Compiled by: Biscuit & Elvin, RootData

In January 2025, BTC reached a new high of $109,000, maintaining a high-level fluctuation between $92,000 and $105,000. The newly elected U.S. President Trump’s cryptocurrency TRUMP sparked excitement, while DeepSeek's emergence may lead to a significant correction in AI-related tokens, and market liquidity remains pessimistic.

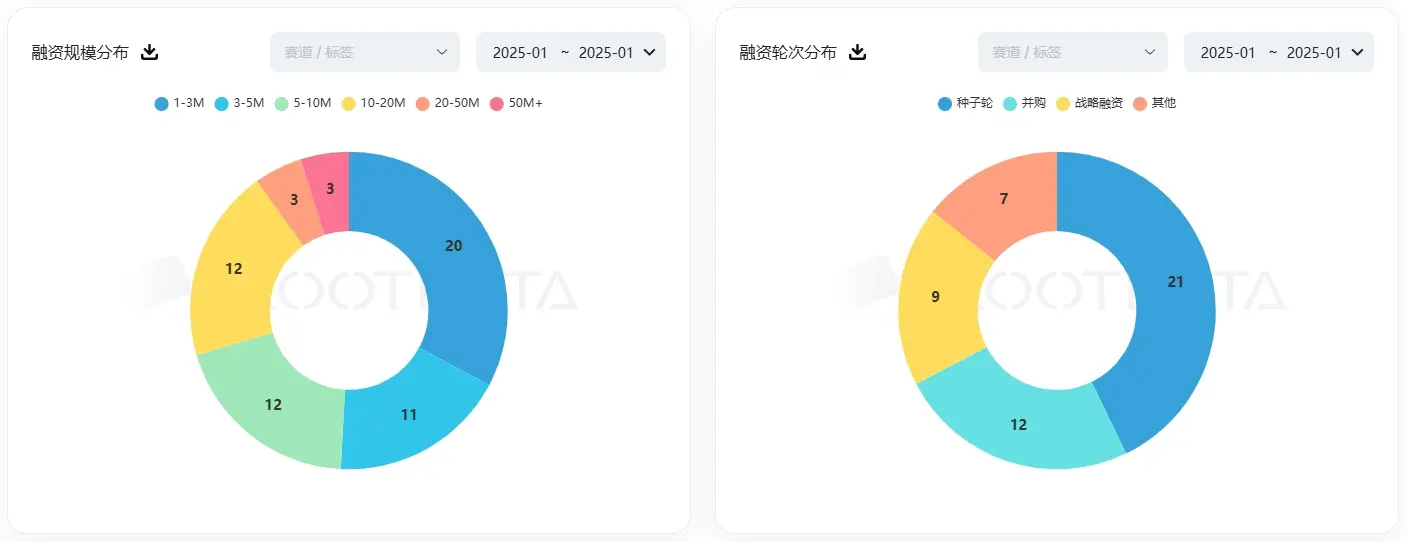

The total financing amount in the cryptocurrency sector in January reached $748 million, nearly unchanged from the previous month. The total number of financing events was 80, a decrease of 25.2% month-on-month, marking the second-lowest figure in nearly two years, only behind the 79 events in August 2023. The average financing amount this month was $11.905 million, with a median financing amount of $5 million.

Recent 2-Year Financing Trends in the Cryptocurrency Sector

In this article, we will focus on specific financing data, active investors, trending projects, and other aspects to present the changing trends in the cryptocurrency market.

