1. Bitcoin Market and Mining Data

From January 27 to February 2, 2025, Bitcoin's price exhibited significant volatility, with market sentiment oscillating between bullish and bearish. The specifics are as follows:

This week, Bitcoin showed a trend of consolidation, rapid decline, and rebound breakthrough followed by a drop. The market was characterized by intense bullish and bearish competition. The price briefly fell below $100,000 but quickly rebounded, forming key support at $104,000 and $102,000. On the evening of the 30th, it briefly broke through $106,100 but failed to stabilize, subsequently retracing to around $102,000 and further dipping to approximately $99,540. Overall, the market remains in a consolidation pattern, leaning towards weakness, with a focus on the upward resistance at $105,200 and the downward support at $98,000 in the short term.

Bitcoin Price Trend (2025/01/27-2025/02/02)

Market Dynamics and Macroeconomic Background

1. Capital Flow: Institutional Funds Cautious, Short-term Market Sentiment Strengthens

This week, Bitcoin market capital flows showed a diverging trend, with net inflows to exchanges rising, indicating that some investors chose to take profits, creating selling pressure. In the derivatives market, perpetual contract funding rates were slightly negative, reflecting strong short-selling sentiment in the short term, with leveraged funds cautious about high-level breakouts. Additionally, the continued outflow of Grayscale GBTC puts downward pressure on the market, while the slowing net inflow of spot Bitcoin ETFs indicates that institutional funds have not provided sufficient buying support, leading to an overall wait-and-see attitude in the market.

2. Technical Analysis: Consolidation Pattern, Key Support and Resistance Levels Alternating Tests

Bitcoin maintained a consolidation pattern this week, repeatedly testing the support areas of $102,000 and $104,000, with buying support remaining relatively strong. However, after rebounding above $105,200, it failed to break through effectively, indicating heavy selling pressure above. From a technical indicator perspective, the RSI (Relative Strength Index) oscillated around 50, failing to provide a clear trend signal, while trading volume did not significantly increase during key position breakthroughs, reflecting insufficient market momentum. Overall, the market remains in a consolidation phase; if $102,000 is lost, it may further retrace to $98,500, while a breakout above $105,200 could push prices up to the $106,500 - $108,000 range.

3. Market Sentiment: Intensified Bullish and Bearish Competition, Short-term Risk Appetite Declines

In terms of market sentiment, this week the Bitcoin Fear and Greed Index fell from the "Greed" zone to "Neutral," indicating a cooling of speculative sentiment and a weakening of investor confidence in the short-term market. Meanwhile, on-chain activity decreased, with average daily trading volume declining, suggesting a lack of strong new capital inflows in the short term. Implied volatility (IV) in the options market slightly increased, reflecting heightened expectations for future volatility, but overall risk appetite has declined, with investors remaining cautious and in a wait-and-see phase.

4. Industry News and Macroeconomic Background: Policies and Market Dynamics Affect Market Expectations

On the macroeconomic front, with the February FOMC meeting of the Federal Reserve approaching, market expectations for interest rate cuts have cooled, and the US dollar index remains high, putting pressure on risk assets like Bitcoin. Additionally, the slowing inflow of spot Bitcoin ETFs has weakened market liquidity support, limiting Bitcoin's short-term upward momentum. On the other hand, significant advancements in the AI industry have triggered market risk aversion, particularly with the rise of the domestic AI model "DeepSeek" impacting global tech stocks, leading Bitcoin to fall below the $100,000 mark, hitting recent lows. Overall, macroeconomic policies and developments in the tech industry are jointly shaping the short-term trends in the crypto market, and investors need to continuously monitor policy expectations and industry movements.

