I have never seen someone who has studied the crypto market for years end up not making money.

Author: Aylo | Blockchain in Plain Language

First of all, this cycle is indeed very difficult; don't let anyone fool you into thinking it isn't. But the reality is that each cycle is harder than the last. The number of market participants is increasing, competition is becoming fiercer, and veteran players are more astute, leading to more failures.

If you didn't heavily invest in BTC or SOL during the bear market, it's highly likely you didn't make any money and may even be feeling frustrated. If I weren't pricing in SOL myself, I would probably be struggling as well.

Yes, there are indeed some individual big winners this cycle, but I bet that if you heavily gambled on these assets, you would likely end up giving back a portion or even most of your profits. After all, most people don't stop after making a big profit; they always feel that "the cycle isn't over yet" and want to take another gamble, resulting in giving back the money they earned.

The principle of "playing silly games, winning silly prizes" always applies; it's just that for traders and gamblers, this process is sometimes prolonged.

So why is this cycle so difficult?

01

Post-Traumatic Stress Disorder (PTSD)

In the past two major cycles of altcoins, most coins experienced a 90-95% crash. The collapse of Luna and FTX further exacerbated the chain reaction in the industry, causing the market to drop more severely than expected. Many heavyweight players were liquidated, and crypto lending platforms have yet to recover.

This "PTSD" has deeply affected native crypto users. In this cycle, the trading patterns in the altcoin market largely reflect a mainstream view—"all projects are scams." In the past two crypto market cycles, people generally believed that "this technology represents the future." But in the current cycle, this belief has significantly weakened or even been destroyed, and many no longer believe in the long-term prospects of the crypto industry. Instead, the view that "everything is a scam" has become one of the mainstream perceptions.

No one dares to hold any assets for the long term because they don't want to experience the pain of having their assets halved or even wiped out again. This has led to an extreme "cutting leeks cycle" (Max Jeet Cycle)—everyone is thinking about making a quick exit, treating others as the ones to take over.

Social media (crypto tweets on X) has further intensified this emotional trading, with market participants searching for the cycle's peak every day, leading to more extreme fluctuations in market sentiment.

This psychological impact is not only reflected in trading behavior but also affects the construction and investment methods of the entire ecosystem. Nowadays, projects face stricter scrutiny, and the trust threshold has significantly increased. This brings a dual impact: on one hand, it helps filter out obvious scams; on the other hand, it makes it harder for genuinely valuable projects to gain attention and development opportunities.

02

Innovation

Current innovations are more iterative; infrastructure is continuously optimized, but there are no disruptive 0→1 breakthroughs like when DeFi was born, nor are there any major advancements that are eye-catching. This makes the view that "the crypto industry has no substantial progress" resonate more easily, while also giving rise to more narratives like "the crypto industry has achieved nothing."

The entire innovation landscape has shifted from revolutionary breakthroughs to incremental improvements. While this aligns with the natural laws of any technological development, this change poses new challenges for a market that relies on narrative-driven dynamics.

Moreover, we still lack true "killer applications"—those groundbreaking products that can push on-chain user scales to hundreds of millions.

03

Regulation

The previously overbearing SEC has caused tremendous chaos in the industry, severely hindering development. Especially in DeFi, which could have attracted a broader user base and found product-market fit (PMF), it has been choked at the neck and failed to grow further. Additionally, the SEC has forcibly prevented all governance tokens from conveying value to holders, ultimately shaping the market narrative that "these tokens are worthless," which to some extent has indeed become a reality.

The SEC has not only driven away a large number of developers (for example, Andre Cronje publicly stated that the SEC's crackdown forced him to completely exit the industry) but also blocked the integration of traditional finance (TradFi) with the crypto industry, ultimately forcing the entire industry to rely on venture capital (VC) financing. This has directly led to an imbalance in supply and demand structures, distorted price discovery mechanisms, and allowed market value to be tightly controlled by a few institutions.

However, the market is now witnessing some positive changes. With more and more projects appearing in public sales, the crypto industry is gradually breaking free from the shackles imposed by the SEC.

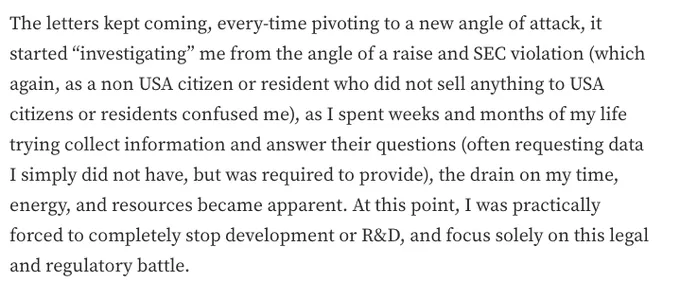

Excerpt from Cronje's experience negotiating with the SEC

Translation: Those letters kept coming, each time with a new angle of attack. Initially, they launched an "investigation" against me on the grounds of financing and SEC violations, which left me very confused—after all, I am neither a U.S. citizen nor a U.S. resident, and I have not sold anything to U.S. citizens or residents.

