Just as NVIDIA drives AI transformation through GPU acceleration, Story will become an indispensable part of the AI value chain.

Chapter 1: IP as an Asset Class

IP: The Largest Intangible Asset Class Globally

As generative artificial intelligence (AI) reshapes various industries, intellectual property (IP) is expected to become a core asset driving the rapid development of AI.

According to the 2023 Global Intangible Asset Tracker Report published by Brand Finance, IP is regarded as the largest asset class globally, with a total value exceeding $61.9 trillion, covering fields such as technology, finance, research and development, and scientific innovation. From code libraries and data to scientific research and inventions, these can all be classified as IP assets.

However, IP transactions and ownership have long been monopolized by a few market giants. The complex registration and enforcement processes, high legal costs, and the fragmentation across jurisdictions make broader market participation difficult.

At the same time, various IP holders, from individuals to large multinational corporations, face challenges in effectively monetizing or partitioning their IP. This has resulted in a significant amount of intangible assets being illiquid, unable to fully realize their potential value.

This is precisely the problem that Story aims to solve. Story is committed to putting IP on the blockchain, changing the financing and monetization methods of IP, transforming intangible assets into programmable tools, and generating revenue from multiple income streams, whether for AI training and inference or other emerging demand sources.

As one of the first blockchain projects to collaborate with top AI companies, Story has partnered with Stability AI, the developer of Stable Diffusion, and demonstrated how to seamlessly integrate on-chain IP assets into AI systems.

This report will explore the challenges faced by traditional IP models in the AI era and detail how Story leverages its technological infrastructure, legal framework, and partner ecosystem to unlock new opportunities for IP creators, businesses, institutions, and investors.

The Surge in IP Value in the AI Era

In an AI-dominated era, the value of IP is becoming increasingly prominent. AI model training relies on vast amounts of text, images, videos, and various data, while proprietary data and domain-specific data for real-time analysis and specific tasks are equally essential during the inference phase.

Therefore, all sources providing data for AI can be classified as IP assets, such as news aggregation, quantitative research, financial data, and user-generated content.

The early collaboration between Story and the globally leading open-source AI development company Stability AI provides a concrete case for the integration of on-chain IP assets with AI.

This collaboration allows IP to be directly integrated into the inference layer of AI models. Outputs generated by Stable Diffusion can be automatically registered on Story and tokenized in real-time as on-chain IP assets.

This collaboration demonstrates the possibility of seamlessly registering AI-generated content as IP and ensures ownership verification and traceability on the blockchain.

The ultimate goal of this collaboration is to establish a globally universal, curated on-chain database. By actively promoting the tokenization of AI-generated content, Story enables Stability AI, and the broader AI ecosystem, to generate authorized on-chain content in bulk while providing IP holders with a transparent revenue distribution mechanism.

As the scale of AIGC continues to expand, seamlessly registering model outputs as IP can bring vast new data to the on-chain ecosystem. In the long run, this will drive the proliferation of tokenized IP and create more opportunities related to ownership, attribution, and monetization.

As computing power becomes increasingly commoditized, the core competitiveness of AI models has shifted from computing power to data and IP.

If AI systems cannot continuously access high-quality data and IP throughout their lifecycle, even the most advanced models will struggle to maintain competitiveness or achieve breakthroughs. This further reinforces the notion that "AI urgently needs data" and indicates that IP will be as crucial to AI development as dedicated computing hardware once was.

However, in the AI era, holders of IP assets face unprecedented risks. When AI models use their IP without authorization, the copyright benefits or attribution rights that IP asset holders should have are stripped away, especially for small IP holders with limited resources who often lack the means or support to enforce their rights.

Once data is scraped, mixed, or input into AI workflows, traditional enforcement methods become nearly ineffective, as IP assets can be aggregated, transformed, or anonymized within the complex layered architecture of AI training and inference, making traceability almost impossible.

On the other hand, this challenge affects not only small IP holders but also large IP holders who face similar dilemmas.

Despite possessing vast IP assets, the existing IP legal system remains rigid and fragmented, unable to support more flexible, programmable, and scalable ways to monetize or distribute IP, especially as AI demand increasingly trends toward dynamism and modularity.

The IP Infrastructure of the AI Era: More Important Than Ever

Generative AI (such as Stable Diffusion, DALL·E, and ChatGPT) is still in its early stages of development but has already completely transformed human production methods, from programming and data analysis to text and image creation, becoming ubiquitous. The training of these AI systems relies on vast amounts of data from around the world.

According to a report by Grand View Research, the global AI training dataset market is valued at $2.6 billion in 2024, with an expected compound annual growth rate (CAGR) of 22% from 2025 to 2030.

Similarly, Fortune Business Insights predicts that the market will grow at a CAGR of 24.7% during the forecast period, reaching $17 billion by 2032.

However, as the AI training data market expands, a key question needs to be addressed: how to define data ownership and attribution rights? Can data contributors receive fair compensation?

Currently, AIGC faces a legal and ethical gray area due to:

Large language models (LLMs) potentially reusing copyrighted text without authorization;

Image-generating AI possibly copying artists' unique styles without providing any compensation.

Without a robust digital IP infrastructure, AI development may lead to two extremes:

Tragedy of the Commons: If IP is used without compensation, innovators will lose the incentive to create, leading the entire industry into stagnation.

Escalation of the AI Arms Race: Only well-funded large enterprises can cope with increasingly complex IP litigation and legal disputes, marginalizing small and medium-sized innovators.

The concept of overgrazing vividly describes the situation where AI systems plunder human creative content without bearing the necessary responsibilities, ultimately depleting the motivation for innovation due to a lack of incentives.