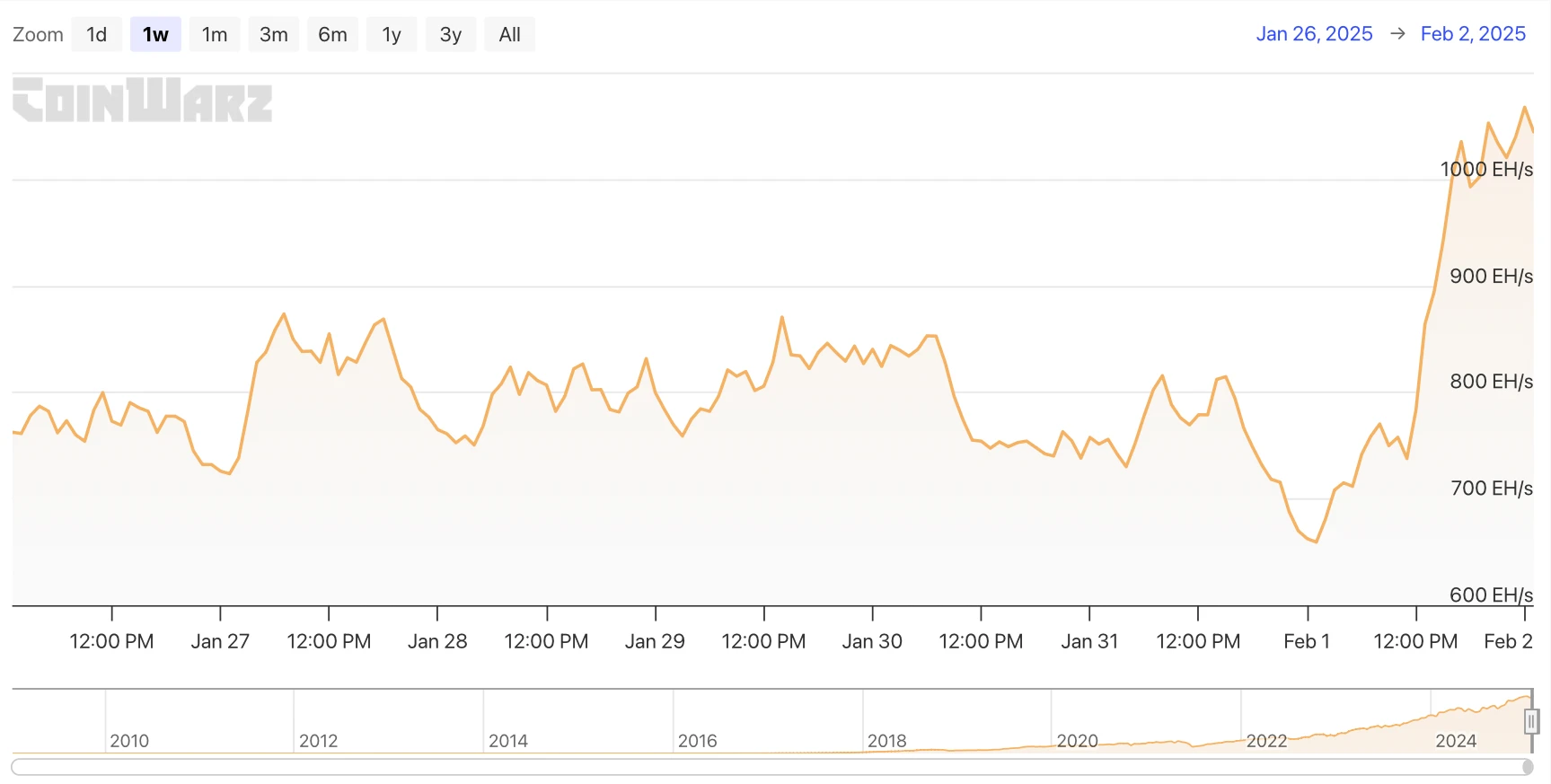

Hash Rate Changes:

