1. Bitcoin Market and Mining Data

From January 20 to January 26, Bitcoin's price showed some volatility. The main changes during this period are as follows:

This week, Bitcoin's price trend exhibited a pattern of "rising sharply and then retreating, entering a phase of consolidation." The previous upward momentum was mainly driven by favorable policies and institutional buying, but after facing profit-taking pressure at high levels, market sentiment became cautious. In the short term, BTC's price may continue to fluctuate around the $104,000 to $107,000 range, with attention needed on changes in trading volume and policy news. If it can break through the $107,000 resistance, it may aim for $110,000; however, if it falls below the $104,000 support, it could test $102,000 or even lower levels.

Bitcoin Price Trend (2025/01/20 - 2025/01/26)

Market Dynamics and Macroeconomic Background

1. Capital Flow:

According to Glassnode data, the net outflow of Bitcoin from exchanges significantly decreased over the past seven days, indicating that investors' confidence in further price increases has weakened. This trend in capital flow corresponds with price adjustments, reflecting a decline in market sentiment. As Bitcoin's price retraced, investors chose to keep their funds on exchanges in the face of uncertainty, possibly due to cautious observation of further market fluctuations or preparation to trade if prices decline further. This change in capital flow corroborates the adjustment in Bitcoin's price, indicating an increase in uncertainty and cautious sentiment in the market in the short term.

2. Technical Pressure:

Technical analysis shows that Bitcoin broke through the historical high of $108,000 in the previous week but soon encountered strong selling pressure around $110,000, failing to effectively break through this psychological barrier, forming a short-term top, indicating significant selling pressure above. Currently, Bitcoin's price hovers around $105,000, with an important support level at the $100,000 mark. If the price falls below this area, it may further test the support at $98,000 (the previous consolidation range low). In terms of technical indicators, the RSI has fallen from the overbought zone (>70) to the 55-60 range, showing a decline in bullish strength but has not yet fully entered the oversold zone, suggesting that prices may continue to adjust. The Bollinger Bands indicate that the price has retreated from the upper band to near the middle band, with the volatility range gradually narrowing, reflecting that the market has entered a phase of consolidation in the short term.

3. Changes in Market Sentiment:

On January 26, the price stabilized around $105,000, without further significant fluctuations. After the price stabilized, market sentiment entered a neutral phase. Investors are no longer eager to chase prices up or down, and market sentiment is balanced. At this time, the market is waiting for further macroeconomic data and technical signals, with investors generally adopting a wait-and-see attitude. Trading volume has decreased, and market sentiment is at a relatively cautious neutral level.

4. Industry News:

First, President Trump fulfilled his campaign promise by pardoning Silk Road founder Ross Ulbricht, an event that has garnered widespread attention in the cryptocurrency community. Meanwhile, inflows into Bitcoin ETFs have significantly increased, with $802.6 million flowing in on Tuesday alone, bringing the total assets of Bitcoin ETFs to over $1.75 billion. Additionally, BlackRock CEO Larry Fink predicts that with more institutional investors joining, Bitcoin's price could potentially reach $700,000 in the future. These factors collectively have driven activity in the Bitcoin market and significantly impacted price trends.

Hash Rate Changes

From January 20 to January 26, 2025, the Bitcoin network's hash rate experienced significant fluctuations, showing a complex pattern of rises and falls. On January 20, the hash rate quickly dropped from 877.89 EH/s to 727.81 EH/s; on January 21, it remained around 825 EH/s before falling to 730.09 EH/s in the evening. On January 22, the hash rate fluctuated between 730-800 EH/s, remaining relatively stable; on January 23, it significantly rose to 887.71 EH/s, then broke through the week's highest value of 920.41 EH/s but quickly fell back to 733.88 EH/s. From January 24 to 25, the hash rate mainly oscillated around 740 EH/s, briefly reaching a small peak of 787.45 EH/s on the evening of the 24th before falling back to 688.53 EH/s. On January 26, the hash rate fluctuated around 710 EH/s and climbed to 786.71 EH/s in the morning. Overall, the hash rate experienced violent fluctuations this week, likely related to market sentiment, miner behavior, and network difficulty adjustments.

