Original | Odaily Planet Daily

Author | jk

On February 3, as the festive atmosphere was still lingering, the sharp decline in the cryptocurrency market caused many investors' wallets to shrink significantly. In just a few hours, Bitcoin plummeted from over $97,000 to a low of $91,000, later stabilizing above $93,000, with a 24-hour drop of 6%; Ethereum fared even worse, dropping from $3,000 all the way down to a low of $2,100 after breaking through support, before recovering to $2,500, with a 24-hour drop of around 20%. Additionally, XRP dropped 20% in 24 hours, Solana fell 7.6%, BNB dropped 13.5%, and Dogecoin decreased by 18.2%. The crypto bulls were in despair, with liquidations reaching $1.8 billion in 24 hours.

The hardest hit were the 1inch team, who spent $10 million in USDC this morning to buy 3,257 ETH at an average price of $3,070. Just two hours later, ETH plummeted 20%, evaporating $2 million in thin air; one can only wonder how they feel about it.

For further insights into the short-term market, you can read “ETH Drops 30% in 24H, Is the Crypto Bull Market Over?.”

Bitcoin trend, source: Coingecko

Meanwhile, another question we are concerned about is, what will happen in the next week, month, and three months? Will the market, as predicted by Arthur Hayes, plummet to $70,000? Or will it briefly recover in value, returning above $100,000 like in December and January? Additionally, many are concerned about another core question: is Ethereum still a buy?

Let’s take a look at institutional perspectives and mid-term predictions.

Arthur Hayes: Bitcoin May Drop to $70,000, Could Reach $250,000 by Year-End

Renowned KOL in the crypto industry and BitMEX co-founder Arthur Hayes stated on January 27, just a week ago on X: “I predict BTC will correct to between $70,000 and $75,000; however, a small financial crisis and the resumption of money printing will push Bitcoin to $250,000 by year-end.”

In a subsequent lengthy post, Hayes mentioned an important point:

“History does not repeat itself, but there are always similarities. I do not believe this bull market cycle has ended; however, from a forward-looking probability perspective, I think Bitcoin is more likely to drop to $70,000 to $75,000, then rise to $250,000 by year-end, rather than continue to rise without a substantial correction.

I believe we will fall back to the previous historical peak (referring to March 2024, when Bitcoin was priced between $60,000 and $70,000) and give back all the gains brought by Trump.

The probability of a 30% correction in Bitcoin is 60%, while the probability of the bull market continuing and Bitcoin rising by 10% is 40%. Based on calculations, reducing risk is the right approach… If Bitcoin crashes, the junk coin sector will face an apocalypse, and that is where I truly want to participate.”

He later stated he would increase his position in Ethena USDe. According to his theory, if the affected investors should calm down and continue to hold, waiting for Trump to fulfill related promises and benefits, they should wait for Bitcoin to reach $250,000.

Arthur Hayes tweet, source: X

Previously, Arthur Hayes successfully predicted that the market would experience a significant correction before Trump took office because the market would eventually realize that Trump's promises could not be fulfilled quickly or before the next midterm elections, corresponding to the significant drop from over $100,000 around December 17 and January 9.

CryptoQuant: The Bull Market Will Not End Before ETF and Institutional Purchases Slow Down

CryptoQuant CEO Ki Young Ju stated on January 31 that the Bitcoin bull market cycle has not yet ended. This seems to be a response to the voices in the market suggesting that “the bull market will peak in March.”

He believes that the buying engine for Bitcoin is still running: “In 2021, the market decline occurred two months after the GBTC fund inflow dried up. There is no need to rush to judge the cycle peak before ETF, MicroStrategy, and institutional purchases slow down.”

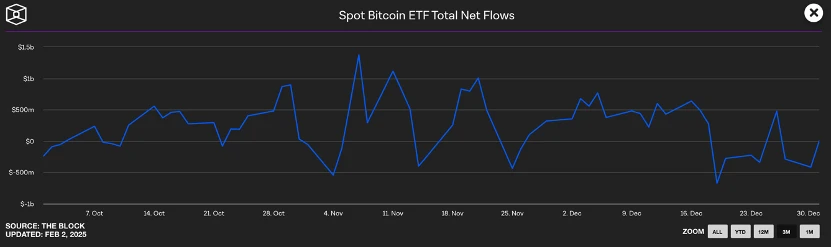

According to current trends, the inflow rate of ETF funds has not slowed down. From the data, the inflow volatility in the past three months is significantly higher than in the previous three months, and the net inflow is significantly greater than the net outflow, showing no signs of exhaustion.

Net inflow of spot Bitcoin ETF in the past three months, source: The Block

Bitwise Chief Investment Officer: Market Decline is Short-Term, Long-Term Still Bullish

A week ago, Bitwise Chief Investment Officer Matt Hougan analyzed the cryptocurrency market decline. He posted on X: “When the market declines and cryptocurrencies are also sold off, people always panic about the correlation. But history shows: short-term declines, long-term rises.

My colleague Juan Leon (Bitwise Senior Investment Analyst) researched this. Over the past decade, if you look at all the days when SPX fell 2% or more, Bitcoin averaged a decline of 2.62%. In contrast, gold averaged an increase of 0.11%, indicating it is a better single-day hedging tool. But if you look at the situation a year later from those days, Bitcoin averaged a rise of 189%, while gold averaged a rise of 7%.

QCP Capital: The Market Will Not See Significant Upside Until Trump's "Bitcoin Strategic Reserve" is Confirmed

Bitcoin is not expected to see significant upside until the confirmation of establishing a strategic Bitcoin reserve. The Trump administration's assessment of the “national digital asset reserve” is insufficient to sustain the market's recent optimistic sentiment. At least from March onwards, the risk reversal still leans towards call options, indicating that the market will not have too many expectations until the end of the quarter.

Matrixport: This Round of Sell-Off Caused by Lack of Liquidity and Trend Following Trading, Market Expected to Recover Soon

Matrixport co-founder Daniel Yan stated that the current Asian market is overly sensitive to negative news and lacks independent thinking. This round of sell-off is a typical weak market caused by a lack of liquidity and trend-following trading by commodity trading advisors (CTAs). The impact of the new tariff policy on U.S. productivity and inflation is limited, and the market is expected to recover soon.

Of course, there is also the classic bullish voice: three hours ago, Michael Saylor posted on X: “Never sell your Bitcoin.” Perhaps we will soon hear the sound of Microstrategy increasing its position again.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。