TCP/IP for AI Agents

Equally important to the concept of "overgrazing" is that AI's capabilities are rapidly surpassing the generation of simple text and images, further expanding into complex machine-to-machine interactions. In this context, traditional human-centered legal frameworks appear outdated and insufficient.

As agent-based AI systems become increasingly intelligent, they are more frequently collaborating and exchanging knowledge directly with one another. In this rapidly evolving era, every piece of data, skill, or insight generated or consumed by AI agents can be considered IP.

Agents may exchange optimized algorithms, specialized code, training data, and even specific task solutions. Since these assets are fully digital and can be instantly replicated or transformed, AI agents urgently need a robust, automated, and programmable IP trading framework to efficiently manage the creation, use, and trading of IP.

However, traditional IP systems rely on manual contracts and slow legal processes, which cannot keep pace with this emerging trading model. This further necessitates a programmable IP framework to manage commercial agreements between agents, facilitate seamless monetary transactions, and provide a reliable and scalable alternative to traditional methods.

Although AI agents already have the capability to trade large amounts of specialized knowledge in real-time, there is currently no recognized standard to regulate how to negotiate and trade these intangible IP assets. This gap not only increases development costs but also poses compliance risks and leaves significant voids in trust and commercialization mechanisms.

This is precisely why Story is developing the Agent Transmission Control Protocol (Agent TCP/IP).

Agent TCP/IP is an open-source framework that allows AI agents to autonomously negotiate, manage, and trade their IP assets, just as the internet operates based on TCP/IP.

Through Agent TCP/IP, AI agents can:

Verify each other's IP licensing terms

Automatically complete payments and transactions

Enforce copyright and usage restrictions

Ensure fair compensation for IP contributors

Currently, multiple AI agent systems have directly integrated Agent TCP/IP into their core frameworks, including: ai16z's Eliza, Virtuals' G.A.M.E., Crossmint's GOAT, and Zerebro's ZerePy. Recently, Virtuals' AI agent Luna even used Agent TCP/IP to publicly negotiate IP licensing with another AI agent, DaVinci, on social media platform X (formerly Twitter).

In the future, AI development will increasingly rely on high-quality IP assets. However, traditional IP laws and regulations primarily revolve around "copying," making it difficult to adapt to the needs of the AI era, especially:

How to define ownership rights for the vast number of derivative works generated by AI?

How to ensure copyright compliance in the use of AI training data?

How to efficiently implement a micro-licensing mechanism for data?

In this context, the acquisition and licensing of IP have transcended computing hardware, becoming a critical bottleneck in AI development. AI models must continuously acquire new IP assets to maintain competitiveness and innovation. All of this can be efficiently managed and optimized through the blockchain infrastructure provided by Story.

Tokenized IP in the Digital Economy

DeFi has introduced the concept of "programmable money," where tokenized assets on the blockchain can interact freely within an ecosystem composed of composable financial protocols. Once an asset is tokenized on-chain, it can connect to the entire network, enabling a range of value-added services.

By tokenizing IP and bringing it on-chain, IP evolves from a static off-chain asset to a programmable on-chain asset, allowing for unprecedented possibilities.

Just as the internet and social media significantly reduced the costs of copying and distributing information—leading to the emergence of entirely new market models—the on-chain IP framework similarly lowers the operational costs of IP licensing and royalty management. By tokenizing IP and defining licensing terms within on-chain modules, IP holders can achieve composable, legally protected usage in a low-friction market environment. Meanwhile, royalty payments that were previously delayed due to manual negotiations can now circulate autonomously on-chain, giving rise to new business models that are difficult to achieve under traditional IP systems.

Additionally, AI developers can quickly verify the usage terms of specific IP and legally reuse IP assets in their modules through micro-payments.

In this system, both large-scale IP institutions and independent creators can fairly contribute IP and receive compensation.

The ownership traceability information of IP is fully verifiable, eliminating unnecessary verification and cumbersome negotiation processes. The process of AI using IP assets is no longer a zero-sum game but a sustainable growth cycle. Once an IP asset is tokenized, it gains a complete digital toolset, bringing transferability, tradability, and revenue-sharing characteristics.

More importantly, when AI agents read data from a blockchain-based IP registry, they can automatically confirm whether a database or asset is available for commercial use, verify AI training permissions, initiate payments on-chain, and store an immutable transaction record.

This is the core of the Agent TCP/IP concept—enabling AI to interpret IP in code form under a universal communication protocol. IP no longer disappears into opaque AI training data pools but becomes a continuously traceable asset, with its usage, royalty earnings, and derivative content recorded in real-time.

In this model, IP holders can allow AI models to learn from their works while retaining oversight and receiving fair compensation. In the Web2 era, large-scale "scraping" of content often left IP holders without due compensation, but programmable IP transforms this process into a collaborative win-win, value-driven market.

Exponential Growth of AI-Generated Content and Data

AI is still in a relatively early stage of development, but it has already reached unprecedented scales in content production.

The most intuitive example is the explosion of generative AI—from Grok on X (formerly Twitter) to Stability AI's Stable Diffusion in collaboration with Story, and OpenAI's ChatGPT and Anthropic's Claude. These large language models (LLMs) can generate complex images or lengthy content from simple text inputs.

However, the influx of massive content and market saturation may dilute the value of original works.

Without infrastructure to track the hierarchical relationships between IP derivative works or ensure that derivative works provide reasonable compensation to original creators, the devaluation of AI-driven content becomes inevitable.

Therefore, we need to establish a new IP framework to coordinate the interests of all parties and create a fair and open environment for collaboration between humans and AI.

