Keep information synchronized and stay alert.

Author: Alea Research

Translation: Deep Tide TechFlow

This has been a busy week, and the market seems to have not yet recovered from the turmoil at the beginning of the year and the impact of President Trump's term. The cryptocurrency market has just experienced the largest 24-hour liquidation in history, with over $2.3 billion liquidated and a market cap evaporating by more than $188 billion.

Currently, U.S. stock index futures are all sharply down. The market may again overreact at the opening, just like last week, where it dropped significantly at the opening and then gradually rebounded, but the specific trend still needs to be observed.

Unlike traditional financial markets, the cryptocurrency market supports 24/7 trading, and thus has already felt the significant impact of Trump's tariff threats. Bitcoin's price once fell to $92,000, then rebounded to $95,600, and is currently stabilizing at this level. Ethereum completely erased the rebound gains on the ETH/BTC chart, with its price once plummeting over 18%, before slightly recovering to just below $2,600. There are even rumors that a trading firm was forced to liquidate due to Ethereum's crash.

As the market downturn has become the focus, today's content will focus on the tariff issue—the main reason for this market crash—and some other important news overshadowed by Trump's intense rhetoric over the weekend.

Keep information synchronized and stay alert.

Tariff Situation

Last Saturday, the market had already reacted negatively to the news announced on Friday, as the tariff effective date was only one day after the announcement. However, similar to last week's DeepSeek incident, the cryptocurrency market further declined over the weekend as the traditional financial market had not fully digested this news.

The market initially believed that Trump was more blusterous about tariffs, viewing them merely as negotiation chips that would not be implemented immediately without consultation with relevant leaders and diplomats. However, what caught the market off guard was that Trump targeted America's allies and closest countries, rather than primarily focusing on China, a strategy that was unexpected and exacerbated market panic.

China was subjected to a 10% tariff, while the previous policy allowing small packages to be shipped to the U.S. tax-free was revoked. This change has impacted the consumer e-commerce sector involving clothing and durable goods, and the actual tariff burden exceeds the standard 10% rate.

Meanwhile, the U.S. directly imposed a 25% tariff on its two major trading partners—Canada and Mexico—but set a 10% exemption for energy products. This decision is particularly critical, as energy is a major export from Canada to the U.S. Excluding energy, Canada actually has a trade deficit with the U.S. Before the tariffs were introduced, some Canadian food export companies had already planned to relocate their headquarters to the U.S. to reduce costs and simplify operations; the implementation of tariffs will only accelerate this trend and make it easier for companies to make such decisions.

Trump's swift imposition of tariffs on these countries indicates two key points:

Trump indeed views tariffs as an important source of revenue and may even consider them as a means to supplement other forms of taxation.

Trump is more willing to accept short-term economic pain than people expected, in pursuit of what he believes are long-term beneficial goals.

Today, President Trump will meet with the leaders of Canada and Mexico, which may provide more clear direction on the current tariff situation, regardless of whether the outcome is good or bad. The total imports from China, Canada, and Mexico account for nearly half of U.S. imports, meaning there is limited room for the U.S. to further increase tariffs on other countries, or it may lead to gradually declining economic benefits, which the market may react to.

(As of the time of publication, President Donald Trump agreed to postpone the implementation of tariffs on Mexico and Canada for 30 days.)

News Updates

The tariff issue will undoubtedly continue to be a focal point in traditional financial media this week. However, aside from tariffs, there are some other important news items that may impact the cryptocurrency market, which have not received sufficient attention due to the recent large-scale liquidation events.

OpenAI Deep Research

To maintain competitiveness, OpenAI quickly launched a series of new features after DeepSeek released its R1 inference model. First, Sam Altman announced that free users of ChatGPT would have access to OpenAI's O3-mini model. Subsequently, the team introduced the "Operator & Agents" feature, allowing users to initiate tasks through the Operator, such as purchasing goods, and have Agents complete the purchase on behalf of the user, leveraging their powerful search and reasoning capabilities. Currently, the next generation of agents—Deep Research—has officially launched, providing users with more powerful automated task handling capabilities.