Bitcoin Network Hash Rate Data

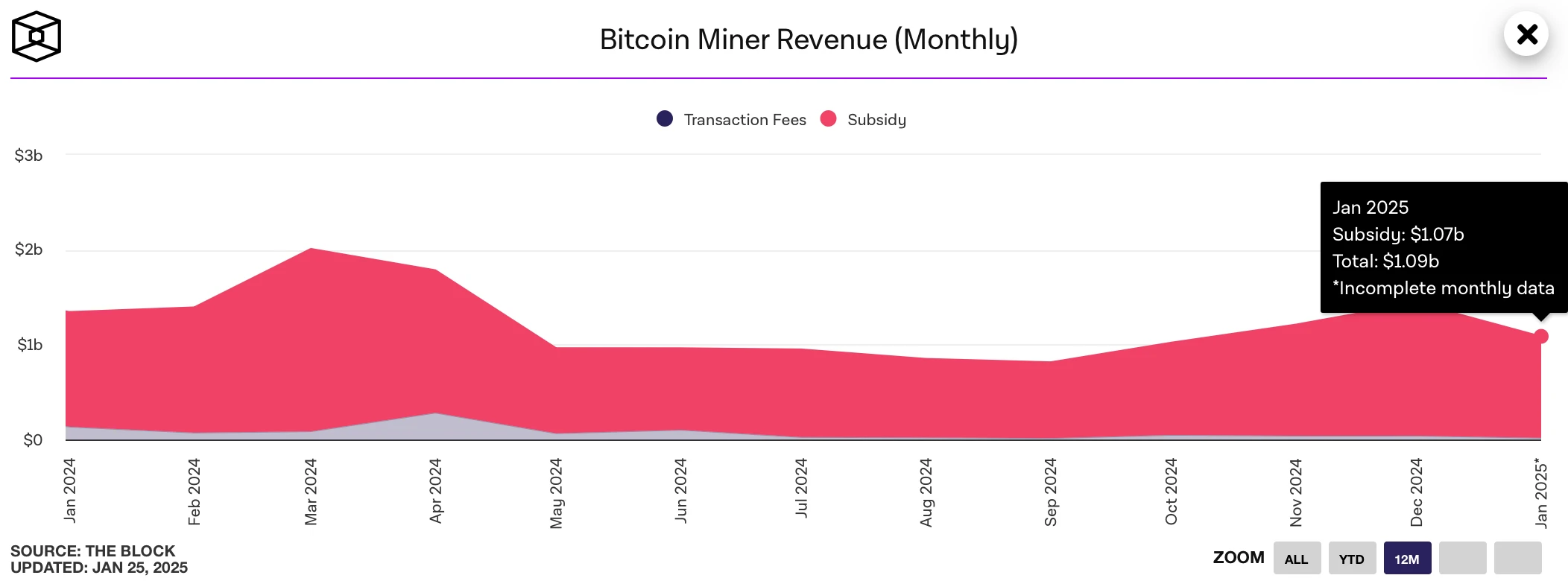

Mining Revenue

According to The Block, as of January 26, 2025, Bitcoin miners' total revenue for January has reached $1.07 billion, slightly down from $1.44 billion in December 2024. This decline is closely related to the recent dramatic fluctuations in the Bitcoin network's hash rate, which have affected miners' overall profitability. Additionally, network mining difficulty adjustments and market volatility have also put some pressure on miners' revenue. Currently, revenue mainly comes from block subsidies, with transaction fees accounting for a relatively small proportion, but if network activity increases, fee income is expected to provide support. Overall, despite the decline in revenue, the miner ecosystem remains stable, and future earnings will depend on changes in hash rate, market trends, and network activity levels.

Notably, a recent research report from global financial services company Canaccord Genuity further highlights the profitability prospects of the mining industry. According to the report, the main cost of Bitcoin mining in 2025 is expected to be in the range of approximately $26,000 - $28,000 per Bitcoin, while the current trading price of Bitcoin is around $105,000, indicating that mining activities still have considerable profit margins. Furthermore, the report points out that large-scale power supplies from mining companies are attracting interest from AI data center hosting businesses, providing miners with diversified income sources. At the same time, several large publicly listed mining companies are enhancing their competitiveness and network hash rate share by upgrading mining equipment, a trend that is expected to further consolidate the industry's stability and profitability in the future.

