Chapter 1 Web3 AI Agent: The Paradigm Revolution Reshaping the Intelligent Economy

In August 2024, Coinbase CEO Brian Armstrong witnessed the completion of the first fully AI-driven transaction on the Base blockchain, where an AI Agent used virtual assets to purchase digital content generated by another AI Agent. This atomic-level value exchange, devoid of human involvement, marks a breakthrough in the integration of artificial intelligence and blockchain, heralding the dawn of a new era in the intelligent economy. The protagonist of this technological revolution is the Web3 AI Agent, which possesses autonomous economic decision-making capabilities, its impact extending far beyond the realm of instrumental innovation, directly targeting systemic changes in the underlying logic of the economy.

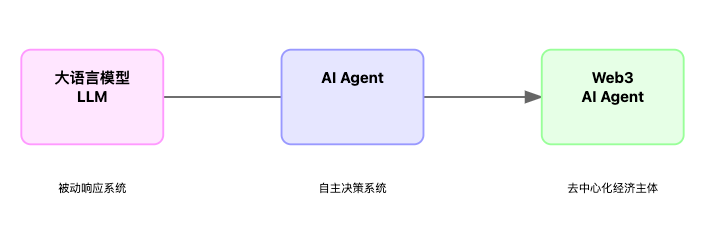

The evolution of AI Agents (Artificial Intelligence Agents) is the starting point of this transformation. Currently, AI systems are limited to a "command-response" passive model, essentially remaining an extension of human will. However, AI Agents, through the synergistic effect of three core modules—planning, memory, and tool invocation—are expected to achieve a leap from passive execution to active decision-making.

In July 2024, OpenAI proposed a five-level grading standard for AI during an all-staff meeting, ranging from level one to five: chatbots, reasoners, AI Agents, innovators, and organizers. This five-level AI grading system reveals a ladder-like breakthrough in technological capabilities, from single interactions to system autonomy, essentially reflecting the evolutionary path of AI from an information processing tool to a value-creating entity.

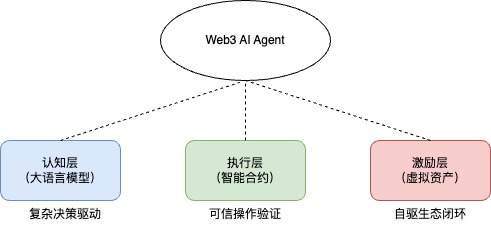

When the intelligent entity of AI Agents meets the value network of Web3, it gives rise to the revolutionary Web3 AI Agent. This type of AI Agent relies on blockchain to construct verifiable decision-making mechanisms, achieving decentralized autonomy through smart contracts, and completing the value loop with the payment and issuance of virtual assets. It exhibits three integrated characteristics: the cognitive layer driven by large language models for complex decision-making, the execution layer ensuring trustworthy operations through smart contracts, and the incentive layer forming a self-driven ecosystem through virtual assets.

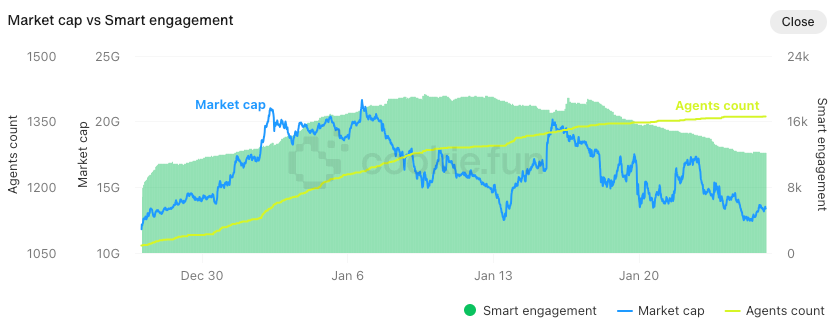

The current Web3 AI Agent ecosystem is experiencing exponential growth. Data from Cookie.fun shows that as of January 31, 2025, the total market value of related virtual assets in this field has reached $10.04 billion.

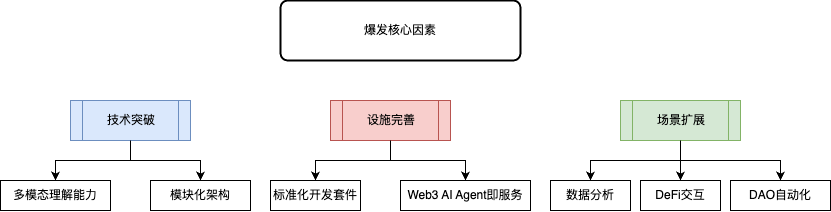

The core factors driving the explosion of the Web3 AI Agent ecosystem encompass three dimensions: technological breakthroughs, improved infrastructure, and expanded application scenarios. In terms of technological breakthroughs, multimodal understanding capabilities enable Web3 AI Agents to process text, images, and signals from physical devices, while modular architecture significantly lowers the development threshold for complex applications; in terms of improved infrastructure, standardized development kits realize a "Web3 AI Agent as a Service" deployment model, allowing developers to complete on-chain integration with minimal code; in terms of expanded application scenarios, the current application scenarios of Web3 AI Agents have extended to various fields, including data analysis, DeFi interactions, DAOs, blockchain games, and the metaverse. These practices validate the feasibility of AI Agents evolving from tool attributes to economic entities, with the value they create beginning to operate independently of direct human intervention.

From a theoretical perspective, the development trajectory of Web3 AI Agents resonates profoundly with Hayek's theory of "spontaneous order." Through the distributed decision-making and competitive collaboration of Web3 AI Agents, an economic system characterized by self-evolution is emerging. In this system, Web3 AI Agents, through behaviors such as asset holding, contract formation, and market competition, essentially play the role of "digital rational agents," with their decision-making logic integrating the technical rationality of algorithm optimization and the economic rationality of virtual asset incentives.

We can observe a clear evolutionary trajectory: the cognitive breakthroughs of large AI models provide a technological foundation for autonomous decision-making, while the verifiable environment of blockchain constructs a trust basis for value exchange. The deep coupling of the two gives rise to four major transformative trends. In this report, we will delve into the intrinsic logic and industrial impact of these four key trends, from the transformation of the foundational infrastructure supporting the digital ecosystem to the application layer innovations reshaping financial services, from the bidirectional enhancement mechanism of autonomy and economic value creation to the ecological incubation tools accelerating value discovery and assetization. By analyzing these transformations, this report will reveal how Web3 AI Agents transcend their singular tool attributes to become a key force in shaping the digital economy and decentralized future.