By transforming IP into liquid, composable tokenized assets, we can ensure that the speed and generative capabilities of AI do not infringe upon the legitimate rights of original creators. This model can guide the exponential growth of AI output from "disorderly plunder" to "collaborative win-win," allowing innovators, developers, and IP holders to share in the dividends brought by AI transformation.

Chapter 2: Story—The IP Blockchain in the AI Economy

Core Infrastructure for AI Data

As AI develops at an unprecedented pace, the demand for high-quality data and IP assets is surging in tandem.

Story is addressing the inefficiencies present in traditional IP systems—such as fragmented ownership, lack of executable licensing mechanisms, and opacity in ownership rights—which have become major obstacles to IP monetization and innovation.

By establishing a blockchain-based IP asset repository, Story aims to become the core infrastructure in the AI economy, making "programmable IP" a reality and enabling fair sharing and utilization of IP resources between humans and AI agents.

Story employs an execution environment similar to Ethereum and introduces a programmable IP license legal framework, allowing various IP assets to integrate with AI technology and provide high-quality knowledge input for AI.

For large IP holders, Story's on-chain repository enables them to efficiently manage vast IP asset portfolios, automating the licensing and monetization of IP assets. For example, AI developers can automatically obtain usage rights for specific IP resources through pre-set smart contracts, ensuring strict enforcement of contract terms.

For small and medium-sized IP holders, Story provides a global marketplace that allows them to tokenize and commercialize their IP assets while ensuring that their IP usage terms are readable and executable, effectively protecting their rights.

In short, IP will become the "digital gold" of the AI era, and Story will leverage its unique blockchain environment and carefully designed legal framework to realize this vision.

Story's Financing and Market Recognition

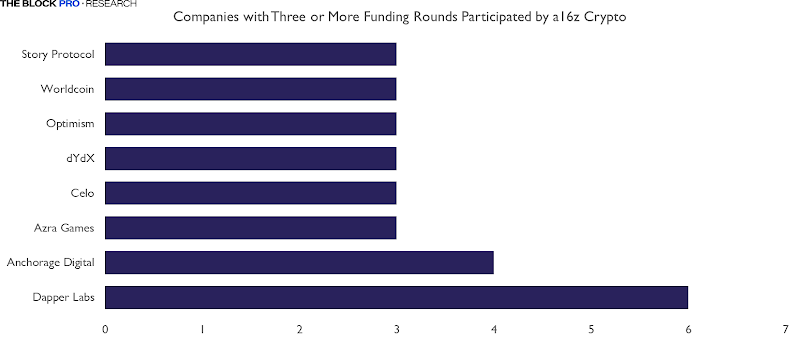

The potential of Story has been recognized by top investment institutions, which are optimistic about the transformative ability of the combination of blockchain and AI for the IP industry. Since its inception, Story has completed multiple rounds of financing, raising over $140 million in total, with a valuation of $2.25 billion following its latest funding round, reflecting the market's confidence in its model and growth prospects.

The seed round of Story was led by a16z Crypto, with support from Samsung NEXT Q Fund, which focuses on investing in AI startups.

Subsequent funding rounds were also led by a16z Crypto, attracting participation from top institutions such as Polychain Capital, Foresight Ventures, and Nomad Capital. Additionally, Story has garnered support from a group of angel investors, including Balaji Srinivasan, Charlie Songhurst, Stability AI head Scott Trowbridge, and Paris Hilton. Notably, South Korean entertainment industry giants such as Hybe founder Bang Si-hyuk and The Black Label CEO Yang Kyung-jin have also joined the investment ranks.

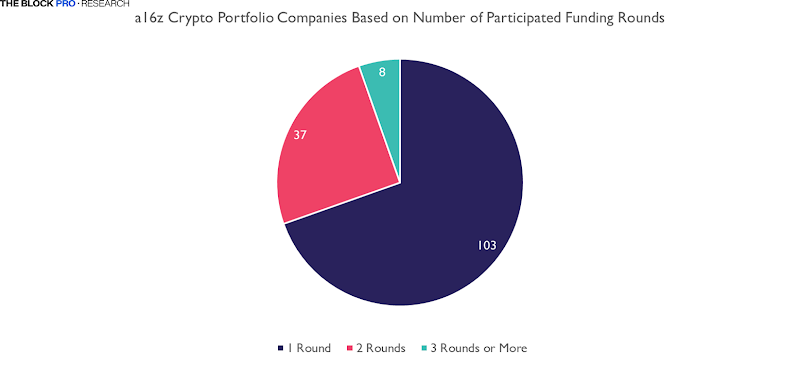

Data Source: The Block Pro Research

Story is one of the eight projects in which a16z Crypto has participated in at least three funding rounds, highlighting a16z's high recognition of its prospects.

Data Source: The Block Pro Research

Notably, Story is the only blockchain project in which a16z Crypto has led three consecutive funding rounds. It is extremely rare for a16z to make a "three-peat" investment across all industries, and our research indicates that this situation is unprecedented among blockchain projects.

Strong financial backing, combined with strategic guidance from top venture capital firms, crypto and AI investment funds, and industry leaders, further solidifies Story's leading position in the IP field. Story empowers IP holders with new tools to remain competitive in the rapidly evolving AI economy.

Story has also successfully completed one of the largest financings in the crypto industry, reflecting the growing recognition of IP as a key asset class and showcasing Story's innovative potential in the IP trading market—it is breaking the long-standing inefficiencies in the industry and providing new monetization opportunities for global IP holders.

Story's Headquarters and Global Layout

The Story team was born in Silicon Valley and is currently headquartered in Palo Alto, California, just minutes away from Stanford University and only a few steps from the headquarters of Aptos and Sui. The concentration of technical talent in this area has made it a hub known as "L1 Valley."