Bitcoin Miner Revenue Data

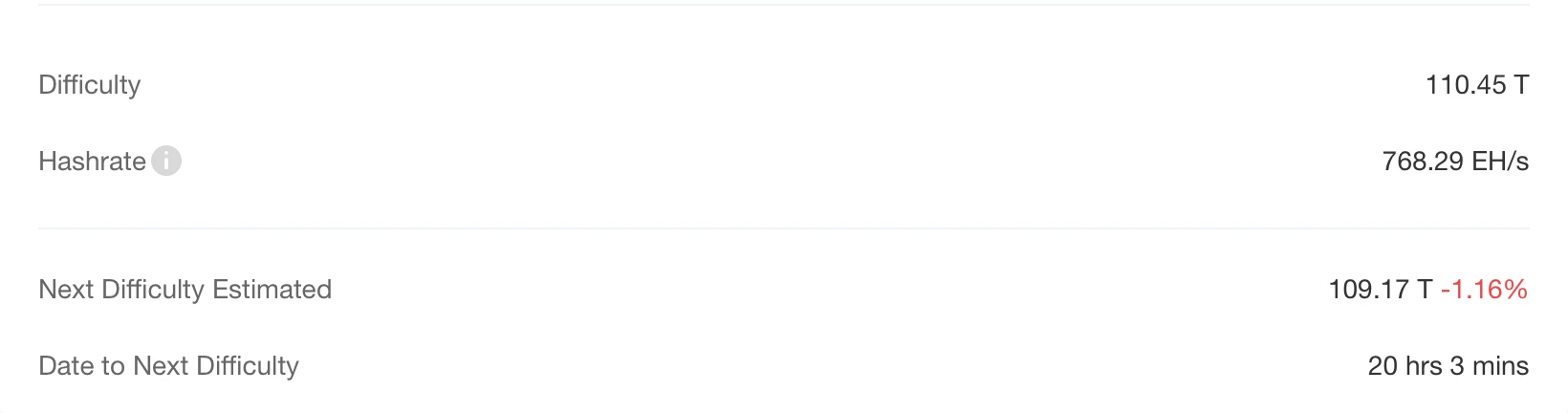

Energy Costs and Mining Efficiency

According to CloverPool data, as of January 26, 2025, the total network hash rate is approximately 768.29 EH/s, and the total network mining difficulty is 110.45 T. The next Bitcoin mining difficulty adjustment is expected to decrease by 1.16% on January 27, bringing it down to 109.17 T. This is a rare difficulty reduction for the Bitcoin network in recent years, mainly due to a recent global cold wave that led to the temporary shutdown of some mining farms, thereby increasing overall hash rate fluctuations.

It is noteworthy that since August 2024, Bitcoin mining difficulty has shown a significant upward trend, with a quarterly increase of 24%. This trend indicates that more miners are entering the market and deploying more efficient mining machines, which enhances network security but also intensifies competition among miners. In this context, optimizing energy costs and improving mining efficiency have become particularly important.

Moreover, Bitcoin mining is having a positive impact on regional energy management. Reports indicate that Bitcoin mining has saved Texas approximately $18 billion by replacing expensive gas peaking power plants. At the same time, miners have balanced grid loads by flexibly adjusting energy consumption during peak electricity usage, significantly enhancing grid stability. This operational model demonstrates the potential of Bitcoin mining in optimizing energy use and supporting grid operations.

In summary, whether it is the fluctuations in hash rate, adjustments in difficulty, or innovations in energy management, they all indicate that the Bitcoin mining industry is in a phase of continuous optimization and development. In the future, with the deployment of more efficient mining machines and the widespread use of clean energy, Bitcoin mining will further balance cost, efficiency, and sustainability.

Bitcoin Mining Difficulty Data

2. Policy and Regulatory News

Utah State Representative Jordan Teuscher Proposes Strategic Bitcoin Reserve Legislation

On January 20, news emerged that Utah State Representative Jordan Teuscher proposed strategic Bitcoin reserve legislation.

Tweet Screenshot

Utah State Proposes Bill: Allows 10% of State Fund to be Invested in Bitcoin and Other Cryptocurrencies

On January 22, news from BitcoinNews reported that a new bill was proposed in Utah that would allow the state government to allocate 10% of its funds to investments in Bitcoin and other cryptocurrencies.