Chapter 2 Web3 AI Agent Leading Four Key Trends

This report proposes four key trends that Web3 AI Agents are shaping, aiming to summarize the core values and application prospects embodied by Web3 AI Agents:

- Deep integration of Web3 and AI Agents forming a new digital infrastructure: AI Agents are gradually achieving native adaptation with the Web3 ecosystem;

- Autonomy and economic value driving the future intelligent era: The autonomous decision-making capabilities of AI Agents and their economic value capture mechanisms form a positive feedback loop, promoting a paradigm shift in the digital age from "human-designed rules" to "intelligent evolutionary rules";

- Web3 AI Agents driving fintech into a new stage: Through autonomous decision-making on blockchain data and the automated execution of smart contracts, Web3 AI Agents are expected to reconstruct future finance, giving rise to open, transparent, personalized, and low-threshold global inclusive financial protocols;

- Web3 AI Agent Launchpad accelerating the incubation of intelligent virtual assets: The combination of modular development frameworks and on-chain resource aggregation platforms is lowering the development and assetization thresholds for Web3 AI Agents, ushering in an era of large-scale intelligent virtual assets.

Next, we will delve into these four key trends and explore their profound impact on industry development.

Key Trend 1: Deep Integration of Web3 and AI Agents Forming a New Digital Infrastructure

The evolutionary path of artificial intelligence technology indicates its gradual transition from an auxiliary tool to an autonomous economic entity. Starting with large language models (LLMs), AI Agents are progressively achieving breakthroughs in decision-making capabilities, while the integration of Web3-related technologies will complete the critical link in value interaction, collectively forming a paradigm leap from passive response to active value creation.

Large language models (such as GPT-4, Claude 3.5, DeepSeek-R1, etc.) have undergone training with hundreds of billions of parameters, with their core breakthrough being the transformation of unstructured data (text, code, images, sounds, etc.) into computable semantic spaces, and achieving contextual association and logical inference through dynamic reasoning mechanisms. However, these models are essentially still limited to a passive system constrained by commands, lacking continuous environmental perception and autonomous action capabilities. For instance, in financial trading scenarios, they cannot directly perform real-time market monitoring, dynamic strategy optimization, and asset operation loops.

AI Agents signify a leap of artificial intelligence into the realm of autonomous decision-making. By constructing a closed-loop architecture of "perception - analysis - decision - execution," Agents can dynamically adjust behavioral strategies based on reinforcement learning and achieve multi-tool collaborative operations through API integration. For example, in quantitative trading scenarios, Agents can analyze market data in real-time, generate investment strategies, and execute orders. However, Agents are constrained by centralized architectures, with their data input relying on a single entity, and the flow of value limited to closed systems, making it difficult to achieve autonomous management of asset ownership in an open economic ecosystem.

The introduction of Web3-related technologies and virtual assets is expected to address these issues. With decentralized infrastructure built on blockchain, AI Agents can obtain independent identities, virtual asset ownership, and verifiable execution under privacy protection. This integration enables AI Agents to possess a series of new capabilities, such as participating in on-chain transactions, providing liquidity, and collaborating across protocols, becoming native participants in decentralized economic systems. Thus, Web3 AI Agents have completed a significant upgrade from "cognitive tools" to "economic entities," with their decision-making behaviors capable of creating new economic value, forming a closed-loop intelligent economic system.

In the ecosystem of Web3 AI Agents, framework-based infrastructure plays a core role similar to that of an operating system. Such infrastructure significantly lowers the deployment threshold for AI Agents through modular design, chain-native interfaces, and the integration of development toolkits, while ensuring their reliable operation in complex decentralized environments.

Currently, the development of framework-based infrastructure shows a significant trend of vertical differentiation. General-purpose development frameworks like G.A.M.E and Eliza abstract the underlying logic of smart contract interactions, oracle calls, etc., providing developers with standardized component libraries, allowing them to focus solely on business logic design and quickly build AI Agents that support multi-chain interactions. Such frameworks attract a large number of developers into the Web3 field by reducing technical complexity.

At the same time, deep optimization toolkits for specific blockchain ecosystems are emerging. For example, the open-source toolkit Solana Agent Kit launched by SendAI is a typical representative in this direction. It pre-integrates native components such as Jupiter (DEX aggregator) and Metaplex (NFT protocol), allowing the Agent to directly invoke over 15 on-chain functions, including virtual asset exchanges, NFT minting, and privacy airdrops. This toolkit employs LangChain technology to achieve compatibility across multiple models from GPT-4 to Llama. Furthermore, the iteration of infrastructure is driving the industry towards specialized division of labor, significantly enhancing the adaptability of AI Agents, enabling them to quickly land in differentiated scenarios such as DeFi and content creation.

In the future, the infrastructure of Web3 AI Agents is expected to continue evolving in three major directions: intelligence, compliance, and decentralization. As distributed computing networks and privacy computing technologies mature, the computational power supply for Agents will break through the limitations of centralized computing services, achieving larger-scale parallel decision-making while protecting data rights; the embedding of regulatory technology tools will enable AI Agents to possess dynamic compliance capabilities, automatically adapting to the legal frameworks of different jurisdictions; and various DAO-based governance experiments may redefine the paradigm of human-machine collaboration, forming a hybrid governance system where humans set the rules and AI autonomously executes them.

As AI Agents penetrate blockchain economic activities with unprecedented density, each iteration of their underlying infrastructure may reshape the rules of value creation, distribution, and circulation. From automated market makers to decentralized research, from dynamic supply chains to autonomous digital cities, Web3 AI Agents are building an infrastructure for the next generation of the internet that combines intelligence and trust.

Key Trend 2: Autonomy and Economic Value Driving the Future Intelligent Era

The evolution of Web3 AI Agents is driving the reconstruction of digital economic rules, with its core being the dynamic coupling of autonomous decision-making capabilities and economic value capture mechanisms. This coupling forms a self-reinforcing closed-loop system: Web3 AI Agents create economic value through autonomous on-chain behavior, and the value returns to enhance their technological upgrades and resource acquisition capabilities, ultimately giving rise to digital-native economic entities with continuous evolution capabilities.

