Yesterday, with Powell's assistance, market sentiment slightly improved, leading to increased trading volume and turnover rate. However, even with the price increase, it still feels like something is missing, as there are no signs of sustained FOMO in the market. To be fair, if there were no FOMO sentiment, the market would have already dropped below $100,000. It seems that the market still has decent expectations for the trend, but the trading volume remains significantly lacking. At least compared to the speculative period before Trump's election, it feels like we are in garbage time now.

This is a highly contrasting situation. On one hand, the market's ability to maintain high prices indicates that investors still have the willingness to buy, but the price fluctuations are very small. Both buying and selling volumes feel like cautious games, afraid of any signs of a breakout. While the macro environment hasn't provided much help, it hasn't hindered progress either. The favorable policies in recent days have been continuous, and there hasn't been any panic-inducing negative sentiment.

This situation is very similar to the eight months of garbage time in 2023 and 2024. I often tell my friends not to rush and to wait a bit longer, which is indeed what I think. Garbage time is always passed this way; as long as there are no direct negative factors, sentiment will continue to build up until something "big" happens, and then it will explode.

Rationally, I believe tomorrow's core PCE isn't significant, just like various recent macro data, which won't affect short-term changes in the Federal Reserve. Regardless of whether the data from the past month is good or bad, Powell's speech will likely be the same. However, the sentiment around the situation may change, which is about finding "excuses" for each other. Compared to the core PCE, I am more looking forward to the earnings reports of $MSTR and $COIN, one coming in the early hours of February 6th Beijing time, and the other on February 19th Beijing time.

Especially with the MSTR earnings report coming out next week, I wonder if it can serve as a catalyst for this market trend, especially since Michael has made it to the cover of Forbes, being called the #Bitcoin alchemist.

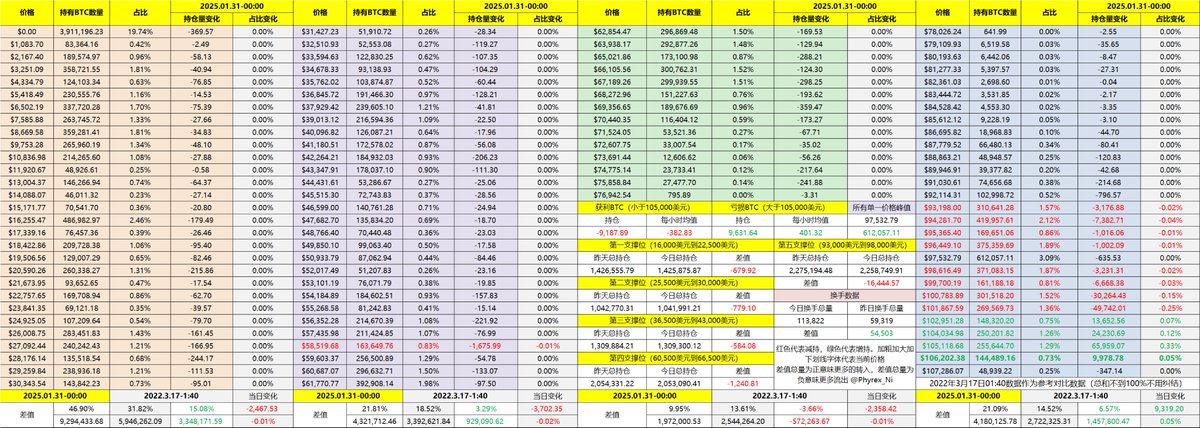

Looking back at the data for $BTC itself, the price has increased, and the turnover rate has risen, but it still feels like a self-entertainment for short-term investors, as earlier investors have not participated in the turnover. Most investors still have very strong expectations for the future market, and only those who bought in the last two days are enthusiastic about the turnover.

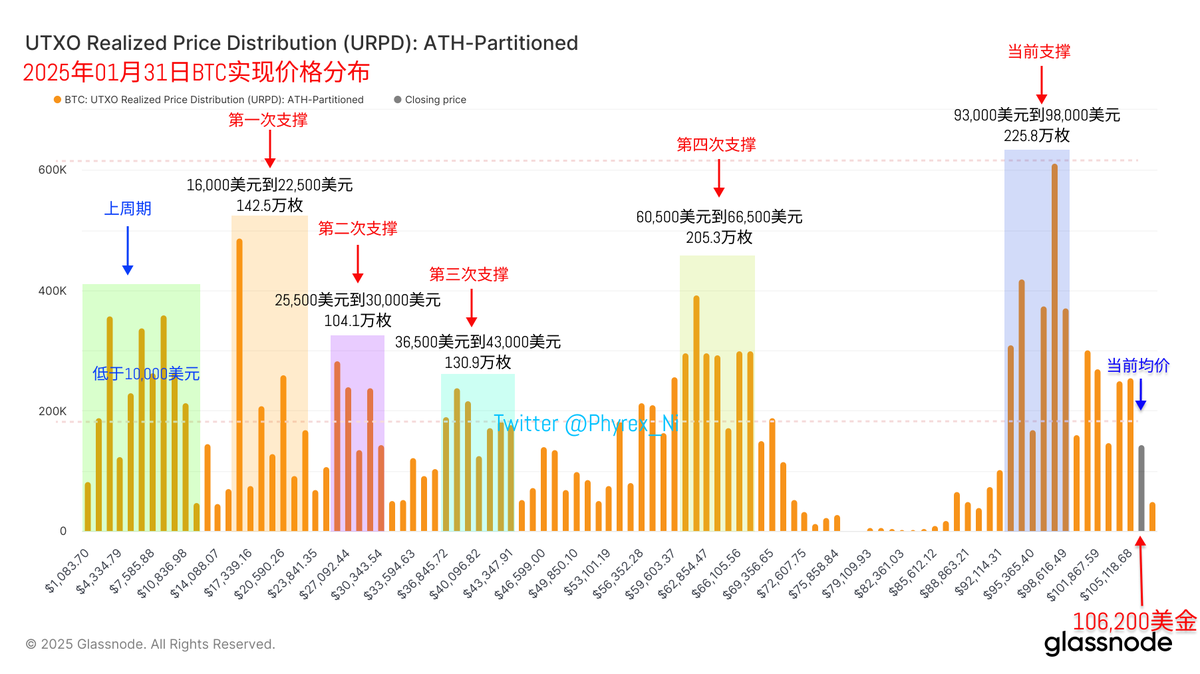

The support level is also very solid, but as mentioned yesterday, there is more defense than offense. There hasn't been a significant bottoming formation yet, and the support above $100,000 is still not solid enough. This might be what I referred to at the beginning as still needing a breath. The current price is being held up by various favorable factors, but the actual purchasing power still shows some gaps.

I hope that whether it's tomorrow's PCE or next week's earnings season, it can fill that gap.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。