Tonight, due to the Federal Reserve's interest rate meeting and Powell's speech, the assignment will be submitted earlier. However, I have also noticed that the assignments have been submitted later and later recently, so I will try to submit them earlier in the future. These two days mark the Chinese New Year, but it is very evident that the liquidity of #BTC has started to decrease, and the trading volume has also seen a significant drop. However, the most active time each day remains during the main trading hours in the United States, which is quite an interesting trend.

Today, there has been quite a bit of discussion among Mandarin-speaking friends regarding the Federal Reserve, but the English-speaking community does not seem very enthusiastic. This is likely due to the understanding of trends. In the past period, there has always been a risk-averse situation ahead of important macroeconomic events in the U.S., but this time it seems there is no risk aversion, which has puzzled many friends. In fact, the market has already fully anticipated that the Federal Reserve will not take action this month, and it may not even reveal any particularly useful information moving forward.

The advantage during this period still lies in the transition of power between Trump and cabinet members, where policy direction may be more important. Expectations for the Federal Reserve had already dropped to a low point in December, and at least until March, the help from macro data will be very limited. So even if there are some emotional influences, it will still return to a more normal level.

Today's interest rate meeting should be like this, with more questions likely related to Trump and tariffs, and Powell may not provide very direct answers. The usual approach: look at the data, 2% remains unshaken, and the labor market is the core that should be reiterated again.

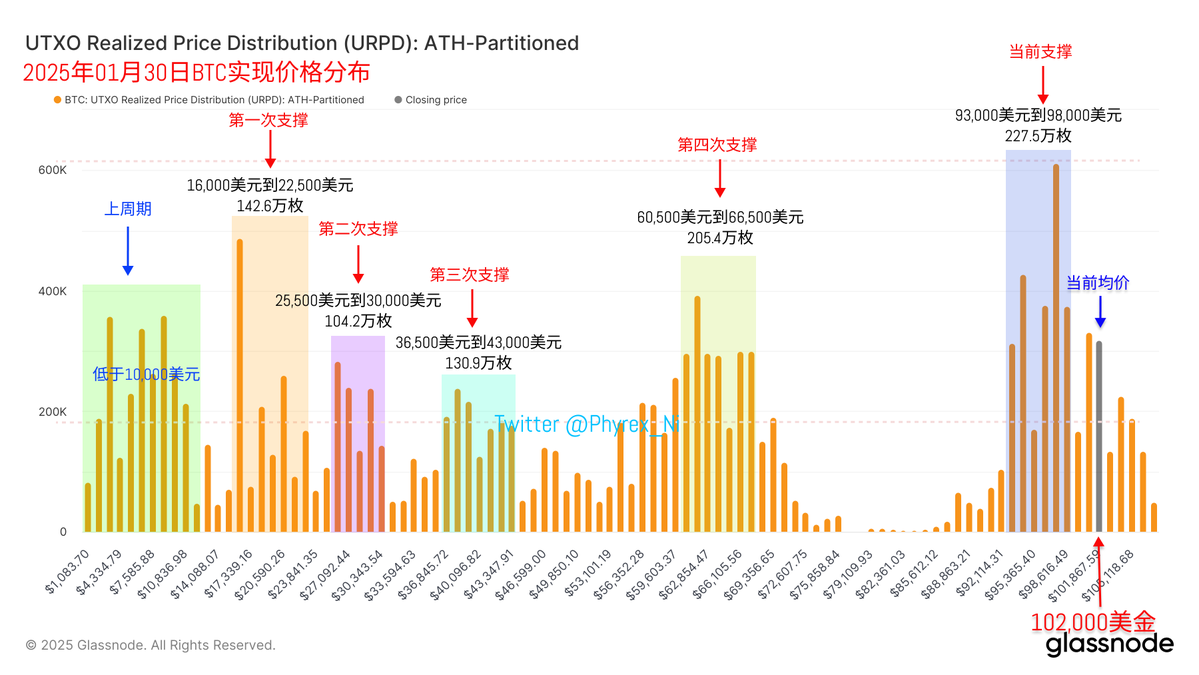

As mentioned earlier, with low liquidity, the ones trading are still short-term investors, and there hasn't been much movement. Short-term investors with losses are still increasing their exit efforts, while earlier investors remain indifferent. The support level is very solid, and it may still be attempting to build a new bottom, but it still requires time to accumulate; we are still quite far from that.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。