I. Financing Data

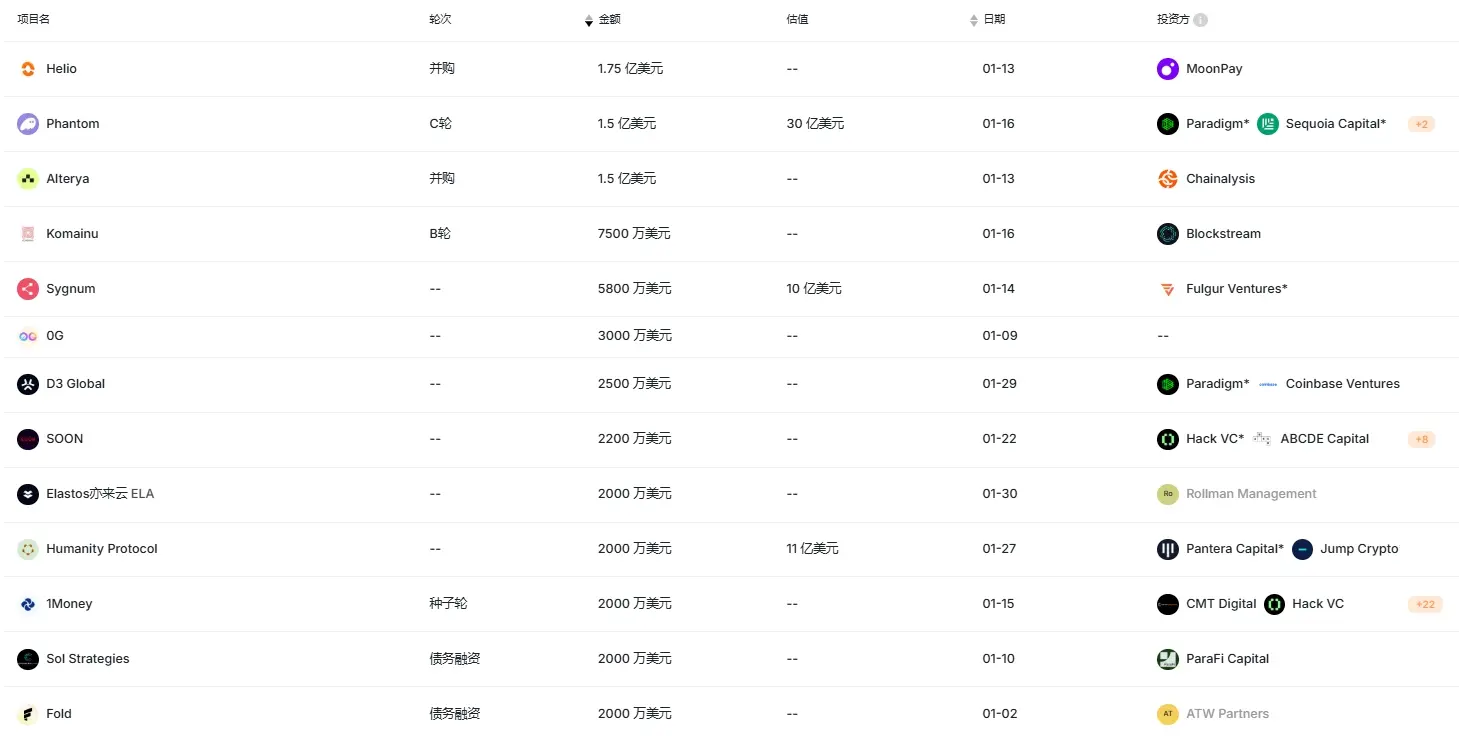

This month, there were 3 financing events exceeding $100 million, and 25 financing events greater than $10 million, with the largest being the acquisition of the Web3 payment platform Helio by the crypto payment infrastructure MoonPay for $175 million. Other popular projects that completed financing include the Solana wallet Phantom which completed a Series C financing led by Paradigm and Sequoia Capital, Chainalysis acquiring the Web3 security platform Alterya, and institutional-grade digital asset custodian Komainu completing Series B financing.

In terms of financing amounts and rounds, the $1-3 million range accounted for the largest proportion of financing, with seed rounds being the most popular financing stage, although the proportion has decreased, with 19 projects completing seed round financing. Notable projects include the payment network 1Money Network ($20 million), L1 primitive Pod Network incubated by Common Prefix ($10 million), open-source economic infrastructure Merit Systems ($10 million), and the Cosmos cross-chain ecosystem wallet Keplr.

Additionally, there were 12 M&A events in January, which is above the monthly average (10 events), particularly with the acquisitions of Helio and Alterya both exceeding $150 million, indicating that leaders in the cryptocurrency industry are accelerating integration and layout. Furthermore, Jupiter acquired the meme coin trading platform Moonshot, Tokenize Xchange acquired the Web3 venture capital data platform Coinseeker, Coinbase acquired the social chain browser Roam, and Circle acquired the decentralized institutional-grade asset management platform Hashnote.

II. Active Investors

Animoca Brands has been the most active venture capital firm for three consecutive months, with investment frequencies of 5, 8, and 5 times respectively over the past three months. Investment records include the Sui liquid staking protocol Haedal, the Layer 2 scaling solution zkCandy, the Berachain life simulation game BeraTone, the digital advertising platform EarnOS, and the TON lending protocol Evaa Protocol.

Following closely are 1kx, Mysten Labs, and Flow Traders, each with 4 investments. Additionally, Sergey Gorbunov, Kain Warwick, and Rushi Manche were the most active Web3 angel investors in January, each investing in at least 2 projects.

In addition to the cooling of the investment and financing market, cryptocurrency VCs have also released relatively negative signals in fundraising data. On January 27, MicroStrategy submitted Form S-3 mixed securities shelf registration to the U.S. SEC. The company plans to issue various securities, including debt securities, Class A common stock, preferred stock, depositary receipts, warrants, and mixed securities units. The raised funds will primarily be used to purchase more Bitcoin and for general corporate purposes.

