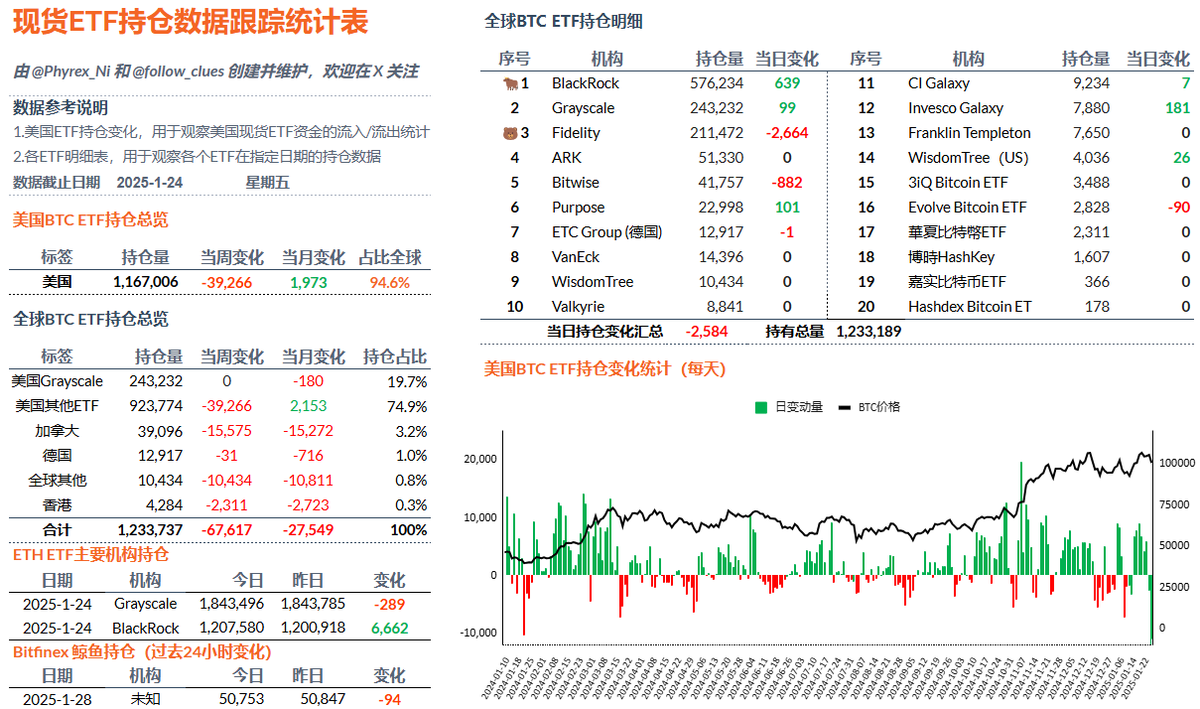

After looking at the data for ETH, it's essentially the same for BTC. To be honest, the data for BTC is worse, as there was more capital entering during better times, but once the funds started to flee, it led to more investors following suit. However, from the perspective of the user base, BlackRock and Fidelity's investors are still the main holders at present. In the past 24 hours, although BlackRock bought 637 BTC, Fidelity's selling volume still exceeded 2,600 BTC.

In fact, this buying volume is quite good, considering that even Grayscale's GBTC has seen nearly 100 BTC flowing out. Aside from Fidelity, the overall inflow has reached a normal level, and Fidelity's selling volume is only about 1.24% of its holdings, which is not a lot.

Moreover, based on BTC's current status and trend in the U.S., it cannot be ruled out that it may enter a prolonged bull market similar to gold. However, for other altcoins, the situation may be tougher. Of course, most investors still expect BTC to have a promising future.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。