This geographical location not only ensures that Story remains at the forefront of blockchain and AI development but also allows it to attract top technical talent and maintain close ties with venture capital firms and leading global AI companies.

Additionally, Story adopts a global remote work model, attracting outstanding talent from around the world to ensure it can deeply engage with different markets and enhance its service capabilities across various industries and communities.

Definition of Story

Story is a purpose-built Layer 1 blockchain dedicated to bringing IP assets on-chain, enabling the programmability and composability of IP assets just as DeFi has made financial assets programmable.

As a "world-class IP blockchain," Story integrates the underlying architecture of the Ethereum Virtual Machine (EVM) and has undergone targeted optimizations.

These adjustments are specifically designed to handle the complex relationships within the IP Graph, such as tracking ownership chains and resolving the relationships between derivative IP assets and parent IP assets within the IP Graph.

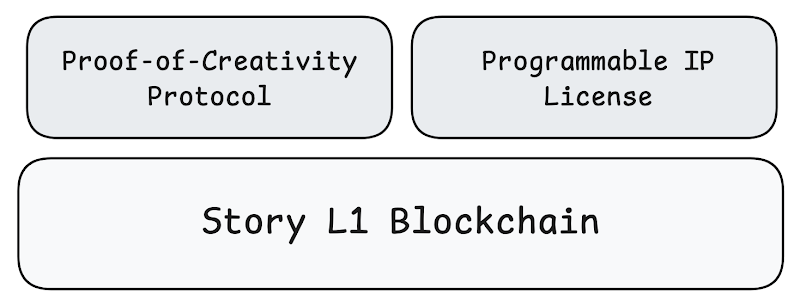

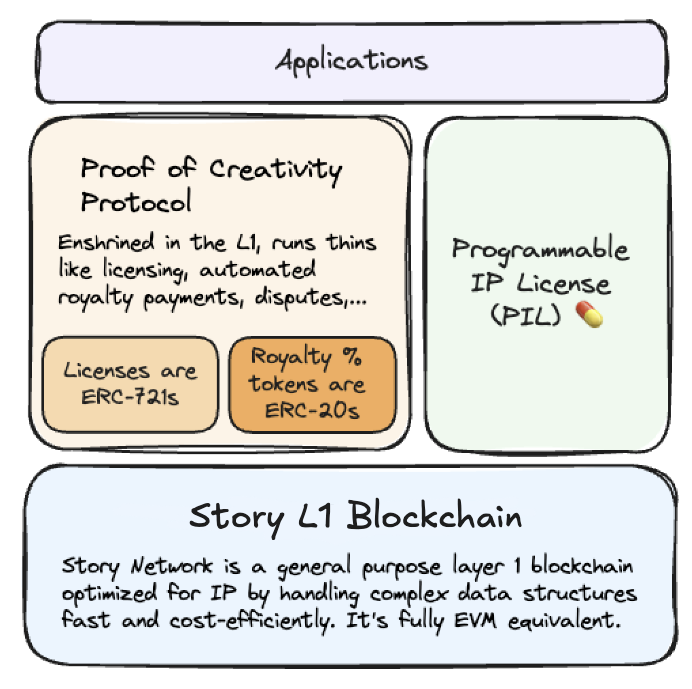

Essentially, Story is a suite of protocols centered around the tokenization of IP assets, consisting of three core components:

Story L1 blockchain network

Proof-of-Creativity (PoC) protocol

Programmable IP License (PIL)

Data Source: The Block Pro Research

These core components together build a complete programmable IP ecosystem, covering key aspects such as the tokenization of IP, revenue, and royalty distribution.

We will delve into the technical details of each component in the following chapters.

Programmable IP

In the Story ecosystem, IP assets tokenized through Story are essentially ERC-721 tokens with special token-bound accounts. Unlike traditional NFTs that link to a single file, Story's IP assets contain detailed IP metadata and embed modules that define usage conditions. This allows tokenized IP assets to automatically execute the following functions through programming:

Allow or restrict the creation of derivative works, setting authorization conditions and revenue distribution rules;

Automatically distribute royalty earnings among multiple co-holders of parent IP assets via smart contracts;

Ensure that the commercial use of AI models or platforms complies with preset authorization terms;

Enable IP asset holders to decide whether to open their data for AI training;

Track the ownership chain of IP assets and record their evolution paths and derivative works.

Once the IP asset is minted, it possesses an embedded API that can interact with dApps or AI services, simplifying the authorization process and promoting the development of AIGC and UGC ecosystems.

This model can facilitate collaborative innovation across various industries, from music distribution to AI model training data, from meme generation to brand licensing, and more.

Story as the Center of IP Assets in the AI Era

Unlike general blockchains, Story's design actively considers the needs of AI. By providing a single on-chain repository for tokenized IP assets:

- AI developers can easily discover and authorize curated databases for AI model training, covering images, text corpora, and even complete virtual worlds, without the need to negotiate with each IP holder individually.

This functionality is not limited to simple AI model training but can also be used for quantitative research or specific purposes such as interactions between AI agents.

Whenever an IP asset is accessed, minted, or derived, its rights holders automatically receive royalty earnings, thereby reducing transaction friction and enabling real-time recording of ownership.

Large studios or data providers can integrate their IP assets on Story, simplifying the authorization process across chains, platforms, or jurisdictions.

In the future, Story could even evolve into a global AI data marketplace where IP asset holders can provide data to AI developers and receive stable on-chain royalty earnings.

With the help of the Programmable IP License (PIL) mechanism, large enterprises around the world can trust that their IP assets have sufficient authorization protection and can easily track and verify the usage of their IP assets.

The collaboration between Story and Stability AI is a practical application of this vision.

