The "eternal second" Ethereum seems out of place in this bull market. Compared to the strength of Bitcoin, SOL, and other cryptocurrencies, ETH has been hovering around $3,000 without progress. Additionally, the Ethereum Foundation's frequent selling of coins has sparked strong dissatisfaction within the community, and market confidence in Ethereum appears to be wavering. Coupled with the hidden costs of the Layer 2 wars and the siphoning effect of the Solana Meme economy, Ethereum's future path seems increasingly unclear amidst various controversies.

EF's Frequent Coin Sales "Lose Favor"

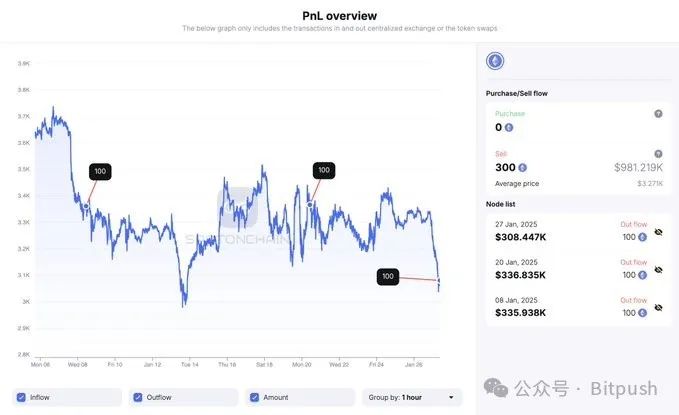

The Ethereum Foundation (EF) has been intermittently selling ETH, recently selling 100 ETH worth approximately $307,893. According to blockchain analysis firm SpotOnChain, this is the foundation's third ETH sell-off in 2025.

In January of this year, the EF sold a total of 300 ETH (as of January 27 data), worth about $981,200. Market observers point out that the foundation's selling behavior has put pressure on Ethereum's price. As of the time of writing, ETH is trading slightly above $3,000, with a 30-day decline of over 7%.

However, the Ethereum Foundation still holds a large reserve of ETH. According to Arkham Intelligence, the foundation owns 269,175 ETH, worth approximately $817 million.

Meanwhile, on-chain activity on Ethereum is also significantly lagging behind other competing chains.

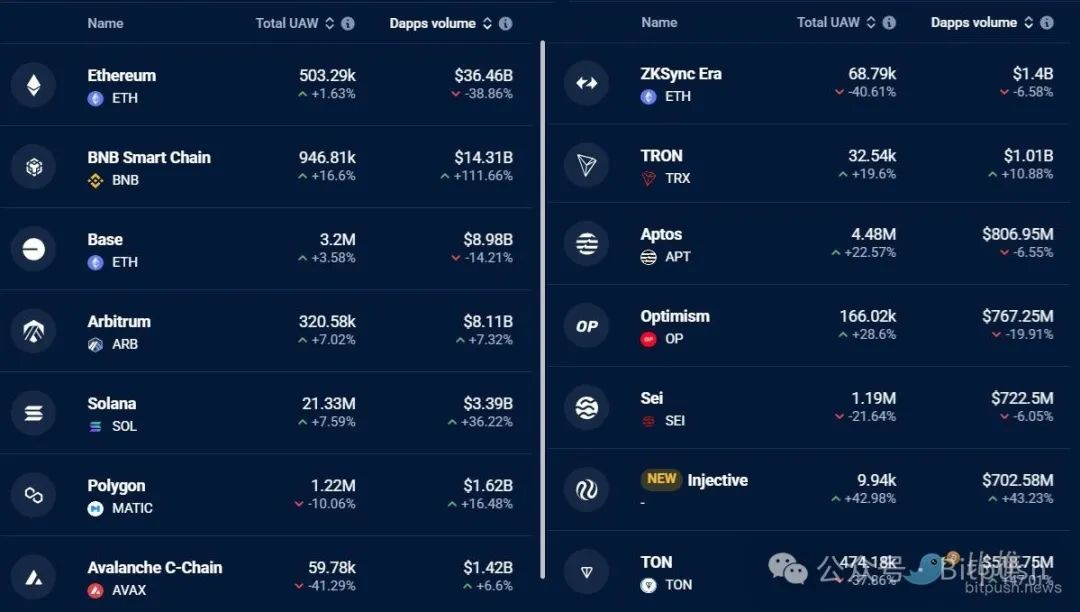

According to DappRadar data, Ethereum's on-chain transaction volume decreased by 38% to $36.5 billion over a seven-day period.

