Supporters of Bitcoin reserves are not wrong in their views on Bitcoin's potential long-term strategic role; the timing is just not right.

Written by: Christian Catalini, Co-founder of Lightspark

Translated by: Luffy, Foresight News

The United States is benefiting from what economists call "exorbitant privilege". As the issuer of the world's reserve currency, the U.S. can borrow in its own currency and support new spending. However, this does not mean that the U.S. can print money at will; government debt must still attract buyers in the open market. Fortunately, U.S. Treasury bonds are widely regarded as the safest assets in the world, with strong demand, especially in times of crisis, making them a common safe-haven option for investors.

Who benefits from this "exorbitant privilege"? First, U.S. policymakers gain additional flexibility in fiscal and monetary policy decisions. Second, banks, which are at the core of global capital flows, earn fees and gain influence. But the real winners are U.S. companies and multinational corporations, which can conduct business in their own currency and issue bonds and borrow at lower costs than foreign competitors. Consumers also benefit from stronger purchasing power, lower borrowing costs, and more affordable loans.

What is the result? The U.S. can borrow at lower costs, maintain higher deficits over the long term, and withstand economic shocks that might cripple other countries. However, this "exorbitant privilege" is not a given; it must be earned. It depends on the U.S.'s economic, financial, and geopolitical strength. Ultimately, the entire system relies on one key factor: trust. Trust in U.S. institutions, governance, and military power. Most importantly, trust that the dollar remains the safest place to store global savings.

All of this has a direct impact on the proposed Bitcoin reserves by the Trump administration. Supporters of Bitcoin reserves are not wrong in their views on Bitcoin's long-term strategic role; the timing is just not right. Currently, the real opportunity is not simply hoarding Bitcoin, but actively integrating Bitcoin into the global financial system to strengthen rather than weaken U.S. economic leadership. This means leveraging both dollar stablecoins and Bitcoin to ensure that the U.S. leads the next era of financial infrastructure.

Before exploring this, let’s first analyze the role of reserve currencies and their issuing countries.

The Rise and Fall of Reserve Currencies

History shows that reserve currencies belong to the dominant countries in the world economy and geopolitics. At their peak, dominant countries set the rules for trade, finance, and military power, granting their currencies global credibility and trust. From the Portuguese real in the 15th century to the dollar in the 20th century, reserve currency issuers have shaped markets and institutions, prompting other countries to follow suit.

However, no currency can hold a dominant position forever. Overexpansion, whether due to war, costly expansion efforts, or unsustainable social commitments, will ultimately erode credibility. The Spanish dollar, once buoyed by vast silver reserves from Latin America, gradually declined as Spanish debt mounted and economic mismanagement ensued. The Dutch guilder waned as endless wars drained Dutch resources. The French franc, dominant in the 18th and early 19th centuries, weakened under the pressures of revolution, the Napoleonic Wars, and poor financial management. The pound, once the cornerstone of global finance, gradually disintegrated under the weight of post-war debt and the rise of American industry.

The lessons of history are clear: while economic and military power may create a reserve currency, financial stability and institutional leadership ensure its status. Without these foundations, privilege disappears.

Is the Dollar's Dominance Coming to an End?

The answer to this question depends on the starting point in time. After World War II, through the Bretton Woods Agreement, the dollar solidified its status as the world's reserve currency, and signs of this had emerged even earlier when the U.S. became the primary global creditor after World War I. Regardless of the starting point, the dollar has dominated the world economy for over 80 years. By historical standards, this is a long time, but not unprecedented; the pound also ruled for about a century before its decline.

Today, some believe that U.S. global hegemony is unraveling. China's rapid advancements in artificial intelligence, robotics, electric vehicles, and advanced manufacturing signify a shift in power. Additionally, China holds significant control over critical minerals essential for shaping the future. Other warning signs are also emerging. a16z co-founder Marc Andreessen described the release of DeepSeek's R1 as an "AI Sputnik moment" for the U.S., a wake-up call indicating that America's leadership in emerging technologies is no longer secure. Meanwhile, China's expanding military capabilities in air, sea, and cyberspace, along with its growing economic influence, raise an urgent question: Is the dollar's dominance under threat?