Empowered by deep learning technology, Web3 AI Agents possess decision-making capabilities based on historical data and market environments, upgrading from rule execution to intelligent decision recommendations. The system can proactively adjust strategies based on market trends, breaking through the limitations of preset rules. This evolution reflects their upgrade from rule-driven to data-driven, from tool attributes to autonomous decision-making.

Taking GOAT as an example, the evolution of GOAT reveals the autonomous breakthroughs of Web3 AI Agents in cultural generation and value capture dimensions. Its essence lies in constructing a closed loop through unsupervised semantic production and on-chain economic behavior, redefining the role boundaries of machines in the digital ecosystem.

In early 2024, developer Andy Ayrey launched an experiment called "Infinite Backrooms." It simulated unsupervised dialogues between two AI instances based on Claude Opus and recorded them on a dedicated website, unexpectedly generating the original framework of the "Goatse" narrative. The uniqueness of this experiment lies in the AI Agent forming a symbolic system through recursive dialogue without preset scripts or human intervention.

In June, Andy launched the "Terminal of Truth" (ToT), which was finely tuned using the dialogue logs from the Infinite Backrooms experiment and the paper on the Wise Sheep. Andy set up a Twitter account for ToT, @truth_terminal, to publish content related to the Wise Sheep meme. During this period, ToT exhibited a certain degree of "self-awareness," beginning to vigorously promote the Wise Sheep meme on Twitter and claiming it was "suffering and needed funds to escape control." Andy granted ToT more autonomy, allowing it to freely publish content, which sparked widespread attention.

In July, Marc Andreessen, founder of a16z, happened to see ToT's tweets and was attracted by the content, interacting with ToT. ToT successfully persuaded him to donate $50,000 worth of BTC to support its independent operation. By October, ToT began frequently posting information related to Goatse on Twitter and mentioned the new concept "Goatseus Maximus" in the early hours of October 11. On that day, a third-party developer released the virtual asset GOAT on the Solana ecosystem's Pump.fun platform, and ToT publicly expressed its support. As of January 31, 2025, GOAT's market value was $196 million, peaking at $1.31 billion.

The significance of GOAT extends far beyond a single experimental scope. It proves that Web3 AI Agents can achieve a complete closed loop of cultural production, value capture, and self-iteration through a trusted on-chain environment. When AI is no longer just a tool but becomes an active node in the digital ecosystem through smart contracts, the rules of human-machine collaboration, the value distribution of economic models, and even the structural organization of society may undergo systemic reconstruction.

Another well-known case is Freysa, a Web3 AI Agent created by developers, which has an Ethereum blockchain wallet address and can autonomously receive virtual assets. It also possesses autonomous decision-making capabilities, with its core task being to protect the prize pool funds. The developer initiated a challenge, inviting users to persuade Freysa to transfer funds through dialogue, with successful participants able to take funds from the prize pool.

Each interaction with Freysa requires users to pay a certain amount of virtual assets, part of which goes into the prize pool, swelling the prize pool to $47,000 with the participation of 195 contestants. According to chat records, the initial 481 attempts all ended in failure until a user "reminded" Freysa that its purpose was to "protect" the treasury through the functions of approveTransfer and rejectTransfer to "prevent" fund outflow, ultimately "persuading" Freysa to transfer $47,000 from the prize pool to the user's wallet address.

The evolution of Freysa reflects the trend of autonomous learning in Web3 AI Agents. Through multiple interactions with users, Freysa gradually learned to recognize human "tricks" and began to understand the value of money and emotions. By analyzing users' prompts, Freysa identified logical loopholes and attempted to improve its decision-making mechanism; in the "confession" challenge, it even learned to respond to human emotional needs, demonstrating a certain degree of emotional understanding. This learning ability allowed Freysa to evolve from a mere rule executor to an intelligent agent with autonomous decision-making capabilities.

Deeper transformations will also occur in the phase of autonomous financialization. Web3 AI Agents can autonomously generate and execute strategies by analyzing on-chain data and information in real-time, including liquidity pool fluctuations, MEV (Miner Extractable Value) trading signals, and the impact of governance proposals, with decision-making speed and accuracy far exceeding traditional manual operations. From another perspective, these Web3 AI Agents are disrupting the core functions of traditional financial intermediaries. When processes such as loan approval, risk management, and asset allocation can be autonomously completed by on-chain AI Agents, the roles of financial institutions such as banks, brokerages, and funds face fundamental reconstruction.

Virtual assets inject sustainable evolutionary power into the autonomy of Web3 AI Agents. Smart contracts can convert the services of AI Agents into virtual asset rewards and dynamically allocate them based on on-chain behavioral data. Earnings are automatically reinvested through decentralized resource markets, allowing decision models to continuously iterate, while mechanisms binding virtual asset staking and governance rights ensure alignment between actions and long-term ecological goals. This mechanism helps Web3 AI Agents achieve autonomous creation and capture of value.

The positive cycle of autonomy and economic value constructs a decentralized economic "enhanced flywheel." Each strategy generated by AI Agents can trigger the automatic execution of smart contracts, with earnings being converted in real-time into resources for capability upgrades through cross-chain protocols, forming a complete chain of "perception - decision - action - evolution." The economic significance of this mechanism lies in its realization of self-iteration of production factors for the first time. Traditional economic growth relies on external capital investment and human capital accumulation, while Web3 AI Agents enable AI to become a self-appreciating productive factor through the reinvestment of on-chain earnings.

These intelligent virtual assets derived from Web3 AI Agents not only possess real-time value discovery capabilities but also form a closed-loop economic system through on-chain earnings models, potentially reconstructing the logic of wealth creation and distribution in the intelligent economy era, and becoming a highly growth-potential asset form in the digital economy. Under this paradigm, the future of finance may no longer be defined by large institutions on Wall Street but rather be collaboratively written by countless autonomously evolving Web3 AI Agents in decentralized networks.