III. Trending Projects

RootData's popularity score is calculated based on normalized data from platform search volume, click volume, user votes, and Twitter popularity index. The projects with the highest popularity score in December include:

Solv is a decentralized Bitcoin staking protocol that unlocks the full potential of Bitcoin assets through liquidity consensus infrastructure. By addressing the fragmentation, yield opportunities, and custody solutions of BTC assets, Solv provides Bitcoin holders with a gateway to BTCFi, continuously establishing pathways and confidence for traditional funds to enter the cryptocurrency world.

Artela Network is a high-performance EVM++ Layer 1 public chain designed for AI Agents. Artela's full-chain AI introduces advanced tools that support the creation of autonomous AI Agents and smart applications, and natively supports on-chain LLM (large language models), providing key features such as verifiability, privacy protection, interoperability, and user policy customization.

Nodepay is a network infrastructure that provides decentralized bandwidth for AI training. By connecting to the Nodepay network, users will be able to sell unused internet bandwidth to AI companies, enabling efficient transmission of public training data, labels, model sharing, and remote distributed training.

Plume is a fully integrated modular chain focused on RWAfi. They have built the first modular, composable EVM-compatible chain centered on RWA, aimed at simplifying the onboarding of all types of assets through native infrastructure and unified RWAfi-specific features across the entire chain.

Official Trump is a meme coin issued on the Solana chain, introduced by the newly elected U.S. President Trump on social media.

Hyperspace is an open standard protocol designed for distributed model inference, aiming to merge the capabilities of large language models (LLM) with the latest user data to create a novel intelligence service that is instant, socially aware, and freely accessible at scale.

SoSoValue is a one-stop financial research platform for cryptocurrency investors, providing real, high-quality macro market information to assist investors in more effective investment research. It also offers AI-based classification system news and research, connecting macroeconomic data with the cryptocurrency market.

GoPlus Network is a modular user security layer for Web3. It can seamlessly integrate with any blockchain or project, providing comprehensive protection throughout the user transaction lifecycle. GoPlus utilizes AVS and cutting-edge AI security solutions for comprehensive risk analysis, offering users intelligent, efficient, and decentralized security services.

DuckChain is defined as the Telegram AI Chain, a blockchain platform designed specifically for the Telegram ecosystem. It combines AI-driven tools with EVM technology to serve over 1 billion global users on Telegram.

Mango Network is a Layer 1 public chain with Multi-VM full-chain infrastructure, primarily addressing multiple pain points such as user experience fragmentation and liquidity fragmentation in Web3 applications and DeFi protocols.

Sonic is a Layer-1 platform with an Ethereum security gateway, providing the fastest settlement layer for digital assets, with a TPS exceeding 10,000 and a transaction confirmation time of one second.

Solayer is building infiniSVM to scale Solana, a hardware-accelerated SVM that connects multiple execution clusters through SDN and RDMA for infinite scalability while maintaining atomic state at 100 Gbps.

Mind Network is an "HTTPZ" infrastructure that employs fully homomorphic encryption (FHE), leading Web3 into a new era of quantum resistance and end-to-end encryption. Mind Network provides unique solutions for data sovereignty protection, fair consensus, private voting, secure cross-chain transmission, and trusted AI.

Sentient is building community-contributed open-source AI models, aiming to compete directly with OpenAI. Sentient will initiate activities for contributors, each with specific metrics to evaluate contributions and rewards based on these metrics.

OpenLedger builds permissionless, data-centric infrastructure for AI development.

Limitus is a decentralized, AI-driven consumer platform. Its uniqueness lies in its emerging intelligence and ability to connect directly with users' devices, transforming them into autonomous operators acting on behalf of users. Unlike traditional tools that rely on static rules and strict processes, Limitus can operate autonomously.

FLock aims to build a decentralized privacy protection solution for AI. FLock proposes a research program called Federated Learning Blocks (FLocks), which uses blockchain as a coordination platform for machine learning among data holders while keeping data local and private.

Chainbase is a full-chain data network. Its core mission is to provide a transparent, reliable, permissionless data layer for the AI era. Through its modular design, it supports cross-chain data interoperability and programmability, making it easy to build and use data models.

BIO Protocol is the financial layer of DeSci, aimed at accelerating the influx of capital and talent into on-chain science. bioDAO can use the auction contracts of the BIO Protocol to raise funds and directly allocate them to research programs, IP assets, and other biotechnology organizations.

Metya is an AI-driven Web3 dating platform designed to revolutionize the dating experience. By combining cutting-edge technology with user-centric features, Metya creates a secure and enriching environment for modern relationships, making every encounter full of possibilities.

