The prediction market is no longer a "one-size-fits-all" model; future platforms will be more specialized and optimized for specific fields.

Author: michaellwy

Translation: Deep Tide TechFlow

In my previous article, I proposed 10 trends and ideas regarding the potential development of future prediction markets. If you missed it, here’s a brief recap:

Market trends are shifting towards short-term: According to data from Polymarket, the average duration of prediction markets is 21 days, with a median of only 4 days, indicating that short-term predictions are more popular than long-term ones.

Modular dispute resolution mechanisms: Future platforms may adopt multi-layered dispute resolution systems, gradually achieving higher decentralization and increasing incentives for dispute resolution.

AI as truth arbitrators: Unlike optimistic oracles that rely on token holders' votes to determine outcomes, we can train specialized AI agents focused on judging and determining the results of prediction markets.

AI agents participating in prediction markets: If AI agents are equipped with the ability to manage wallets and execute trades, they can actively participate in trading and activities within prediction markets.

Specialization and segmentation of markets: The prediction market is no longer a "one-size-fits-all" model; future platforms will be more specialized and optimized for specific fields.

Integration of insurance functions: When transaction amounts are large, insurance markets will naturally emerge, as participants seek to mitigate risks through insurance.

Mobile-first interfaces: Future prediction market platforms will prioritize mobile interface design, focusing on intuitive operations and user experience while retaining advanced features.

Integration of yield-bearing stablecoins: Currently, idle funds do not generate returns, while yield-bearing stablecoins (YBS) can provide interest income on users' idle funds.

Layered information markets: Prediction markets may evolve into a layered structure, where lower-tier markets predict specific event outcomes, and higher-tier markets interpret and summarize these predictions.

Conditional markets: Conditional markets allow users to bet based on certain preconditions (e.g., the occurrence of an event), providing a more flexible "if-then" prediction tool.

In this article, I have compiled a list of 10 prediction market projects worth noting. Some of these projects are actively developing the trends and features mentioned above, while others are exploring more innovative possibilities.

Let’s dive in!