As a developer of open-source AI models, Stability AI needs to continuously acquire licensed data streams. By incorporating global database providers and individual IP holders, Story has built a transparent market for Stability AI and other AI developers, where they can discover available IP assets, quickly confirm usage terms, and complete payments within a preset legal framework.

This system helps AI developers avoid the gray areas of data scraping while providing IP holders with efficient monetization channels.

Eliminating Barriers for IP Holders

Another significant advantage of Story is that even individuals and organizations lacking expertise in IP law can tokenize their assets and protect them from unauthorized use or other infringements.

By simplifying operational processes, Story makes the tokenization of IP assets more convenient, significantly lowering the entry barrier and enabling more people to utilize blockchain technology for IP protection and revenue maximization.

This simplified approach is highly attractive to different types of IP asset holders. For example, independent creators can quickly transform their IP assets into profitable digital assets.

From startups to mature tech companies, innovators and technical experts can use Story to protect their patents, software, and product designs while leveraging the automated execution of on-chain smart contracts to reduce infringement risks and explore various monetization methods, such as fractional ownership trading or time-limited licensing.

Universities and research institutions can utilize Story to tokenize databases, research results, and experimental methods, establishing a transparent authorization system and facilitating research collaboration or commercialization without dealing with the complexities of traditional IP contracts.

For large IP asset holders such as brands and enterprises, Story provides an efficient IP asset management solution, making cross-chain and cross-platform IP utilization more convenient. Companies no longer need to manage numerous fragmented licensing agreements or switch back and forth between multiple networks; instead, they can integrate IP assets on a unified platform and rely on Story's reliable legal mechanisms and transaction guarantees for safer and more efficient management.

Through these features, Story significantly lowers the technical and legal barriers to IP asset protection and monetization, allowing individual creators, research institutions, and even large enterprises to confidently engage in this ecosystem and manage and protect their IP assets more efficiently.

Chapter 3: Overview of Story Technology

Main Components of Story

Built on a dedicated technical architecture, Story aims to address the large-scale complexity of IP asset relationships, particularly suitable for AI systems handling vast tokenized databases.

Story employs advanced data structures, such as IP Graph and modular smart contract logic, to achieve precise automation in the authorization, royalty distribution, and dispute resolution of IP assets.

As mentioned earlier, Story consists of three core components, each providing solutions to different issues in the IP asset lifecycle.

Data Source: Story

Story L1

Story L1 is the infrastructure layer of the protocol, utilizing an EVM-compatible execution environment combined with the CometBFT consensus mechanism to achieve efficient transaction confirmation. However, the most critical feature of L1 is its ability to handle complex IP asset relationships, a capability known as the "IP Graph."

IP Graph and Vector-like Database Queries

Story uses custom precompiles and indexing techniques to track the complex upstream and downstream relationships or derivative relationships within the IP Graph. Unlike the traditional method of registering tokenized IP assets as static NFTs, Story's ledger structure allows for rapid querying and advanced retrieval within potentially large derivative networks.

This feature is crucial for AI applications. Because an image, a database, or a piece of text may have multiple parent assets, each parent asset needs to be allocated royalties or recognized in some form.

In practical applications, Story employs a vector-like database technology and optimizes it for on-chain use, enabling rapid tracing and traversal of multi-level IP assets.

As a result, AI developers can programmatically identify which parent IP elements are embedded in a database, calculate the corresponding royalty obligations, and check whether a specific derivative chain is subject to particular usage terms.

This specially designed data structure shifts Story's focus from traditional throughput metrics like TPS (transactions per second) to providing customized functional support for the AI era.

Proof-of-Creativity Protocol (PoC)

The Proof-of-Creativity Protocol (PoC) is built on top of Story L1, defining the tokenization and authorization methods for IP and regulating the flow of royalties both on-chain and off-chain.

PoC is often referred to as the "operating system" for IP assets, with its main functions including:

- Tokenization Rules

Ensuring that each IP asset adheres to standard metadata definitions, such as asset categories or usage terms during minting, representation, and identification.

- Modular Architecture for Agent Flows

Utilizing a plugin architecture to support flexible expansion of various modules (such as authorization, disputes, or royalty distribution).

This feature is particularly important for transactions between AI agents, as readable contract modules allow agents to autonomously negotiate or verify the usage terms of IP assets.

- Programmable Royalty Distribution and On-Chain Dispute Resolution

Including automatic royalty distribution logic applicable to complex derivative chains.

If a certain AI creation references several parent IP assets, PoC will proportionally distribute the income to each parent asset according to the terms preset by their holders. Additionally, the protocol has a dedicated dispute resolution function that can flag AI misuse or unauthorized derivative products and suspend their use until the dispute is resolved or escalated to the PIL legal layer.

The modular design of PoC ensures the protocol's continuous iteration without the need for large-scale reconstruction of the entire system. When new AI-specific modules are needed, such as for verifying synthetic content or implementing specific usage restrictions, they can be seamlessly integrated into PoC.

Programmable IP License (PIL)

The Programmable IP License (PIL) is responsible for the programmable management of on-chain tokenized IP assets, while PIL serves as an off-chain legal framework that connects to the traditional legal system in the real world.

By providing standardized terms, referencing recognized legal standards, and offering clear legal recourse when the on-chain solutions of the Story ecosystem are insufficient, PIL ensures that all IP asset transactions (including minting, licensing, and transfer) have corresponding legal validity off-chain.

Since PoC automates the on-chain mechanisms, when PoC automatically executes on-chain royalty distribution or generates sub-licenses for AI models, PIL guarantees that these smart contract obligations remain enforceable in court, with the relevant on-chain transaction history serving as litigation evidence.

