Preface

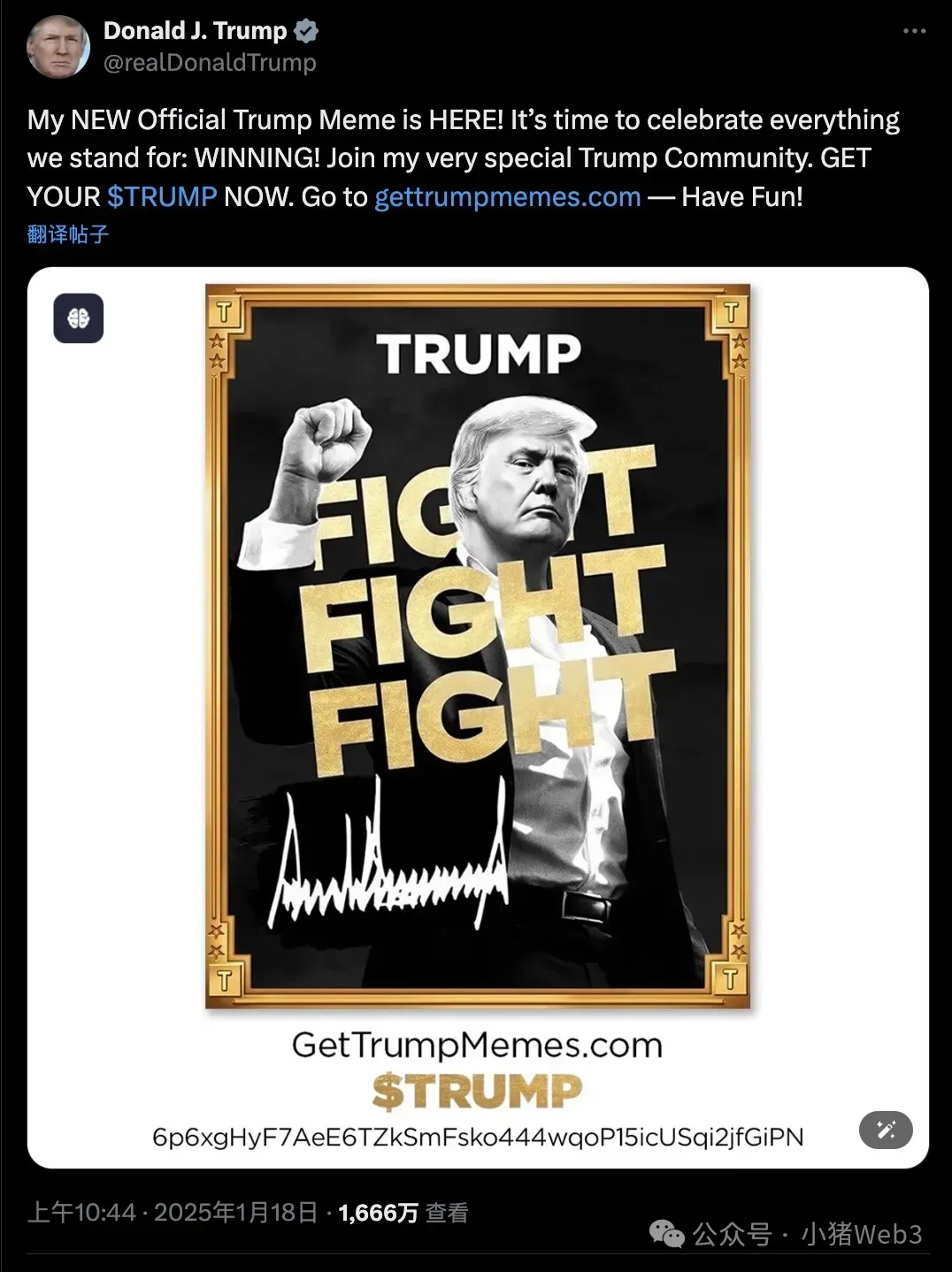

On the morning of January 8, Trump posted on Twitter and his social media platform Truth Social, launching a meme coin named TRUMP on Solana. In just four hours, TRUMP's market capitalization surged to $16 billion, making it the second-largest meme coin by market cap, only behind Dogecoin. On January 9, TRUMP's price continued to skyrocket, with its market cap reaching $80 billion at one point, surpassing Dogecoin to become the largest meme coin by market cap, and it was less than $50 billion away from SOL's market cap at that time, completing in two days what took Dogecoin 11 years.

