In the market, predicting #BTC difficulty can be particularly challenging, but the U.S. stock market has a history of over a hundred years, filled with many techniques and characteristics, making it easier for people to find data references and validation. After all, the market has always been a pendulum of cycles; although each story is somewhat different, the essence and history are remarkably similar.

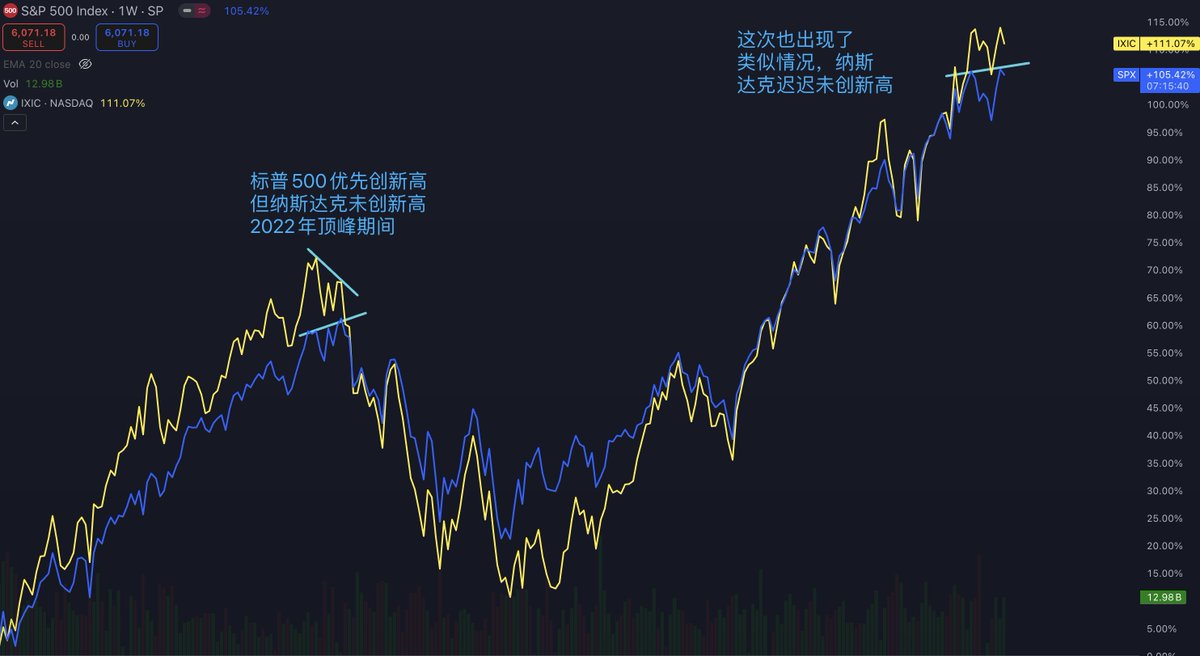

We have a simple and easy-to-learn strategy internally, which is one of our many quantitative research methods: the reference between the S&P 500 and the Nasdaq index. Generally, both tend to move forward hand in hand, but when uncontrollable factors or black swan events occur in the market, the Nasdaq tends to be more sensitive than the S&P 500, especially at high points. Currently, we are seeing a situation similar to the peak at the beginning of 2022: the S&P 500 reached a new high before the Nasdaq index, but the Nasdaq has yet to break through. What happens next can be reviewed in history.

Now we are experiencing a similar situation. If the Nasdaq cannot reach a new historical high within 10 trading days, you may need to learn to take some hedging actions. Additionally, for every 5 trading days of delay, reduce your position by one layer (the same applies to cryptocurrencies). This strategy is for reference only; although quantitative analysis requires various factors to work together, this is an important reference. I hope it turns out to be a mistake, and I am willing to pay the price for being wrong! 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。