The current cryptocurrency market is dominated by hype, often overlooking projects with real applications and sustainable value. Investors should focus on fundamentals rather than short-term gimmicks to promote healthy industry development.

Author: Henri

Translation: Baihua Blockchain

In today's cryptocurrency market, a "wild land" filled with frenzy and hype, gimmicks often overshadow logic. From a market valuation perspective, projects endorsed by celebrities and influencers tend to be more sought after than those quietly building ecological foundations and generating actual revenue. As a developer focused on creating impactful software rather than chasing market bubbles, I invite you to temporarily set aside the market noise and explore the true value of cryptocurrency projects together.

1. Hype Over Substance

Take a look at Ripple (XRP), Dogecoin (DOGE), Cardano (ADA), and TRUMP tokens. As of February 2, 2025, their market capitalizations reached $166 billion, $44 billion, $31 billion, and $21 billion, respectively. These numbers create a huge illusion of value and prospects.

However, many of these tokens, from their inception, lacked substantial content beyond an eye-catching concept. For example, XRP has been mired in controversy, with its centralization issues being heavily questioned, leading one to ponder whether its actual use cases truly match its market value. Recently exposed court documents revealed that Ripple has signed over 1,700 XRP trading agreements with financial institutions and enterprises, providing some reference for its business operations. While some in the XRP community interpret this as a positive sign, these agreements are essentially just commercial transaction terms and hardly represent a breakthrough achievement in light of the project's massive valuation.

DOGE started as a joke meme coin; despite its enthusiastic community, it lacks a clear application scenario and technical support, leading many to question whether its market value is entirely reliant on speculative hype. As for ADA, despite being touted as a representative of blockchain solutions, it has failed to deliver on its grand promises over the years, creating a stark contrast between its lofty valuation and the actual progress of its underlying technology.

Full of hype, yet substance remains unfulfilled

The highly publicized TRUMP token did not rise due to technological innovation but rather through celebrity effect, reflecting how market sentiment can inflate the valuation of a token lacking real application scenarios. Within just a few days, its market capitalization soared to $70 billion, attracting a significant outflow of funds from projects that are more reputable or have actual utility.

2. Real Projects Support the Industry

Unlike those hype-driven tokens, protocol tokens with real applications that are widely used every day tell a different story. Especially within the Ethereum ecosystem, the core projects that drive technological advancement in the crypto industry are the true builders.

Take UNI as an example; it is the token of the decentralized trading platform Uniswap, which handles a massive trading volume and is a leading DEX in the industry. Another example is AAVE, currently the largest decentralized lending platform, directly supporting users in borrowing assets and generating revenue through fees and interest. Similarly, Arbitrum (ARB), Optimism (OP), and Starknet (STRK) are layer-two network solutions that expand blockchain networks by reducing congestion and lowering costs. Among them, Starknet has pioneered cutting-edge research in zero-knowledge proofs, backed by a team of experienced researchers and engineers who have worked for years to develop today's cutting-edge technology. However, the total market capitalization of these industry-driving projects still falls far short of XRP.

There are many more examples, such as Lido (LDO), Ethereum Name Service (ENS), and Curve (CRV), which are technological pioneers. These protocols not only support critical infrastructure but also have clear profit models, ongoing development progress, and a user base that relies on their functionalities daily.

Compared to those projects that rely solely on media hype to boost their valuations, these protocols are the cornerstones of decentralized finance (DeFi) and the blockchain ecosystem. They drive transaction execution, smart contract operations, and introduce innovative financial products. However, their market capitalizations remain insignificant compared to those projects that lack real value and are entirely dependent on market speculation.

3. The Role of Information and Media

This irrational behavior largely stems from information asymmetry—or rather, the public's access to information is overly one-sided. Many investors are easily swayed by superficial data and buzzwords, lacking channels for in-depth analysis to distinguish between projects with real application value and tokens that purely rely on marketing hype.