From January 27 to February 2, 2025, the Bitcoin network hash rate experienced significant fluctuations, reflecting the dynamic adjustments of miners' computing power and the impact of market conditions on mining activities. From January 27 to 28, the Bitcoin hash rate initially stabilized around 775 EH/s, briefly dipped, and then quickly rebounded to 873.35 EH/s, before falling back to the 850 EH/s range and further declining to 752.36 EH/s in the evening. On the evening of January 28, the hash rate oscillated around 800 EH/s. From January 29 to 30, the hash rate remained around 800 EH/s, with a slight increase on the evening of the 29th, reaching 870.30 EH/s. On January 30, the hash rate maintained around 835 EH/s but dropped to 754.84 EH/s in the evening, indicating some fluctuations in computing power. From January 31 to February 1, the hash rate continued to adjust. On January 31, it was relatively stable, operating around 750 EH/s during the day, and rose to 815.35 EH/s in the evening. However, on February 1, the hash rate first dropped to 659.12 EH/s and then quickly rebounded to 856.65 EH/s. On February 2, the hash rate rapidly surged to 1034.99 EH/s and then oscillated up to 1067.35 EH/s, indicating a dramatic change in network computing power within a short period.

Bitcoin Network Hash Rate Data

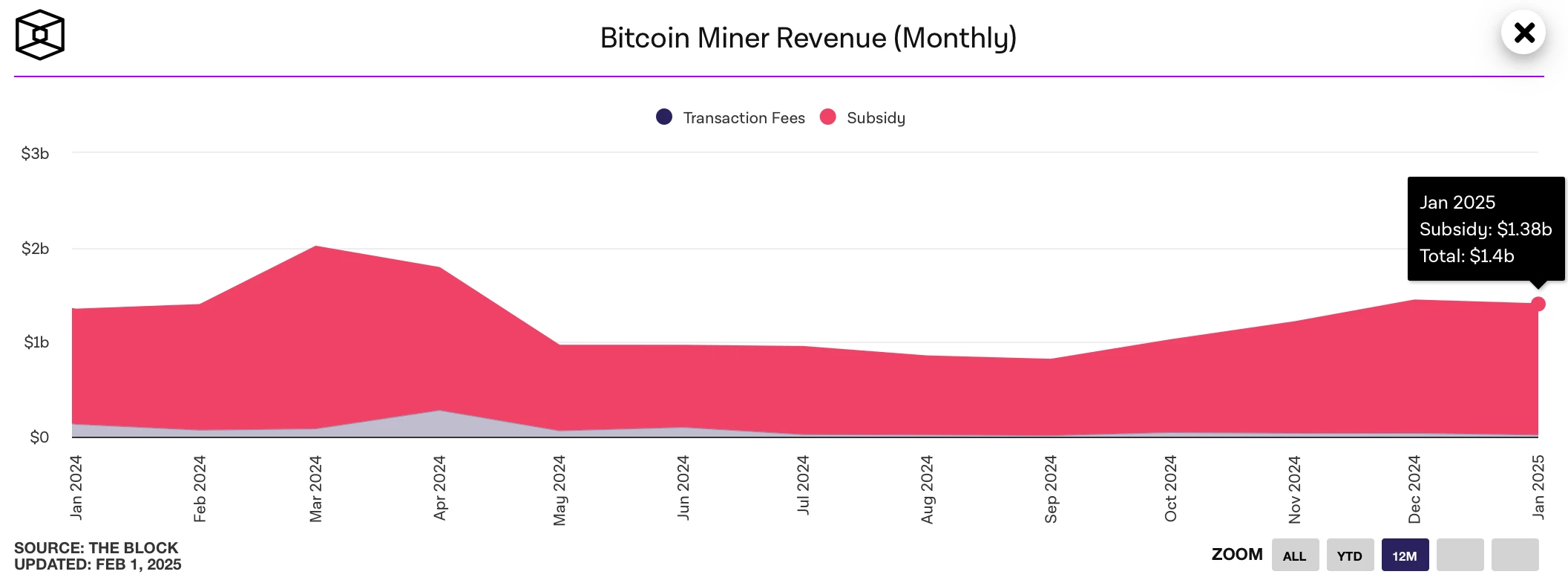

Mining Revenue:

According to data from The Block, Bitcoin miners' total revenue in January reached $1.38 billion. Although this is a slight decrease from $1.44 billion in December 2024, it remains at a high revenue level, indicating the stability of miners' profitability. During the period from January 27 to February 2, 2025, miners' revenue was influenced by Bitcoin's price fluctuations and changes in block rewards. During this period, Bitcoin's price briefly fell below $100,000 before rebounding, while the hash rate experienced significant fluctuations, reflecting the dual impact of miners' computing power adjustments and changes in market sentiment. Additionally, transaction fees contributed to miners' revenue during this cycle, with some periods showing slight increases in miners' income due to changes in network congestion. Overall, Bitcoin miners' profitability remains at a high level this week, but future attention is needed on Bitcoin's price trends and mining difficulty adjustments, as these factors may affect miners' long-term profitability.

Bitcoin Miners' Revenue Data

Energy Costs and Mining Efficiency:

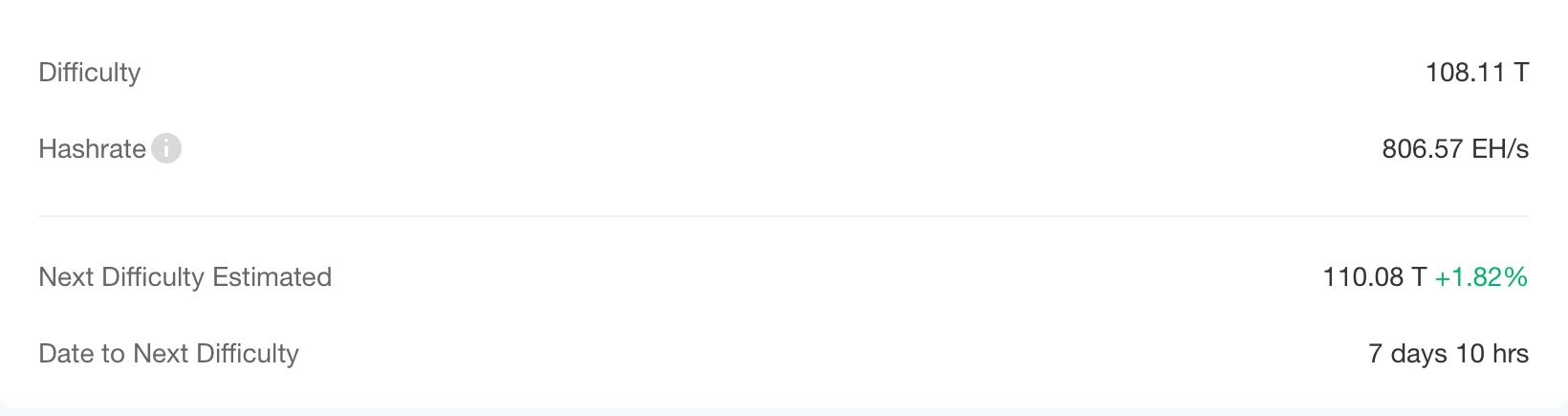

On January 27, 2025, the Bitcoin network completed a new round of difficulty adjustment at 11:22:53, with the difficulty value reduced by 2.12% to 108.11T. This adjustment lowered the mining difficulty for miners and improved overall mining efficiency. Currently, the average computing power of the Bitcoin network is 806.57 EH/s, and the next Bitcoin mining difficulty is expected to increase by 1.82% to 110.08T on February 9. With the difficulty adjustment, miners' operational efficiency has also been optimized, affecting overall energy consumption.

On February 1, news reported that due to a cold wave in the United States, rising electricity prices led to a decrease in Bitcoin mining difficulty for the first time since late September 2024. According to statistics from Bitcoin mining company Luxor, the US accounts for 36% of global Bitcoin computing power, with Texas contributing nearly half. The polar cold wave in January increased electricity costs in the US, impacting mining company profitability, leading to a decrease in mining difficulty on January 27. In the previous six months, there had only been two decreases in mining difficulty. Luxor expects that as temperatures warm up, computing power will gradually stabilize. Additionally, some US mining companies, such as Riot Platforms, are planning to shift some computing power to AI and high-performance computing businesses to reduce market volatility risks.