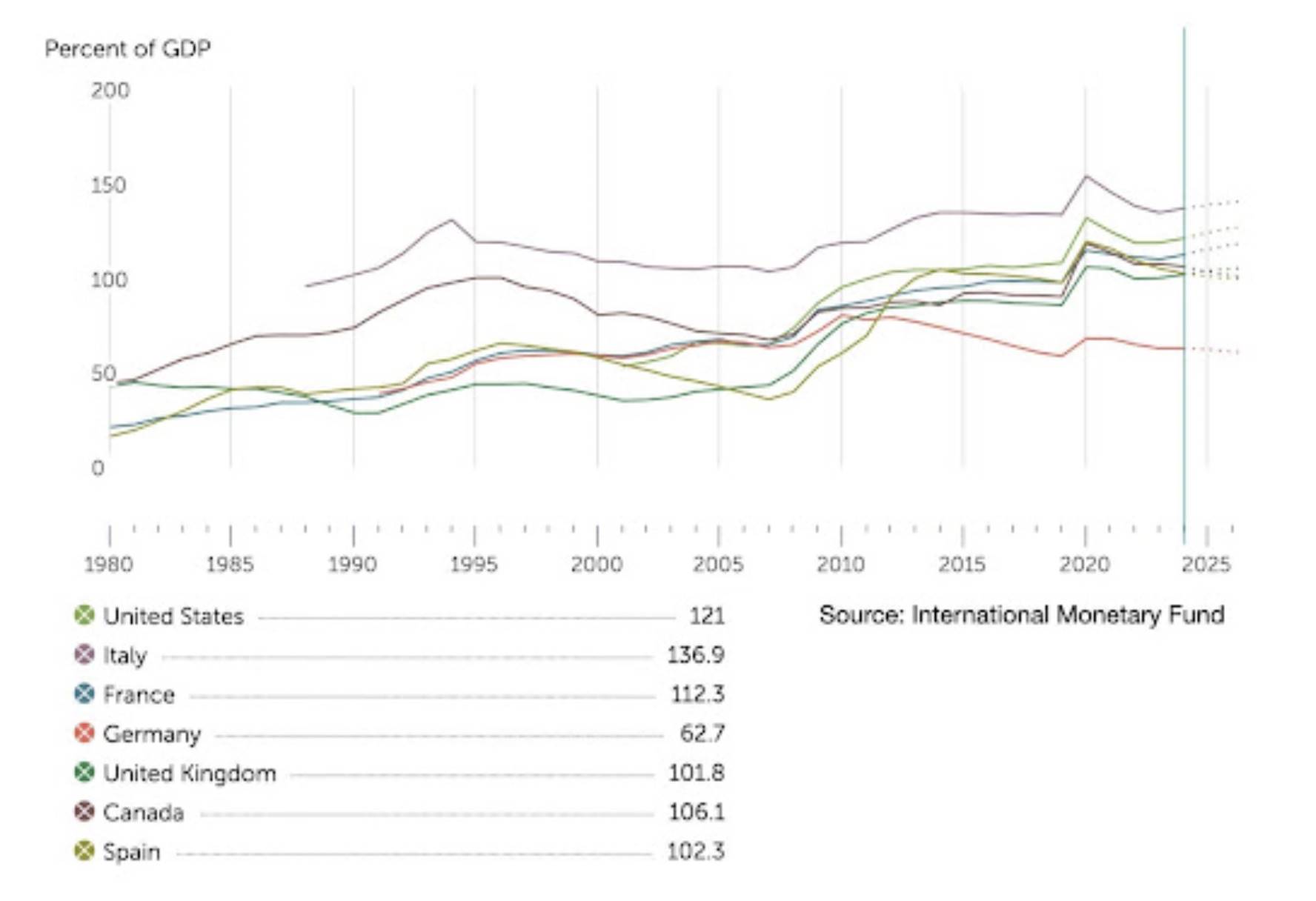

Percentage of debt to GDP for major economies. Data source: International Monetary Fund

The short answer is: not yet. Despite rising debt and misinformation suggesting the dollar is on the verge of collapse, the U.S. is not on the brink of a fiscal crisis. Indeed, the debt-to-GDP ratio is high, especially after increased spending during the pandemic, but it remains comparable to other major economies. More importantly, the vast majority of global trade is still conducted in dollars. The yuan is narrowing the gap with the euro in some international settlements, but it is far from replacing the dollar.