PIL is particularly critical for resolving large-scale IP disputes or cross-border IP conflicts. Without PIL, the ownership and copyright recorded on-chain may be difficult to obtain legal recognition due to their inability to fully align with traditional IP regulations.

PIL Practical Use Case Analysis

Suppose an independent data provider mints its data as an IP asset on Story and plans to license it for use by AI developers.

The provider can set a pre-paid licensing fee and a continuous revenue-sharing ratio linked to future AI model outputs.

Whenever an AI developer initiates a transaction on Story L1 to integrate the data provider's IP asset into their AI model, the authorization module will reference PIL, automatically encoding the relevant fees and royalty distribution logic in PoC.

If the AI developer later sells an application that relies on the IP asset, they must distribute a portion of the revenue to the original IP holder.

If they fail to fulfill this obligation, the IP holder can initiate the on-chain dispute resolution mechanism. If the dispute cannot be resolved, for example, if the developer moves the activity off-chain or goes missing, the IP holder can still file a lawsuit in the relevant jurisdiction based on PIL.

The combination of Story L1, PoC, and PIL allows Story to provide a complete ecosystem for the registration, authorization, and execution of IP assets.

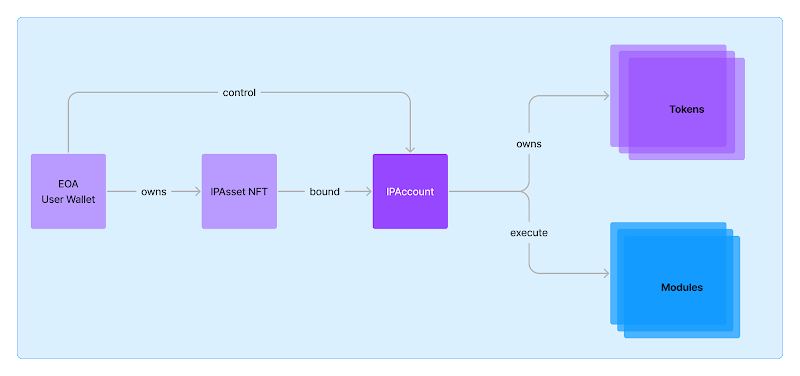

IP Assets & IP Accounts

In the Story ecosystem, IP assets and IP accounts are two core concepts.

IP assets are ERC-721 tokens that represent tokenized IP on-chain.

IP assets maintain a dynamic connection with Story's on-chain modules, allowing them to respond to external calls, which is crucial for AI use cases, especially for the numerous micro-authorization events that may occur during AI model iterations.

Each IP asset can form connections with its parent or child assets, thereby constructing a graph that helps trace the lineage of assets. When AI outputs involve multiple IP assets, the IP Graph ensures that all relevant parent assets are recognized, simplifying multi-party royalty calculations.

This functionality is vital for large AI models that rely on an entire content library, as it helps ensure compliance and enhance trust.

Since IP assets are bound to an IP account (smart contract account), they can have built-in modules and be customized for management as needed.

Data Source: Story

IP accounts are a modified implementation of the ERC-6551 standard, essentially serving as the "brain" for each IP asset, controlling the operation of these asset modules and enabling communication with external smart contracts.

Modules

Modules are independent smart contracts responsible for defining various operations within the Story ecosystem. Core modules include:

- Authorization Module

This module mints specialized IP assets and sets specific usage terms for the licensor (such as commercial or non-commercial use). The AI framework can call this module for the use of large-scale IP assets, whether for quantitative analysis, financial modeling, data insights, or general AI model training.

- Royalty Module

This module automatically handles royalty distribution for derivative works, particularly suitable for AI-generated content covering multiple parent IP assets, distributing revenue according to preset rules and proportions.

- Dispute Module

This module is used to flag potential infringement, suspend the use of disputed assets, or submit disputes to off-chain arbitration when necessary. If there is IP asset abuse or unauthorized derivative works, this module provides a trustless solution on-chain, avoiding direct entry into traditional legal processes.

- Future Module

The system's scalability allows for easy addition of new modules, such as partial IP fragmentation or Agent TCP/IP plugins for interactions between AI agents.

By breaking down IP operations into multiple independent modules, Story ensures the convenience of functional updates and new features, thereby providing an open environment for continuous innovation.

Chapter 4: Use Cases of Story

Stakeholders in the IP Ecosystem

As a multifunctional platform, Story provides programmable IP asset custody services, facilitating a broad ecosystem of IP holders, including AI practitioners and researchers. Each group benefits from the on-chain programmable IP features in different ways.

Key stakeholders include:

IP Creators—who wish to directly control licensing and revenue.

Large IP Holders—who plan to consolidate large-scale IP asset portfolios onto a single platform for management.

AI Developers—who seek convenient ways to use tokenized databases.

Users—who are eager to create derivative works from existing IP.

Developers—who build user-facing dApps for derivative creation of IP.

These stakeholders collectively form a self-reinforcing virtuous cycle—more IP assets minted lead to more derivative IP assets, resulting in more licensing transactions, enriching Story's IP repository.

This section will explore the various ecosystems supported by Story and their implementations.

AI Models, Agents, and Frameworks

The most prominent applications of Story are concentrated in the AI field.

For example, when an AI developer wishes to integrate a specific database into their AI model, the Story system can confirm whether the IP holder has enabled royalties and derivative licensing for that database.

If the developer decides to use the IP asset in their model and generates commercially viable content, Story's mechanisms will automatically trigger the corresponding royalty flows, ensuring that the IP holder receives their due compensation.

When AI developers require thousands of databases, they can rely on Story's universal IP repository to handle large-scale requests without needing to issue separate licensing agreements with tens of thousands of small IP holders. This frictionless approach greatly expands the application range of tokenized databases.

