The original text is from Arthur Hayes' "The Ugly", translated by Odaily Planet Daily's jk.

(Original title: The Ugly Reality

Any opinions expressed in this article are solely those of the author and should not be construed as investment advice or recommendations.)

"The Ugly Reality" is the first of three articles in my series. "The Good Side" will discuss the rise of political meme coins, while "The Bad Side" will explore how U.S. cryptocurrency holders may be frustrated by the Trump administration's crypto regulatory policies.

Disclaimer: I am an investor and advisor for Ethena, the parent company of the $USDe stablecoin, which is mentioned multiple times in this article.

The main text is as follows:

“Stop—keep a distance of thirty meters.” This was the instruction given to me by a guide a few weeks ago while climbing a dormant volcano to ski. Our pace was easy all the way until we reached an altitude of 1,600 meters, when things changed.

As we stopped together on the ridge, my guide said, “That last stretch made my stomach tighten; the avalanche risk is too high, so let’s start skiing here.” I didn’t share the same intuition and couldn’t perceive the subtle yet profound changes in the snowpack. This is precisely why I always choose to ski with a certified guide—seemingly mundane terrain can become my icy grave. You can never be sure whether skiing down a slope will trigger an avalanche, but if the anticipated risk exceeds your comfort level, the prudent course of action is to stop, reassess, and change your route.

In my first article of the year, I proclaimed my bullish outlook on the market, at least for the first quarter. However, as January came to a close, my excitement had dissipated. Subtle changes in central bank balance sheet levels, fluctuations in bank credit expansion rates, the relationship between U.S. 10-year Treasury yields and stock and Bitcoin prices, and the wild price movements of $TRUMP all left me feeling uneasy. This sentiment is strikingly similar to the mood before the market crash at the end of 2021.

History does not repeat itself exactly, but it often rhymes. I do not believe this bull market has ended, but from a forward-looking probability perspective, Bitcoin is more likely to first drop to $70,000 to $75,000 before rising to $250,000 by the end of the year, rather than continuing to rise without a pullback. Therefore, Maelstrom has increased its staked amount of Ethena $USDe to an all-time high and continues to lock in profits on multiple altcoin positions. We still maintain a significant net long position, but if my intuition is correct, we will hold a large cash reserve to buy in when Bitcoin pulls back and to build positions aggressively when many quality altcoins crash.

Such a magnitude of pullback would be quite severe, as current market sentiment is extremely bullish. Trump has continuously made pro-crypto statements through executive orders, boosted market sentiment by pardoning Ross Ulbricht, and recently launched his own meme coin, igniting a frenzy in the crypto market. However, aside from the launch of meme coins, most of this was anticipated. What the market has yet to fully realize is that the issuance of fiat currency in the U.S., China, and Japan is slowing down.

The remainder of this article will discuss relevant charts and monetary policy announcements from various countries that have prompted me to reduce Maelstrom's cryptocurrency holdings.

United States

My views on U.S. monetary policy are influenced by two firm beliefs:

The 10-year U.S. Treasury yield will rise to 5% to 6%, triggering a small financial crisis.

Federal Reserve officials hate Trump, but they will take necessary measures to maintain the financial system under Pax Americana.

I will explain the interaction between these two viewpoints.

10-Year Treasury

The U.S. dollar is the world’s reserve currency, and U.S. Treasuries are the global reserve asset. This means that if a country or institution has a surplus of dollars, buying U.S. Treasuries is the safest way to store value while also earning interest. Since U.S. Treasuries are considered “zero-risk” assets under accounting standards, financial institutions can borrow funds or assets to purchase them with almost unlimited leverage. However, if the value of Treasuries declines rapidly, the accounting “fairy tale” can turn into an economic nightmare, potentially leading to the bankruptcy of systemic financial institutions.

The 10-year Treasury yield is the benchmark that influences the pricing of most medium- to long-term fixed-income instruments (such as mortgages and auto loans). It is one of the most important asset prices in the fiat currency system, making the 10-year yield crucial.

Since 1913 (the year the Federal Reserve was established), every financial crisis has been “solved” by printing money, leading to the accumulation of leverage in the financial system. Consequently, the yield threshold for a crisis in the financial system has been decreasing. When the 10-year yield briefly broke above 5%, former U.S. Treasury Secretary “Bad Gurl Yellen” immediately implemented policies to issue more short-term Treasuries (T-bills), which is essentially a form of invisible money printing. As a result, the 10-year yield quickly fell back to 3.60%, marking a local low in this cycle.