3. Mining News

Siberian Power Company Plans to Sue 400 "Illegal" Crypto Miners

On January 21, news from Tim Alper reported that the Siberian power company Irkutsk Energosbyt plans to sue approximately 400 illegal cryptocurrency miners who are accused of "stealing" $6.3 million worth of electricity from the grid. The company stated that these miners were illegally using electricity for crypto mining, particularly by installing high-energy-consuming mining equipment in garages, private residences, apartment balconies, and garden plots, leading to increased household grid loads and potential accidents.

As of January 1, 2025, the court has supported 1,348 lawsuits from the power company, and 104 miners have chosen to settle out of court by paying their electricity bills. Irkutsk Energosbyt stated it will continue its legal actions.

If Mining Hash Rate Long-Term Shifts to AI, Bitcoin Centralization Risks Will Increase

On January 24, news emerged that Bitfinex released an analysis report stating that the symbiotic potential between Bitcoin mining and artificial intelligence infrastructure should not be overlooked. AI operations require substantial energy and specialized facilities, which Bitcoin miners already possess. During peak AI operations or periods of high energy demand, miners can scale down Bitcoin mining and increase it when energy is more abundant. This dynamic can enhance the economic efficiency of mining operations while maintaining sufficient hash power for the Bitcoin network.

Whether this shift is beneficial or harmful to the Bitcoin network depends on the degree of diversification among miners and the industry's ability to maintain network security amid changing dynamics. If executed strategically, the combination of AI and Bitcoin mining can foster innovation and efficiency without compromising Bitcoin's decentralized nature.

However, if a significant amount of hash power is permanently transferred, the Bitcoin network may face greater centralization risks. Choosing AI over other digital assets also aligns with the broader strategic goals of many mining companies. The growth trajectory of the AI industry is expected to achieve long-term scalability and align with emerging technological trends, from automation to advanced data analytics.