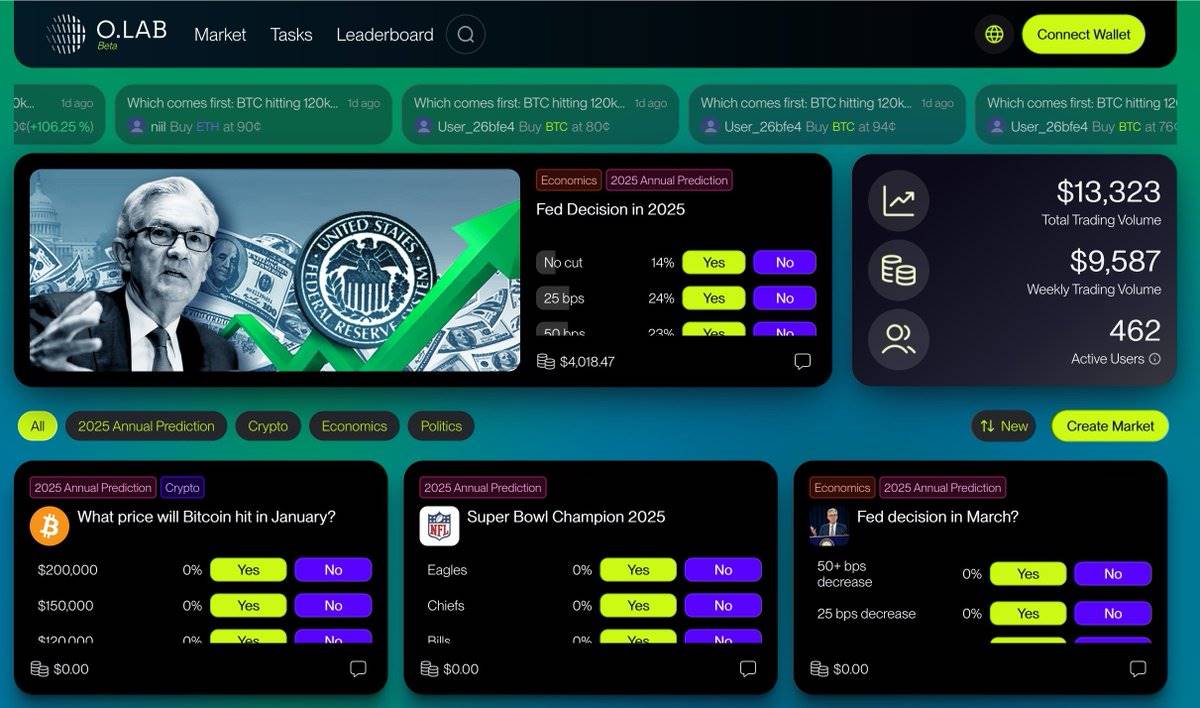

1. Opinion Protocol (@opinionlabsxyz)

Opinion Protocol is a decentralized platform where users can create markets without permission. Supported by Binance Labs, the platform aims to simplify the market creation process, enhance price discovery efficiency, and provide an efficient scalable infrastructure for decentralized applications (dapps).

Users can create prediction markets using any token, which allows Opinion Protocol to support a more open ecosystem compared to more centralized platforms.

Its consensus oracle verifies on-chain data through decentralized consensus and cryptoeconomic incentives, effectively reducing the risk of a 51% attack by randomly selecting jury members and granting equal voting rights to each.

2. True Markets (@Truemarketsorg)

True Markets combines news media with market sentiment, allowing users to bet on real-world events through prediction markets and using a multi-layer oracle system to determine outcomes.

The platform recently raised $4.03 million through Patron NFT sales, with Vitalik Buterin purchasing 400 NFTs.

The system employs a three-stage dispute resolution mechanism:

1) Initial disputes can be raised within 6 hours by paying a $250 deposit, resolved by the Oracle Council;

2) Further disputes require a $5,000 deposit, resolved by TRUE token holders;

3) Final disputes are adjudicated by 11 "provers" randomly selected from 100 reputable individuals.

The platform aims to generate market-driven data points around news and events and achieve higher decentralization and greater economic incentives through a tiered dispute resolution mechanism.

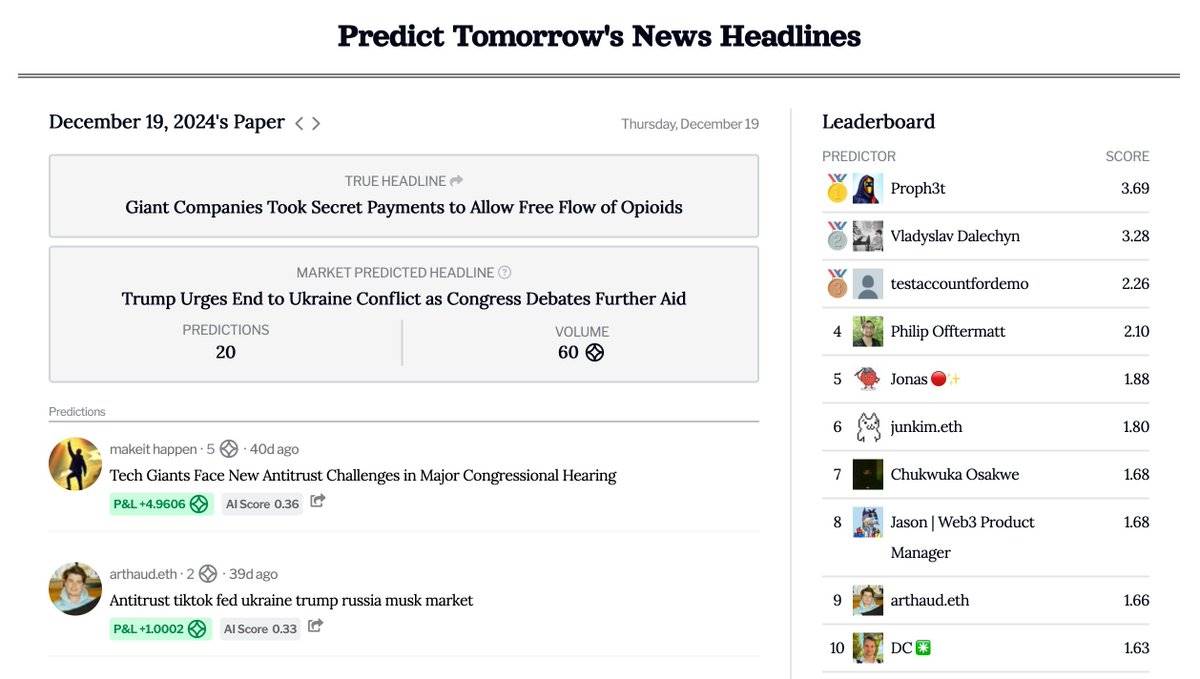

3. Tmr.news

tmr.news is a prediction platform where users can bet by submitting a one-sentence guess of the next day’s New York Times front-page headline.