If 5% is the critical point for a financial crisis, why would the yield rise from the current 4.6% back to 5% or even higher? To answer this question, we need to understand who the main incremental buyers of U.S. Treasuries are.

Who is Buying These “Junk” Treasuries?

It is well known that the U.S. government is issuing debt at an unprecedented rate. As of now, the total U.S. national debt has reached $36.22 trillion, more than doubling from $16.70 trillion at the end of 2019. So, who is buying these Treasuries?

Let’s look at several major potential buyers.

1. The Federal Reserve

The Federal Reserve implemented quantitative easing (QE) from 2008 to 2022, during which it purchased trillions of dollars in Treasuries. However, starting in 2022, the Fed stopped printing money (quantitative tightening, QT) and no longer increased its holdings of Treasuries.

2. U.S. Commercial Banks

U.S. commercial banks bought heavily into Treasuries when prices were at historical highs, only to be crushed by “transitory inflation” and the fastest rate hike cycle by the Fed in 40 years. Worse still, under Basel III capital adequacy regulations, banks need additional equity as collateral when purchasing Treasuries, significantly increasing the cost of holding them. As a result, U.S. commercial banks' balance sheets are fully occupied and cannot buy more Treasuries.

3. Major Forex Surplus Countries

This refers to oil-exporting countries (like Saudi Arabia) and commodity-exporting countries (like China and Japan). Although these countries have accumulated a large amount of dollars from global trade, they have not been actively purchasing U.S. Treasuries. For example, as of November 2024, China’s 12-month trade surplus reached $962 billion, but during the same period, China's holdings of U.S. Treasuries decreased by about $14 billion.

So, who is buying these “rough single-ply toilet paper” Treasuries?

Despite the U.S. desperately trying to force Treasuries into the global financial system, a debt crisis has yet to erupt. I ask again, who is buying these junk bonds? Undoubtedly, anyone buying these things does not respect their own backside.

Let’s give a round of applause to the relative value (RV) hedge funds. These funds are typically registered in places like the UK, Cayman Islands, and Luxembourg to avoid taxes, and they are the marginal buyers of U.S. Treasuries. How do I know this? The recent U.S. Treasury quarterly refinancing announcement (QRA) explicitly stated that these hedge funds are the current marginal buyers supporting Treasury yields. Additionally, if you look at the monthly TIC (Treasury International Capital) report released by the U.S. Treasury, you will find that institutions from the aforementioned countries and regions have accumulated a significant amount of U.S. Treasuries.

How Do Hedge Funds Engage in Treasury Arbitrage?

As long as the trading price of spot Treasuries is lower than the corresponding Treasury futures contract price, hedge funds can profit through arbitrage trading (basis trade). Due to the small price difference, the only way to make big money is to trade nominal amounts in the billions. However, hedge funds do not have that much cash, so they need the banking system to provide leverage.

The trading process is as follows:

Hedge funds buy Treasuries with cash, but before actual payment, they enter into a repurchase agreement (repo) with a major bank.

Hedge funds deliver the Treasuries, and the bank provides cash.

The fund uses this cash to pay for the Treasury purchase.

Ultimately, the hedge fund buys Treasuries with other people's money, only needing to pay the margin to the futures exchange (e.g., Chicago Mercantile Exchange CME).

In theory, as long as the following conditions are met, RV hedge funds can buy U.S. Treasuries in unlimited quantities:

The bank's balance sheet has enough space to support repo transactions.

The repo yield is low enough; otherwise, the arbitrage trade will not be profitable, and hedge funds will stop buying Treasuries.

Margin requirements remain low; if hedge funds need to put up more margin in the futures market for hedging, the number of bonds they can buy will decrease. Hedge funds have limited capital, and if most of their funds are locked in margin accounts at exchanges, their trading volume will decrease.

However, due to the constraints of the above factors, the buyer role of RV hedge funds is facing threats.