4. Bitcoin News

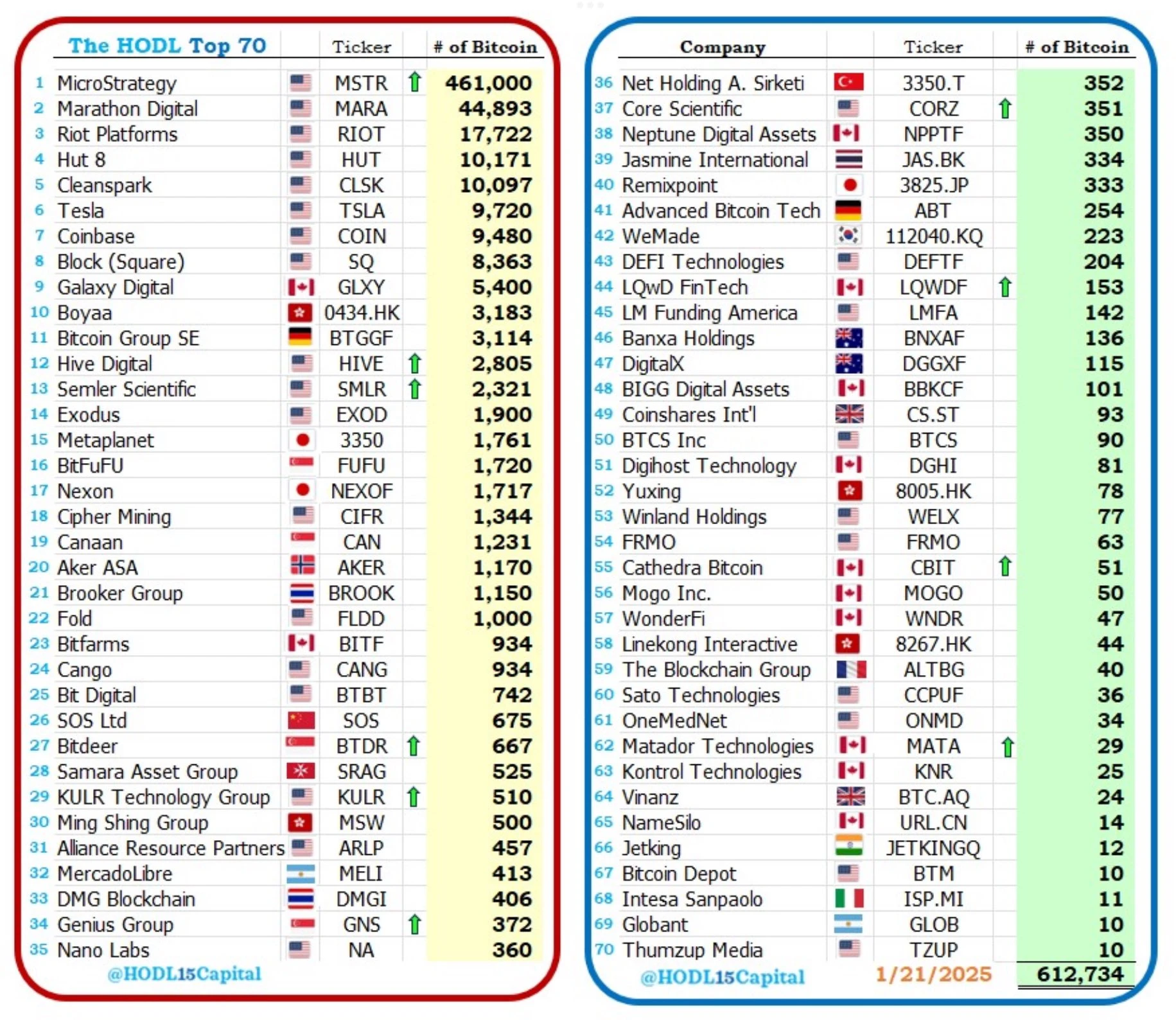

This Week's Global Corporate and National Accumulation of Bitcoin

El Salvador: Added 12 Bitcoins, bringing total holdings to 6,047.18 Bitcoins, valued at approximately $631 million.

MicroStrategy: Increased holdings by 14,600 Bitcoins in January, totaling 461,000 Bitcoins, accounting for 2.2% of Bitcoin supply.

Genius Group: Increased holdings of Bitcoin worth $5 million, totaling 420 Bitcoins, valued at approximately $40 million.

KULR Technology Group: Increased holdings of Bitcoin worth $8 million, totaling 510 Bitcoins, with a total investment of $50 million, yielding 127% this year.

Critical Metal Corp: Plans to allocate $100 million to purchase Bitcoin, with a total fund pool of $500 million; timing and scale of purchases are yet to be determined.

Australia Monochrome ETF: Held 295 Bitcoins as of January 22, with a market value of approximately $49.7196 million.

Fathom Holdings: Will purchase up to $500,000 worth of Bitcoin or Bitcoin ETFs within two weeks.

Semler Scientific (holdings): Held 2,321 Bitcoins as of January 17, with a total purchase price of $191.9 million, averaging $82,689 per Bitcoin.

Semler Scientific (financing): Increased financing to $85 million for purchasing more Bitcoin.

Thumzup: The board authorized holding 90% of the company's remaining cash in Bitcoin.

OKG Research: The U.S. Public and Private Sectors Hold About 10% of Global Bitcoin

On January 20, news from OKG Research indicated that the U.S. public and private sectors collectively hold about 10% of global Bitcoin, with the private sector accounting for approximately 9%. Although the U.S. government has not directly included Bitcoin in its strategic reserves, the deep involvement of private companies like Tesla and MicroStrategy has gradually drawn attention to Bitcoin's potential as an alternative reserve asset.

Compared to the U.S. shares in gold (23% globally) and oil (15% globally) reserves, Bitcoin's status is gaining global market attention amid increasing fiscal deficits and debt pressures.

Polymarket Predicts a 58% Chance Trump Will Create a Bitcoin Reserve Within 100 Days of Taking Office

On January 20, data from Polymarket showed that the probability of Trump creating a Bitcoin reserve within 100 days of taking office surged to 58%, up from 43% the previous day.

Additionally, the market anticipates a 42% chance that the number of executive orders Trump signs on his first day will exceed 40; Kalshi implies that the expected number of executive orders on his first day is 40.4. Areas expected to see intensive policy announcements include immigration, tariffs, foreign affairs, and energy.

Moreover, the market generally expects that Trump's presidential executive powers will be significantly strengthened during his second term, with Kalshi indicating a 77% probability that he will declare a national emergency within his first 100 days.