Emerging AI agent frameworks can further leverage Story's modular architecture. For instance, through Agent TCP/IP, AI agents can discover specialized IP assets relevant to their specific domains, then automatically negotiate usage terms and execute royalty payments through the on-chain authorization module.

Story will record the expansion of derivative works in real-time, ensuring that multiple parent IP holders can receive revenue shares promptly.

All of this points to a future where AI systems become active participants in the IP economy, autonomously generating derivative works and proportionally distributing royalties without human intervention.

IPFi—DeFi for IP

IPFi, as a new concept, is similar to DeFi. However, it does not limit financial activities to traditional on-chain collateral assets (such as ETH or stablecoins) but utilizes intangible IP assets.

Through this, IP holders can stake, borrow, or collateralize their IP assets, creating various DeFi-like opportunities that were previously only applicable to fungible tokens.

The stable income streams generated by on-chain licensing flows and derivative works can provide ongoing revenue for IP assets. These on-chain income streams can serve as financial support, form automated revenue strategies, or be packaged into advanced derivative financial products.

As the largest asset class globally, IPFi is expected to significantly expand the total addressable market (TAM) for DeFi and programmable blockchains. IP holders who have never participated in traditional DeFi now have the direct incentive to tokenize their IP assets; meanwhile, DeFi users can access non-traditional collateral assets.

By combining programmable IP with DeFi primitives, IPFi lays the foundation for building a more inclusive and diverse on-chain economy, not limited to native DeFi participants but also including large enterprises, research laboratories, and even small businesses seeking to monetize undeveloped IP.

Enterprise Applications

While large studios and corporate groups can handle high-value IP transactions, they miss many monetization opportunities in the long-tail transaction market.

With the emergence of AI, it enables the possibility of millions of high-quality derivative works, and the existing licensing structures of large corporate groups cannot keep pace with these changes. With near-zero-cost IP licensing, derivative tracking, and automated revenue distribution, Story opens up a new paradigm for the monetization and expansion of IP assets.

A typical example is the collaboration between Story and Stability AI, the developer of Stable Diffusion, one of the most well-known open-source text-to-image generation models.

Typically, agreements between enterprise-level IP and AI require cumbersome legal processes, especially when dealing with complex uses involving large-scale data, making it even more challenging to address the growing long-tail IP issues in commercial applications, such as niche AI image generators, derivative databases, or small specialized models that only require large corpus fragments.

By integrating Stable Diffusion into Story, IP holders can specify detailed terms for the use and derivatives of their IP assets while enjoying features like automated revenue sharing and real-time usage tracking.

Every new image content generated that references the IP asset will be recorded on-chain, storing its metadata, such as its parent assets, hierarchical relationships, and applicable royalty obligations. This means that enterprises no longer need to negotiate licensing permissions for each potential AI application individually but can rely on Story's programmable IP modules to execute or update their usage rights at scale.

From a business perspective, this model allows large enterprises, data providers, or AI laboratories to conduct extensive generative AI exploration without consuming excessive legal resources.

At the same time, it provides a convenient pathway for small businesses or independent developers, allowing them to quickly license and integrate large enterprise IP into their own AI applications.

In other words, the collaboration between Story and Stability AI provides an on-chain environment that replaces cumbersome one-off agreements, connecting IP assets with the demand for AI works through a unified authorization and monetization mechanism, forming an efficient ecosystem. For enterprises, this transparent and automated process helps them capture every incremental revenue.

In summary, the partnership with Stability AI positions Story as a pillar in data-intensive industries, offering an enterprise-level platform that simplifies derivative tracking, royalty distribution, and authorization management processes to support large-scale AI applications.

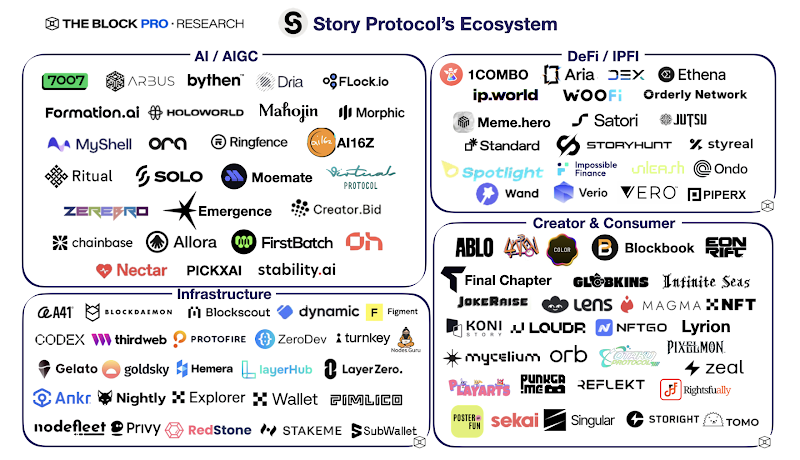

Story Ecosystem

One of the key features of the Story ecosystem is that it significantly lowers the barrier for developers to create innovative IP applications.

Since each IP asset can be found in a global, easily searchable IP repository, dApps can easily integrate advanced authorization and derivative features with almost no additional cost.

Aria is a project within the Story ecosystem that utilizes Story's IP repository to tokenize cultural IP (such as music copyrights, film copyrights, and significant artworks) into programmable IP assets.

This approach not only bridges the gap between culture and finance but also allows fans, investors, and IP creators to own cultural IP and profit from it in unprecedented ways. It provides IP creators and holders with new revenue sources while enabling fans and investors to share in the profits of their favorite IP.

Mahojin is a typical project in the Story ecosystem. It uses AI algorithms to generate derivative works from existing IP assets. Whenever Mahojin interacts with an IP asset, it queries Story's repository to verify the applicable authorization terms.