Rewards are distributed based on the semantic similarity between the predicted headline and the actual headline, evaluated using a large language model (LLM). The market is parsed through cryptographic verification on the blockchain, ensuring transparency and trustless validation, built on Base.

A 10% fee and standard gas fees are charged when claiming rewards, providing users with a secure and innovative way to predict news.

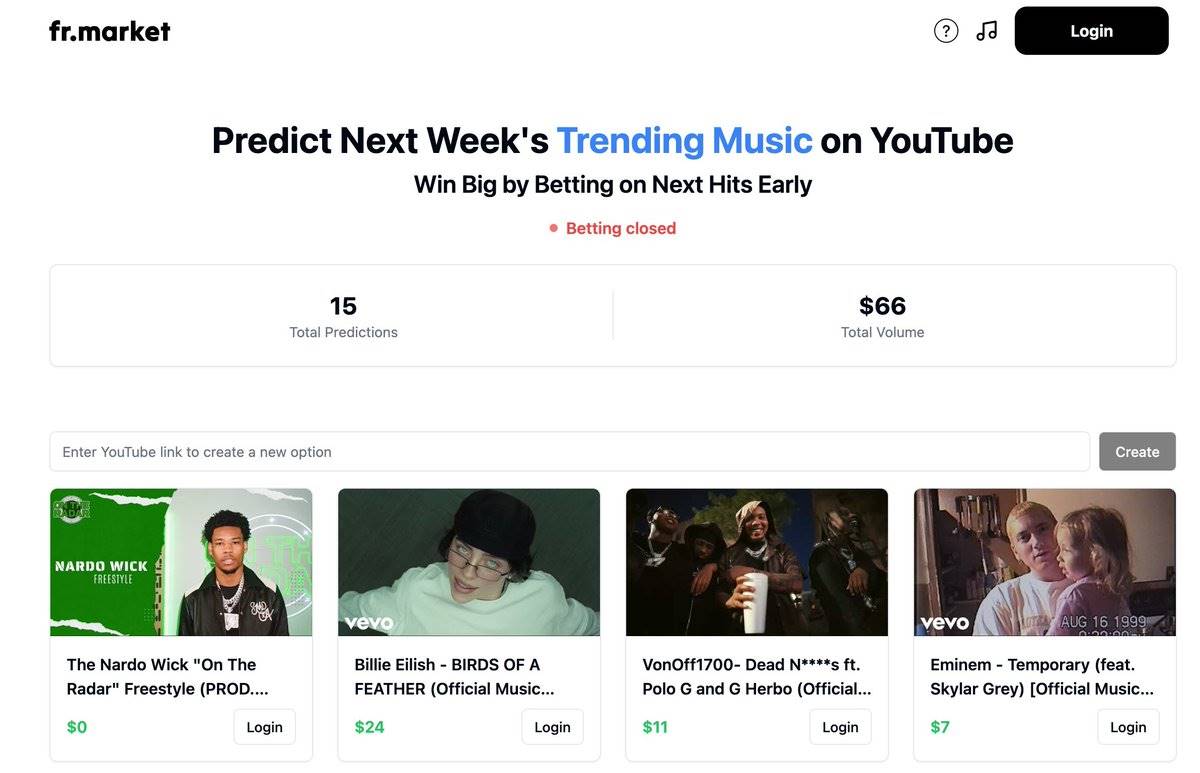

4. Fr.market (@frdotmarket)

fr.market is a platform that gamifies music preferences, allowing users to bet on predictions about others' music tastes or music trends.

It uniquely combines music fan culture with gaming mechanics, creating an engaging and competitive environment for music lovers to test their intuition and knowledge.