Mainstream media often focuses on eye-catching numbers, even tending to interpret them from a negative perspective, while rarely delving into the real application scenarios behind these tokens. Ultimately, this information gap allows projects with strong brand packaging but lacking real support to benefit more easily, while truly technically capable and long-term valuable projects are overlooked.

When the media leans towards hype rather than focusing on actual value, it becomes easy to place blame

When ordinary investors see XRP's market capitalization soaring to $166 billion or DOGE's valuation at $44 billion, they may mistakenly believe these numbers represent some extraordinary technology or financial innovation. Yet the same investors often overlook UNI or AAVE, not because these projects lack real value, but because the narratives surrounding them are not eye-catching enough and lack the hype factor.

When the public struggles to access in-depth analyses of these projects, the market becomes dominated by hype and speculation. This makes the market appear increasingly irrational to those who focus on fundamental performance.

4. Real Applications Often Overlooked

Projects that genuinely generate revenue are often reported using dry technical jargon, failing to spark market enthusiasm like headlines such as "Market Cap Surpasses $166 Billion!"

This leads to an unfair competitive environment—where even some projects lacking real users and application scenarios can still occupy the center of discussion through hype and controversy. Meanwhile, those quietly supporting decentralized finance infrastructure become the unsung heroes of the crypto industry. They handle millions of dollars in transactions daily, drive the development of decentralized lending, and continuously lower user costs. However, these crucial contributions to the crypto economic system receive little attention from mainstream media.

This underestimation of truly practical tokens could have far-reaching consequences. Investors may misallocate funds to projects that cannot deliver on long-term promises, and if the market is driven by hype rather than actual performance, it will lead to severe volatility and even create speculative bubbles. Therefore, the industry urgently needs better educational resources and more in-depth investigative reporting, driven by data analysis rather than merely pursuing eye-catching hype content.

5. Small Scale but Real Impact

GMX is such a project—despite its low profile, it truly provides real applications and stable revenue. In a market filled with exaggerated narratives, GMX stands out with its genuine use cases.