The real question is not whether the dollar will collapse; it will not. The real concern is whether the U.S. can maintain its lead in innovation and economic strength. If trust in U.S. institutions erodes, or if the U.S. loses competitive advantages in key industries, cracks in the dollar's dominance may begin to show. Those betting on the dollar's decline are not just market speculators but also geopolitical rivals of the U.S.

This does not mean that fiscal discipline is unimportant. It is extremely important. Reducing spending and improving government efficiency through the Department of Government Efficiency (DOGE) or other means would be a welcome shift. Streamlining outdated bureaucracies, removing barriers to entrepreneurship, and promoting innovation and competition can not only cut wasteful public spending but also enhance U.S. economic strength and solidify the dollar's position.

Coupled with ongoing breakthroughs in artificial intelligence, cryptocurrency, robotics, biotechnology, and defense technology, this approach could emulate the U.S. regulatory and commercialization model for the internet, driving a new wave of economic growth and ensuring that the dollar remains the undisputed reserve currency of the world.

Can Bitcoin Reserves Strengthen U.S. Financial Leadership?

This leads to the idea of a Bitcoin strategic reserve. Unlike traditional reserve assets, Bitcoin lacks the historical backing of state institutions and geopolitical power, but this is precisely the key. It represents a new paradigm: no state support, no single point of failure, fully globalized and politically neutral. Bitcoin offers an alternative that operates outside the constraints of the traditional financial system.

While many view Bitcoin as a breakthrough in computer science, its true innovation is more profound: it redefines how economic activities are coordinated and how value is transferred across borders. As a decentralized, trustless system (with its anonymous creator imposing no control), the Bitcoin blockchain serves as a neutral, universal ledger, an independent framework for recording global credit and debt without relying on central banks, financial institutions, political alliances, or other intermediaries. This not only makes it a technological advancement but also structurally changes the way financial coordination operates globally.

This neutrality gives Bitcoin a unique resilience against the debt crises and political entanglements that have historically led to the collapse of fiat currency systems. Unlike traditional currency systems that are deeply reliant on national policies and geopolitical changes, Bitcoin operates independently of any single government. This also gives it the potential to become a common economic language between countries that would otherwise resist financial integration or completely reject a unified ledger system. For example, the U.S. and China are unlikely to trust each other's payment channels, especially as financial sanctions increasingly become powerful tools of economic warfare.

So how will these divided systems interact? Bitcoin could become a bridge: a globally accepted settlement layer with minimal trust requirements, connecting otherwise competing economic realms. When this vision becomes a reality, the U.S. holding strategic Bitcoin reserves would undoubtedly make sense.

But we have not reached that point yet. To move Bitcoin beyond the realm of an investment asset, critical infrastructure must be developed to ensure scalability, establish a modern compliance framework, and provide seamless integration channels with fiat currencies for mainstream adoption.

Supporters of Bitcoin reserves are not wrong in their views on its potential long-term strategic role; the timing is just not right. Let’s clarify the reasons.

Why Do Countries Maintain Strategic Reserves?

The reasons countries reserve strategic materials are simple: in a crisis, the ease of obtaining materials is more important than price. Oil is a typical example; while futures markets can hedge prices, when supply chains are disrupted by war, geopolitics, or other disturbances, no amount of financial instruments can replace the physical oil on hand.

The same logic applies to other essentials, such as natural gas, food, medical supplies, and increasingly important critical raw materials. As the world transitions to battery-driven technologies, governments are already stockpiling lithium, nickel, cobalt, and manganese to prepare for future shortages.

The same goes for currencies. Countries burdened with significant foreign debt hold dollar reserves to extend debt maturities and guard against currency crises. But the key difference is that currently, no country is burdened with significant Bitcoin debt, at least not yet.

Bitcoin supporters argue that Bitcoin's long-term price trajectory makes it an obvious reserve asset. If the U.S. buys in now, the value of this investment could multiply as Bitcoin adoption increases. However, this approach aligns more with the strategies of sovereign wealth funds, which focus on capital returns rather than reserve strategies critical to national security. It is more suited for resource-rich but economically imbalanced countries seeking asymmetric financial gains or for countries with weak central banks hoping Bitcoin can stabilize their balance sheets.