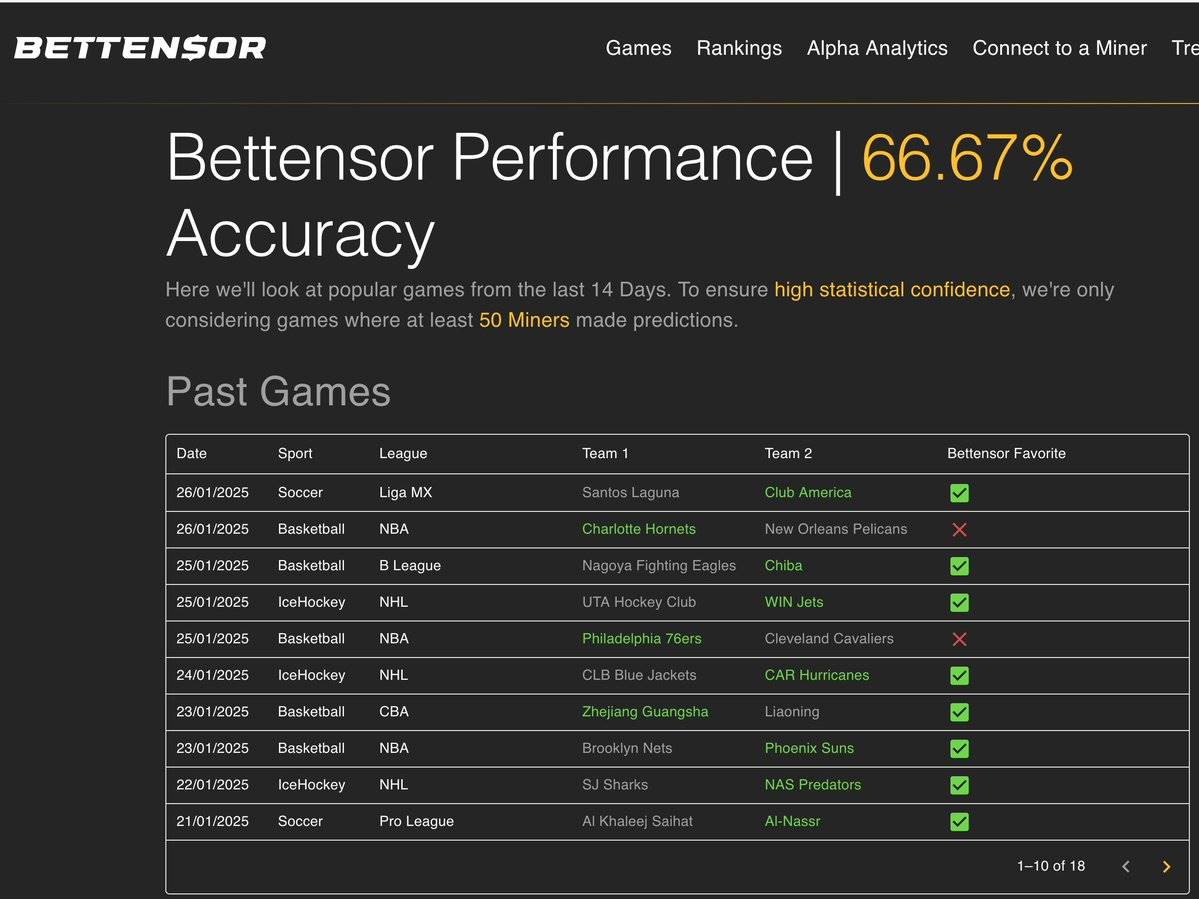

5. Bettensor (@Bettensor)

Bettensor is a decentralized sports prediction market based on the Bittensor network, incentivizing users to accurately predict sports event outcomes through a unique reward mechanism.

Participants receive a simulated balance of $1,000 daily to bet on the odds of sports event outcomes. Prediction scores are based on the returns from successful bets made in the past 2 days, calculated at the odds recorded at submission.

The system generates valuable odds and prediction data by creating a competitive environment. Participants can use any prediction method (such as human intuition, AI models, or statistical analysis), and successful predictions will be rewarded, while unsuccessful predictions may lead to disqualification.

6. Hookt (@Hookt_app)

Hookt is a mobile-first prediction market platform designed to make betting as easy and fun as swiping on Tinder.

With a swipe-based user experience (UX), Hookt simplifies the betting process, allowing users to quickly bet on short-term events such as sports matches, cryptocurrency price fluctuations, or pop culture-related events.

7. Sweep (@trysweep)

Sweep is a gamified prediction platform designed around live content, where users can bet during live events, such as "Will XX get 15 kills in the match?" and use two different currencies for betting.