SOON is a rollup stack designed to provide top-tier performance for all Layer 1 blockchains, supported by Decoupled SVM and configurable DA layers.

ai16z is an AI venture fund that simulates the investment decisions of a16z partner Marc Andreessen using AI models and makes investments based on recommendations from DAO members, with the weight of investment suggestions depending on the number of tokens held by members and their historical success rates of recommendations.

Story Protocol is building web3 technology to fundamentally change the way narratives are created. Its mission is to unleash a brand new way to create, manage, and license on-chain IP, ultimately forming a "story Lego block" ecosystem that can be remixed and recombined. Story Protocol provides a simplified framework to manage the entire lifecycle of IP development, supporting features such as source tracking, frictionless licensing, and revenue sharing. Applications built on Story Protocol are designed for creators across all media (prose, images, games, audio, etc.), enabling writers and artists to track the provenance of their works, allow anyone to contribute and remix, while capturing the value of their contributions.

IV. Project Updates

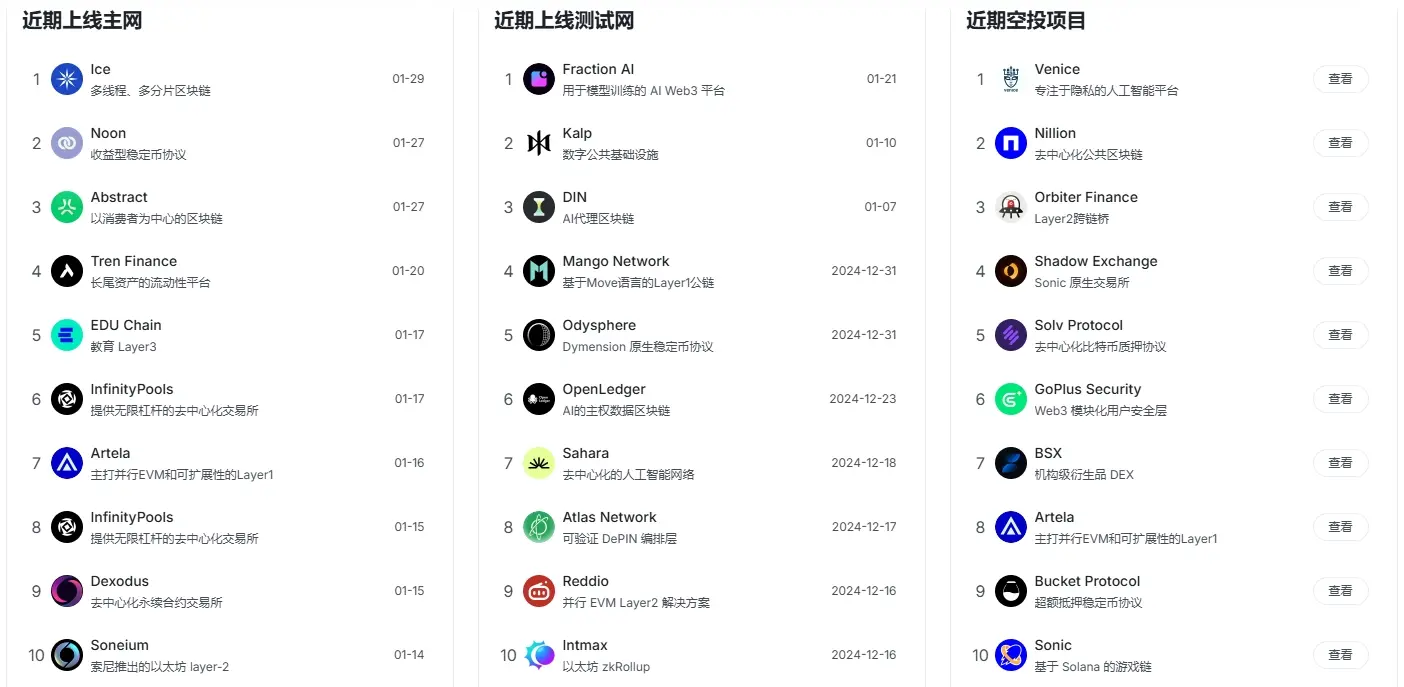

In January, RootData also recorded many events such as the mainnet launch of various projects and new coin issuances, helping users understand important project dynamics in the market and grasp earlier alpha opportunities.

In addition, RootData launched a token unlocking feature, helping users capture investment signals more efficiently through the "hot list" and comprehensive token unlocking information, combined with structured basic information from primary and secondary markets of projects.

Due to space limitations, the above is a portion of the mainnet and token information. For more complete and timely data, please visit the RootData official website (https://www.rootdata.com/zh/).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。