WisdomTree Report: With Rising Institutional Adoption, Bitcoin Is No Longer a Niche Investment

On January 21, CoinDesk reported that WisdomTree's 2025 Crypto Trends report indicated that Bitcoin is no longer a niche investment, with institutional adoption rapidly growing. The report showed that multi-asset portfolios that include Bitcoin consistently outperform those that do not. WisdomTree expects Bitcoin adoption rates to continue rising in 2025 due to increased client demand. The launch of U.S. spot Bitcoin ETFs has driven the mainstreaming of cryptocurrencies, and more countries may approve trading products (ETPs) for altcoins, including SOL and XRP. The report also highlighted Ethereum's significant position in DeFi, NFTs, and Web3, although its scalability issues remain unresolved. Stablecoins and asset tokenization are expected to grow significantly, further promoting the application of blockchain technology in the global financial system.

Analysis: If Bitcoin Follows Cycles, Year-End Prices Could Exceed $1 Million

On January 21, CoinDesk analyst James Van Straten stated that if Bitcoin continues to follow the cycle of 2017, it could exceed $1 million by the end of the year. Currently, Bitcoin's price has risen about 550% from the cycle low. This performance aligns with previous cycles.

Discussions about Bitcoin often focus on the four-year cycle analysis, which revolves around Bitcoin's halving mechanism that reduces supply every four years. Typically, Bitcoin's price experiences significant increases in the year following each halving, and the current cycle continues to show similar trends to the previous two cycles.

As of now, Bitcoin's price has risen about 550% from the cycle low during the FTX collapse ($15,500). Data shows that Bitcoin's performance in the current cycle is similar to that of the 2015-2018 cycle: after the cycle low on January 14, 2015, Bitcoin (blue line) also saw an increase of about 550%.

If Bitcoin continues to follow the trend of the 2015-2018 cycle, its price could rise about 1,100% from the cycle low to $186,000 by the end of Q1 2025. The peak of this cycle may occur in October this year, with an increase of 11,000%, pushing the price to approximately $1.7 million.

Data: 70 Public Companies Hold Over 612,000 Bitcoins, Valued at Over $61.2 Billion

On January 21, the latest statistics from HODL15 Capital revealed that the top 70 public companies holding Bitcoin on their balance sheets collectively own 612,734 Bitcoins.

Data on Bitcoin Holdings of 70 Public Companies

12 U.S. States Are Actively Promoting Strategic Bitcoin Reserve Bills

On January 22, Cointelegraph reported that 12 U.S. states are actively promoting strategic Bitcoin reserve bills, including:

Florida, Alabama, New Hampshire;

Pennsylvania, Ohio, North Dakota;

Oklahoma, Texas, Wyoming;

Massachusetts, Utah, Arizona.

Standard Chartered: Institutional Fund Inflows Expected to Drive Bitcoin to $200,000 This Year

On January 23, a report from Standard Chartered indicated that this year, more funds are expected to flow into Bitcoin from institutions than last year, particularly with the entry of pension funds likely pushing Bitcoin to $200,000 this year.

The report stated, "If we take proactive actions as we expect, we believe institutional fund flows will continue. We anticipate that institutional inflows into BTC will exceed 2024 levels, with new capital potentially coming from long-only funds classified as 'pension funds.' The dominance of institutional fund inflows into ETFs may support the performance of BTC and ETH; we expect their prices to reach $200,000 and $10,000, respectively, by the end of 2025."

CZ: U.S. Strategic Bitcoin Reserve Plan Essentially Confirmed

On January 24, CZ commented on the X platform regarding "U.S. Senator Cynthia Lummis serving as chair of the Senate Banking Committee's Digital Assets Subcommittee," stating, "The U.S. strategic Bitcoin reserve is essentially confirmed. Cryptocurrency is advancing at an accelerated pace once again."

U.S. Bitcoin Spot ETF Sees Net Inflows of $517 Million

On January 25, Farside Investors reported that the U.S. Bitcoin spot ETF saw net inflows of $517 million yesterday, including: BlackRock IBIT: +$155.7 million

Fidelity FBTC: +$186.1 million

Bitwise BITB: -$8.6 million

ARKB: +$168.7 million

Wtree BTCW: +$2.8 million

Grayscale Mini BTC: +$13 million

Coinbase CEO: Bitcoin Is a Better Form of Currency Than Gold

On January 26, Coinbase CEO Brian Armstrong stated, "Bitcoin is a better form of currency than gold."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。