Author: Niu Xiaojing, Xu Xiaohui

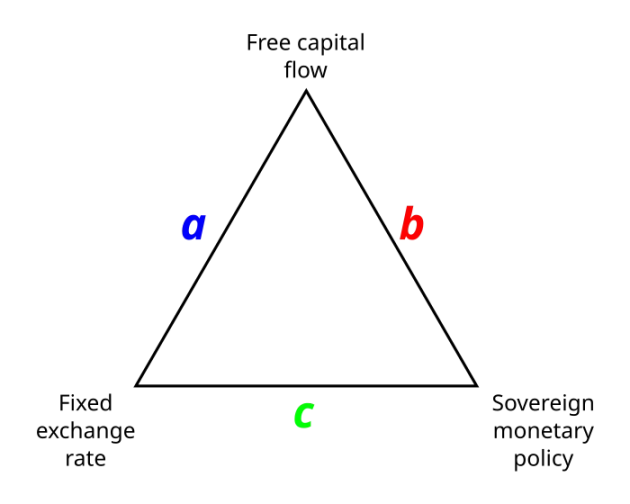

Many friends may have heard of the "Mundellian Trilemma" in international finance, also known as the trilemma, which states that a country cannot simultaneously achieve the following three objectives:

- Capital mobility

- Exchange rate stability

- Monetary policy independence

A similar "trilemma" phenomenon is also prevalent in other fields. For example, the process of withdrawing cryptocurrency (converting cryptocurrency into fiat currency and cashing out) also faces a "trilemma." Here, the "impossible triangle" can be described as: high security, high convenience, and low cost. These three elements are often difficult to achieve simultaneously, yet they constitute the core needs of users.

So, can the OTC (Over-The-Counter) trading in Hong Kong's cryptocurrency sector alleviate this contradiction or even break this constraint? The following will analyze the performance of the Hong Kong OTC market in this "impossible triangle."

Analysis of the Advantages and Disadvantages of the Hong Kong OTC Market

Security

Fund security: Currently, Hong Kong's digital currency OTC market is not fully regulated. These OTC traders typically do not fall under the jurisdiction of the Hong Kong Money Service Operators (MSO) or the Hong Kong Securities and Futures Commission (SFC). However, some merchants hold money exchange licenses (regulated by Hong Kong Customs), making them somewhat more reliable.

According to the public consultation document released by the Hong Kong government titled "Legislative Proposals for Regulating Virtual Asset OTC Trading" (hereinafter referred to as the "Virtual Asset OTC Consultation Document"), Hong Kong Customs will issue licenses to virtual asset OTC service providers in the future, requiring all service providers to operate with a license. The introduction of this regulatory framework is expected to enhance industry transparency and reduce the risk of non-compliance.

However, due to the lack of effective regulation, OTC trading still carries certain risks. For example, some customers' bank cards have been frozen by Hong Kong banks after receiving remittances from OTC merchants. To mitigate such risks, users should prioritize choosing merchants that hold money exchange licenses or are certified by large exchanges (such as Binance or OKX).

Personal information security: Personal information leakage is a major hidden danger in Hong Kong's OTC industry. Since 2012, Hong Kong exchange shops have implemented a real-name system, requiring customers to provide real-name information before transactions. By 2023, the requirements for renminbi exchange have further included:

- Customer's own Hong Kong bank account

- Customer's own Chinese bank account

- Customer's Hong Kong-Macau travel permit

Some exchange companies even require the provision of fund flow from domestic bank cards. This personal information is kept by each exchange shop, lacking a unified platform and strict regulation, which significantly increases the risk of information leakage.

Under the existing legal framework in Hong Kong, the confidentiality requirements for the exchange shop industry are far less comprehensive than those in banking, securities, and insurance sectors, and information checks do not require judicial authorization. This poses a significant risk for high-net-worth clients. Therefore, it is crucial to choose compliant and reputable merchants.

Exchange Costs

Spread and fees: The spread for OTC trading is usually higher, around 1%-3%. Compared to publicly listed trading on exchanges, OTC trading costs more, but it offers flexibility in trading scale and speed.

Advantages for large transactions: For large transactions, the spreads and fees in the OTC market are usually lower than those on exchanges. Some service providers can adjust rates based on customer needs, offering more attractive cost solutions for large clients.

Bargaining space and hidden costs: The flexibility of the OTC market allows users to negotiate prices with merchants. Loyal customers may enjoy additional discounts. Moreover, compliant platforms typically provide transparent rate quotes to avoid hidden fees. However, on informal platforms, customers may face increased burdens through opaque exchange rates or additional fees.

Convenience

OTC market transactions are relatively convenient.

Flexible trading hours: Most well-known OTC platforms offer 24/7 service, allowing users to complete transactions at any time.

Quick processing of large transactions: The OTC market supports large transactions at the million-dollar level without worrying about market slippage (price fluctuations due to changes in trading volume). This is particularly important for institutions or high-net-worth clients.

Offline trading network: Several financial center areas in Hong Kong (such as Central) have physical OTC counters, and it is recommended that users with large exchange needs complete transactions in-store.

Summary by Lawyer Mankun

The OTC trading market in Hong Kong cannot break the "high security, high convenience, low cost" trilemma, but its flexibility, diverse services, and unique geographical advantages have alleviated the withdrawal difficulties faced by cryptocurrency investors to some extent.

At the same time, as the Hong Kong government gradually introduces a regulatory framework for virtual asset trading, the security and transparency of the OTC market are expected to improve further. However, users still need to be cautious when choosing traders, prioritizing compliant platforms or reputable merchants, weighing the trade-offs between security, convenience, and cost, and finding the most suitable solution for themselves to avoid potential risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。