The original text is from CoinTelegraph, translated by Odaily Planet Daily's Moni

On the eve of the Lunar New Year, the artificial intelligence model DeepSeek has brought a tremendous shock to the global market. This model is extremely low-cost but can compete with AI products from American companies like OpenAI.

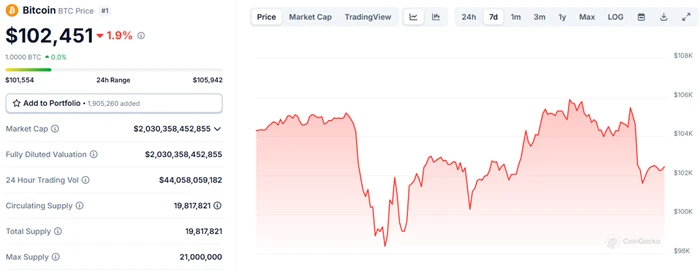

A ripple effect ensued, with American tech stocks suffering significant losses. The "Seven Giants"—Apple, Nvidia, Tesla, Microsoft, Amazon, Meta, and Alphabet (Google)—all saw declines, with Nvidia's stock price dropping nearly 17% at one point. The cryptocurrency market was not spared either, with Bitcoin and Ethereum falling by 6% and 7% respectively, and some altcoins experiencing double-digit losses. This seems to reaffirm that cryptocurrencies are indeed risk assets and are influenced by market forces similar to those in traditional finance.

DeepSeek Shakes Tech Stocks, Bitcoin, and the Broader Cryptocurrency Market

Marc Andreessen, founder of a16z, referred to DeepSeek as the "Sputnik moment" in the AI field, primarily because it caught the global market off guard, given that the mainstream narrative in the AI sector has always viewed the U.S. as the industry leader. (Note: The Sputnik moment refers to the realization that one is under threat and must double down to catch up.)

Jean Rausis, founder of the decentralized exchange SMARDEX, stated that although it seems "completely unrelated" to DeepSeek, the prices of cryptocurrencies and crypto-related companies like MicroStrategy have dropped, suggesting that cryptocurrencies may just be one of the casualties in the broader market sentiment. JP Richardson, CEO of Exodus, explained that cryptocurrencies are a "risk-on" asset, and any fluctuations or panic in the stock market, such as the emergence of an unexpected AI model, will lead to declines, as the stock market is correlated with cryptocurrencies and Bitcoin, triggering synchronized price drops.

(January 27, 2025, cryptocurrency prices fell across the board)

Analysts from cryptocurrency market maker Wintermute believe that while cryptocurrencies lack a short-term narrative, their correlation with the stock market is driving capital flows, and de-risking has already been marked.

In other words, if cryptocurrency investors are spooked by the stock market, they will also choose to sell.

As digital assets gain wider adoption and acceptance in traditional financial markets, the correlation between Bitcoin and stock prices has been under study. BitMEX noted in its investor report that the correlation between cryptocurrencies and stocks is likely to persist for quite some time. Dow Jones market data shows that the six-month rolling correlation indicator between Bitcoin and the Nasdaq Composite Index reached 0.5 this past Monday, the highest level since March 2, 2023.

(Note: The correlation indicator between Bitcoin and the Nasdaq Composite Index is calculated on a scale from -1 to 1, measuring the degree to which the two assets move together. A correlation of 1 indicates a perfect positive correlation, meaning the two assets move in sync, while -1 indicates a perfect negative correlation, meaning the two assets move in opposite directions. A correlation of zero indicates that the movement of one asset has no effect on the other.)

Fortunately, the recovery of cryptocurrencies is relatively quick. After a short-term fluctuation, Bitcoin has rebounded above $100,000 this weekend.

Andre Dragosch, head of European research at asset management firm Bitwise, pointed out that while the Nasdaq index continues to decline, Bitcoin remains stable, which is extremely optimistic. Even amidst broader market volatility, many remain optimistic and believe that cheaper AI models like DeepSeek will bring long-term benefits.

DeepSeek Lowers AI Costs, Long-Term Impact on Bitcoin Prices Minimal

Technical experts and market observers quickly noted that DeepSeek is open-source, meaning other AI developers can adopt some of its advantages to build and improve their own models. Standard Chartered analyst Geoff Kendrick analyzed that "the AI market positioning will become clearer; in any case, if lower-cost AI tools (marginally) reduce inflation, then risk assets unrelated to AI, such as Bitcoin, should benefit."

As risks temporarily recede, Bitcoin's momentum seems to be strengthening again. Geoff Kendrick predicts that Bitcoin may be just days away from its next historical high, likely surpassing its record of around $109,000 next week, with prices potentially reaching $130,000 during February to March.

Paul Howard, an executive at liquidity provider Wincet, further analyzed that "DeepSeek will accelerate AI development in the U.S. and abroad, negating AI hegemony, and its potential impact on cryptocurrencies is actually quite small. The functionalities offered by DeepSeek are few compared to other LLM trading models, and its lower cost does not significantly affect how institutional participants interact with the cryptocurrency market, as the cryptocurrency market is the risk amplification side of the stock market."

On the macro level, there have also been some positive news recently for Bitcoin and the broader cryptocurrency market.

According to the Financial Times, if the plan proposed by Czech National Bank Governor Aleš Michl is approved, the Czech central bank may eventually convert 5% of its €140 billion foreign exchange reserves into Bitcoin. Geoff Kendrick calculated that "at current prices, the Czech central bank would hold 69,000 Bitcoins, with El Salvador being the country known to hold the most Bitcoin, at 6,049." Additionally, the Swiss National Bank also seems to be moving towards embracing Bitcoin. The Swiss federal government has officially begun reviewing a nationwide referendum proposal called "Building a Financially Robust and Responsible Switzerland (Bitcoin Initiative)," which has been published in the federal gazette and is in the signature collection phase. This proposal aims to incorporate Bitcoin into the Swiss national financial system through a constitutional amendment. Although it may take some time, this move is significant, as Switzerland's foreign exchange reserves are six times that of the Czech Republic.

The cryptocurrency community predicts that the establishment of Bitcoin reserves by the U.S. will trigger other countries to establish their own Bitcoin reserves, significantly driving up Bitcoin prices. Although Trump has not yet taken action, his order has indeed created space for establishing a "reserve," meaning the U.S. may retain its existing 207,000 Bitcoins. Meanwhile, the U.S. Securities and Exchange Commission's cancellation of Staff Accounting Bulletin No. 121 (SAB 121) will also boost institutional demand for digital assets.

Overall, as a powerful AI model, the development and application of DeepSeek will have some degree of impact on traditional finance and the cryptocurrency market, especially after recently causing a "brief collapse" in the Bitcoin and cryptocurrency markets. However, in the long run, it seems unlikely to have a significant impact on prices, so it may be worthwhile to view DeepSeek as a gift for creating better, cheaper, faster, open, and free AI.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。