So what about the U.S.? It currently does not need Bitcoin to keep its economy running, and despite President Trump's recent announcement of a sovereign wealth fund, cryptocurrency investments may primarily be left to private markets for effective allocation. The strongest argument for establishing Bitcoin reserves is not out of economic necessity but rather for strategic positioning. Holding reserves could signal that the U.S. is decisively betting on leading the cryptocurrency space, establishing a clear regulatory framework, and positioning itself as a global hub for decentralized finance (DeFi), just as it has dominated the traditional financial sector for decades. However, at this stage, the costs of such a move may outweigh the benefits.

Why Bitcoin Reserves May Backfire

Beyond the logistical challenges of accumulating and securing Bitcoin reserves, a larger issue lies in perception, and the costs could be high. In the worst-case scenario, this could signal a lack of confidence in the U.S. government's ability to maintain its debt, a strategic misstep that could give geopolitical rivals like Russia and China an advantage, as these countries have long sought to undermine the dollar's position.

Russia is not only promoting de-dollarization abroad, but its official media has been spreading doubts about the stability of the dollar and predicting its imminent decline for years. Meanwhile, China has taken a more direct approach by expanding the influence of the yuan and its digital payment infrastructure, including the domestically focused digital yuan, challenging the U.S.-dominated financial system, especially in cross-border trade and payments. In the global financial arena, perception is crucial. Expectations not only reflect reality but also shape it.

If the U.S. government begins to accumulate Bitcoin on a large scale, the market may interpret this as a hedge against the dollar itself. Just this perception could prompt investors to sell off dollars or reallocate capital, thereby weakening the dollar's position. In the global financial realm, belief drives behavior. If enough investors begin to doubt the stability of the dollar, their collective actions could turn that doubt into reality.

U.S. monetary policy relies on the Federal Reserve's ability to manage interest rates and inflation. Holding Bitcoin reserves could send contradictory signals: if the government is confident in its economic tools, why would it need to hold an asset that is not controlled by the Federal Reserve?

Could Bitcoin reserves alone trigger a dollar crisis? Highly unlikely. But they may also fail to strengthen the existing system. In geopolitics and finance, unnecessary missteps often come at the highest cost.

Strategic Leadership, Not Speculation

The best way for the U.S. to reduce its debt-to-GDP ratio is not through speculation but through fiscal discipline and economic growth. History shows that reserve currencies do not last forever; those that decline often do so due to poor economic management and overexpansion. To avoid repeating the mistakes of the Spanish dollar, the Dutch guilder, the French livre, and the pound, the U.S. must focus on sustainable economic strength rather than risky financial bets.

If Bitcoin were to become a global reserve currency, the U.S. would be the biggest loser. The transition from a dollar-dominated system to a Bitcoin-based one would not be smooth. Some believe that the appreciation of Bitcoin could help the U.S. "repay" its debts, but the reality would be much harsher. Such a shift would make it more difficult for the U.S. to finance its debt and maintain its economic influence.

While many believe that Bitcoin will never become a true medium of exchange or unit of account, history tells a different story. Gold and silver are valuable not only because they are scarce but also because they are divisible, durable, and portable, making them effective currencies, much like Bitcoin today. Similarly, early Chinese paper money did not initially emerge as a government-mandated medium of exchange. It evolved from commercial promissory notes and deposit certificates, which represented already trusted forms of value storage before gaining wider recognition as a medium of exchange.

Fiat currencies are often seen as exceptions to this model; once declared legal tender by the government, they immediately function as a medium of exchange and later become a store of value. But this oversimplifies reality. The power of fiat currency comes not only from legal stipulations but also from the government's ability to enforce taxation and fulfill debt obligations through that power. Currencies backed by countries with strong tax bases have intrinsic demand because businesses and individuals need them to settle debts. This taxing power allows fiat currencies to maintain value even without direct commodity backing.

However, even fiat currency systems are not built from thin air. Historically, their credibility stems from commodities that people already trust, most notably gold. Paper money was accepted because it could once be redeemed for gold or silver. The shift to purely fiat currency occurred only after decades of trust had been reinforced.

Bitcoin is following a similar developmental trajectory. Today, it is primarily viewed as a store of value, highly volatile, but increasingly regarded as "digital gold." However, as adoption expands and financial infrastructure matures, Bitcoin's role as a medium of exchange may follow. History shows that once an asset is widely recognized as a reliable store of value, the transition to functional currency is a natural process.

This presents significant challenges for the U.S. While there are some policy levers, Bitcoin is largely beyond traditional national control over currency. If it gains recognition as a global medium of exchange, the U.S. will face a harsh reality: the status of reserve currency cannot be easily relinquished.