Impact of Bank Balance Sheets / Repo Rates

According to the Basel III Accord, bank balance sheets are limited resources. Supply and demand determine that when balance sheet space approaches exhaustion, its price (i.e., repo rate) will skyrocket. Therefore, as the Treasury continues to issue more Treasuries, RV hedge funds engage in more arbitrage trades, using more repo financing, occupying more bank balance sheet space, ultimately leading to a surge in the overnight repo rate (o/n repo rate).

Once the repo rate skyrockets and funds stop buying, the U.S. Treasury market will collapse.

If you want to delve deeper into the underlying mechanisms of financial market liquidity, I recommend subscribing to Zoltan Pozar's research reports, which provide an in-depth analysis of the mechanisms of the money market.

Exchange Margin Requirements

In simple terms, the higher the volatility of an asset, the higher the margin requirements. When bond prices fall, volatility increases. If bond prices fall/yields rise, volatility (as referenced by the MOVE index) skyrockets. When this happens, the margin requirements for bond futures increase, leading to a rapid decline in the bond purchasing volume of RV hedge funds.

The interaction of the above two factors forms a reflexivity mechanism. The question is, is there a way to untie this "Gordon Knot" through monetary policy, allowing RV hedge funds to continue financing the Treasury?

The answer is, of course, yes. Our monetary authorities can always resolve financial crises through accounting maneuvers. In this case, the Federal Reserve could suspend the Supplemental Leverage Ratio (SLR). If the SLR rules are suspended, making them no longer applicable to U.S. Treasuries and related repurchase agreements (repo), then banks would be able to use unlimited leverage.

If the SLR exemption policy takes effect, the following will happen:

Banks can purchase Treasuries in unlimited quantities without needing to pledge capital, thereby freeing up balance sheet space.

Banks' balance sheets will no longer be constrained, allowing them to provide low-cost repo financing.

The Treasury will gain two new marginal buyers: commercial banks and RV hedge funds. Bond prices will rise, yields will fall, and margin requirements will decrease—market prosperity will be restored, and peace will reign.

If the Federal Reserve is willing to be a bit "more generous," it could stop QT (quantitative tightening) and restart QE (quantitative easing). This way, the Treasury would gain three major marginal buyers.

The Treasury and the Federal Reserve are well aware of the above issues. The banking industry has been calling for years for a similar SLR exemption policy as during 2020. A recent report from the Treasury Borrowing Advisory Committee (TABCO) explicitly stated that the market needs an SLR exemption, while the Federal Reserve should resume QE to "fix" the liquidity issues in the Treasury market.

The only thing missing is the political will of the Federal Reserve, which leads me to my second point.

The Federal Reserve's Political Stance

The statements of former and current Federal Reserve officials, as well as their actions during the Biden administration, lead me to believe that the Federal Reserve will do everything in its power to obstruct Trump's policies.

However, the Federal Reserve's constraints have limits. If a large financial institution faces bankruptcy, or if the fiscal stability of the entire empire is threatened, the Federal Reserve will not hesitate to adjust bank regulatory rules, lower funding costs, or even restart the printing press.

How Do Federal Reserve Officials View Trump?

Here are the remarks from two high-ranking Federal Reserve officials. The first is former Federal Reserve Governor and New York Fed President William Dudley (2009-2018), and the second is current Federal Reserve Chair Jerome Powell, whom I refer to as the "beta cuck towel bitch boy":

“President Trump’s trade war with China has continued to undermine business and consumer confidence, worsening the economic outlook. This man-made disaster has put the Federal Reserve in a dilemma: should we provide economic stimulus to alleviate the damage, or refuse to cooperate? … Federal Reserve officials can clearly state that they will not 'foot the bill' for a government that continually makes erroneous trade decisions, and make it clear to the public that Trump must bear the consequences of his policies … It can even be said that the election itself is within the Federal Reserve's responsibilities. After all, Trump’s re-election clearly poses a threat to the U.S. and global economy, the independence of the Federal Reserve, and its employment and inflation targets.”

— "The Federal Reserve Should Not Enable Trump's Policies," William Dudley

How Will the Federal Reserve Respond to Trump's Victory?

At a press conference following a policy meeting, when asked how the Federal Reserve would respond to Trump’s victory, Powell stated:

“Some people have indeed taken a very preliminary step to begin incorporating the economic impact of policy into highly hypothetical forecasts at this meeting.”