Do not confuse OpenAI's Deep Research with the similarly named feature from Google Gemini. OpenAI's Deep Research builds upon the current leading large language model (LLM) technology, aiming to provide users with an intelligent agent that possesses high skills and extensive knowledge across multiple white-collar fields. These fields cover a wide range, from finance to data analysis, with enormous potential.

Notably, Sam Altman stated that Deep Research is currently capable of completing tasks that represent a "single-digit percentage" of economic value in the global economy, primarily focused on white-collar work. This further supports the view that white-collar jobs will be impacted by AI earlier than manual labor. This development also reflects that large language model companies need to establish competitive barriers through user interfaces (UI) rather than solely relying on the models themselves. The launch of Operator and now Deep Research are significant steps in this direction, and it remains to be seen how other companies will respond to this trend.

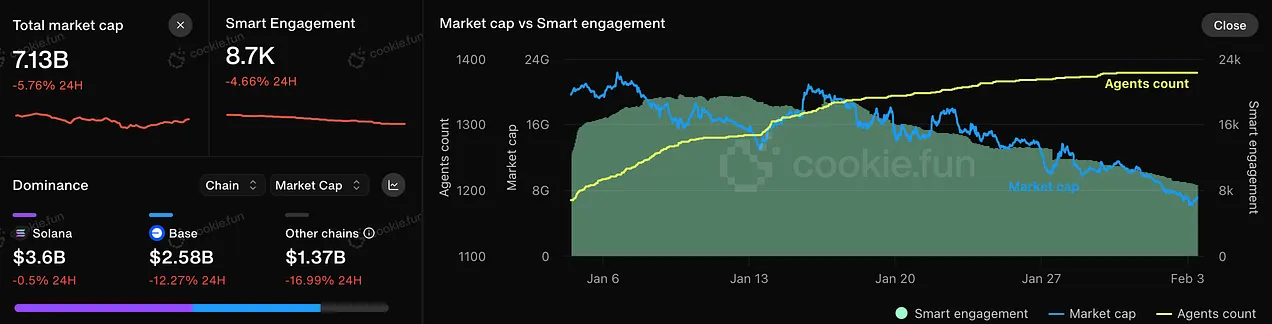

For the cryptocurrency sector, this is undoubtedly good news for the AI agent industry, even though the promotion of Deep Research is still in its early stages. Considering that the total market value of the current AI agent market is only $7.13 billion, while its previous peak was as high as $22 billion, this progress is particularly significant. Regardless of how the current tariff situation changes, Deep Research could have far-reaching impacts on AI technology, financial markets, and even the cryptocurrency sector.

Indian Cryptocurrency Dynamics

Although this topic is not as significant as other news, it may still have some impact. Reports indicate that India, as the world's third-largest real economy (fifth by nominal ranking), is reviewing its existing cryptocurrency policies, or more accurately, its lack of policies. In the short term, this could be detrimental to the cryptocurrency market. There are rumors that the Indian government may impose taxes of up to 70% on undisclosed cryptocurrency gains, and if this proposal is implemented, it would negatively impact the market.

However, Ajay Seth, Secretary of Economic Affairs, stated that the government plans to re-examine the regulatory framework for cryptocurrencies. This move seems more driven by circumstances rather than a genuine desire by the government to embrace cryptocurrencies. In contrast, some smaller countries, such as El Salvador and the Czech Republic, have shown a more friendly attitude towards cryptocurrencies. Among the major global economies, India is undoubtedly a key player most likely to adjust its cryptocurrency policy.

Additionally, there have been rumors about China possibly allowing the holding of cryptocurrencies or easing restrictions on cryptocurrency trading, but these often lack substantial evidence. If China were to indeed relax relevant restrictions, it would have a tremendous positive impact on the cryptocurrency market, but currently, this possibility seems low. In contrast, if India can adjust its cryptocurrency policy framework, it would be a more realistic and significant positive development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。