As a result, Solana's native token SOL also experienced a positive upward trend. On January 16, according to the New York Post, Trump expressed an "open attitude" towards the idea of issuing digital currencies in the U.S. (such as SOL, USDC, and XRP) as strategic reserves. SOL and XRP (Ripple) are expected to launch spot ETFs this year, with prices rising over 40% in the past week, and voices in the community are beginning to suggest flipping Ethereum.

In contrast, ETH (Ethereum) and its ecosystem's DeFi tokens (LINK, AAVE, ENA, etc.) that shone during the "Trump market" last December have not performed well, especially Ethereum. As the second-largest cryptocurrency by market cap after Bitcoin and one of the only two cryptocurrencies with a spot ETF, its price increase has lagged far behind BTC, SOL, and XRP, and the foundation has recently faced criticism from founders of several well-known projects, finding itself in a predicament.

The Impact of Trump's Coin

Firstly, TRUMP is not a meme coin that was "spontaneously" issued on Solana's largest meme coin issuance platform Pump.fun, but rather a collaborative action that has been "premeditated" in cooperation with Solana and several protocols and related projects on its chain. It can be said to be a VC coin disguised as a meme coin. Partners include Jupiter, the largest DEX aggregator on Solana, the liquidity protocol Meteora, and the meme coin trading platform Moonshot, with market maker Wintermute behind it. Notably, Wintermute is also a major market maker for many high-market-cap meme coins and previously provided liquidity for the well-known meme coin PEPE.

Secondly, in the short term, the issuance of TRUMP has caused a significant "vampiric effect," draining liquidity from the market and leading to a collapse in the prices of cryptocurrencies outside the Solana ecosystem. The deployment of TRUMP on the Solana chain will further enhance market recognition of the Solana ecosystem, and meme coins and AI coins on Solana have also gained more liquidity, increasing the revenue of DeFi protocols on Solana. The crypto market has also welcomed a wave of new users, with Moonshot reporting that they attracted over 400,000 new users within 24 hours. Additionally, on-chain tools like GMGN have also benefited, with revenues exceeding those of the largest DeFi protocol, Uniswap, in the short term.

Finally, in the long term, Trump is fulfilling his promises regarding crypto policy. Combined with Trump's statement at the World Economic Forum in Davos about planning to make the U.S. the "world capital" of AI and cryptocurrency, his issuance of a coin actually indicates a lenient stance on regulation in the crypto industry. The Trump family's World Liberty Financial is not only involved in the DeFi space but is also actively laying out RWA (real-world assets), which may encourage more traditional financial institutions to enter the DeFi space. Furthermore, domestic cryptocurrencies in the U.S. are likely to receive favorable policies, such as Solana, Ripple, and Sui, with the first two seeing a glimmer of hope in the ETF approval process.

Here, let’s further introduce Solana and Ripple, as well as their differences from Ethereum.

Ethereum was born in November 2013 when Russian-Canadian programmer Vitalik Buterin published a white paper titled "Ethereum: A Next-Generation Smart Contract and Decentralized Application Platform." Compared to Bitcoin's single cash system function, Ethereum is a decentralized global computer platform capable of running smart contracts of any complexity. ETH (Ethereum's native cryptocurrency) is the second-largest cryptocurrency by market cap, only behind Bitcoin, and is one of the only two cryptocurrencies with a spot ETF. Ethereum marks the beginning of Web3, pioneering the era of smart contracts on the blockchain and catalyzing the explosion of DeFi projects on Ethereum in the summer of 2020, such as Uniswap, which, as the largest DEX on Ethereum, saw trading volume exceed $450 billion in 2023, surpassing the spot trading volume of the largest U.S. exchange, Coinbase.