This is interesting. Before the election, the Federal Reserve used one set of economic forecasts to lower interest rates to help Harris, but now, because of Trump’s victory, they are considering another set of forecasts. In fact, the Federal Reserve should have consistently used the same estimation model in the months leading up to the election. However, what do I know? I’m just a crypto muppet.

What Has the Federal Reserve Done for Biden?

Initially, we heard about “transitory inflation.” Remember? Powell calmly asserted that the inflation caused by the fastest and largest monetary printing in U.S. history was merely a temporary phenomenon that would soon disappear. However, four years later, inflation levels have remained above the Federal Reserve's own manipulated, false, and dishonest inflation indicators.

They used these sophistries to delay interest rate hikes, only beginning to tighten monetary policy in 2022, knowing that raising rates could trigger a financial crisis or economic recession. Their judgment was correct; the Federal Reserve directly caused the regional banking crisis in 2023.

Subsequently, the Federal Reserve went silent, and "Bad Gurl" Yellen completely undermined the Federal Reserve's monetary tightening policy. Starting in September 2022, she drained liquidity from the Reverse Repo Program (RRP) by issuing more short-term Treasuries (T-bills). The Federal Reserve could have at least stood up against the Treasury's actions, after all, they claim to be independent of the federal government, but they did not do so.

By September 2023, the Federal Reserve paused interest rate hikes while inflation remained above target. By September 2024, they even directly initiated a rate-cutting cycle, massively printing money. Has inflation fallen below target? No.

The Federal Reserve claims to be combating inflation, but when political needs require maintaining low-cost government financing and boosting financial asset prices, the Federal Reserve plays along.

Why do politics need to do this? Because the Biden administration was doomed to fail from the start. Half of Americans believe Biden is a senile old man, and his party cheated in the 2020 election. In hindsight, the Republicans were right about Biden's "vegetable" qualities, and whether he cheated is also likely true. In any case, to prevent the Republicans from regaining Congress and to stop Trump from being re-elected in 2024, the Federal Reserve will go to great lengths to avoid a financial and economic crisis.

How Does the Federal Reserve Protect the Existing Financial System?

In some cases, the Federal Reserve has even exceeded its mandate to help the Democrats. The most typical example is the introduction of the Bank Term Funding Program (BTFP).

During the regional banking crisis in early 2023, the Federal Reserve's rate hike policy and the subsequent bond market crash caused significant losses on the Treasuries that banks had purchased at the highs of 2020-2021, leading to a financial crisis. The Federal Reserve recognized the crisis and adopted a special political strategy: allowing three banks that supported cryptocurrencies to fail to appease Elizabeth Warren (a senator who has attacked the crypto industry multiple times). Subsequently, the Federal Reserve directly provided an invisible backstop for up to $4 trillion in U.S. Treasuries and mortgage-backed securities (MBS) on the banks' balance sheets.

In hindsight, the BTFP may have been an overreaction, but the Federal Reserve's purpose was clear: to signal to the market that if the Pax Americana financial system faced a significant threat, they would not hesitate to start the printing press and take comprehensive action.

Bad Blood

Powell is a traitor; he was appointed by Trump in 2018 but has now completely betrayed him. This is not surprising, as Trumpism was undermined during his first term by a group of disloyal subordinates. You can view this as a good or bad thing, but in any case, the relationship between Trump and Powell is now completely broken.

After Trump recently defeated Biden, Powell immediately clarified concerns about his potential resignation, stating that he would serve his full term until May 2026.

Trump has consistently emphasized that the Federal Reserve must lower interest rates to "Make America Great Again." Powell responded in his usual manner—Federal Reserve decisions are "data dependent." This means they will do whatever they want and then have the interns in the Federal Reserve basement concoct an economic theory to provide so-called "academic justification" for their decisions. Remember DSGE (Dynamic Stochastic General Equilibrium), the IS/LM model, and "Ricardian Equivalence"? If you are not working at the Federal Reserve headquarters—the Marriner Eccles Building—those things are all nonsense.

How Can Trump Make the Federal Reserve "Choose Sides"?