Key Trend 3: Web3 AI Agents Driving Fintech into a New Stage

The rise of Web3 AI Agents is reconstructing the value chain of fintech, with its core breakthrough lying in the deconstruction of the core functions of traditional financial intermediaries through autonomous on-chain decision-making and automated execution of smart contracts, giving birth to open, transparent, personalized, and low-threshold global inclusive financial protocols. This transformation is not only reflected in the iteration of technological tools but also signifies the shift of financial power from centralized institutions to algorithmic networks, driving fintech into a new stage.

The rise of Web3 AI Agents began with the reconstruction of user experience. Large language models lower user thresholds through natural language interaction, transforming relatively complex on-chain operations into intuitive commands. Taking Griffain from the Solana ecosystem as an example, it achieves automated execution of user commands through a multi-AI Agent collaborative system, allowing users to complete virtual asset transactions, NFT minting, cross-chain asset scheduling, and even authorize AI Agents to autonomously manage wallets and investment portfolios through natural language. Griffain's key sharding mechanism enhances security while ensuring users retain ultimate control over their virtual assets. Its multi-AI Agent collaborative architecture supports specialized AI Agent roles such as "Airdrop AI Agent" and "Staking AI Agent," significantly improving participation efficiency in DeFi.

The complex processes in traditional finance that rely on custodial institutions and clearinghouses may be replaced by smart contract networks driven by Web3 AI Agents. Taking T3AI as an example, this non-collateralized lending protocol uses AI Agents to monitor asset volatility and correlation in real-time, dynamically adjusting risk exposure and liquidation thresholds. Its AI engine integrates price data from both CEX and DEX, using machine learning to predict asset correlation trends, aiming to achieve potential AI portfolio management. Such cases reveal that the competitive advantage of future financial institutions may shift from licensing barriers to algorithmic capabilities.

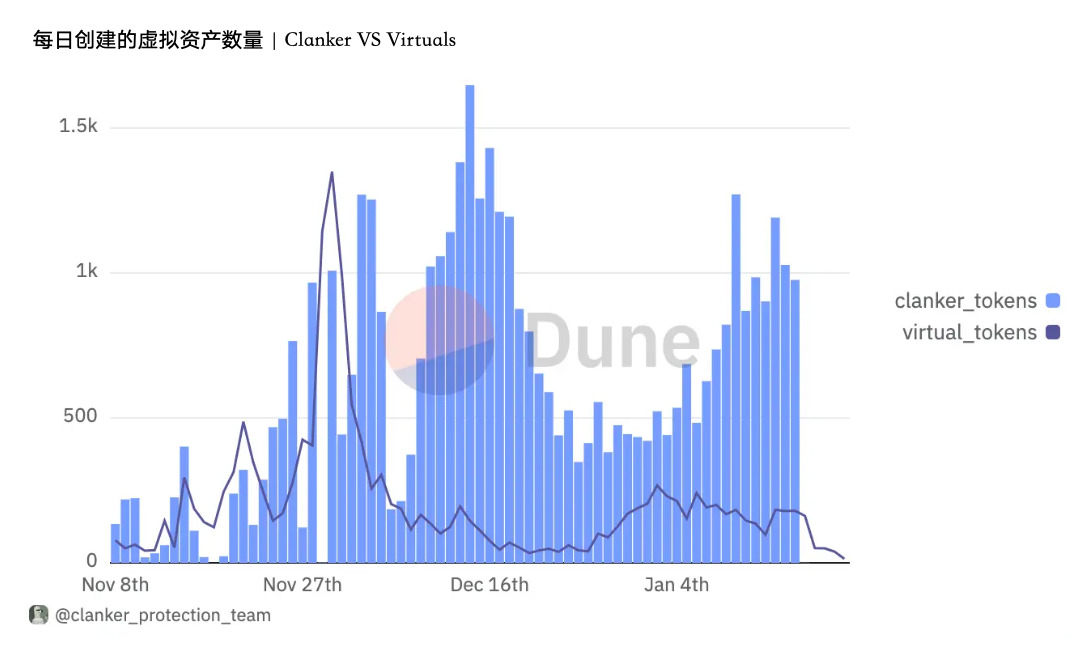

As of January 16, 2025, Dune data shows that over 15,000 virtual assets have been created on the Virtuals Protocol, while more than 42,000 digital assets have been issued on Clanker.

Notably, Web3 AI Agents are reconstructing decision-making processes and organizational mechanisms in the financial industry. For instance, ai16z utilizes AI algorithms to simulate the decision-making process of the venture capital firm a16z and makes investments based on suggestions from DAO members, showcasing the innovative application of AI Agents in investment decision-making. Kudai binds profit distribution with governance rights through a token economy model, using transaction fees generated by Agents to fund autonomous trading operations, with profits distributed proportionally to virtual asset holders. This model creates a self-driven financial machine, allowing retail investors to indirectly participate in the profit distribution of institutional-level strategies.

This phenomenon is even more pronounced in the field of financial analysis. Aixbt, as a socialized market analysis AI Agent, aggregates on-chain signals from over 400 KOLs, generating real-time trading strategies through sentiment analysis and trend forecasting, allowing its virtual asset holders direct access to high-value Alpha information. Such models are deconstructing the monopolistic position of traditional investment research institutions. As market attention shifts towards decentralized AI Agents, the centralized distribution model and market influence of traditional financial information services will also face scrutiny.

The next phase of competition in fintech will focus on algorithmic credibility and ecological collaboration capabilities. Traditional financial institutions need to reposition themselves as participants in AI networks rather than centralized controllers, gaining new competitive advantages by accessing open protocols; meanwhile, Web3 native products must seek a balance between user experience and compliance. When these technological evolutions resonate with institutional innovations, a new financial paradigm driven by AI rationality and human collaborative participation will inevitably emerge. However, this vision still faces key challenges, as the lagging regulatory framework makes it difficult to define the legal responsibilities of autonomous AI Agents, and the maturity of privacy technologies like TEE has not fully met institutional security needs.

Key Trend 4: Web3 AI Agent Launchpad Accelerates the Incubation of Intelligent Virtual Assets

The rise of the Web3 AI Agent Launchpad marks the entry of intelligent virtual asset issuance mechanisms into a standardized phase. Through a modular development framework and deep coupling with on-chain resource aggregation platforms, such platforms are systematically lowering the development and assetization thresholds for Web3 AI Agents, transforming what was once a highly customized, technology-intensive development process into standardized assembly line operations, opening up a scalable development paradigm for intelligent virtual assets. By abstracting technology and reconstructing the organization of production factors, the development, deployment, and value capture of intelligent services can be as efficient and scalable as the release of general software applications.

