Good evening, brothers!

Warren Buffett's Investment Principles

In his 2003 letter to shareholders, Buffett wrote: "We will continue to maintain our past practice of capital allocation. If buying stocks is cheaper than buying entire companies, we will buy stocks aggressively. If specific bonds are attractive enough, we will hold those bonds fully, regardless of market or economic conditions. We are always happy to buy businesses that meet our standards." This brief statement reveals several of Buffett's investment principles:

First, investing is about comparison. Buy stocks when they are cheap, buy bonds when they are cheap, buy company equity when it is cheap; focus solely on whether it is cheap, without worrying about the type of investment. Second, macroeconomics is useless. As long as individual stocks are satisfactory, even if the economic environment is poor or the overall market is overvalued, we will still buy. Third, timing is not a concern. Buffett does not have a so-called "investment schedule"; for high-quality and undervalued companies, his buying time is "anytime."

We can 100% absorb and adopt these three investment principles. Additionally, Buffett mentioned that due to Berkshire's large size, much of the capital is not fully utilized. While having large amounts of idle capital is not ideal, it is better than making foolish investment decisions rashly. However, for ordinary investors, the amount of capital can be fully absorbed by the market, and there is no need to hold too much cash.

Buffett also stated that as Berkshire's size continues to grow, it has become increasingly difficult to achieve the same performance as in the past, but he and Munger still hope to outperform the index, which is the meaning of their existence. In my view, this is actually a high level of self-restraint. Because Buffett has only shareholders, not clients, he has no obligation to make promises to anyone. But Buffett always regards shareholders as partners, truly embodying "both virtue and talent."

……

Michael Hartnett, the chief strategist at Bank of America, known as "Wall Street's most accurate analyst," outlined the ten key trends that will disrupt the global economy, technology, and social governance in his latest "Flow of Funds" report.

He predicts that "technology will consume the world," with artificial intelligence driving industries into the 6.0 era. Breakthroughs in reasoning AI, billion-level AI agents, and quantum computing will reshape production systems, with human intervention approaching zero and technology costs continuing to decline. However, the "peak of monopoly" also faces challenges, as the market dominance of the "Tech Seven" giants like Microsoft and Nvidia may weaken, and the diffusion of AI dividends along with global antitrust policies will force a reshaping of industry patterns.

BTC: On the 4-hour level, the price continues to stay near the lower Bollinger Band, indicating that the price is oversold, and there is a demand for a short-term rebound.

On the daily level, the price has dropped to the vicinity of the moving average support; if it does not break below, there is still a possibility of a rebound.

In summary, the support level is 98,900, and the resistance level is 99,300.

ETH: On the 4-hour level, the price continues to stay near the lower Bollinger Band, with a weak price trend and a demand for a weak short-term rebound; the support level is 3,050, and the resistance level is 3,080.

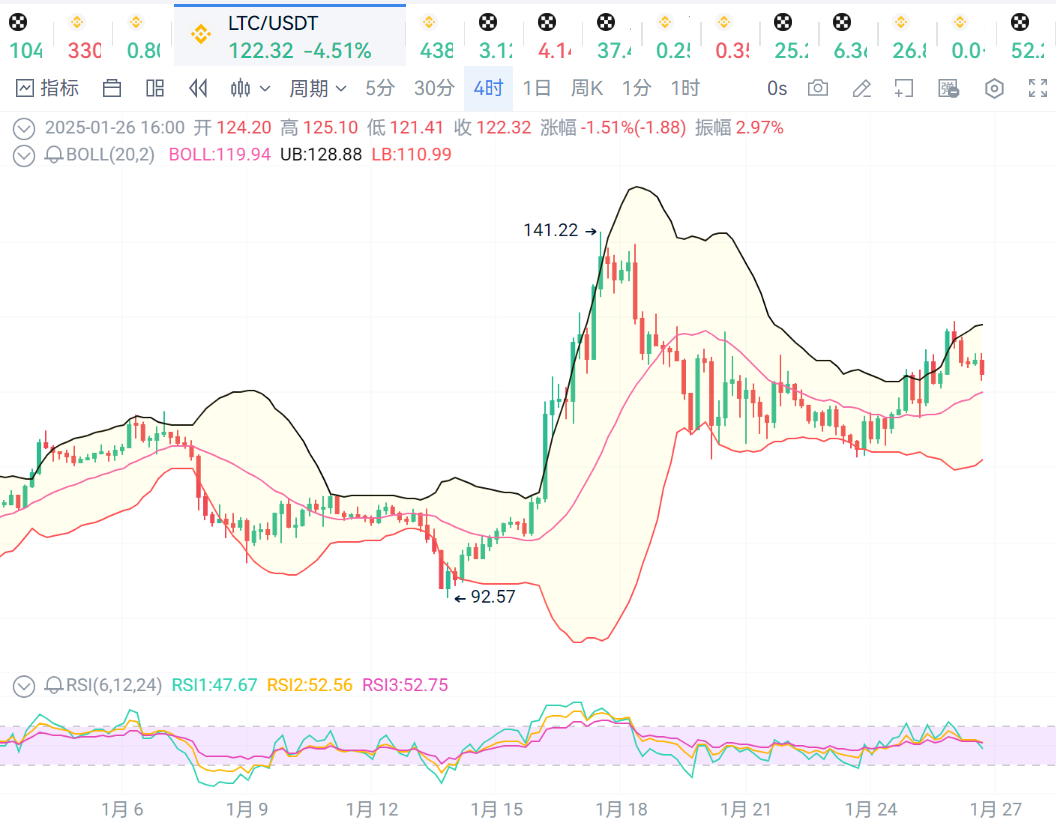

LTC: The price continues to stay near the lower Bollinger Band, with a weak price trend; the support level is 100, and the resistance level is 130.

BCH: The price continues to stay near the lower Bollinger Band, with a weak price trend; the support level is 390, and the resistance level is 420.

That's all for now, good night!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。