I spent weeks or even months trying to gather information and answer their questions (many of which were data they requested that I simply couldn't have). This torment took a huge toll on my time, energy, and resources. At this stage, I was almost forced to completely stop development and research, focusing all my attention on this legal and regulatory battle.

04

Financial Nihilism

All of the above factors have collectively driven the prevalence of "financial nihilism" in this cycle. The essence of financial nihilism is losing faith in the market but having to play anyway. Since one sees through everything, one might as well speculate to the end; if there's a chance to make a profit, even betting on Memecoins is better than holding onto something foolishly.

The narrative of "useless governance tokens," combined with the high FDV and low float caused by the SEC, has led many native crypto users to completely abandon the fantasy of long-term holding and turn to Memecoins in search of more "fair" opportunities.

Moreover, in reality, young people seeking upward mobility can almost only rely on gambling-style investments. Asset prices are soaring, while wages are being left far behind by the endless devaluation of fiat currency, making Memecoins, as a "crypto version of a lottery," particularly attractive. The core value of a lottery has never been the odds but the hope it carries, which is why it has always drawn people in.

Due to the natural market fit of gambling culture in the crypto market, and the increasing maturity of related technologies (like Solana and Pump.fun), the issuance of new tokens has seen explosive growth. Essentially, the core logic behind all this is simple—there are a large number of users in the market eager for extreme speculation, and demand drives the market.

There has always been a saying in the crypto market about "struggling on the front lines," but in this cycle, this concept has been widely recognized.

This nihilistic investment mentality is reflected in several aspects:

· The rise of all-in speculation culture entering the mainstream

· Investment cycles further shortened

· Trading behavior leaning more towards short-term speculation rather than long-term investment

· The prevalence of extreme leverage and high-risk operations

· A "whatever" attitude towards fundamental analysis

05

Past cycle experiences have become obstacles

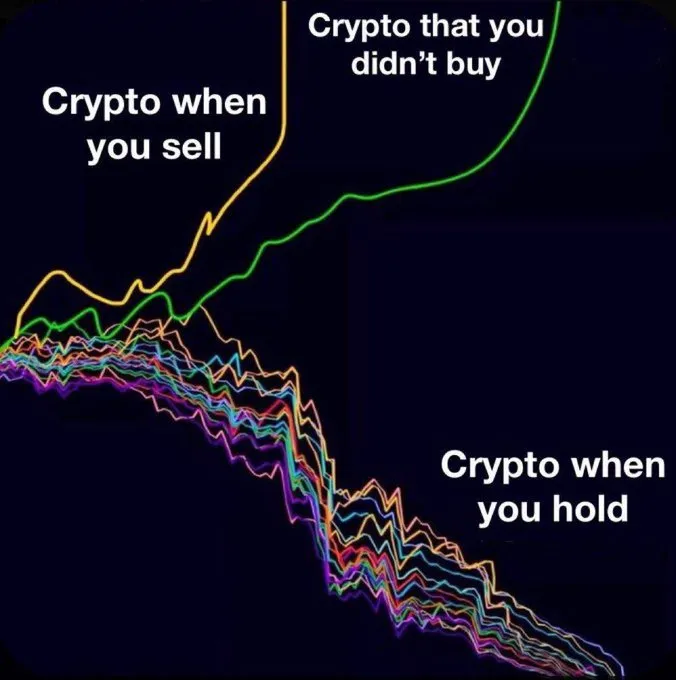

Past cycles have taught investors that as long as they buy some altcoins during a bear market, they will eventually achieve returns that surpass BTC.

Almost no one is a naturally excellent trader, so for most people in past cycles, the safest strategy has been to hold—after all, even the worst altcoins will eventually see a wave of price increases.

But this cycle is entirely a trader's market, more favorable to sellers than to long-term holders. Traders even seized the biggest profit opportunity of this cycle through HYPE airdrops.

The market narratives of this cycle generally have a short lifespan and lack sufficiently compelling themes. Market participants are more mature than ever, adept at extracting value more efficiently, so the local bubbles in altcoins have not been inflated to extremes like in the past.

Take the first round of speculation around AI agents as an example—this may be the first time the market truly feels, "this is the new narrative we've been waiting for." However, we are still in the very early stages, and long-term winners may not have truly emerged yet.

06

BTC has attracted new buyers, while most altcoins have not

The differentiation between Bitcoin and other crypto assets has never been as pronounced as it is now.

BTC has successfully attracted buying interest from traditional finance (TradFi), gaining a strong and sustained source of passive demand. Some central banks have even begun discussing incorporating BTC into their balance sheets.