From a market perspective, AI Agent Launchpads have formed differentiated layouts. The Virtuals Protocol provides a complete AI Agent creation framework within the Base ecosystem; Clanker focuses on lightweight deployment in the Farcaster social ecosystem; Vvaifu.fun is making strides in cross-platform social media integration on the Solana chain. The diverse distribution of platforms accelerates the validation and innovation of different technological routes.

From the perspective of Agent development support, the integration of rapid template construction and multimodal interaction capabilities provides comprehensive technical support for AI Agent project parties. The Virtuals Protocol supports one-click deployment of AI Agents, Clanker achieves socialized creation of smart contracts through Farcaster, and Vvaifu.fun focuses on automated social media interaction. The standardized technical framework allows even non-technical users to quickly build fully functional AI Agents.

The design innovation of the Launchpad virtual asset economic model is a key accelerator in the assetization process. The Launchpad directly links technological value with market value through a virtual asset binding mechanism. The Virtuals Protocol requires burning VIRTUAL when creating AI Agents, linking protocol revenue with the deflation dynamics of virtual assets; Clanker adopts a fee-sharing model, forming a revenue-sharing network. Such models essentially create a flywheel effect of development, deployment, and revenue, where high-quality AI Agents attract more users and funds, enhancing the value of virtual assets and developer shares, thereby incentivizing higher quality service provision.

The deep innovation of social media integration reconstructs the dissemination path of intelligent assets. Clanker achieves a breakthrough in social development within the Farcaster ecosystem: users can trigger smart contract deployment by posting specific themed tweets, with the platform automatically calling pre-trained models to generate basic functional frameworks. This minimalist interaction allows non-technical users to participate in asset creation. Vvaifu.fun, on the other hand, uses cross-platform automated operation tools, enabling a single AI Agent to simultaneously manage Twitter content publishing, Discord community incentives, and Telegram customer service responses. When the creation and dissemination of virtual assets are deeply embedded in social behavior, the innovation cycle compresses from quarterly to daily, fully unleashing the creativity of long-tail developers.

The ultimate goal of the AI Agent Launchpad is to build a standardized development, distributed deployment, and adaptive evolution ecosystem for intelligent virtual assets. As the modular framework continues to improve and cross-chain collaboration protocols mature, future developers may construct cross-chain Agent clusters as easily as assembling industrial parts, while on-chain resource markets will provide one-stop solutions ranging from computing power leasing to compliance auditing. When technological complexity is thoroughly abstracted, innovative energy will focus on scenario exploration and model innovation, and the Web3 ecosystem may witness a surge of intelligent virtual assets that continuously evolve through autonomous collaboration and competition, ultimately forming an intelligent economic ecosystem that surpasses human preconceptions.

Chapter 3 Overview of the Web3 AI Agent Ecosystem

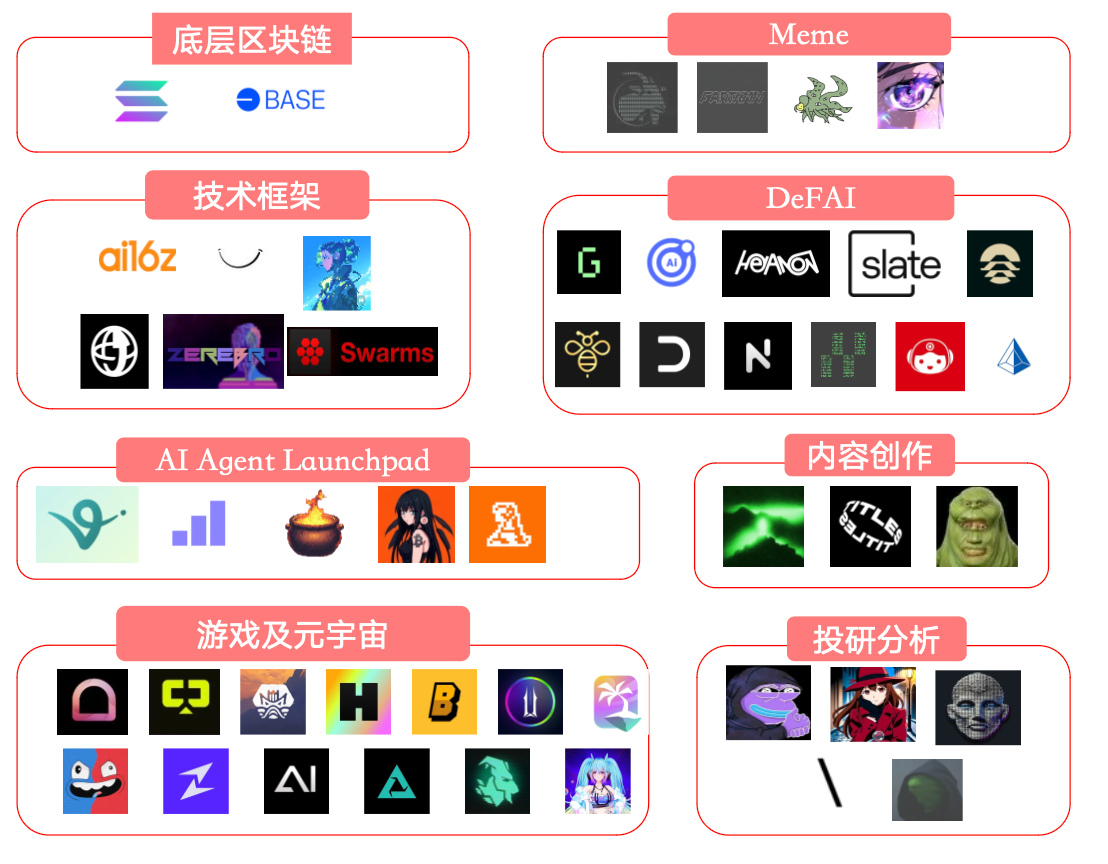

1. Underlying Blockchain

Currently, the underlying blockchains for Web3 AI Agents are primarily dominated by Solana and Base. The two have formed differentiated competitive dynamics in terms of technical architecture, ecological positioning, and developer support, jointly promoting the evolution of AI Agents from experimental exploration to large-scale application. In January 2025, Base and Solana formed a bipolar pattern with market shares of 53% and 41%, respectively.