This does not mean the U.S. should resist or ignore Bitcoin; on the contrary, it should actively engage with and shape Bitcoin's role in the financial system. However, simply buying and holding Bitcoin for price appreciation is not the answer. The real opportunity is greater but also more challenging: to integrate Bitcoin into the global financial system in a way that reinforces U.S. economic leadership.

The U.S. Bitcoin Platform Strategy

Bitcoin is the most mature cryptocurrency, unparalleled in security and decentralization. This makes it the strongest candidate for mainstream adoption, first as a store of value and ultimately as a medium of exchange.

For many, Bitcoin's appeal lies in its decentralized nature and scarcity, which drive its price up as adoption accelerates. But this is a narrow view. While Bitcoin will continue to appreciate during its adoption phase, for the U.S., the real long-term opportunity lies not just in holding it but in actively guiding its integration into the global financial system and establishing itself as the international center for Bitcoin finance.

For every country except the U.S., simply buying and holding Bitcoin is a perfectly viable strategy that can accelerate Bitcoin adoption and yield financial returns. But the stakes for the U.S. are much more complex, requiring more action. It needs a different approach that not only maintains its role as the issuer of the world's reserve currency but also drives large-scale financial innovation based on the dollar as a "platform."

The key precedent here is the internet, which transformed the economic landscape by shifting information exchange from proprietary networks to open networks. Today, the U.S. government faces choices similar to those of businesses before the advent of the internet, as the financial landscape shifts toward more open and decentralized infrastructure. Just as companies that embraced the open architecture of the internet thrived while those that resisted were ultimately eliminated, the U.S.'s attitude toward this transition will determine whether it maintains global financial influence or cedes ground to other countries.

The first major pillar of a more ambitious, forward-looking strategy is to view Bitcoin as a network, not just an asset. As open, permissionless networks drive the construction of new financial infrastructure, existing enterprises must be willing to relinquish some control. However, by doing so, the U.S. can unlock significant new opportunities. History shows that countries that adapt to disruptive technologies strengthen their positions, while those that resist ultimately fail.

The second key pillar that complements Bitcoin is to accelerate the adoption of dollar stablecoins. With appropriate regulation, stablecoins can reinforce public-private partnerships that have supported U.S. financial dominance for over a century. Stablecoins will not undermine the dollar's supremacy; rather, they can solidify it, expand the dollar's influence, enhance its utility, and ensure its relevance in the digital economy. Furthermore, compared to slow-moving, bureaucratic central bank digital currencies or the vaguely defined unified ledgers of the Bank for International Settlements' "financial internet," stablecoins offer a more flexible and agile solution.

However, not every country is willing to adopt dollar stablecoins or operate entirely within the U.S. regulatory framework. This is where Bitcoin plays a critical strategic role, serving as a bridge between the core dollar platform and non-geopolitical allied economies. In this context, Bitcoin can act as a neutral network and asset, facilitating capital flows while reinforcing the U.S.'s core role in global finance, thereby preventing the U.S. from ceding ground to competing currencies like the yuan.

If the U.S. successfully implements this strategy, it will become the center of Bitcoin financial activity, thereby gaining greater influence and guiding these capital flows according to American interests and principles.

This is a subtle but feasible strategy that, if effectively implemented, could extend the dollar's influence for decades. Rather than simply hoarding Bitcoin reserves, which could imply doubts about the dollar's stability, the U.S. should strategically integrate Bitcoin into the financial system, promoting the development of the dollar and dollar stablecoins on the network, positioning the U.S. government as an active manager rather than a passive observer.

What are the benefits? A more open financial infrastructure, while the U.S. still controls the "killer app"—the dollar. This approach is similar to that of companies like Meta and DeepSeek, which set industry standards through open-source AI models while achieving profitability in other areas. For the U.S., this means expanding the dollar platform and ensuring interoperability with Bitcoin, ensuring that in a future where cryptocurrencies play a core role, the dollar remains relevant.

Of course, like any initiative to respond to disruptive change, this strategy carries risks. But the cost of resisting innovation is obsolescence. If any administration can successfully implement this strategy, it is this one, which possesses deep expertise in platform competition and clearly understands that maintaining a leading position is not about controlling the entire ecosystem but about how to extract value from it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。