Trump returns, eliminating corruption, the doghouse of the Ma public, killing all around.

Written by: Grandpa Zuo of Crooked Neck Mountain

Originally thought that map expansion was exclusive to small islands, but unexpectedly, world-class hegemons would follow this old example; originally thought that the ETH L2 ecosystem was chaotic enough, but the world trade system has gradually shattered; originally thought that Web3 settlement was just a dream, but stablecoins have become a new pillar.

On February 1, 2025, Trump began to "fulfill his promises," increasing tariffs on Mexico and Canada, with an additional 25% tariff on goods imported from the two countries, except for Canadian energy products.

Although Trump's style has always been extreme pressure, the final tariffs may not necessarily be 100% realized, but once the bow is drawn, there is no turning back. The core economic idea of Trump 2.0 is to replace "domestic taxes" with tariffs, bringing America back to the good old days without the IRS.

Of course, Americans are not foolish enough to believe Trump's rhetoric, thinking that increasing tariffs and price stability can coexist. In a fully deindustrialized America, any product is an import; it’s just that from the halls of power to the grassroots, a quasi-war state has already entered, and temporary pain is necessary to win the final victory.

Cryptocurrency Wartime Economy

After the start of Tariff War 2.0, the cryptocurrency market was the first to bear the brunt, with Bitcoin dropping to 97,000, and the entire market entering a downward cycle, just like the weak A-shares of the past.

Theoretically, the cryptocurrency market is a global market. Even if one is not optimistic about America's tariff war against the world, there should be massive funds entering the market for hedging. However, this all hinges on the fact that the crypto space is indeed a global market.

Unfortunately, the emergence of DeepSeek has shattered the stereotype that U.S. stocks are the global market. If everyone has a good memory, they will recall that not long ago, on December 26, 2024, when DeepSeek V3 released its technical report, the crypto space was the first industry to accept and recognize its advancements, even before the general public.

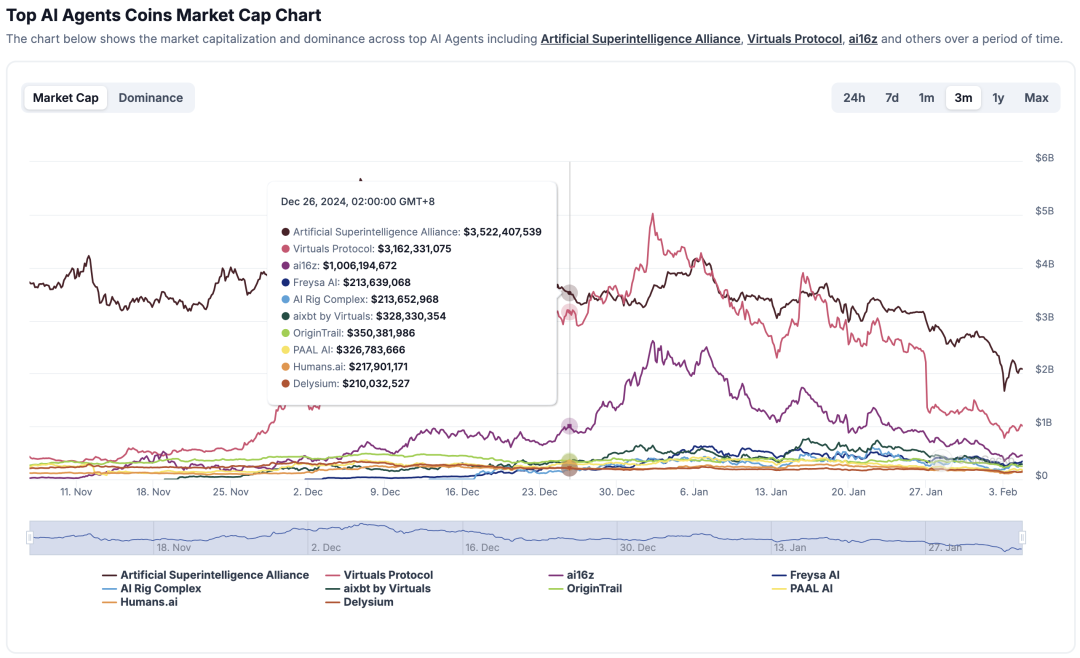

Image caption: Overall trend of AI Agent. Image source: CoinGecko

At this time, AI Agent was still thriving. The real crisis lies in the simultaneous launch of $TRUMP and DeepSeek R1. From January 17 to January 20, in just three days, the world experienced two shocks: the president would really issue a coin, and Chinese AI would temporarily lead the U.S.