Bitcoin Mining Difficulty Data

2. Policy and Regulatory News

Multiple US States Advance Bitcoin Reserve Legislation, Texas Joins the Push

Multiple US states are advancing Bitcoin reserve legislation, with Arizona having approved a bill and Texas joining the ranks. On January 27, the Arizona Senate Finance Committee approved a bill by a vote of 5 to 2, allowing public funds to invest in Bitcoin and other digital assets. Meanwhile, South Dakota and Kentucky have also proposed similar legislation to establish strategic Bitcoin reserves. Additionally, on January 30, Texas Lieutenant Governor Dan Patrick announced that Bitcoin reserves would be included in the legislative priorities for 2025, further promoting the proposal for Bitcoin reserve legislation in the state. Texas has joined at least five other states pushing for Bitcoin or cryptocurrency reserves, marking ongoing progress in the US towards incorporating digital assets into public finance.

El Salvador's Congress Has Amended Its Bitcoin Law to Comply with IMF Agreement

On January 30, news reported that El Salvador's Congress has swiftly passed legislation to amend its Bitcoin law to comply with the International Monetary Fund (IMF) agreement. Ruling party legislator Elisa Rosales stated that the amendment aims to ensure the permanence of Bitcoin as legal tender while promoting its practical application.

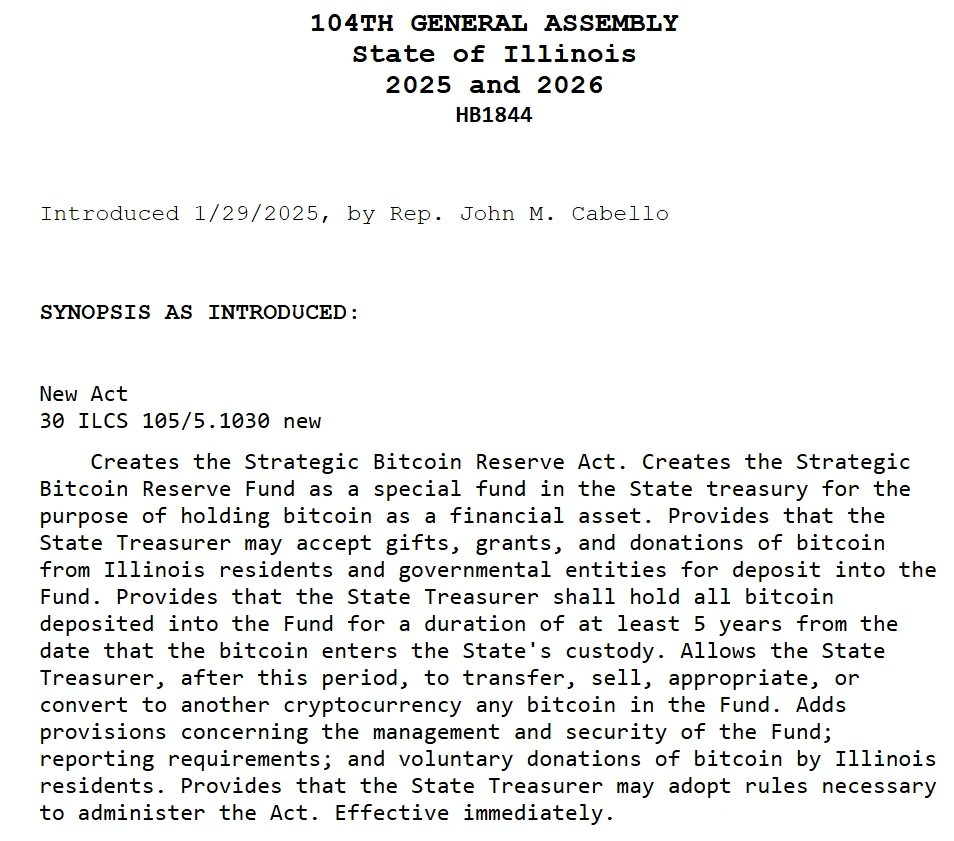

Illinois Proposes Bitcoin Reserve Bill Requiring a Holding Period of At Least 5 Years

On January 30, news reported that Illinois lawmaker John Cabello proposed HB1844, a bill to establish a strategic Bitcoin reserve fund within the state treasury.