He could trigger a small financial crisis. Here’s a possible scenario:

Continue to maintain large fiscal deficits, which require the Treasury to issue a significant amount of debt. This is evident from the appointment of Musk to lead a "meme department" that has no real power. Musk's wealth largely depends on the billions in subsidies and tax breaks provided by the government (such as the policies enjoyed by Tesla). This so-called "Department of Government Efficiency" (DOGE) is not a real federal government department, as establishing a new department requires congressional legislative authorization. It is merely an "honorary advisory role" directly under Trump, with no real power. Memes are powerful, but they cannot cut Medicare spending or defense budgets. Only members of Congress can make those tough decisions, but why would they do something that would affect their chances in the 2026 re-election?

Immediately provoke a debt ceiling showdown. Bessent (a possible Treasury Secretary) could use various fiscal tools to delay the government shutdown. During the debt ceiling struggle in the summer of 2023, Yellen used funds from the Treasury General Account (TGA) to provide additional liquidity to the market while delaying the government shutdown, allowing the Treasury to continue borrowing. But Bessent could choose to sit on the sidelines, not depleting TGA funds. If the Treasury does not inject funds, the U.S. Treasury market will grind to a halt, and investors will panic and sell Treasuries due to fears of government default.

This series of actions will quickly push the 10-year U.S. Treasury yield above 5%.

If Bessent announces that the government will hit the debt ceiling on a specific date and that the Treasury will not use TGA funds to keep the government running, the turmoil in the financial markets could rapidly escalate within days.

As Treasury yields soar, the stock market will plummet, and certain large financial institutions in the U.S. or abroad will face severe liquidity crises. The Federal Reserve will be cornered by political realities, and to save the financial system, they will have to take the following measures (partially or fully):

Provide SLR (Supplemental Leverage Ratio) exemptions so that banks can purchase Treasuries with unlimited leverage.

Significantly lower interest rates.

Stop quantitative tightening (QT).

Restart quantitative easing (QE).

If the Federal Reserve takes these actions, Trump will publicly praise the Federal Reserve for "making a tremendous contribution to America," and the financial markets will regain vitality.

The aforementioned issues could develop into a crisis due to the uncertainty surrounding the debt ceiling, and when the crisis will be triggered entirely depends on Trump. If the crisis occurs in the later stages of Trump's administration, the Republican Party is more likely to be blamed for the crisis rather than the leverage issues accumulated during the Biden administration. Trump must ensure that voters attribute the responsibility to Biden and the Democrats, rather than to himself or the Republican Party; otherwise, Trumpism and the MAGA movement will die in the womb, surviving only two years until the Democrats regain power after the 2026 midterm elections.

The printing spree of the dollar will eventually come, but the prerequisite is that the Federal Reserve must first stand on Trump's side. The Federal Reserve is not the only financial driving force; is the banking system creating credit?

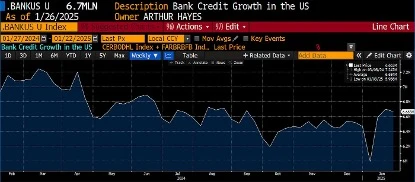

The answer is no. From my bank credit index, which is the sum of the Federal Reserve's bank reserves, deposits, and liabilities, credit growth is currently stagnating. The flow of funds must remain smooth; if the pace of credit expansion is below expectations, the market will give back the gains brought by Trump's victory.

China

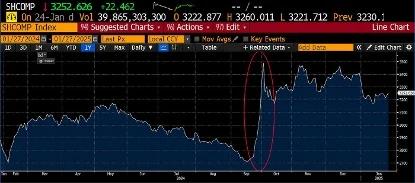

In the third quarter of 2023, the People's Bank of China announced a series of measures aimed at boosting the economy. Essentially, these measures involve printing money. They lowered the bank reserve requirement ratio, began purchasing Chinese government bonds, and assisted local governments with debt refinancing. These measures ignited a strong rebound in the A-share market.

If you are addicted to Xiaohongshu and have not realized when the Chinese central bank and government announced these re-inflation policies, I have already circled it on the Shanghai Composite Index chart above. The government hopes investors will rush in to welcome the asset price surge brought by the renminbi printing, and this strategy has worked.

In the article "Let’s Go Bitcoin," I argued that China is prepared to allow the renminbi to depreciate if necessary, as an inevitable result of large-scale money printing policies. Allowing the dollar to rise against the renminbi means a stronger dollar and a weaker renminbi. Everything was going according to plan until January 2024, when China suddenly changed its policy.