In contrast, altcoins are finding it harder than ever to compete with BTC. This is not hard to understand—BTC has a clear growth target ahead, which is to challenge the market value of gold, while altcoins lack a similar grand narrative.

Altcoins have almost no new buyers. Although some retail investors have re-entered the market after BTC hit an all-time high (but they bought XRP), overall, the inflow of new retail funds remains limited, and the negative reputation of the crypto industry persists.

07

The role of ETH has transformed

The decline in BTC's market share is mainly influenced by the growth of ETH's market capitalization.

In past cycles, the rise of ETH was often seen as a signal for the start of "altcoin season," but this rule of thumb has not worked in this cycle. The fundamental reason is that ETH's performance has been poor and weighed down by fundamental factors.

Many traders and investors are confused because ETH is no longer the trigger for the market to take on more risk; instead, it has become a sign of the end of many mini alt-seasons, which is completely different from past market rhythms.

Although many narratives and sectors have independently launched and operated without ETH's involvement, many traders still firmly believe that ETH needs to rise to kick off a true alt season.

Of course, the reasons for market changes are far from limited to these, but these are some key points that came to mind while I was sipping coffee and clearing my thoughts.

So, what should we do next? Work either harder or smarter.

I still believe that, in the long run, fundamentals will ultimately determine everything. But the premise is that you must truly understand the projects you support and how they can actually surpass BTC. There are indeed some potential candidates in the current market, but their numbers are still limited. Look for projects with the following characteristics:

· Clear profit model · True product-market fit (PMF) · Sustainable token economic model · Strong fundamentals supported by compelling narratives (currently, AI and RWA are two fields that meet this standard)

I believe that as the regulatory environment in the U.S. changes, projects with strong fundamentals and PMF will eventually be able to convey value to tokens, making them relatively more robust investment choices. Those protocols capable of generating stable income are currently in a good development cycle. This stands in stark contrast to the past token models dominated by the "greater fool theory."

If your strategy is to "wait for retail investors to enter before dumping," then you may find yourself in trouble. The market has evolved and no longer solely relies on retail to drive cycles, and more astute funds often position themselves in advance and exit these obvious strategies.

Possible strategic directions:

1) Become a better trader

Try to establish a trading edge, focusing on short-term trading, as there are still many stable short-term opportunities in the current market.

On-chain trading, while offering higher returns, also comes with greater volatility and is not suitable for those with low stress tolerance.

2) The "barbell portfolio" still applies (suitable for most people without a clear trading edge)

Allocate 70-80% of funds to BTC & SOL, leaving a small portion for more speculative investments.

Regularly rebalance to maintain a reasonable asset allocation.

3) Assess your available time and adjust your strategy

If you are just an ordinary person with a job and cannot spend all day in the market, you cannot compete with young traders who sit in the trenches for 16 hours a day.

However, passively holding underperforming altcoins and waiting for the market to turn in your favor is also not an effective strategy.

4) Explore diversification strategies (combine different fields to improve win rates)

Core portfolio (BTC & SOL) + low-risk arbitrage strategies (such as airdrop mining, which, although more challenging now, still presents opportunities).

Position yourself in new ecosystems that are not yet mature, such as HyperLiquid, Movement, Berachain, etc.

Deepen your expertise in a specific niche and become an expert in that sector.

08

The altcoin market still has room for growth, but competition is fiercer

I still believe that the altcoin market will have room for growth in 2025, and the overall market environment will still be influenced by the global liquidity cycle. However, only a few sectors and projects are likely to significantly outperform BTC & SOL. Moreover, the rhythm of altcoin rotation will be faster, meaning investors need to adjust their positions more keenly.

If the market truly experiences a crazy monetary easing, we might see a repeat of past altcoin bull markets, but I believe the likelihood of this happening is lower than it not happening. Even if it does occur, the gains of most altcoins will only be at the market average level, and will not take off across the board like in the past.

This year, there are still many altcoin projects set to launch, and market liquidity will continue to be diluted and dispersed, which is something to pay special attention to.

09

Conclusion: A glimmer of hope

I have never seen someone who has seriously studied the crypto market for years end up not making money.

There are still many opportunities in the market, and the growth in this field remains promising. After all, I don't understand any more than others; I just continuously adjust myself based on the realities of this cycle.

One thing is very clear—we are no longer at the beginning of a bull market. Whether you have made money or not, the bull market has lasted a long time, and this fact will not change.

"Control the downside risk, and the upside will naturally follow." This saying always applies.

Original title: Why has this cycle been so hard?

Original link: https://www.alphaplease.com/p/why-has-this-cycle-been-so-hard?utmsource=%2Finbox&utmmedium=reader2

Original author: Aylo

Translation: Blockchain in Plain Language

Article link: https://www.hellobtc.com/kp/du/02/5659.html

Source: https://mp.weixin.qq.com/s/CzU-Rj8MDjapj0Al7DNw

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。