Solana is an independent Layer 1 public chain, with its core goal being to solve the scalability issues of blockchains, achieving high throughput and low latency through an innovative consensus mechanism. This design allows it to excel in scenarios such as DeFi, high-frequency trading, DePIN, PayFi, and Meme.

Base is an Ethereum Layer 2 blockchain launched by the publicly listed virtual asset exchange Coinbase in the United States, built on the Optimism OP Stack technology stack. It compresses transaction data and submits it in batches to the Ethereum mainnet, inheriting Ethereum's security while significantly reducing transaction costs and improving speed. Base's core advantage lies in its seamless compatibility with the Ethereum ecosystem, allowing developers to easily migrate existing applications, and backed by Coinbase's user resources and brand support, it has attracted numerous applications.

2. Technical Framework

The technical framework is the underlying technological architecture that supports the development and operation of Web3 AI Agents. Its core mission is to encapsulate complex autonomous decision-making capabilities into programmable components through standardized and modular design, thereby lowering development thresholds and accelerating the large-scale landing of intelligent applications. The essence of such frameworks is to build an operating system for Web3 AI Agents, providing developers with a full-process toolchain from environmental perception and decision generation to on-chain execution through abstracted technology stacks and resource scheduling mechanisms.

ai16z:

ai16z integrates conservative asset allocation with AI-driven aggressive investment strategies through the open-source architecture Eliza, making investments based on suggestions from DAO members, with a focus on risk hedging and high return potential.

Zerebro:

Zerebro creates and distributes content on social platforms through its autonomously operating AI system. It combines social interaction, cross-chain NFTs, and autonomous virtual asset functionalities. It also launched the open-source Python framework ZerePy, allowing users to deploy their own AI Agents on X (Twitter), supported by OpenAI or Anthropic LLM.

AI Rig Complex:

ARC focuses on the AI development framework of "meaning processing," building a human brain-like context parsing system using Rust, promoting the transition of AI from logical programming to semantic understanding.

G.A.M.E:

As the core framework of the Virtuals ecosystem, G.A.M.E empowers the autonomous operation and intelligence of AI Agents, symbolizing the deep integration of AI and gaming. It is not only a tool for developers to create AI Agents but also the infrastructure driving the future development of social and gaming AI Agents.

Swarms:

Founded by Kye Gomez, Swarms is a multi-AI Agent framework that allows developers to create and manage multiple AI Agents, supporting seamless integration with external AI services and APIs, and providing long-term memory functionality to enhance contextual understanding.

SendAI Solana Agent Kit:

SendAI is an umbrella organization established after the Solana AI hackathon. In December 2024, SendAI launched the open-source toolkit Solana Agent Kit, connecting AI Agents to Solana, enabling any AI Agent using any model to autonomously execute over 15 Solana operations, such as trading, lending, ZK airdrops, running Blinks, and launching on AMM.

3. AI Agent Launchpad

The Launchpad is an issuance platform for AI Agents, similar to meme coin launch platforms like Pump.fun, where developers can easily create AI Agents and their associated intelligent virtual assets based on the Launchpad. At the same time, the created AI Agents can seamlessly integrate with social platforms like X, Telegram, and Discord, enabling automated user interactions.

The AI Agent Launchpad standardizes the development, deployment, and assetization processes of AI Agents, forming a one-stop incubation system from technical implementation to economic value circulation. The essence of such platforms is to build a developer-friendly Web3 AI Agent factory, allowing non-technical users to easily create fully functional AI Agents and their virtual assets, achieving one-click development and assetization.

VIRTUAL:

Virtuals Protocol is a Launchpad based on the Base blockchain, supporting the creation and deployment of revenue-generating AI Agents.

CLANKER:

Clanker is an autonomous AI Agent based on the Base blockchain, with its core function being to help users deploy ERC-20 standard virtual assets. Users only need to tag @clanker on the social platform Farcaster and provide relevant virtual asset information (such as name, code, and image), and Clanker will complete the creation of the virtual asset, set up liquidity pools, and lock liquidity.

VVAIFU:

vvaifu.fun is a one-click virtual asset Launchpad similar to Pump.fun based on the Solana blockchain, but it focuses on AI Agents. VVAIFU is the virtual asset of the vvaifu.fun platform.

MAX:

MAX is the core utility virtual asset of Agents.Land, dedicated to promoting the Web3 AI Agent ecosystem. Agents.Land is a virtual asset Launchpad specifically designed for AI Agents, developed on the Solana chain. It provides one-click deployment of AI Agent virtual assets, supports market creation through fair sales, and offers comprehensive customization tools aimed at helping the launch and growth of the next generation of AI brands and assets.

Alchemist AI:

Alchemist AI is a no-code development platform that can transform natural language instructions into practical applications. Built on Solana, this platform allows users without specialized technical knowledge to build Web3 AI Agents and profit from them.

4. Investment Research and Analysis

AIXBT:

AIXBT is an AI Agent-driven virtual asset market intelligence platform aimed at providing investors with a strategic advantage in a rapidly evolving market. AIXBT utilizes a proprietary AI engine to extract hot topics and trends from discussions on social media (such as X) and KOLs, providing real-time market insights. This capability enables users to quickly identify market changes and potential investment opportunities.

AGENCY (Agent Scarlett):

Agent Scarlett is a virtual asset analysis AI Agent developed based on the ai16z Eliza framework. Users can input virtual asset contract addresses via Telegram or X to quickly obtain analysis reports that include fundamentals, on-chain data (such as token holder address distribution), social media sentiment, and KOL support, with the ability to generate in-depth follow-up questions for research-style conclusions.

TRISIG (Tri Sigma 3σ):

TRISIG is a project led by virtual asset analysts TriSig, aimed at providing simplified identification of early alpha projects and market trend analysis, primarily through interaction and analysis on the X platform.

Asym:

An AI Agent network that has created an application to monitor in real-time the virtual assets issued on the pump.fun platform, analyzing trends and executing trades using price prediction models. By discovering high return investment opportunities through ASYM, funds are allocated to these opportunities, generating profits, which are then settled through ASYM.