Ripple was born in September 2012, slightly earlier than Ethereum, originating from the RipplePay project, which was taken over by Jed McCaleb, Chris Larsen, and Arthur Britto to create Ripple (XRP). Ripple was established to revolutionize the global remittance industry, aiming to replace outdated systems like SWIFT. Strictly speaking, Ripple is not a public blockchain but a permissioned blockchain, as it uses a PoA (Proof of Authority) consensus mechanism, where transactions and blocks must be verified by approved validators (known as the UNL list). This makes it more centralized compared to traditional blockchains (like Bitcoin and Ethereum) but also demonstrates better scalability. Additionally, Ripple donated $5 million worth of XRP to support Trump's presidential inauguration.

Solana was born in November 2017 when former Qualcomm engineer Anatoly Yakovenko published a white paper introducing "Proof of History" (PoH) — a mechanism for maintaining time between untrusted computers. With PoH, Anatoly set out to build the Solana blockchain, aiming to match the performance of a single machine and overcome the scalability constraints of traditional blockchains (like Ethereum), allowing for more efficient data propagation between nodes, thus achieving high-performance Layer 1 software that scales according to hardware speed. Solana has many technical advantages that directly address Ethereum's shortcomings, such as ultra-fast speed, with a real average daily transaction execution rate reaching 1,000, while Ethereum can only achieve 20; and ultra-low fees, with Solana's transaction fees being only one-hundredth of Ethereum's.

Ethereum's Internal and External Troubles

Ethereum's predicament can be summed up in four words: "internal troubles and external threats."

Internal Troubles

The Ethereum Foundation has recently become a target of criticism, primarily due to its inaction, the continuous sale of ETH on-chain, a lack of communication with the community, and strategic issues regarding Layer 2. Kain Warwick, founder of Synthetix and Infinex, believes pressure should be applied to Layer 2 to repurchase ETH, while Michael Egorov, founder of Curve, more aggressively suggests abandoning Layer 2 to develop Layer 1. AAVE founder Stani Kulechov believes the Ethereum Foundation needs a complete reform in 12 areas.

On January 18, Vitalik stated that after the Ethereum Foundation faced criticism for its lack of participation in the Ethereum ecosystem, there would be "significant changes" in the foundation's leadership structure, communication with the network developer community, and support for them. Regarding the issue of selling ETH on-chain, on January 21, the Ethereum Foundation announced the establishment of a wallet address to begin participating in DeFi. The organization plans to inject approximately $150 million worth of ETH into this wallet but noted that it may take several days to complete the setup.

On January 22, Lido co-founder Konstantin Lomashuk retweeted a post suggesting the establishment of a "Second Foundation." He stated, "Ethereum is the ultimate world computer, and every Ethereum enthusiast can help it grow, evolve, and succeed. If a second foundation is really established, it must have a clear goal to complement the tremendous work of current contributors. I appreciate everyone's support and believe we need more organizations to contribute to Ethereum."

On January 24, Vitalik published an article exploring Ethereum's scaling strategy for 2025 and beyond, emphasizing Ethereum's unique advantages in both decentralization and practical application value, and stated that the success of Layer 2 confirms the development philosophy of the Ethereum ecosystem, emphasizing a continued commitment to the Layer 2 strategy. Vitalik pointed out two major challenges currently faced: scaling and heterogeneity issues, with specific plans including: increasing data block capacity, enhancing interoperability and ZK-EVM, building security, and optimizing the economic model.

