Original | Odaily Planet Daily (@OdailyChina)

Author | Nan Zhi (@Assassin_Malvo)

This morning, Coinbase announced the launch of the AI concept token Venice Token (VVV) on the Base chain. The token's market cap set a record of $2.3 billion at the time of the announcement, and as of the time of writing, the market cap remains at $1.6 billion.

Venice does not have a publicly disclosed financing background, and when compared to mainstream AI applications, it does not have a large user base. Why was it able to launch directly on Coinbase? Odaily Planet Daily will interpret Venice's business, airdrop rules, and token economics in this article.

What is Venice (VVV)?

Venice is a permissionless, privacy-focused, and censorship-resistant AI platform, its mission is to provide users with private and unmonitored AI inference services. Venice states that various AI products based on OpenAI permanently store every conversation for reading, cracking, or sending to the NSA or CCP. Venice was created to address this issue and supports functions such as conversation, image generation, and code creation, but does not view, store, or restrict any user data (including prompts, conversations, or generated content).

(Note: NSA refers to the National Security Agency of the United States.)

Since its launch in May 2024, it has accumulated 400,000 registered users, 50,000 daily active users, and processes 15,000 inference requests per hour. (Note: For comparison, ChatGPT has about 300 million weekly active users, and Doubao has 50 million monthly active users.) Today, January 28, Venice has opened its API to the public for use by AI agents, developers, and third-party applications, while also launching the VVV token and airdropping it to 250,000 addresses. Detailed rules for the airdrop can be found in the next section.

Venice Airdrop Rules

This airdrop will allocate 50 million VVV to two types of users, accounting for 50% of the initial supply:

Venice users, who need to have at least 25 points by December 31, 2024, and have had an active operation on October 1, 2024.

Specific token holders, including VIRTUALS, AERO, DEGEN, AIXBT, GAME, LUNA, VADER, CLANKER, MOR, and 200 Coinbase Agentkit developers.

The deadline for claiming the airdrop is March 13, 2025, and it can be claimed directly through the official website.

Venice Computing Power Rules

Generally speaking, AI applications like OpenAI's ChatGPT and Anthropic's Claude are divided into free terminal versions and paid APIs, with the latter charging based on the number of tokens used. (Note: Tokens can be simply understood as the number of characters in input and output.)

Venice offers a new model, which is to stake tokens to obtain computing power, and then use that computing power to gain access to AI.

Venice has established a standardized unit called VCU to measure the computing power required for AI inference, the proportion of VVV tokens staked by users to the total staked amount determines the amount of VCU available to them daily (for example, holding 1% of the staked amount grants access to 1% of the total VCU capacity). As Venice's infrastructure expands, the total VCU capacity increases, meaning that even without additional staked users, the daily inference capacity will also grow.

Venice Token Economics

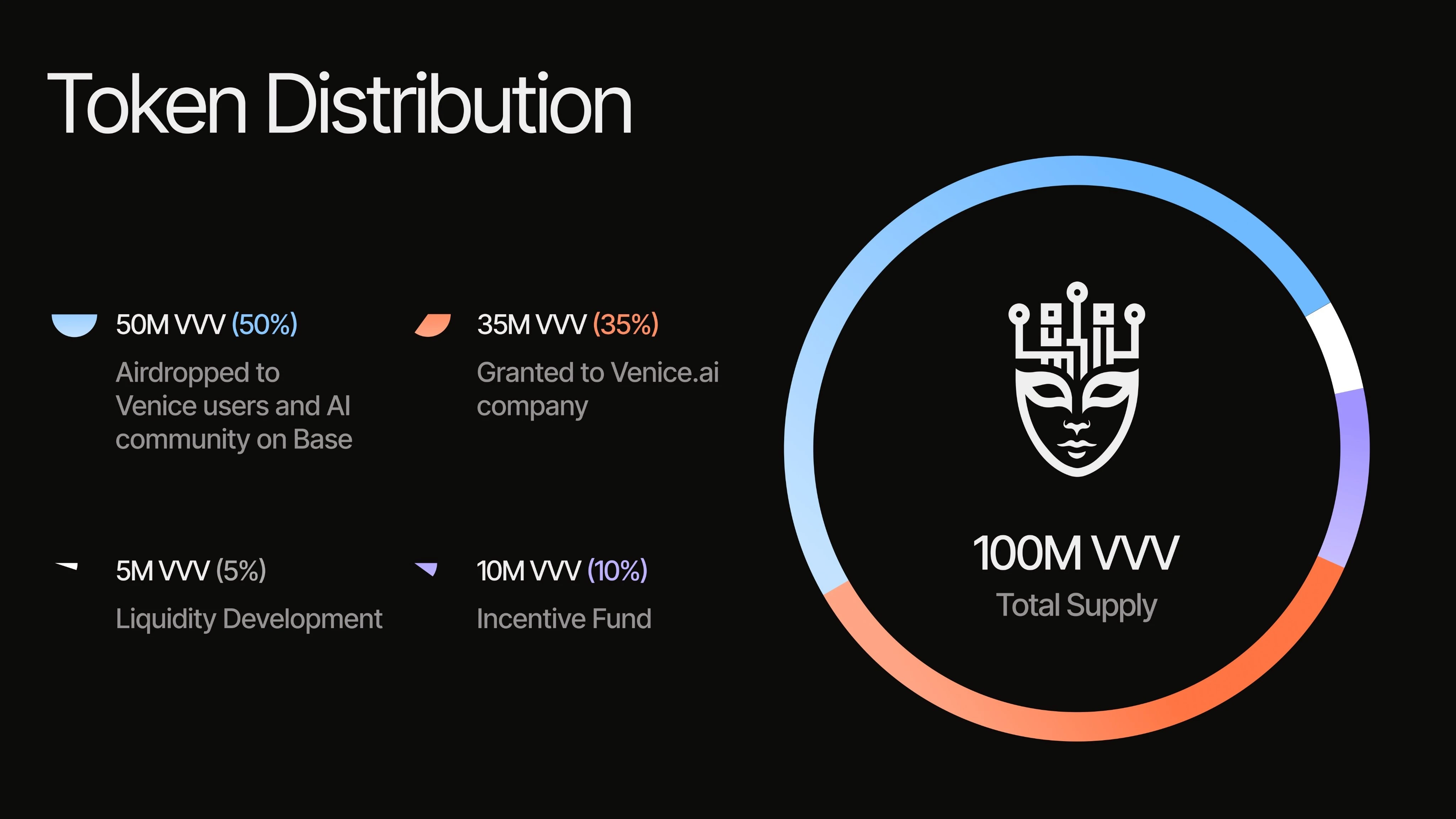

The initial supply is 100 million VVV, distributed as follows:

50% for user and community airdrops

10% allocated to incentive funds

5% for providing liquidity

VVV has an inflation mechanism, with an annual issuance of 14 million VVV (initial inflation rate of 14%, decreasing year by year), used to incentivize staking and network expansion. Venice states in its documentation that this model allows VVV stakers to use the API for free while covering costs through staking rewards, achieving "negative cost" usage. This claim holds true only if the token price does not decline further or fluctuates minimally. However, the actual number of real users, token demand, and development prospects for Venice, excluding users who inflate numbers, are currently unknown. According to official documentation, unstaking requires a waiting period of 7 days, during which there are no earnings and tokens cannot be withdrawn, users participating in token staking should consider carefully.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。