Recently, I've been thinking that if I had chosen to buy BTC two years ago and done nothing, I would have seen a fourfold return by now. Meanwhile, I have been busy every day with sectors, concepts, and token economies, and my returns are far less than BTC.

In the past year, BTC has steadily risen, but altcoins have performed very poorly. Every time BTC makes a slight adjustment, altcoins tend to plummet dramatically. In this bull market, there are many people losing money.

The United States has announced plans to create a world center for cryptocurrency, and the entire cryptocurrency sector is bound to have a bright future. However, altcoins may not necessarily share that future. Therefore, I personally believe that the most certain returns in the future may come from holding top tokens primarily based on BTC. In this regard, the index fund released by SoSoValue is a very good choice.

Among them, MAG7.ssi is carefully selected from the top 7 tokens by market capitalization, with strong consensus and ample liquidity. It allocates over 30% to BTC, along with ETH, BNB, SOL, XRP, DOGE, and ADA.

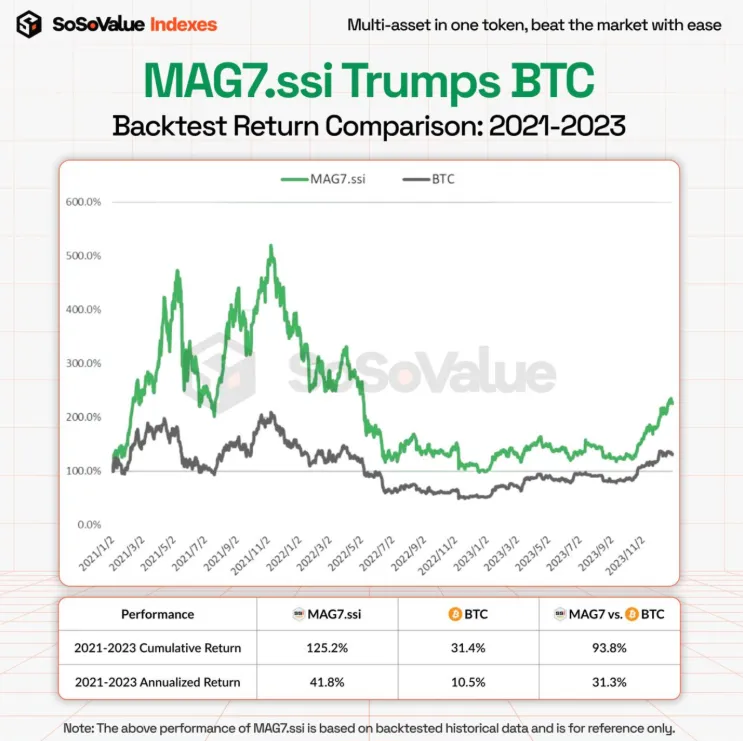

Additionally, it undergoes certain adjustments each month based on market conditions. Historical data shows that MAG7.ssi has outperformed Bitcoin in both returns and drawdown rates over the past three years. Furthermore, its return since 2025 is 15.32%, exceeding BTC's return of 3.26%. **At the same time, MAG7.ssi also features unlimited liquidity, making it suitable for investors seeking long-term growth and enjoying the benefits of the cryptocurrency market's development.

SoSoValue Index (SSI) uses Cobo and Ceffu as asset custodians. Ceffu was renamed from Binance Custody in 2023 and specializes in asset custody, with Binance as one of its clients. Cobo, founded by Shen Yu, is a leading global asset custody institution, serving clients such as Deribit, Bitget, and Hashkey.

Although MAG7.ssi may seem like a new concept, passive index funds are very common in the stock market and are the preferred choice for most non-professional traders. Its advantages are quite clear:

1) Excellent returns. Historically, long-term annualized returns for indices like the S&P 500 and Nasdaq 100 typically reach 8%-12%. When compounded, this is quite substantial and surpasses the performance of most funds.

2) It does not require research on specific stocks; most of the time, you just need to buy and hold. This makes it very suitable for asset allocation for those who do not actively trade stocks.

By the end of 2023, the overall size of U.S. index funds reached $7 trillion. Among them, the VFIAX, which tracks the S&P 500 index, reached $850 billion. History is remarkably similar; when the first passive index fund was launched in the U.S. in 1976, the asset size of the U.S. stock market was $2.1 trillion, comparable to the current market cap of BTC. It can be predicted that as the cryptocurrency market continues to develop, the scale of cryptocurrency index funds will also grow significantly.

In addition to MAG7.ssi, SoSoValue Index (SSI) currently has four types of indices: MEME.ssi, DEFI.ssi, and USSI (hedging). These are designed to help investors confidently and efficiently capture growth in the cryptocurrency market.

MEME.ssi

Composition: Focuses on top projects in the Meme sector.

Characteristics: Meme is a significant hotspot in this cycle. The MEME.ssi index token mainly includes leading Memes like Doge, Shib, and Pepe, with the largest Meme token's circulating market cap nearing $60 billion, while the smallest Meme token exceeds $800 million. Purchasing MEME.ssi tokens is equivalent to buying a basket of the most core Meme assets in the market.

DEFI.ssi

Composition: Carefully selected large-cap, high-liquidity DeFi assets.

Characteristics: DeFi has always been a fundamental sector in cryptocurrency, with most projects having operated stably for many years. After Trump's administration, regulatory oversight on cryptocurrency is expected to relax, and DeFi will become the largest profit sector. We have also noticed that the Trump family fund has been continuously buying into DeFi assets.

Objective: To provide broad industry risk exposure through a market-cap-weighted strategy while reducing liquidity risks and uncertainties associated with emerging fields. Although DeFi has performed poorly this year due to previous SEC crackdowns, it offers opportunities for short-term growth and stable long-term development.

USSI

Hedging Strategy: Employs a systematic Delta hedging strategy to maintain Delta-neutral exposure while optimizing returns through funding rates.

Asset Allocation: Allocated to the top 7 cryptocurrencies by market cap, providing ample strategic capacity and good liquidity; dynamically adjusted to enhance returns.

Characteristics: Neutral strategy, fully hedged, Delta-neutral exposure, with very small drawdowns. Funding rates provide continuous and stable returns. In a bull market, funding rates may soar and exceed an annualized 100%, yielding low-risk excess returns.

The golden age of cryptocurrency is about to begin, and token index funds like MAG7.ssi may be the best choice for most people, just as smart investors in the U.S. stock market choose the S&P 500 and Nasdaq 100.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。