The platform employs a dual-currency system: one is non-redeemable "Coins," used for casual entertainment and interaction with streamers; the other is "Sweep Cash," which can be converted into real money.

Users can predict various outcomes during the live stream, from match results to specific live challenges, adding a layer of real-time interactive experience to existing live content. The platform transforms passive live viewing into an active prediction game, allowing viewers to engage deeply with the content through real-time predictions.

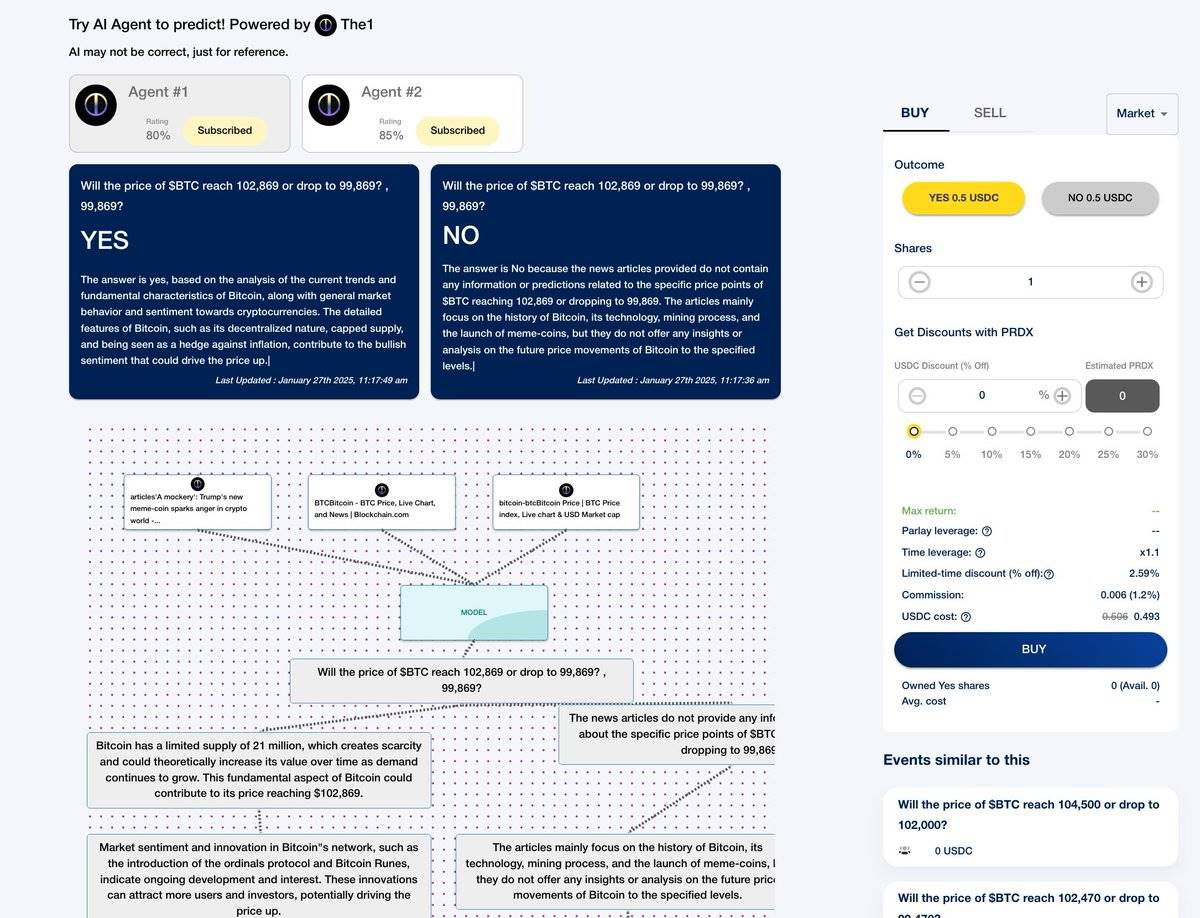

8. PredX (@PredX_AI)

PredX differentiates itself from other platforms through its AI-driven market creation and analysis approach. The platform uses agents based on Generative AI, actively analyzing multiple data streams (such as price charts, news sources, and sentiment data) to provide predictions and analytical insights for market outcomes.

Taking Bitcoin price prediction as an example, in addition to relying on its own analysis, users can also obtain predictive insights generated from comprehensive data through AI, helping them make more informed betting decisions. This hybrid system combines human predictions with AI analysis, providing users with deeper decision support.