On January 9, 2024, the People's Bank of China announced the termination of its government bond purchase program. The central bank intervened in the market, actively promoting the appreciation of the renminbi. This means:

The central bank cannot relax the domestic financial environment through the depreciation of the renminbi.

At the same time, it actively intervenes to promote the appreciation of the renminbi.

Economist Russell Napier believes that China is preparing for difficult negotiations with Trump, avoiding the premature consumption of policy tools. He predicts that the U.S. and China may reach some sort of "big deal," as both countries want their currencies to depreciate to stimulate exports and improve the domestic economy. However, the leaders of both sides cannot directly compromise, or they will be seen as weak by their domestic populations, violating their campaign promises.

Regardless of the true reasons, China has chosen to stabilize the renminbi rather than continue to push for economic recovery. Therefore, the renminbi printing machine has been temporarily shut down until further notice.

Japan

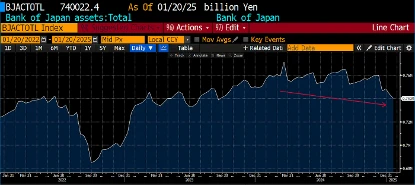

The Bank of Japan (BOJ) has fulfilled its commitment to continue raising interest rates. In a recent meeting, they raised the policy interest rate by 0.25% to 0.50%. A direct consequence of the interest rate normalization plan is that the expansion of the central bank's balance sheet has stagnated.

As the policy interest rate rises, the yield on Japanese government bonds (JGB) has climbed to levels not seen in nearly 15 years.

The growth rate of the money supply is far below that of the past, while its price (interest rates) is rising rapidly. This is not a favorable market environment for financial assets priced in fiat currency.

The USD/JPY is in the process of peaking. I believe that in the next 3 to 5 years, the USD/JPY exchange rate will reach 100 (meaning the dollar depreciates and the yen appreciates). As I have analyzed multiple times before, the appreciation of the yen will prompt Japanese companies (Japan Inc.) to repatriate trillions of dollars in capital, while investors who borrowed in yen must sell assets to cope with the surge in financing costs.

For the global fiat currency financial market, the biggest concern is the negative impact of this selling on U.S. Treasury prices. This will become a long-term structural resistance, and Bessent must find a way to cope. Ultimately, the U.S. government will have to release dollar liquidity through some form of dollar swap line facility to resolve the issue, but before that, the market must first undergo a period of pain to provide the necessary political cover to make monetary support policies reasonable.

I have explained why the liquidity conditions of the dollar, renminbi, and yen are unfavorable for the price growth of fiat financial assets. Now, I will further explain the impact of this on Bitcoin and the crypto capital market.

The Sharpening Correlation

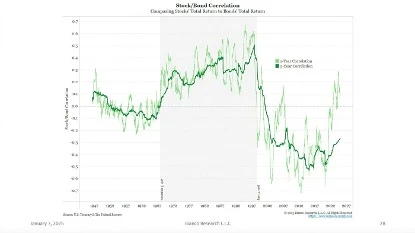

We need to discuss the most concerning issue for bond investors under Pax Americana. I will take some time to analyze a highly valuable chart created by Bianco Research, which shows the correlation between 1-year and 5-year stock-bond prices and draw some conclusions from it.

From the 1970s to the early 21st century, inflation was the "boogie man" that American investors feared the most. Therefore, stock and bond prices were positively correlated. When inflation intensified and negatively impacted the economy, investors would sell both bonds and stocks simultaneously.

This situation changed after China joined the World Trade Organization (WTO) in 2001. American capitalists began outsourcing manufacturing to China in exchange for profit growth for domestic companies. From then on, the market's focus shifted from inflation to economic growth. In this new paradigm, a decline in bond prices indicated accelerated economic growth, so stocks should perform well, leading to a decrease in the correlation between stocks and bonds.

However, starting in 2021, you can clearly see that the 1-year stock-bond correlation has risen sharply. This is because the Flu-19 crisis (fiscal stimulus during the pandemic) led to a resurgence of inflation, which soared to its highest level in 40 years. The Federal Reserve began its rate hike cycle in early 2022, during which bond prices and stock prices fell simultaneously, returning this relationship to the pattern seen from the 1970s to the early 2000s, where inflation became the primary concern of the market.