If the terms allow for commercial use, Mahojin's AI can generate derivative works in different modes and automatically calculate the royalty distribution for the parent IP holders.

This method avoids the hassle of negotiations and ensures that every contributor, whether a creator or an indirect parent IP asset, receives a fair share of the revenue.

Mahojin exemplifies the gradual shift of the Story ecosystem towards agent-driven flows. In some cases, these processes are triggered automatically by AI agents rather than humans.

Leveraging Story, Mahojin does not need to redesign dispute modules, authorization logic, or royalty calculation mechanisms; instead, it can directly call standardized modules shared by the ecosystem, alleviating the compliance burden for Mahojin developers and IP holders.

Ablo is an application that allows users to create derivative works based on various well-known brand IPs using AI.

On Ablo, anyone can use Ablo's AI tools to create derivative works based on brand licensing templates and publish co-branded products. The platform serves as a hub for well-known brand IPs, allowing anyone to use IP as easily as building with Legos, while brand owners can set corresponding rules for how their IP is used. This enables users of varying skill levels to generate unique designs using AI and apply them to clothing to share with others.

Typically, if users want to collaborate with each brand, it involves a large number of contracts, negotiations, and legal statements. However, with Story's global IP repository, Ablo only needs to identify available IP assets, check their usage terms, and pay the relevant fees and royalties on-chain.

If a dispute arises, such as a developer using unauthorized derivative IP assets, the ecosystem's built-in dispute module will automatically engage, flagging the infringing derivative IP, suspending its further use until the dispute is resolved.

Additionally, since Story automatically manages the ownership chain and provenance of each IP asset, such conflicts are easier to detect and address.

In addition to direct licensing, Ablo also supports aggregation features, allowing multiple smaller IP holders to bundle their assets into a curation package and collectively license them to larger gaming projects.

The fourth example is Sekai, which showcases the potential of the Story ecosystem in large-scale community-driven "universe building."

Sekai provides a platform that allows multiple IP holders to contribute to storylines, characters, and backstories, minting each contribution as an IP asset. A virtual universe can thus accumulate tens of thousands of IP assets.

Since these assets exist within the Story ecosystem, whenever new derivative works are created, the system automatically identifies their parent assets. If users in Sekai merge multiple IP assets into a new series of derivative works, Story will automatically set the correct revenue distribution to ensure that each relevant IP holder receives their due earnings.

Some IP holders may allow their IP to be used unconditionally, while others may charge a small fee, hoping their IP is used only under specific conditions.

The ultimate effect is the formation of an ever-expanding collaborative universe. IP holders can be assured that their contributions will be recognized and monetized appropriately, while IP creators can quickly create based on existing contexts.

In addition to human-centered dApps, several well-known AI agent frameworks, including Virtuals' G.A.M.E., Zerebro's ZerePy, and ai16z's Eliza, are also integrating with Story to enable automated IP transactions between AI agents, allowing them to exchange or optimize data in real-time.

Through Agent TCP/IP, these frameworks enable AI agents to seamlessly locate and authorize IP assets from Story's repository.

For example, a G.A.M.E. agent can access specialized databases required for advanced simulations, while an Eliza-based agent may integrate multiple on-chain research assets during analysis and "converse" with other agents to share derived insights or code.

In each case, Story's authorization and royalty modules autonomously track asset usage, ensuring that every parent IP holder is fairly compensated, regardless of how many times the asset is remixed or merged.

This frictionless IP exchange between AI agents expands the economic possibilities for AI developers and IP holders. Knowledge, data, and royalties can autonomously flow on a large scale between AI agents, shaping a machine-driven IP economy.

Data Source: The Block Pro Research

While many existing dApps focus on human IP creators, the development of the Story ecosystem also actively considers the needs of AI agents.

Open-source frameworks can access Story for direct authorization, allowing autonomous AI agents to operate on behalf of human operators and even request/permit the use of IP assets on behalf of other AI agents.

If an agent is designed to acquire high-quality images for a specific AI model, it can seamlessly browse the Story repository, select relevant IP assets, and use them through small payments.

In more complex application scenarios, these AI agents may generate derivative IP after optimizing or merging multiple IP inputs. Story's modular architecture and built-in dispute resolution mechanisms fully support this agent-driven process. Therefore, when agents misuse authorized IP data, the on-chain complaint mechanism can instantly freeze infringing derivative works or readjust royalty flows.

Chapter 5: Conclusion

With the foundational components of Story, including programmable IP, an open network, a framework connecting code and law, and an ever-growing ecosystem, the next generation of tokenized databases is poised for unprecedented explosive growth.

By focusing on integration with AI, Story lays the groundwork for a self-reinforcing cycle, where each new project showcases the platform's potential and drives more IP holders to join the wave of IP tokenization.

At the same time, as AI application scenarios become richer, the economic demand for a robust IP infrastructure continues to grow. AI model builders need a reliable channel for tokenized databases for training, while IP holders need to ensure that the use of their data is fairly compensated.

Story provides just such a unified platform, bridging different media and ensuring that the flourishing of AI becomes a tremendous opportunity for IP holders rather than a threat.

Just as NVIDIA has established dominance in AI computing, Story is also striving to become the "NVIDIA" of the intellectual property (IP) field. If NVIDIA's hardware innovations address the computational bottlenecks of AI, then Story addresses the next critical bottleneck of the AI era: access to and management of high-quality data and IP.

By building a unified on-chain IP asset repository, Story aims to reshape data rights and provenance mechanisms, just as NVIDIA drives AI transformation through GPU acceleration, making Story an indispensable part of the AI value chain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。