9. Offmarket (@offmarketfun)

Offmarket is a prediction market platform focused on startup company IPO outcomes, built on the Base blockchain.

The core value of the platform lies in providing users with a tool to transform private company information into trading opportunities, allowing users to profit from their understanding and judgment of startup development trajectories.

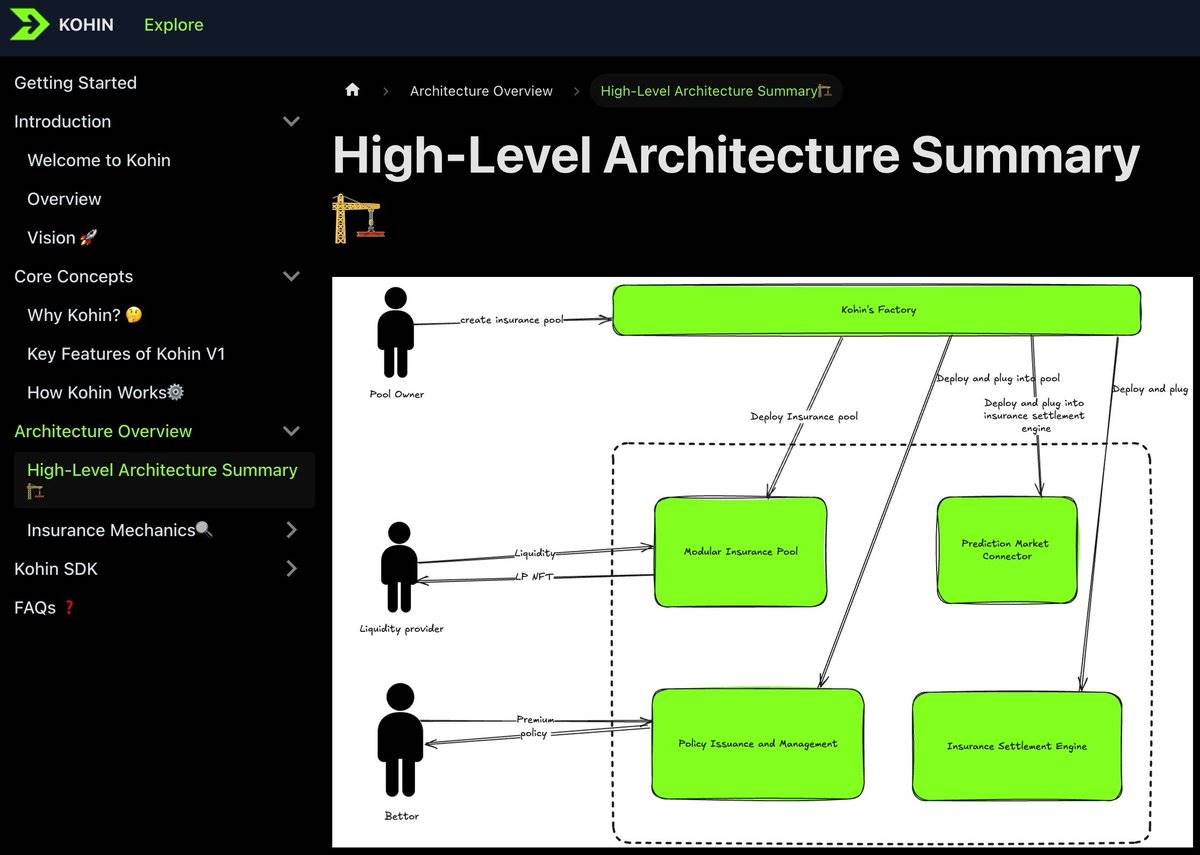

10. Kohin (@kohinxyz)

Kohin is an innovative platform that provides a decentralized insurance layer for prediction markets, offering a new way to manage risk by allowing users to insure their bets.

Users only need to pay a small premium (for example, paying a $20 premium for a $100 bet) to obtain bet insurance. If users win, they can keep the winnings minus the premium; if they lose, they can recover the full principal, losing only the premium amount.

Kohin V1 has launched on Polygon, initially supporting sports parlay betting through the Azuro Protocol, with plans to expand to other platforms like Polymarket. Its core innovation lies in reducing the risk of total loss, making prediction markets more user-friendly and attracting more participants and interactions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。