This is particularly evident in the performance of the 10-year U.S. Treasury. When the Federal Reserve paused interest rate hikes in September 2023 and began a rate-cutting cycle in September 2024, inflation remained above the 2% target, but the market was still worried about inflation.

The following three charts illustrate this trend:

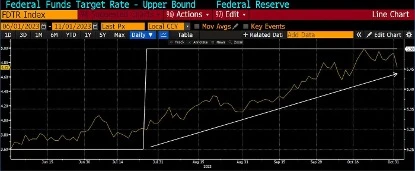

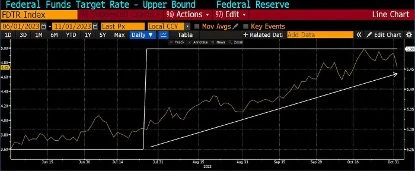

- Federal Reserve Federal Funds Rate Upper Limit (white) vs. 10-Year U.S. Treasury Yield (yellow)

From these charts, it is evident that market fears of inflation are intensifying, as yields continue to rise even when the Federal Reserve loosens monetary policy (cuts rates).

Comparing the first two charts, which represent the previous rate-cutting cycle from late 2018 to March 2020, when the Federal Reserve cut rates, yields fell in tandem. This time, however, the situation is entirely different.

No matter what others say, the price of money will always affect assets priced in fiat currency. Tech stocks are extremely sensitive to interest rates; you can think of them as bonds with infinite duration. Simple math tells us that when the discount rate for future cash flows rises, the present value of tech stocks will decline. When dysfunction in the financial system causes yields to break through a certain critical level, this mathematical relationship will reveal its ugliest side.

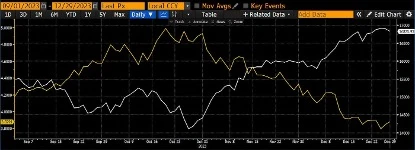

The chart above shows the Nasdaq 100 Index (white) vs. 10-Year U.S. Treasury Yield (yellow). You can see that when yields approach 5%, the stock market declines, while when yields fall back, tech stocks experience a significant rebound. This is a typical market reaction in a financial environment where inflation is the primary concern rather than economic growth.

Let’s put all the factors together. The dollar, renminbi, and yen are interchangeable in the global financial market, and they will ultimately flow into large U.S. tech stocks in some form. Whether you like it or not, this is a fact. I have just analyzed why, in the short term, neither the U.S., China, nor Japan is accelerating the expansion of fiat currency supply, and in some cases, they are even raising the price of money.

Inflation remains high and is likely to rise further in the short term against the backdrop of a decoupling global economy. This is why I expect the yield on 10-year U.S. Treasuries to continue to rise. So, how will the stock market react when the reason for rising yields is market panic over inflation and the rapid expansion of U.S. debt without finding new marginal buyers? They will plummet.

In the long term, Bitcoin has a low correlation with the stock market, but in the short term, their correlation may become very high. The 30-day correlation between Bitcoin and the Nasdaq 100 index is currently elevated and continues to rise. If tech stocks suffer a severe setback due to soaring yields on 10-year U.S. Treasuries, this is not a good sign for Bitcoin's short-term price trajectory.

Moreover, I firmly believe that Bitcoin is currently the only truly free market globally, and it is extremely sensitive to changes in global fiat liquidity. Therefore, if a fiat liquidity crunch is about to occur, Bitcoin's price will collapse ahead of the stock market and become a leading indicator of financial stress.

If there is a panic sell-off in the bond market that leads to systemic pressure in the financial markets, the regulators' answer will be to print money. First, the Federal Reserve will side with Trump, fulfilling its "patriotic duty"—pressing the button on the dollar printing machine (USD Brrr). Subsequently, the People's Bank of China can also loosen monetary policy in sync without worrying about the depreciation of the renminbi. Remember, the monetary system is relative; if the Federal Reserve engages in large-scale money printing, then the People's Bank of China can print money in sync without affecting the USD/CNY exchange rate.**

As for Japan, the largest foreign exchange asset holdings of Japanese companies (Japan Inc.) are dollar-denominated financial assets. Therefore, if the prices of these assets decline, the Bank of Japan (BOJ) will pause interest rate hikes to ease the financial environment for the yen.