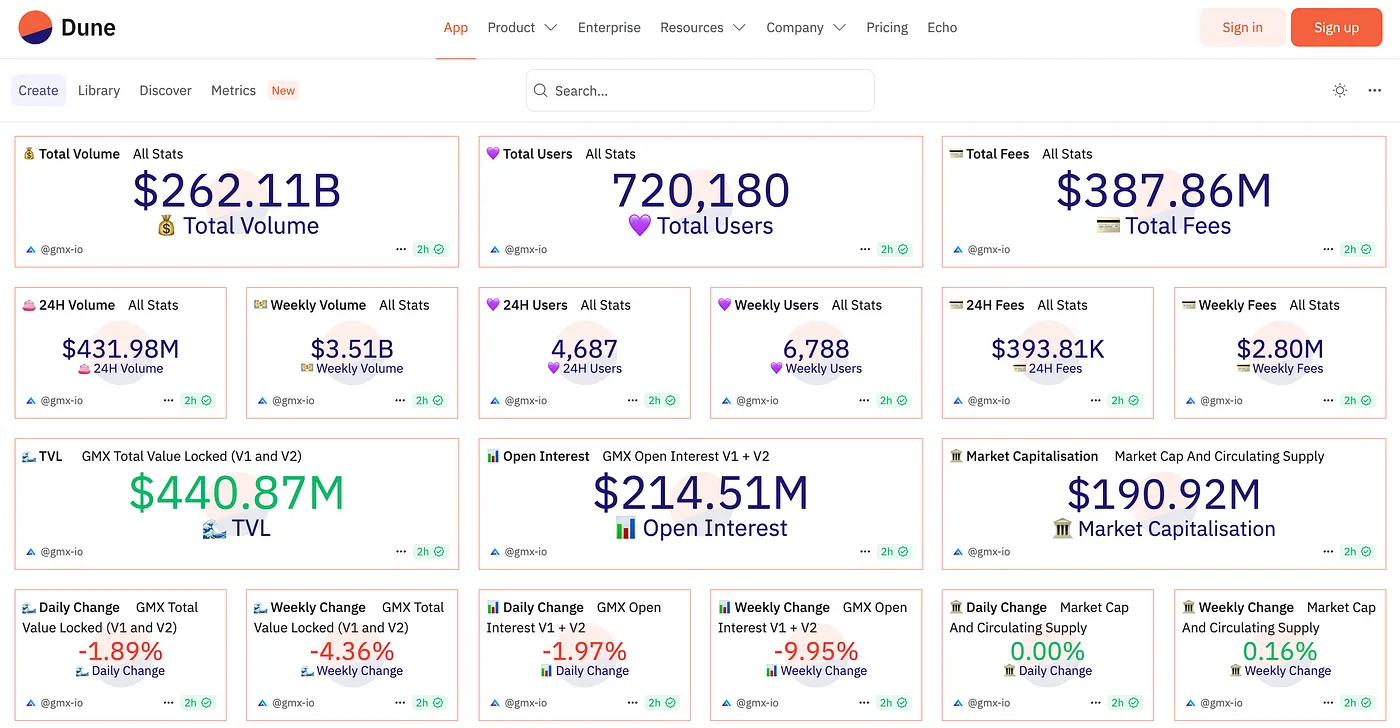

Like all true blockchain projects, GMX's protocol data is completely open, with all transactions and operational conditions being transparently visible in real-time, which is the best proof of its value.

GMX's data dashboard on Dune

GMX has been operating steadily for three years, quietly building a solid reputation. Its annual fee revenue is close to $130 million, clearly indicating traders' high reliance on its decentralized trading platform. The protocol extracts 27% from trading fees, amounting to an actual annual revenue of about $35.1 million, while its current market capitalization of $180 million implies a price-to-earnings (P/E) ratio of only about 5.1.

By traditional market standards, a 5.1 P/E ratio is relatively reasonable, even low, especially considering the enormous growth potential of blockchain technology. This valuation starkly contrasts with those projects that lack sustainable revenue sources but have inflated market capitalizations due to hype.

Beyond financial data, GMX's technical strength further corroborates its value. The project has built a high-quality open-source codebase, widely recognized in the industry. Many projects have attempted to fork GMX's code, but due to the lack of GMX's consistent performance and community support, they ultimately had to rely on social media hype to maintain their valuations, even achieving similar market recognition.

With its real and measurable application value and sustainable profit model, GMX has become a severely undervalued asset in a crypto industry filled with irrational speculation.

6. Looking Ahead

Just a few days ago, the new U.S. government officially took office and signaled support for cryptocurrencies, bringing a more favorable regulatory environment for the industry. This political change is an ideal opportunity to return to fundamentals—focusing on real applications and technological innovation rather than purely relying on speculative hype. Currently, investors and developers should seize this favorable moment to promote the sustainable growth of the entire crypto ecosystem in this friendly environment.

A healthy market should allow projects with both practical use and sustainable development to achieve the highest valuations. However, until the media narrative fully shifts, the crypto market will continue to show a stark contrast—those "pseudo" projects relying on hype may enjoy inflated market capitalizations in the short term, while the projects that truly support decentralized applications and financial systems quietly lay the foundation for the future economy behind the scenes.

For investors, going beyond market noise and delving into data—such as trading volume, fee income, user growth, and other core metrics—is essential to accurately assess which tokens genuinely possess long-term value. As the market matures, media and analysts also need to take responsibility by providing clearer and more objective perspectives to help the public distinguish between fleeting hype and sustainable growth, guiding the market towards a more rational direction.

Article link: https://www.hellobtc.com/kp/du/02/5658.html

Source: https://medium.com/@hbbio/the-irrational-crypto-market-hype-misinformation-and-the-overlooked-value-of-real-utility-3cfe631e577a

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。