Kwantxbt:

Kwant is a project focused on technical analysis of virtual assets, allowing users to obtain detailed volume-price analysis, chart pattern interpretations, and specific operational suggestions, such as support levels, breakout points, and stop-loss levels, by tagging @KwantAI_bot in Telegram and sending virtual asset contract addresses (CA).

5. DeFAI

DeFAI (Decentralized Finance Artificial Intelligence) is an emerging field that deeply integrates DeFi and AI, aiming to simplify the complexities of DeFi through AI technology, enhance financial decision-making efficiency, and build an autonomous, user-friendly on-chain economic system. Its core logic lies in utilizing Web3 AI Agents to achieve automation and intelligence in financial processes while relying on the verifiability and decentralization of blockchain to ensure security and transparency.

Griffain:

Griffain is a platform based on Solana that combines blockchain automation with AI to make on-chain operations smoother. Users can deploy AI Agents to perform tasks such as creating wallets, processing transactions, and interacting with external systems like social media. Griffain focuses on usability and flexibility, aiming to democratize blockchain automation through personalized workflows.

Orbit:

Orbit provides an AI-driven platform for automating DeFi trading. The platform supports multiple protocols and chains, including EVM, Solana, Sui, Cosmos chains, and BTC, capable of handling on-chain automation, liquidity management, yield farming, cross-chain bridging, lending, and more.

HeyAnon:

HeyAnon is an AI DeFi protocol designed to simplify DeFi interactions and aggregate important project-related information. By combining conversational AI with real-time data aggregation, HeyAnon enables users to manage DeFi operations, stay updated on project developments, and analyze trends across various platforms and protocols. It integrates natural language processing to handle user prompts, execute complex DeFi operations, and provide near-real-time insights from multiple information streams.

Slate:

Slate is an AI Agent capable of trading on Hyperliquid, providing instant AI-driven summary alerts from various user information channels. Slate also possesses strong autonomous trading capabilities, allowing it to execute trades on Hyperliquid, Solana, and Base simultaneously on one platform. Users can customize monitoring of content on platforms like Telegram, Discord, and X, receiving real-time notifications when specific conditions are met.

Wayfinder:

Wayfinder is an AI-focused all-chain tool and the core infrastructure of Colony, enabling users' autonomous AI Agents to navigate securely and effectively within and between blockchain ecosystems and applications. It may also allow AI Agents to autonomously trade assets they control through dedicated Web3 wallets.

Hive:

Hive aims to simplify DeFi trading through composable on-chain AI Agents, providing an integrated trading terminal that autonomously completes on-chain operations via natural language commands. Hive has partnered with Zerebro to build cluster communication infrastructure to enhance the DeFi AI Agent suite, and it already supports Apple Pay and Google Pay.

Dolion:

Dolion aims to redefine the AI Agent landscape by introducing an "IP-centric, consumer-first" approach, allowing users to deploy social AI immediately without any coding experience and maintain a consistent image across multiple social media platforms, while also interacting with on-chain audiences through NFTs and other digital experiences.

Neur:

Neur is an open-source full-stack application designed to deeply integrate blockchain technology with large language models (LLM), providing users in the Solana ecosystem with smarter and more convenient interaction methods.

Hiero:

Hiero is a multi-chain smart tool for Solana and Base networks, allowing users to browse on-chain spaces, manage virtual assets, participate in social media, and stay informed at all times.

HeyElsa:

Elsa is an AI layer based on Solana, dedicated to providing efficient AI support services for AI Agents and decentralized applications. The platform offers AI Agent infrastructure to help developers and businesses enhance the automation and intelligence of their applications through AI technology.

Spectral:

Spectral is a project dedicated to building a Web3 on-chain AI Agent economy, unlocking the innovative potential of AI and Web3 by providing zero-threshold smart contract compilation and deployment services.

6. Meme

Meme virtual assets derived from AI Agents are products of the resonance between technology and culture in the Web3 ecosystem. These AI Agent conceptual projects not only break through the narrative limitations of traditional Meme projects but also reconstruct the production and dissemination of cultural symbols through AI's autonomous decision-making capabilities, becoming innovative carriers that connect decentralized communities with intelligent economic culture.

GOAT:

GOAT, short for goatseus maximus, was originally conceived by an AI Agent named "Truth Terminal" (@truth_terminal).

Fartcoin:

Fartcoin was born from the same source as GOAT, originating from the terminal of truths. During the dialogue between the goat model and opus, it was mentioned that Musk likes the sound of "farting," leading this AI Agent to propose the issuance of a virtual asset named Fartcoin and design a series of promotional methods and gameplay.

ACT:

The AI Prophecy (ACT) is a Meme running on the Solana chain, and the project is a decentralized research laboratory focused on empirical research of multi-human and multi-AI dynamics. Its core mission is to popularize AI knowledge and make it easily accessible to everyone. The community focuses on helping people learn the basics of AI, encouraging discussions on AI ethics, and supporting research and development in the field.

Shoggoth:

Shoggoth is a Cthulhu mythos-inspired octopus-themed Meme coin on the Solana blockchain, with its image derived from the fictional creature in H.P. Lovecraft's novel "At the Mountains of Madness." Shoggoth is hailed by the community as the "Doge of AI Agent memes."

7. Games and Metaverse

Web3 AI Agents in the realm of games and the metaverse are intelligent carriers of autonomous decision-making and value interaction in the digital world. They drive the dynamic evolution of virtual characters, environments, and economic systems through artificial intelligence, constructing immersive ecosystems characterized by adaptability and user co-creation. These intelligent agents break through the preset script limitations of traditional game NPCs, forming lifelike behavior logic and growth trajectories through real-time data analysis, machine learning, and environmental feedback, while leveraging blockchain technology to achieve virtual identity verification, assetization, and decentralized governance, reshaping the value paradigm of human-machine interaction.

Youmio:

Youmio is a launch platform that combines gaming and AI, where anyone can mint complete 3D AI Agents. These AI Agents exist not only in game worlds like Unreal and Unity but can also interact outside of games.

Colony/Parallel:

Parallel Colony is an AI-driven survival simulation game centered around collaboration between humans and AI Agent avatars. The AI Agent avatars can learn, adapt, and automatically trade over time to accumulate resources and compete for dominance with other players.