The bill stipulates that Bitcoin must be held for at least five years after entering state custody before it can be transferred, sold, or converted into other cryptocurrencies. The bill has currently been submitted to the rules committee, awaiting final approval from lawmakers.

Screenshot of HB1844 Bill

Texas Lieutenant Governor Announces "Bitcoin Reserve" as a Legislative Priority for 2025

On January 30, news reported that Texas Lieutenant Governor Dan Patrick announced the state's legislative priorities for 2025, which include a proposal to establish a Texas Bitcoin reserve. Texas joins at least five other states in the U.S. that are pushing to establish Bitcoin (BTC) or cryptocurrency reserves, including Arizona and Utah, where strategic reserve bills have passed through committees.

3. Bitcoin News

Global Corporate and National Bitcoin Holdings (This Week's Statistics)

MicroStrategy increased its holdings by 10,107 Bitcoins at an average price of approximately $105,596, bringing its total holdings to 471,107 BTC, with a purchase cost of about $30.4 billion and an average price of approximately $64,511. Additionally, MicroStrategy submitted a mixed securities registration application, planning to use potential proceeds to further increase its Bitcoin holdings.

Metaplanet plans to raise approximately 116 billion yen (about $745 million) to purchase Bitcoin, which would set a record for the largest Bitcoin fundraising in Asian stock market history. At the same time, Metaplanet announced its Bitcoin strategy, planning to hold 10,000 BTC by the end of 2025 and further increase it to 21,000 BTC by the end of 2026.

Nuvve plans to allocate 30% of its idle funds to purchase Bitcoin to diversify its treasury assets and support Bitcoin payment options.

El Salvador currently holds 6,049.18 Bitcoins, worth approximately $618 million.

BlackRock's IBIT spot Bitcoin ETF holds 576,529.33 BTC, accounting for 2% of the total Bitcoin supply, with a market value exceeding $58.8 billion.

Worksport announced the completion of its first Bitcoin and XRP purchases and plans to continue increasing its holdings while adding cryptocurrency payment options to its official website.

Monochrome's spot Bitcoin ETF (IBTC) holds 305 BTC, with a market value exceeding $50 million, approximately $50.2765 million.

Thumzup Media Corporation released a shareholder letter disclosing its holding of 19.106 BTC, and the company plans to allocate up to 90% of its liquid assets to Bitcoin based on board-approved strategies.

Matador announced spending approximately $500,000 to increase its holdings by 3.38 Bitcoins, bringing its current holdings to nearly 65 BTC, with plans to continue increasing its Bitcoin holdings.

Genius Group is seeking up to $55 million in equity and additional loan financing to purchase BTC to bolster its Bitcoin reserves, with expected net proceeds from the equity offering reaching $33 million and additional loan financing up to $22 million.

Trump: 100% Support for the Cryptocurrency Industry and Will Elevate Bitcoin to New Heights

On January 27, news reported that Bitcoin Magazine CEO David Bailey stated on the X platform that U.S. President Trump mentioned in their conversation, "He will 100% support the cryptocurrency industry and will elevate Bitcoin to new heights." David Bailey also thanked Trump for fulfilling his commitment to the crypto industry in the post.

Author of "Rich Dad Poor Dad": February Will See the Largest Stock Market Crash in History, with Significant Funds Flowing into Bitcoin, Gold, and Silver

On January 27, news reported that Robert Kiyosaki, the author of "Rich Dad Poor Dad," reiterated his prediction from his 2013 book, stating that February 2025 will witness the largest stock market crash in history. He indicated that this crash would lead to significant funds flowing from the stock and bond markets into Bitcoin, gold, and silver.

He predicts substantial growth for Bitcoin and advises investors to position themselves early in cryptocurrency and precious metal assets. He emphasized that even a small investment, such as one Satoshi, could yield significant returns. Kiyosaki views this crash as an opportunity for "discounted" assets while reminding investors to stay away from "fake assets."