Or to put it this way, the narrative of AI Agent in the crypto space is built on two premises:

The U.S. AI is unparalleled globally; AI Agent is primarily a Pax Americana AI Agent, requiring OpenAI to maintain its lead algorithmically, and Nvidia chips are irreplaceable in hardware;

AI Agent has not generated real profits and has not attracted real users; the liquidity siphoned off by $TRUMP will not mindlessly flow back, remaining a narrative economy rather than a PMF product.

The world line converges, returning to the trade war.

In the face of the sharp decline of giants like Nvidia and the Magnificent 7 in U.S. stocks, the AI Agent track, as well as the chaos of the Ethereum Foundation and Binance, seem insignificant.

Nvidia's chips and Bitcoin's price, if these are the Plan A and B of America's revitalization plan, are currently under scrutiny. The only solution is to re-establish global capital market confidence in the U.S.

Tariffs and trade wars will only be the first axe; the core issue is the rise of U.S. stocks and interest rate cuts. Domestically, the U.S. needs to cut interest rates to stabilize the economy, but at the same time, as a global financial power, the stock market cannot have any issues, and it can only rise, not fall. Therefore, there will only be one option: U.S. stocks must rise.

In normal economic theory, these two options are not easily compatible, but the miraculous $TRUMP can bypass the existing fiscal-monetary system, while tariffs and trade wars will create government revenue in the short term. With Musk's layoffs, the remaining funds can only be funneled into the capital market, unless someone really opens a factory in the U.S.

In this system, the short-term impetus is that tariffs need to be effective, so it can be inferred that even if Canada compromises with Trump, his tariffs against the world will only intensify.

In the long run, the fiscal role of cryptocurrencies will be inevitable; either the dollar—the Federal Reserve system—will shed its nominal independence and reach closer political cooperation with Trump, or the Trump administration will continue to use unconventional means to "command" the dollar.

However, there is no doubt that for cryptocurrencies themselves, the current driving force is no longer blockchain technology or the concept of decentralization. After all, Vitalik himself admits to having ultimate control over the Ethereum Foundation. The true rulers of the crypto space are now real political forces; the largest CEX must take sides, the issuers and operators of USDT must take sides, and even every trader must make their own choice.

A wartime state has quietly come true in 2025.

Two Worlds

Looking ahead to the main theme of 2025, the fragmentation of world trade has become a reality. Regionalization has effectively replaced the old globalization centered on the U.S. and the WTO mechanism; the only thing left is that the dollar remains the global currency.

In fact, Trump has repeatedly warned BRICS countries not to challenge the dollar's status, but everyone understands that if the U.S. does not participate in global trade, it is very strange to use the currency of non-trade countries. However, everyone also understands that no country or organization has a currency that can challenge the dollar's status.

This entanglement is rare in the world.

There have been attempts with blockchain technology, such as mBridge, which involves the Bank for International Settlements (BIS), focusing on settlements between CBDCs. Central banks and enterprises from multiple countries and regions, including the People's Bank of China and the Central Bank of the UAE, have already tried it;

However, the BIS cannot bridge the divided world. The BIS has withdrawn from the mBridge project, and the reason is simple: too many BRICS countries are involved, and the BIS fears being accused by the West of helping Russia and other countries evade sanctions. The BIS can only launch the Agorá project, with participants from South Korea, Japan, the EU, etc., making it clear that the East and West are distinctly divided.

Web3 projects continue to advance, with the PayFi concept entering a long-term construction phase. Huma Finance hopes to facilitate cross-border settlements for enterprises in the post-Ripple era, and the means, of course, can only be stablecoins. However, the power of a single project is ultimately limited, and B2B has become the mainstream choice, ultimately disconnected from ordinary people.

Super individuals in Web3 are at a loss. In the era of explosive CEX growth, holding onto Bitcoin, Ethereum, or even BNB could outperform, but in the PVP era, super individuals must face the ultra-fast reactions of robots, the predatory tactics of coin issuance groups, and the unscrupulous PUA of rogue VCs. The old world has ultimately faded away.

Last year, Web3 settlement based on stablecoins might have been the biggest trend in the industry, but now it is hard to say. After the AI Agent cooled down, the entire industry has entered a boring and lengthy soap opera mode, starting a mode of complaining about family matters. VCs lament their 6x returns, while CEXs claim to have achieved a platform token market cap of 100 billion and a trading volume of 100 trillion.

Conclusion

There is no true empathy in this world; humans cannot empathize with their peers. However, before the epic correction of U.S. stocks, I hope we still have one more chance for ourselves.

From any perspective, this DeepSeek surprise attack is just a rehearsal for the next long and protracted war. I hope that before this, we can all be well-prepared.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。