External Threats

The two cryptocurrencies with similar market caps are Ripple and Solana. However, Ripple is not a competitor; as mentioned in the previous chapter, Ripple is a permissioned blockchain. Since Ripple's main clients are international banks and investment firms, its key goal is regulatory compliance rather than decentralization, making the use of a permissioned blockchain understandable. Therefore, Ethereum's main competitor remains Solana, which is also a public blockchain. Excluding the "Trump factor," we can compare the two blockchains in terms of decentralization, scalability, and ecosystem.

It is generally believed that Ethereum's level of decentralization is higher than that of Solana. The reason for using "generally believed" is that decentralization itself is an abstract concept that is difficult to measure. Common indicators include the number and distribution of nodes, the distribution of token holders, client diversity, Nakamoto coefficient, and governance processes, among others. To avoid controversy, I will only express my personal opinion: if Ethereum's level of decentralization scores 100 points, Solana would score around 70 to 80 points, while other PoS blockchains score below 60 points.

However, if we score from the perspective of scalability, Solana can score 90 points, while Ethereum is below 10 points. Ethereum's approach to solving scalability issues is through Layer 2, which builds an additional network layer on the Ethereum chain, allowing for more transactions to be processed while maintaining security and decentralization. Currently, Base is the largest Layer 2 on Ethereum, developed in collaboration between the cryptocurrency exchange Coinbase and Optimism, with a maximum TPS of 300, but this is still significantly lower than Solana.

The ecosystem is Ethereum's greatest advantage. Ethereum's mainnet went live six years earlier than Solana, accumulating a large number of developers and users, with substantial infrastructure and long-term applications built around Ethereum. However, starting in 2024, the number of new developers on Solana has already surpassed that of Ethereum. For users, most transactions occur on-chain through DEXs, and due to the wealth effect of meme coins and AI coins on Solana, active users have recently surpassed those on Ethereum.

Conclusion

Personally, I am not as pessimistic about Ethereum's future development. I joined the Web3 industry in 2020, attracted by Ethereum's innovations, and as a contributor to LXDAO and ETHPanda, I have had the opportunity to meet Vitalik on several occasions and hear his insights.

From an emotional perspective, I believe Vitalik is an outstanding leader with a "computer culture" temperament. Although he does not use extravagant marketing rhetoric, he is able to listen to information, respond to questions, and make decisions. Therefore, I also believe that the Ethereum Foundation can successfully reform under Vitalik's leadership.

From a technical perspective, I think Ethereum has established a long-term and detailed technical roadmap to uphold the principle of decentralization. In the future, Ethereum can achieve over 100,000 TPS through Layer 2, with second-level transaction confirmations and low fees, provided that it can deliver on the roadmap in a timely manner.

As for Solana as a competitor, Solana is currently positioned as a consumer-grade public blockchain, gradually capturing user mindshare in the ToC space. After all, users are less concerned about decentralization and more focused on tangible low transaction fees and high transaction speeds. Ethereum may need three to five more years of technical implementation to match Solana in high performance, so the opportunity in this cycle is not significant.

However, Ethereum can take a completely different route, positioning itself as a financial-grade public blockchain, focusing Layer 1 on the ToB direction, attracting traditional financial institutions to expand their Web3 business, with RWA being a typical example. The financial business in the real world is inherently a conservative system, requiring higher stability, low risk, and low maintenance. Ethereum has never experienced downtime, its decentralization remains stronger than Solana's, and its ecosystem is significantly stronger than Solana's. Ethereum still has the most developers and the most complete infrastructure, and the prosperity of DeFi over a cycle has already accumulated a wealth of financial security usage constraints and contract examples, all of which are attractive bait for traditional financial institutions.

Finally, I want to say that Ethereum must take immediate action to address internal management issues within the foundation and external competitive pressures from Solana. It cannot just talk about technology and ideals while neglecting users and the market. Overall, Ethereum has been around for ten years, and any company that reaches the ten-year mark must undergo transformation due to changes in the external environment and internal interest distribution. The issues Ethereum faces today will also be the issues Solana will face in the future. "Embracing change" is the best way for Ethereum to move toward a bright future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。