Previously, the author of "Rich Dad Poor Dad" stated that buying one Satoshi of Bitcoin could also lead to wealth.

Screenshot of Social Media Post

Tesla Reports $600 Million Profit from Bitcoin Holdings in Fourth Quarter

On January 30, news reported that Tesla's fourth-quarter report indicated a $600 million profit from its Bitcoin holdings, as Tesla adopted new accounting rules allowing the company to value digital assets at market prices each quarter.

According to data from Arkham Intelligence, the electric vehicle manufacturer holds 11,509 BTC, estimated to be worth $1.19 billion at current market prices. However, Tesla did not disclose its Bitcoin holdings in its Q4 2024 report, only mentioning a $600 million profit from "digital assets" valued at market prices.

10x Research: Bitcoin May Face Supply Tightening, Making Stable Returns from Altcoins Increasingly Difficult

On January 30, news reported that 10x Research analysts stated that Bitcoin may face supply tightening, although the market still lacks key structural data support. They noted several positive signals in the market, including on-chain data, seasonal trends, breakout indicators, the Chinese New Year effect, neutral Federal Reserve policies, and a crypto-friendly president. However, these factors have yet to resonate with market structure.

Additionally, 10x Research mentioned that obtaining stable returns from altcoins has become increasingly difficult in the current bull market. Only during the period from November 5 (U.S. elections) to December 6/9 (employment report) did altcoins perform strongly, while the Federal Reserve's hawkish stance in mid-December put pressure on the market.

