Recently, why have we been so cautious? Let me explain the reasons!

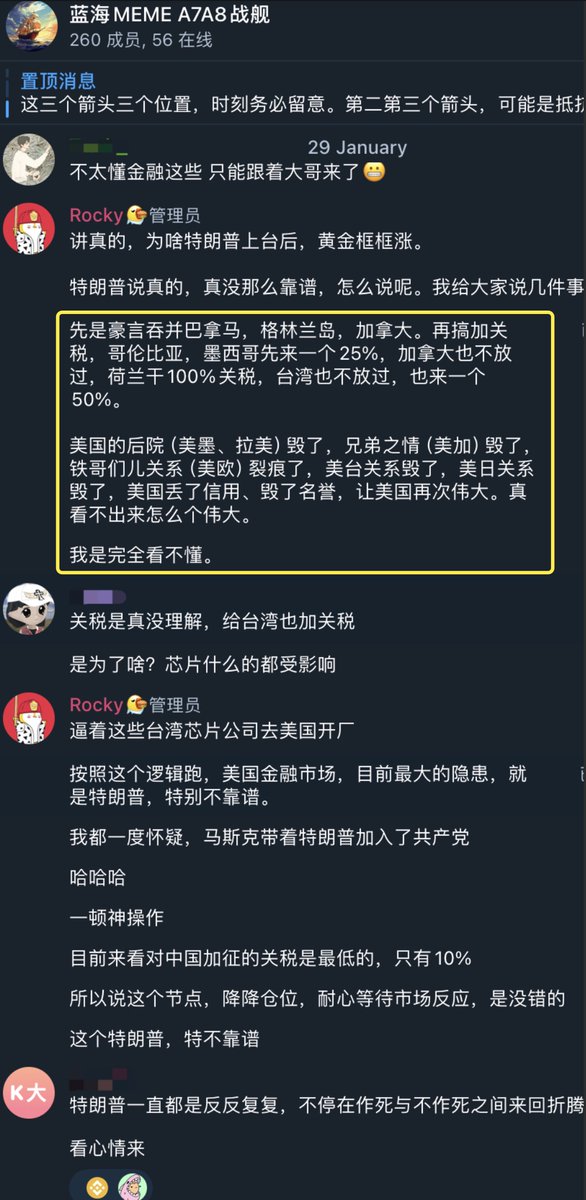

As I mentioned a couple of days ago in a small group: "Trump is not particularly reliable." Currently, looking at the countries and policies imposing tariffs, this has disrupted the rhythm of making America great again, and it is completely unclear how greatness will be achieved, especially with the tariffs on Taiwan. TSMC has been in the U.S. for several years and hasn't made significant progress, which is due to systemic reasons. This series of tariff policies will ultimately affect the economy itself, requiring a 1-2 quarter transmission effect, around Q2.

From Q1 2023 to Q2 2025, we are in the expansion phase of this Kitchin cycle, with around Q2 being the peak of the expansion phase and an important turning point. Over the past five years, global GDP has experienced rapid recovery and expansion, although many people do not feel it strongly. Let me share some data 📊: In the past five years, from 2020 to 2024, global GDP growth rates were: -2.93%, 6.26%, 3.09%, 2.72%, and 3.2% (2024 is an expected value). So overall, the economy is doing well, but there are local issues, that's all. A typical indicator of the Kitchin expansion phase is the inventory cycle, and I can clearly state that global commodity inventories are nearing their peak. A typical observation is the global automotive inventory situation. For example: Currently, the best-selling Tesla can be ordered and picked up within a week, which is unimaginable compared to two years ago.

Major insider traders in the U.S. stock market are cashing out. This indicator is very obvious; whether it's Jensen Huang from Nvidia or Jeff Bezos from Amazon, they are cashing out their stocks in batches, although the proportion is not large. But just like Buffett, the actions of these big players are so unified, the essence of selling is seeing many insider details that we cannot see.

To preemptively cause someone's demise, one must let them go wild. The final stage of the market rally should be the most violent and crazy. I mentioned in a previous Space that the most optimistic expectation for this cycle's #BTC is $150,000. Each cycle requires enough crazy FOMO to distribute the chips. During this phase, one must remain rational and clear-headed; this is the season for harvesting, not for sowing. Do not reverse the timing, as it is easy to endure another cycle. For most of the post-90s friends, the best time node for the Kondratiev cycle was late 2019, and the next best time node for the Kondratiev cycle will be late 2027 (this conclusion is not mine, but from Zhou Tianwang). By that time, you need to retain enough seeds to sow; remember, remember, (if you are interested in the Space roundtable meeting at that time, please let me know in the comments, and I will send you the replay link).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。