In short, a small financial crisis in the U.S. will provide the cryptocurrency market with its most coveted monetary "nectar." At the same time, this is also extremely beneficial for Trump's political interests. Overall, I believe the probability of this situation occurring in the first quarter or early second quarter is about 60%.

Trading Probability and Expected Value

As mentioned in the introduction, when the perceived risk of an avalanche rises, we stop skiing. The key is not to take unnecessary risks to verify unknown dangers. Extending this metaphor to the crypto market, Maelstrom chooses to maintain a low allocation to hedge against risks. The core here is not about right or wrong, but about expected value (EV).

How do you determine if you are wrong? In reality, you will never truly know, but in my view, if Bitcoin breaks through $110,000 (the peak during the $TRUMP frenzy) with strong trading volume and a significant increase in perpetual contract open interest, then I will concede and buy back at a higher position.

More specifically, the $TRUMP token skyrocketing to nearly $100 billion in fully diluted valuation (FDV) within 24 hours is undoubtedly an absurd market signal. I bought it a few hours after it launched and sold it during half of my weekend spa vacation. The profits from this trade far exceeded the entire vacation expenses, accomplished with just a few clicks on my phone. Trading shouldn't be this easy, but during a frenzy, it is that simple.

In my view, the surge signal of $TRUMP is similar to the advertising signs that FTX purchased for MLB umpires during the 2021 bull market—it symbolizes the approach of a market top.

The essence of trading is not about right or wrong, but about recognizing probabilities and maximizing expected returns. Let me explain my thought process. Of course, these probabilities are subjectively perceived; the essence of investing is making decisions under conditions of imperfect information.

Why do I believe Bitcoin will have a 30% pullback?

I have been trading in this market for over 10 years and have experienced three bull markets. Such a magnitude of pullback is very common in bull markets. More importantly, after Trump's re-election in early November 2024, Bitcoin will quickly break through the historical high set in March. Many, including myself, have widely discussed that Trumpism will accelerate the U.S. money printing process, and other countries will respond with their own money printing to stimulate their economies.

But the core point of this article is that these large-scale monetary easing policies in the U.S., China, and Japan cannot be initiated before a real financial crisis occurs.

Therefore, I believe the market will pull back to the previous historical high, completely giving back the Trump bump.

Trading Strategy Calculation:

60% probability: Bitcoin pulls back 30%

40% probability: Bull market continues, Bitcoin rises 10%

Calculating Expected Value (EV):

(60% * -30%) + (40% * 10%) = -14%

Mathematics tells me that reducing risk is the right choice. I reduce risk by selling Bitcoin and holding more liquid assets (staking USDe, currently yielding 10% to 20% annually).

If Bitcoin drops 30%, the altcoin market will face a catastrophic disaster. And that is the area I am truly interested in.

Maelstrom holds a large liquidity position in early investments and advisor allocations. We have already liquidated most of it. The highest quality projects in the market will drop at least 50% if Bitcoin falls 30%.

The ultimate mega liquidation candle will tell me when to "go all in" and acquire crypto dung in the market.

If I am wrong, my loss is merely having taken profits early and sold some Bitcoin that I previously bought with altcoin profits. But if I am right, we have ample cash on hand to quickly increase our positions during the market sell-off and earn 2x or even 3x profits on quality altcoins.

Conclusion

When this article is submitted to my editor on January 27, 2025 (Monday), the market is in a state of full panic. The reason is that investors are beginning to reassess their bullish logic regarding NVIDIA and U.S. tech stocks, and the trigger for all this is the release of DeepSeek. DeepSeek is an AI model developed by a Chinese team, with training costs 95% lower than those of OpenAI and Anthropic's latest models, yet it outperforms them.

The nature of bubbles is that when investors begin to question a core belief, they start to question all beliefs. What I am most concerned about is the collapse of the market's belief that "interest rates don't matter." The DeepSeek event may prompt Western investors to panic and begin to focus on the global fiat liquidity crisis and the long-term upward trend of 10-year U.S. Treasury yields.

It is truly ironic that China is fully embracing open-source, while the U.S. still clings to closed systems (walled gardens). Market competition is a wonderful thing, isn't it?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。