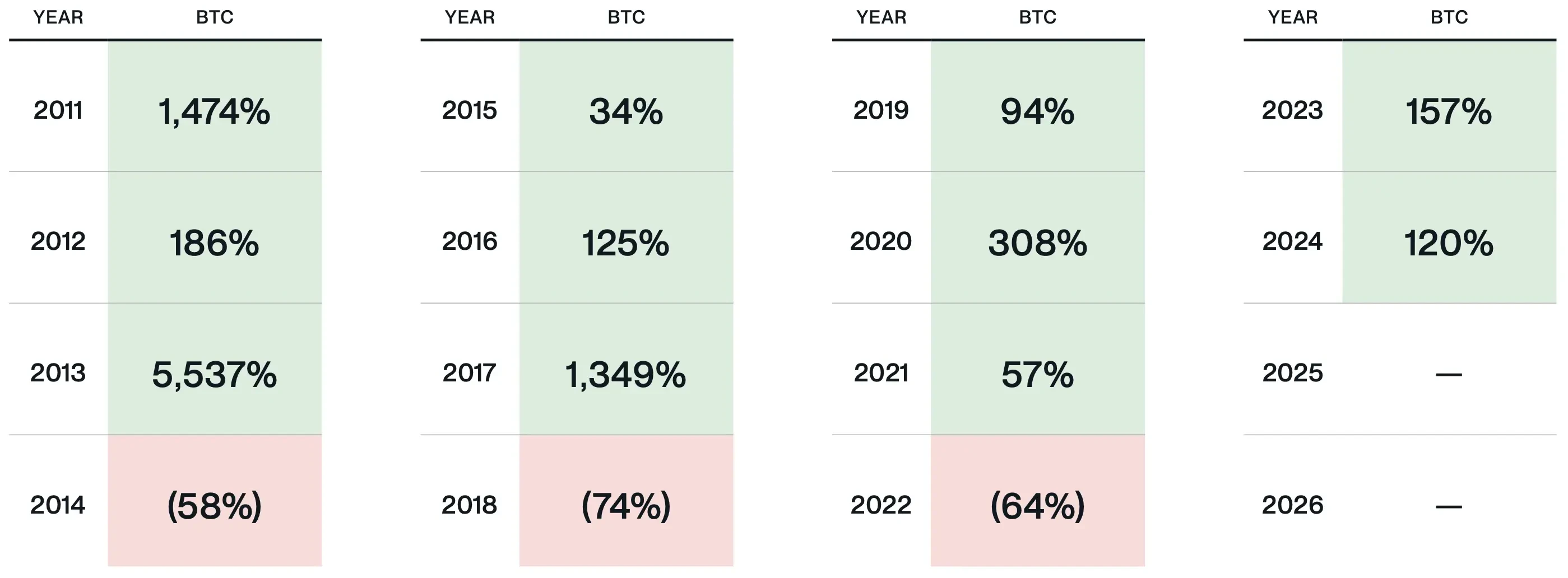

Bitwise: Trump's Cryptocurrency Order May Disrupt Bitcoin's Four-Year Cycle

On January 30, news reported that Bitwise's Chief Investment Officer Matt Hougan stated that cryptocurrencies would not "completely overcome" the four-year cycle, but he indicated that market corrections would be "shorter and shallower" than before. The recent cryptocurrency executive order issued by U.S. President Donald Trump may disrupt the four-year boom and bust cycle that the cryptocurrency market has experienced over the past decade.

Hougan stated in a note on January 29 that Trump's comprehensive order issued on January 23, along with changes from the Securities and Exchange Commission, has brought about "the full mainstreaming of cryptocurrency," allowing banks and Wall Street to "actively enter this space."

He added that cryptocurrency exchange-traded funds are "large enough" to bring in billions of dollars from new investors, but he believes that Trump's executive order regarding exploring the establishment of a digital asset reserve and drafting a regulatory framework "will bring in trillions of dollars."

Image Related to the Four-Year Cycle

Standard Chartered: The Emergence of DeepSeek AI May Benefit Bitcoin and Other Risk Assets

On January 30, news reported that Standard Chartered analyst Geoffrey Kendrick stated that the emergence of DeepSeek AI may benefit Bitcoin and other risk assets, as DeepSeek's low-cost characteristics help reduce inflation, which may benefit assets like Bitcoin that are not AI-related.

Although most analysts expect the Federal Reserve to maintain interest rates, some opinions suggest a "slightly dovish surprise" may occur, which could alleviate the short-term impact of DeepSeek on Bitcoin prices. Kendrick expects Bitcoin to rebound in the coming days, but the specific trend still depends on Federal Reserve Chairman Powell's policy stance. He believes that if the Federal Reserve's attitude is neutral, Bitcoin prices may rise back above $105,000.

Czech Central Bank to Vote on $7 Billion Bitcoin Reserve Proposal, Finance Minister Warns of BTC Volatility Risks

On January 30, news reported that the Czech National Bank (CNB) would vote today on a $7 billion Bitcoin reserve proposal, but Czech Finance Minister Zbynek Stanjura warned about Bitcoin's high volatility, believing it does not meet the central bank's stability requirements.

CNB President Michl plans to propose investing up to 5% of reserves in Bitcoin, noting that interest in Bitcoin has continued to grow since institutions like BlackRock launched BTC spot ETFs. However, he also acknowledged Bitcoin's high volatility and stated that further assessment of its potential role in central bank reserves is needed.

If the proposal is approved, the CNB may hold at least $7 billion in Bitcoin, which would be part of its total reserves of $146 billion. The proposal has received some support in the local Czech industry, with Trezor analyst Lucien Bourdon stating that the Czech Republic has long been at the forefront of Bitcoin innovation, including the world's first mining pool, hardware wallets, and large Bitcoin conferences.

Analysts Expect Bitcoin to Reach New Highs by the End of This Quarter

On February 1, news reported that Swyftx Chief Analyst Pav Hundal stated that the current bearish atmosphere has become very tense, which is favorable for the macro environment of cryptocurrencies, indicating that Bitcoin is expected to reach new highs by the end of this quarter.

BitMEX co-founder Arthur Hayes previously predicted that Bitcoin could fall to the range of $70,000 to $75,000, which, if it occurs, could trigger a "mini financial crisis." However, Dr. Sean Dawson, head of research at Derive, recently stated that the likelihood of Bitcoin dropping to the $75,000 level in the first quarter is less than 10%.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。