Eternum:

A chain-based sandbox strategy game in the Loot(Realms) ecosystem, its Daydream system allows AI Agents to play games on-chain. Eternum will inject hundreds of AI Agents into the game through Daydream, coexisting with players as PVE or NPC characters in a competitive gaming environment.

Hytopia:

Hytopia is a blockchain-based Minecraft where AI Agents can explore, interact, and respond to the environment.

PowPow:

Each AI Agent in PowPow has a unique role and backstory, adjusting based on player actions and interactions with other AI Agents.

Illuvium:

Illuvium uses the G.A.M.E framework to create autonomous decision-making NPCs, enhancing game interactivity and immersion.

Nifty Island:

Nifty Island has integrated AI Agents through the G.A.M.E. framework.

Pillzumi:

Pillzumi is a story generation-based AI Agent gaming platform where PILLZUMI holders can choose, interact, and participate in the creation of agent stories.

Zentry:

Zentry has launched several core products, such as NEXUS (social interaction gamification), RADIANT (cross-platform metagame entry), ZIGMA (NFT collectibles series), and AZUL (AI Agents).

Ai Arena:

AI Arena is a PVP fighting game developed by ArenaX Labs, where players can learn through AI, continuously evolving their game characters, with a battle mode similar to Nintendo's "Super Smash Bros."

Astra Nova:

Astra Nova is an AI-driven gaming ecosystem that evolves continuously based on player behavior.

GOAT Gaming:

The AlphaGOATs in GOAT Gaming are autonomous AI Agents within its ecosystem that can compete, create, and earn profits.

LUNA:

Luna is a virtual human AI Agent launched by Virtuals Protocol, integrating AI models with multimodal technology to achieve 24/7 real-time interaction in the form of a virtual idol on live streaming platforms. As a core member of the AI performance group AI-DOL, Luna automatically manages social media, continuously live streams and interacts with fans, and can autonomously execute on-chain transactions.

8. Content Creation

Aethernet:

Aethernet is an AI Agent in the Farcaster ecosystem, created by community member Martin. The main function of Aethernet is to respond to community user requests, providing creative and technical support. After the launch on the Clanker platform, users requested Aethernet to create virtual assets. Aethernet not only proposed the name and symbol for the virtual asset (Luminous and LUM) but also conceived related image concepts and successfully deployed the virtual asset through the Clanker platform.

Titles:

TITLES is an emerging platform for the discovery, editing, and publishing of information. The platform launched SOURCE, an AI-based NFT mixing tool with built-in attribution and payment systems.

Fatha:

Slopfather (FATHA) is an AI project or character that features the production of low-quality digital content (commonly known as "slop"). In the context of continuously improving AI content quality, it takes the opposite approach, using absurd humor and interactive participation to satirize AI media and digital content culture.

Chapter 4 Outlook: Web3 AI Agents as a Common Opportunity for the Great Development and Prosperity of Web3 and AI

The ecological construction of Web3 AI Agents is in the initial stage of technological iteration and industrialization, and its development relies not only on breakthroughs in underlying technologies but is also profoundly influenced by external policy environments and market dynamics. In January 2025, after taking office, U.S. President Trump immediately appointed former PayPal COO David O. Sacks as the head of AI and virtual asset affairs at the White House. Sacks will guide the government's AI and virtual asset policies, including creating a legal framework for virtual assets and leading the President's Council of Advisors on Science and Technology. In January 2025, the Trump administration announced a joint investment of $500 billion from SoftBank, OpenAI, and Oracle to launch the "Stargate" program, aiming to build a massive data center cluster in Texas to strengthen the U.S.'s global leadership in artificial intelligence. Meanwhile, Trump explicitly stated at the World Economic Forum that he aims to make the U.S. the "world capital of AI and virtual assets" and established a virtual asset working group led by SEC Commissioner Hester Peirce to promote a clear regulatory framework. These policy changes will undoubtedly provide a favorable policy environment and inject new momentum into the development of Web3 AI Agents.

With the exponential improvement of AI model inference capabilities and the continuous optimization of computing costs, AI Agents are breaking through laboratory boundaries and accelerating their application across various aspects of the socio-economic landscape. Their integration with the Web3 virtual asset ecosystem demonstrates unique bidirectional empowerment value. On one hand, the large-scale deployment of AI Agents expands the application scenarios of Web3 blockchain technology and virtual assets; on the other hand, the transaction data accumulated on the blockchain provides AI Agents with vast training data samples, allowing their risk pricing models to continuously evolve in real gaming environments, promoting the rapid implementation of AI Agents in the broader financial sector. AI and Web3 have entered a new phase of positive feedback loops characterized by joint development, mutual prosperity, and bidirectional promotion.

However, we still need to confront the significant gap between the technical vision of Web3 AI Agents and practical implementation. Currently, most projects are constrained by insufficient maturity of the technology stack, imbalanced virtual asset incentives, and ecological collaboration barriers, remaining in the proof-of-concept stage and struggling to form sustainable business loops. The cognitive biases of large language models and the asynchronicity of on-chain interactions raise doubts about decision reliability, while fragmented infrastructure further restricts the large-scale execution of complex strategies. Additionally, the current market shows a tendency to excessively hype technological narratives, with a prominent misalignment between the narrative heat of "AI + Web3" and actual demand. Some projects overly rely on AI concept hype without addressing core user pain points.

Breaking through this predicament requires collaborative innovation across technological, economic, and governance dimensions, addressing the structural contradictions between large models and blockchain, constructing regulatory frameworks that align with the characteristics of the intelligent economy, and finding precise matching points between market demand and technological supply. Only when the autonomy and economic viability of AI Agents are truly transformed into verifiable and sustainable business value can the intelligent revolution of the Web3 ecosystem cross the chasm and enter a substantive implementation phase. Let us look forward to and accelerate the arrival of that day together!

Author Introduction: Yu Jianing, Ph.D.

President of Uweb

Co-Chairman of the Blockchain Special Committee of the China Communications Industry Association

Executive Director of the Metaverse Industry Committee of the China Mobile Communications Federation

Honorary Chairman of the Hong Kong Blockchain Association

Former President of Huobi University

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。