In contrast, activity on the BNB Chain surged by 112%, while Solana grew by 36%.

According to DefiLlama data, from January 14 to January 21, Ethereum generated only $46 million in fees. In comparison, Solana collected $71 million in fees, and when including contributions from Raydium, Jito, and Meteora, the total for that period reached $309 million.

Ethereum L2 Criticized as "Band-Aid": The "Division" Behind Prosperity

As ETH's performance remains lackluster, the Ethereum Foundation is facing severe challenges, with calls for innovation and internal restructuring growing louder. The rise of competing blockchains like Solana has intensified the necessity for Ethereum to enhance its capabilities and innovate within its ecosystem to maintain its competitive edge.

The emergence of Layer 2 solutions like Optimism and Arbitrum has alleviated congestion and high gas fees on the Ethereum mainnet. However, competition among these Layer 2 solutions is becoming increasingly fierce, and the issue of ecosystem fragmentation is becoming more pronounced.

Michael Egorov, founder of the decentralized exchange Curve Finance, criticized in a report that L2 "is more like a Band-Aid… and a temporary solution rather than a foundation for building a sustainable strategy." He emphasized that the Rollup roadmap hinders composability and "leaks" most of ETH's value to L2 tokens and their operating companies.

Justin Drake from the Ethereum Foundation shared a post on X last weekend calling for "enabling native Rollup technology to end the Layer 2 fragmentation era."

Cryptocurrency research and investment firm Paradigm also called for reform. The firm believes that Ethereum's current annual upgrade plan limits its ability to innovate and effectively respond to market trends. Paradigm stated, "Accelerating Ethereum's development will enable more people to enjoy the convenience of permissionless innovation, helping to pave the way for a truly global, trust-minimized financial system."

In the face of increasing pressure, the Ethereum Foundation announced plans to allocate 50,000 ETH (approximately $165 million) to support its decentralized finance ecosystem.

Ethereum co-founder Vitalik Buterin stated that the foundation is indeed undergoing "significant adjustments" in leadership to improve transparency and better support developers.

Technical Analysis: Key Support and Market Sentiment Struggle

The saying "seeking a sword in a boat" suggests that February and March have historically been bullish for ETH.

Coinglass data shows that for the past six consecutive years, ETH has shown an upward trend in February, with the largest increase occurring in 2024, when it rose from $2,280 to $3,380 by the end of the month, an increase of over 46%. March has also historically been a favorable time for ETH. In the past nine years, it has risen in seven of those years in March, while April has seen increases in six years.

Engineer and analyst Wolf stated on X on January 26, "With eight years of analyst experience, I can confidently say I've never seen a chart as strong as ETH's; the potential here is unparalleled. This is the best asymmetric bet you can make."

Technical analyst Rakesh believes that ETH/USDT could drop to $2,850, which may become a strong support level. If the price rebounds from $2,850 but falls below the 20-day moving average ($3,308), it indicates that bears are selling on rallies. This increases the risk of breaking below $2,850. If this occurs, the trading pair could drop to $2,400.

Time is running out for the bulls; if they want to prevent a decline, they must push the price back above the 50-day moving average ($3,455), after which ETH/USDT may continue to rebound to $3,745.

In summary, as Solana reconstructs traffic entry with meme coins and Layer 2 becomes a value extraction machine, Ethereum's moat seems to be severely eroded. Technical advantages must translate into ecosystem dominance, and the loss of each price support level could trigger a collapse of faith. Where Ethereum will ultimately head remains to be seen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。