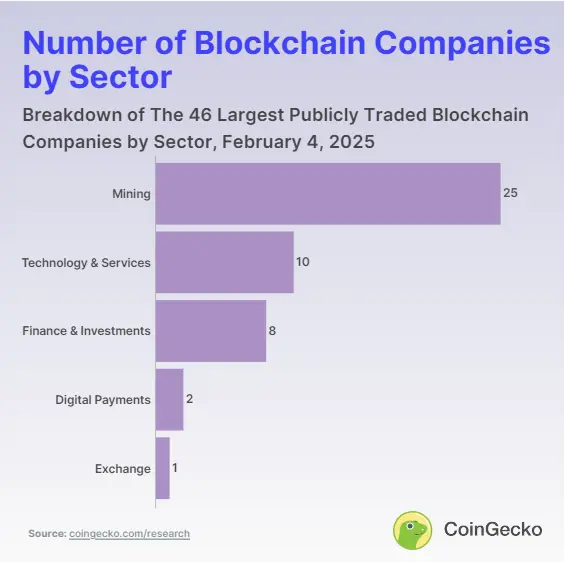

As expected, among the 46 largest publicly listed blockchain companies, most focus on cryptocurrency mining, accounting for 25 companies. Although some companies have expanded their business scope from mining to AI and Web 3 solutions, such as Bluesky Digital Assets, they can generally be categorized into five industries.

After Bitcoin's fourth halving, the Bitcoin mining reward decreased from 6.25 BTC to 3.125 BTC, significantly accelerating the trend of diversification. Leveraging existing server expansion and infrastructure maintenance expertise, Bitcoin mining companies are venturing into high-performance computing (HPC) and AI data centers.

The most notable examples of this trend include the previously bankrupt Core Scientific (CORZ), Hut 8 Mining (HUT), TeraWulf (WULF), HIVE Digital Technologies (HIVE), and CleanSpark (CLSK). However, in terms of the total market capitalization of publicly listed companies in the cryptocurrency space, a few companies dominate.

Market capitalization of blockchain companies vs. total cryptocurrency market

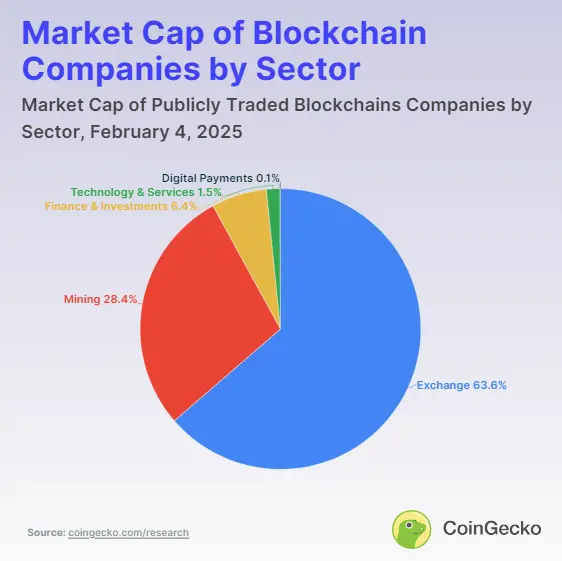

Among the 46 publicly listed blockchain companies, Coinbase (COIN) is the only representative of the exchange industry, as mentioned earlier, with a market capitalization of 2.2%. However, Coinbase's market cap of $71.2 billion dwarfs all other companies, with only MicroStrategy (MSTR) having a larger market cap at $97.7 billion.

Excluding MicroStrategy's market cap, as the only company employing a debt leverage strategy to accumulate BTC and capitalize on BTC price fluctuations, the market cap stands at $121.9 billion.

While Coinbase is the only segment on the blue pie chart, with a market cap of $71.2 billion, accounting for approximately 63.6%, the mining sector's stock value is $31.7 billion, primarily occupied by MARA ($7 billion), CORZ ($4.2 billion), RIOT ($4.7 billion), and CLSK ($3.4 billion). Other mining companies have market caps below $3 billion.

Similarly, in the financial and investment sector valued at $7.1 billion, Galaxy Digital occupies most of it, valued at $6.7 billion. Overall, the total market capitalization of publicly traded blockchain companies is $199.5 billion. This only accounts for 5.8% of the total cryptocurrency market cap of $3.45 trillion.

Methodology

Data is as of February 3, 2025. To determine the number of listed companies and their market capitalization, we used publicly available data from North American OTC and institutional exchanges. Canadian exchanges primarily hold ETFs, which are excluded as they are not structured as companies but as investment funds. Although there is overlap with U.S. exchanges, Galaxy Digital is the only notable exception as a non-low-priced stock, with a share price well above $5.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。